News November 07, 2024

Election 2024: How Will Trump’s & Harris’ Policies Impact Promo?

Plus, exclusive ASI Research findings on which candidate promo end-buyers and Power Summit attendees think will be better for the economy.

Key Takeaways

• Trump Ahead In Promo: ASI Research indicates a majority of promotional products industry leaders and end-buyers who responded to an ASI survey prefer Trump over Harris for the White House.

• Economic Priority: A majority (62%) of industry executives say the issue that matters most to them and their vote in the 2024 election is the economy, with more (46%) saying they’d be optimistic about the economy if Trump wins as opposed to Harris (18%).

• Worlds Apart: Trump and Harris have markedly different policies on issues like taxes and import tariffs.

Promo appears to be leaning toward Donald Trump.

Findings from ASI Research show that top promotional products industry leaders and end-buyers (see sidebar below) of branded merchandise would favor a second Trump term in the White House over a Kamala Harris presidency.

Still, there’s a vocal minority of industry executives who take the opposite view, believing a Harris promotion to president will benefit both the U.S. economy and promo in particular.

The findings come at a time in which national polls show that Trump and Harris are locked in a dead heat on the final sprint of the race to election day on November 5th.

With so much rhetoric flying back and forth, ASI Media cuts through the clutter and delves into promo-specific perspectives on the battle for the White House, exploring industry views and what the potential policies of each candidate could mean.

Promo Executives’ Take on the Presidency

When hundreds of promotional products industry leaders arrived in San Diego in mid-October for the 2024 ASI Power Summit, the biggest thing collectively on their minds was the upcoming election.

The uncertainty over the race between Trump and Harris weighed heavily on their businesses, as did consumer perceptions on the state of the economy that contributed to months of slow sales.

Prior to the event, ASI Research surveyed attendees on a number of topics. A pivotal finding? Nearly two-thirds (62%) said the issue that matters most to them and their vote in the 2024 election is the economy.

Relatedly, almost half (46%) of respondents said they’d be optimistic about the economy if Trump wins, while only 18% said they’d be buoyant about America’s GDP prospects under Harris.

The findings are consistent with historical views and polling that show business owners (particularly small business owners) are less likely to vote Democratic. And, indeed, a recent CNBC survey revealed that 50% of small business owners feel that Trump will positively impact their companies, compared to 32% for Harris. (The U.S. Small Business Administration counts companies of 1,500 employees or less, as well as those generating $40 million in revenue and under, as small businesses.)

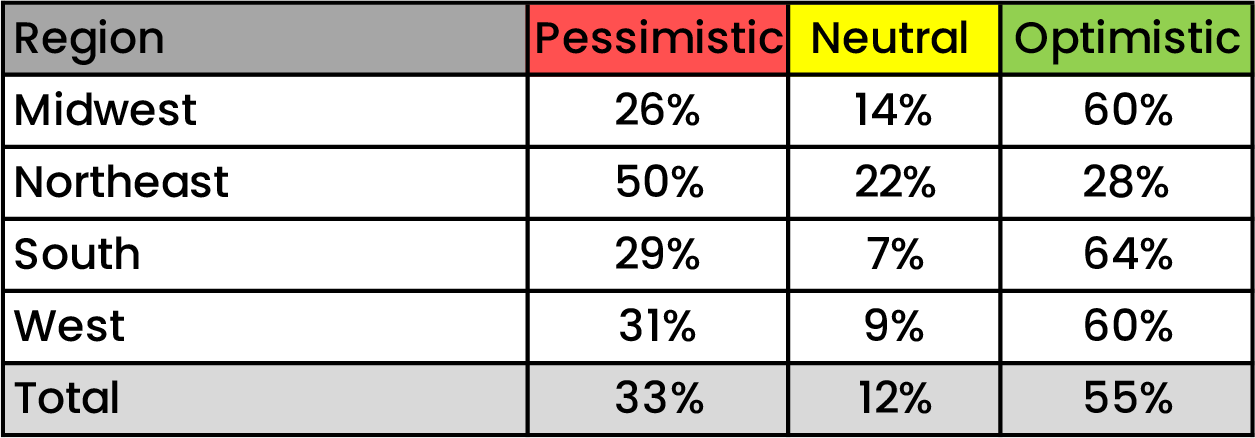

ASI Research asked ASI Power Summit attendees: “How optimistic are you for the overall economy if Donald Trump/Kamala Harris wins the presidency?”

Count Randy LeFaivre among the industry professionals who are firmly in the Trump camp.

