Strategy Last Updated: December 23, 2024

Are ‘Made-in-USA’ Promo Sales About to Surge?

Major anniversaries in American history and other events are spurring suppliers who manufacture domestically to ramp up for a pending increase in sales.

Key Takeaways

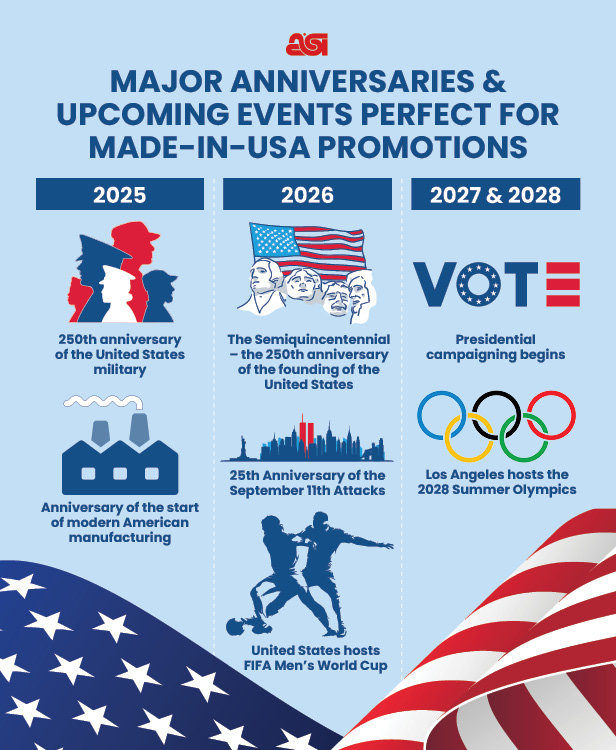

• Potential Sales Drivers: Historical milestones, like the 250th anniversary of the U.S. military and America’s Semiquincentennial, are poised to increase demand for Made-in-the-USA promo products, some supplier executives say.

• In Action: Certain suppliers are investing in marketing, production capacity and automation to meet the anticipated demand.

• The Role of Import Levies: Potential new tariffs in 2025 could also make domestically-made merch more attractive to end-buyers.

• The Reshoring Outlook: While sales growth in Made-in-the-USA swag may occur over the next few years, large-scale onshoring of merch manufacturing is unlikely.

Mitch Cahn says he’s never seen anything like it.

The founder/president of Unionwear (asi/73775) is talking about a confluence of historical milestones, high-profile events and potential federal actions that he believes will send demand for Made-in-the-USA promotional products soaring over the next several years.

“A perfect storm is brewing for brand building through Made in USA, and it will provide countless promotional product opportunities for end-buyers,” says Cahn, whose 32-year-old union shop, which is headquartered in New Jersey, specializes in domestically produced headwear, bags and portfolios.

Other suppliers that offer USA-manufactured promo products similarly see a ramp up in end-client desire for Made-in-America merch in 2025, 2026 and possibly beyond. Many of these merch makers with USA-made lines are putting funds behind their forecasts, preparing enhanced marketing and production initiatives to capitalize. The investment-backed efforts speak to their conviction about a coming surge in sales of USA-made swag.

“We foresee a rather large increase in demand for Made in the USA in both 2025 and 2026,” says Matt Quinn, president/CEO of Pennsylvania-based Quinn (asi/80228), whose domestically made products include outdoor flags, table covers, banners, pennants, trade show displays and American flags. In anticipation, “we’ve begun adding several large upgrades to the company,” Quinn continues.

So what has some suppliers so bullish on Made in the USA? How are some preparing? And what might it all mean for the longer-term future of U.S.-made promo products?

Historic Anniversaries, Sporting Events & Federal Policies

A series of generational anniversaries are happening for America in 2025 and 2026 – big enough that certain suppliers believe a broad spectrum of end-clients will be eager to align their brands with a patriotic ethos.

For starters, the 250th anniversary of the American Armed Forces occurs in 2025. The history of the U.S. military stretches back to June 14, 1775, with the founding of the Continental Army. “The Army, Navy and Marines all have 250th anniversary celebrations planned,” Cahn states. “Any business who wants to do a promotion honoring our veterans during 2025 can produce American-made branded keepsakes that will be kept as souvenirs.”

“A perfect storm is brewing for brand building through Made in USA, and it will provide countless promotional product opportunities for end-buyers.” Mitch Cahn, Unionwear (asi/73775)

Domestic manufacturers may also be looking to 2025 as a special year, according to Cahn. While some put the start of modern American manufacturing in the 1780s or 1790s, others view the true genesis to be in 1775, when efforts first began to try to produce some supplies at greater scale to help power the Revolutionary War effort. “Domestic manufacturers will be celebrating 250 years of Made in USA,” asserts Cahn.

Still, 2025 may just be an appetizer to the main course.

In 2026, America celebrates its Semiquincentennial – the 250th anniversary of the nation’s founding. Then there’s the 25th anniversary of the Sept. 11 terrorist attacks.

There’ll be special events and initiatives across the nation tied to these landmark anniversaries. Furthermore, brands and businesses aligning marketing or do-gooding initiatives with the anniversaries will be especially on-message with USA-made merch, says Cahn and others.

Another potential sales accelerator in 2026? The United States is hosting the biggest event in the sporting world – the men’s FIFA World Cup, with top national soccer teams from around the globe playing matches over the course of a month in cities across the U.S.

Download above pdf here.

While a select number of vendors will provide the officially licensed World Cup swag, a wide range of clients – sports bars, local sports leagues and organizations, entertainment brands, venues organizing watch parties – could be in need of everything from rally towels to flags and hand fans, all themed around patriotic support of Team USA.

“There are many positive events occurring in the U.S. that will be celebrated in a big way,” says Colleen Shea, vice president of sales at All American Writing Instruments (asi/76811), which manufactures its products in America. “These events tend to drive patriotism and a desire to purchase USA-made goods.”

Looking even further out, the U.S. is hosting the Summer Olympics in 2028 in Los Angeles. And, campaigns for the