The president of MetroLogo (asi/268938), an inside-the-D.C.-Beltway distributorship that’s worked on merch initiatives for Republicans and Democrats, passionately supports the return of Trump to the White House. Quite simply, he thinks another Trump presidency will have the most beneficial impact on the U.S. economy and the promotional products market.

“Donald Trump’s pro-business position will translate into more businesses needing more promotional products to market themselves,” LeFaivre tells ASI Media. “Their growth will mean that they will need to add employees, who will require branded uniforms and merchandise. Our industry needs a Trump victory again. The positive effect that his ‘MAGA’ branding movement has had on our industry is undeniable.”

Jo Gilley couldn’t disagree more about the impact of a second Trump term on the economy and promo.

The CEO of Counselor Top 40 distributor Overture Promotions (asi/288473) thinks Trump’s anticipated policies, especially those related to tariffs on imported goods, could reignite inflation, increase the unemployment rate and cause gross domestic product to retreat.

Gilley, a member of Counselor’s Power 50 list of promo’s most influential people, favors Harris’ projected approach on everything from taxes to plans for fostering growth and innovation among small business.

Citing a recent analysis by the International Monetary Fund, Gilley says “the U.S. economy leads the world. The surge of investment under the Biden administration has attracted private investment, which is paying off in higher productivity, higher wages and higher stock prices. I expect Harris to continue the Biden approach to managing the U.S. economy.”

But just how could the stated policies of both candidates affect promo and business more broadly? Here’s a look at where the candidates stand on several big issues of importance.

Issue #1: Tariffs

The promotional products industry imports the vast majority of goods sold in the United States and Canada from overseas manufacturers, particularly producers based in China.

During his first term in the White House, Trump implemented import tariffs on hundreds of billions of dollars of China-made goods, a fact that contributed to increases in the cost of promo items as the products became more expensive to bring stateside. While importing industry suppliers absorbed or offset some of the cost, portions of the fees were passed along to distributors and ultimately end-buyers.

If elected, Trump is vowing to intensify tariffs. He’s talked about placing a 10% to 20% tariff rate on everything imported into the United States. Going further, he’s eyeing levies of up to 60% on all imports from China.

Up to

60%

The tariff rate Donald Trump has indicated he could impose on goods imported from China.

It’s a prospect that worries some promo pros.

“Tariffs are bad for our industry and Trump seems all in on them,” says Power 50 member Craig Nadel, president/CEO of Counselor Top 40 distributor Nadel (asi/279600). “They make our advertising medium more expensive. If products get expensive enough, some clients could switch to other things, like gift cards.”

Trump believes the tariffs will help bolster domestic manufacturing and cut down reliance on foreign providers, all while bolstering American employment, strengthening domestic industries and serving as a crucially important card in the fiercely competitive poker match of international trade.

“I like his Made-in-the-USA efforts and policy of bringing manufacturing and jobs back to America,” says LeFaivre.

Nonetheless, though Trump makes assertions to the contrary, economists have generally asserted that it’s American businesses and consumers that pay the cost of tariffs, not China-based companies.

The average American household could experience an annual cost increase of about $2,600 under Trump’s tariff policies, according to the nonpartisan research nonprofit Peterson Institute for International Economics. The organization adds that, if Trump wins the presidency, his tariffs and related policies could cause inflation to rise between 6% and 9.3% by 2026, as opposed to a baseline estimate of 1.9%.

25%

The higher tariff rate on steel and aluminum that the Biden administration authorized this year. Previously, the rate was 7.5%.

Still, to vote for Harris isn’t really to vote against tariffs.

As vice president, Harris was part of President Joe Biden’s administration that not only kept Trump-era import levies but also expanded tariffs on another $18 billion worth of imported-from-China goods, including steel and aluminum.

Harris hasn’t specifically outlined a tariff policy, but she has spoken about the importance of bulwarking domestic industry against foreign competitors and building up American manufacturing. Would she remove already-in-place Trump tariffs or erase the duties established while she was VP? At this point, that seems doubtful.

“While tariffs have been used for various reasons and sometimes have had a long-lasting positive effect, I don’t believe the way they’re being used today is good,” says Power 50 member Memo Kahan, CEO of Counselor Top 40 distributor PromoShop (asi/300446). “I believe markets should be free to flow without adding extra obstacles.”

Gilley believes what she described as Harris’ more targeted approach on international trade is preferable.

“Rather than an across-the-board policy like Trump’s, VP Harris aims to calibrate the U.S. response to ensure fair trade, as well as commercial predictability and stability,” Gilley asserts. “Harris’ broader economic policies suggest a focus on strengthening domestic production and reducing reliance on imports through economic subsidies rather than tariffs.”

Presidential Campaign Merch Spending

Since taking over President Joe Biden’s campaign, Vice President Kamala Harris has significantly outspent former President Donald Trump on print and promotional materials, investing $3.4 million in promo between July 21 and September 30 alone. ASI Media has the full breakdown on presidential campaign merch spending.

Issue #2: Taxes

Harris and Trump say they’ll eliminate the federal tax on tips and both reportedly support increasing child tax credits for parents.

“An increased child tax credit will help bring a lot of women back to the workforce,” opines Kathy Finnerty-Thomas, president of Arizona-based distributorship Stowebridge (asi/337500).

Despite some commonality on tip taxes and child tax credits, Harris and Trump largely differ otherwise in their intended approaches to taxation.

Take the corporate tax rate. Trump’s previous administration lowered the rate to 21%. He’s said he’d like to slash the rate again, perhaps as low as 15% for some qualifying C corps. Meanwhile, Harris wants to hike the corporate tax rate to 28%. The prospect of a higher rate is keeping certain promo leaders up at night, as some fear it will reduce cash available for investment in branded merch.

“There’s no doubt,” says one promo executive who wished to remain anonymous given the controversial topic, “that increasing the corporate tax rate and other tax plans by the Democratic candidate will have a negative impact on our industry.”

“Trump is probably the most business-friendly president in our country’s history. I look back at his previous four years as president as proof that his economic policies work.” Randy LeFaivre, MetroLogo (asi/268938)

Some industry pros also think a lower corporate tax rate will free up money that corporations could use to invest in hiring and marketing – all of which can benefit promo.

Trump’s signature tax cuts, first signed into law in 2017, are set to expire in 2025. The Republican candidate plans to extend those cuts and possibly reduce taxes for individuals and businesses across the board. He’s even floated the idea of eliminating federal income taxes, saying cash could be generated from tariffs instead.

“Trump is probably the most business-friendly president in our country’s history,” says LeFaivre. “I look back at his previous four years as president as proof that his economic policies work.”

Harris has pledged that people and households earning less than $400,000 won’t pay more in federal taxes, but she does want to increase taxes on upper-income earners. To wit, she intends to elevate the top income tax rate back to 39.6% and increase the net investment income tax rate from 3.8% to 5% for those earning $400,000 and above.

Additionally, Harris aims to impose a 25% minimum wealth tax on those with a net worth of at least $100 million. She also has indicated she’d raise the long-term capital gains tax rate from 20% to 28% on taxable income that exceeds $1 million. While he hasn’t explicitly said so, Trump appears to support lowering the top tax rate on long-term capital gains to 15%, according to analysts.

“I like the Harris plan for small business, which would encourage innovative growth for the promo industry.” Jo Gilley, Overture Promotions (asi/288473)

Harris’ approach to taxes will have a chilling effect on commerce, detracting from investment in promo, some industry executives said. “If this country elects Kamala Harris, the effects on business in general will be devastating and marketing budgets are always the first to be cut,” opines LeFaivre.

Gilley disagrees. “Harris’ tax plans would raise taxes on the richest 1% of Americans, while cutting taxes for all other income groups, which will be good for the economy – and promo,” the CEO says.

Gilley also believes Harris’ plans will help the small businesses that make up the backbone of the American economy – and that fill the client rosters of many promo distributors.

Among other things, Gilley says she likes Harris’ plan to expand the tax deduction for new small businesses from $5,000 to $50,000, helping startups during their first year. Gilley’s also keen on Harris’ plans to institute a small business expansion fund to enable financial institutions to provide start-up capital to new businesses by using federal funds to cover interest costs on loans.

“I like the Harris plan for small business, which would encourage innovative growth for the promo industry,” Gilley says.

Issue #3: Independent Contractors

Trump and Harris also clash on certain labor issues – in particular, the status of independent contractors (ICs). It’s a key point the promo industry will be watching closely this presidential election.

Under the Biden administration (of which Harris is a part), the U.S. Department of Labor this year adopted new rules on when a worker should be classified as an employee or an IC under the Fair Labor Standards Act (FLSA).

In effect, the regulations make it harder for employers to classify workers as ICs. The rules, critics contend, push employers to classify workers as employees, which tends to be costlier for businesses and grants more rights under law. A handful of lawsuits are seeking to have the rules abolished. So far, the regulations remain on the books – a concern for many in the promo products space, which relies heavily on ICs.

Courtroom developments in the battle over independent contractor status could have implications for industries across the United States that rely on ICs, including the promotional products market.https://t.co/lDPMOZfR2M#independentcontractor

— Chris Ruvo (@ChrisR_ASI) October 25, 2024

Detractors in promo have said the Labor Department’s rules could ruin the livelihoods of industry ICs and/or drive up labor costs for merch businesses. Detractors have included business owners and ICs themselves.

The Biden administration’s rules changed what proponents have generally categorized as simpler, clearer Trump-era standards under the FLSA for determining IC status. Broadly speaking, promo has favored the Trump approach, though some ICs prefer the new Biden-era rules, believing they compel companies to compensate ICs fairly.

What does seem clear is that Harris won’t be reversing the IC regs established this year. In fact, she’s professed support for the Protecting the Right to Organize (PRO) Act, a controversial piece of legislation that aims to strengthen unions and encourage more workers to organize.

Previous incarnations of the bill contain language that would largely wipe out IC status under most scenarios and compel companies across industries in the United States to reclassify contractors as employees. “When I am president…I will sign the PRO Act into law,” Harris said recently.

Trump and conservatives in general have panned the PRO Act, calling it a power grab by unions that Democrats are pushing to strengthen support among organized labor groups.

Issue #4: Immigration and Labor

Ostensibly, one issue Trump and Harris agree on is that America’s immigration system is a mess. They have different plans for fixing it, and depending on how things go, there could be implications for the labor market in the United States.

Trump is vowing to spearhead the largest domestic deportation operation in American history. Meanwhile, Harris has expressed support for legislation the Biden administration put forward that sought to curtail illegal immigration (a deal that failed to pass Congress this year). Harris would also take, according to some analysts, a more “enforcement-first” approach than Biden.

Reducing the number of illegal immigrants could impact the availability of workers, and critics of Trump’s approach in particular think it could be prohibitively expensive and create worker shortages in industries that rely on immigrants, which they fear will contribute to spurring inflation through higher labor costs.

“With employment figures so high, there’s already difficulty finding workers,” says Finnerty-Thomas. “Mass deportation will create a huge labor shortage.”

The survey of 2024 ASI Power Summit attendees revealed that recruiting and finding employees with the right skill sets was the leading employee-related concern in 2025 for survey respondents.

51%

of 2024 ASI Power Summit attendees said recruiting and securing workers with the right skill sets was their top employee-related concern for 2025.

Minimum wage is another labor-related topic of issue for promo and business more broadly. Trump hasn’t said if he’d increase the federally mandated minimum wage, which hasn’t been changed in more than 15 years, still sitting at $7.25. Harris has said the current rate is “poverty wages” and needs to be increased. She hasn’t given an exact number, though.

Released in December 2023, a study by the Congressional Budget Office determined that raising the federal minimum wage to $17 an hour by July 2029 could increase wages for more than 18 million people. Still, the same study showed such a move could put 700,000 Americans out of jobs. A higher minimum wage could have a knock-on effect of propelling higher labor costs all the way up the employee pay scale.

The list of issues could go on. Harris and Trump have markedly different stances on matters that include abortion and America’s energy future – all of which stand to impact society and the economy. Promo pros will be keeping all of those in mind as they head to the polls.

“There are so many issues worth considering when choosing the candidate to support,” says Power 50 member Aaron Hamer, CEO of Counselor Top 40 distributor Boundless (asi/143717).

“Anyone prioritizing our industry in their decision criteria,” Hamer continues, “should consider which candidate they believe will create the most jobs and spur GDP growth, who will help reduce friction in operating a global supply chain, who will support the industry’s initiatives around shipping reforms and who will fight to preserve the independent contractor status that works for our industry.”

Promo End-Buyers’ Outlook on the Oval Office

When it comes to the economy, promo end-buyers are bigger believers in Donald Trump.

ASI Research conducted a survey in September that showed that 55% of promo end-buyers would be optimistic about the overall economy heading into 2025 if Trump were to return as the nation’s chief executive, including more than a third (36%) who said they would be “very optimistic.” Another third expressed pessimism.

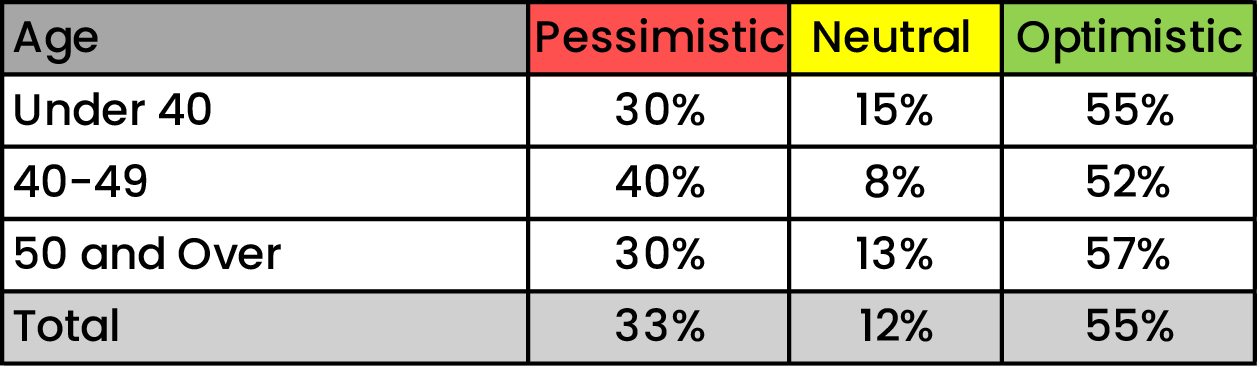

End-buyers were more downbeat about a Harris presidency and the related potential impacts on the economy. Nearly half (49%) said they’d feel pessimistic about the economy on the way into 2025 if Harris wins, while a total of 40% expressed optimism.

ASI Research found that optimism about a Trump victory was fairly consistent across different age groups. More than half of end-buyers under 40, between 40-49, and 50 and over were optimistic about the economy if Trump prevails.

Economic Optimism/Pessimism of Different End-Buyer Age Groups if Donald Trump Wins

By contrast, Harris fared better among younger end-buyers than she did with those above 40. Nearly half (49%) of the under-40 contingent of promo purchasers would be optimistic if the current vice president won the White House, compared to a third of people 40 and over.

Economic Optimism/Pessimism of Different End-Buyer Age Groups if Kamala Harris Wins

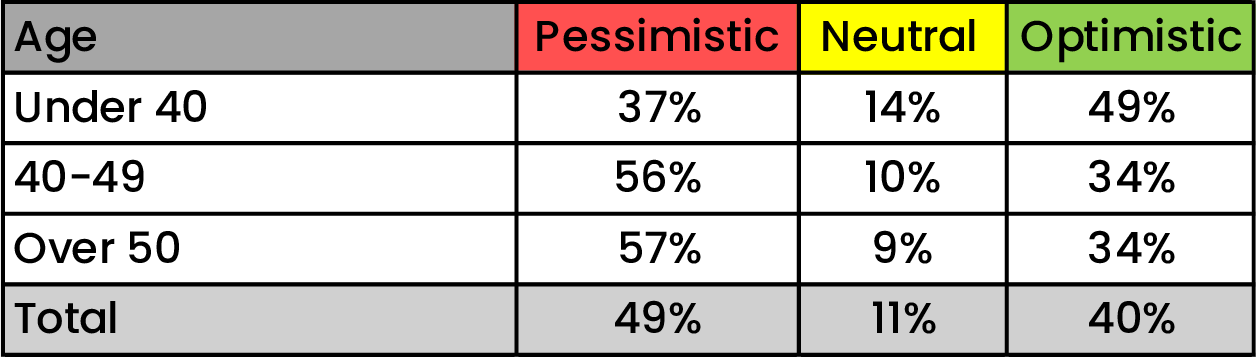

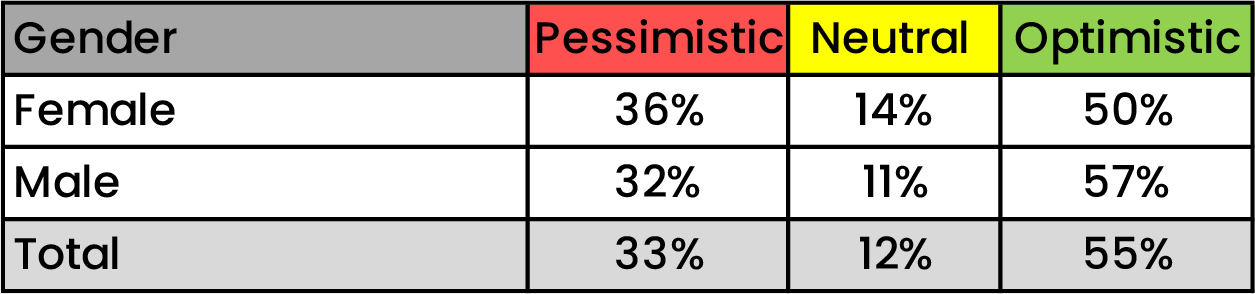

Segmented based on gender, male and female end-buyers had nearly identical outlooks on the U.S.’ economic future in the event of a Harris win, with about 40% expressing optimism.

Economic Optimism/Pessimism Among Male & Female End-Buyers if Kamala Harris Wins

Trump polled stronger among male end-buyers, with nearly 6 in 10 (57%) saying they’re bullish about the effect the former president will have on the economy. Exactly half of women felt the same.

Economic Optimism/Pessimism Among Male & Female End-Buyers if Donald Trump Wins

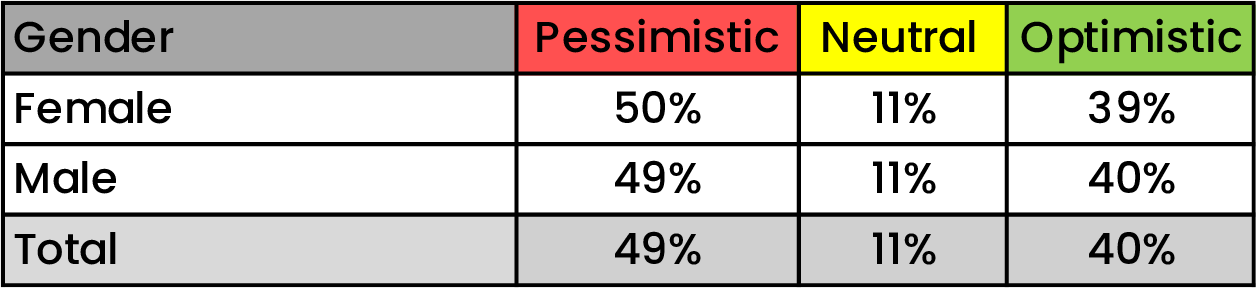

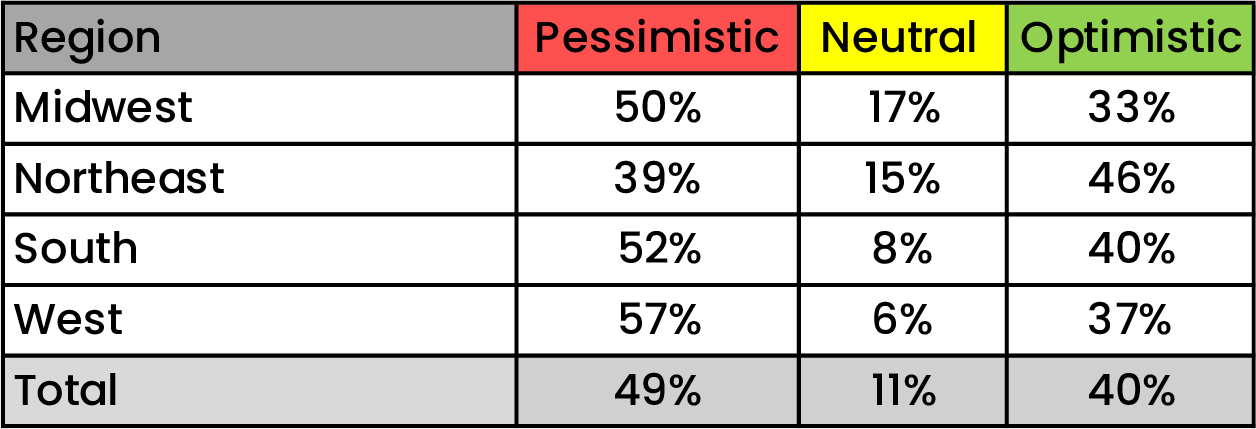

Geographically, Trump outperformed Harris among end-buyers in the South, West and Midwest by wide margins. Still, Harris found a stronghold in the Northeast – where 46% of merch end-buyers said they’d feel positive about the economic future if she’s elected compared to only 28% for Trump.

Economic Optimism/Pessimism Among End-Buyers by Region if Kamala Harris Wins

Economic Optimism/Pessimism Among End-Buyers by Region if Donald Trump Wins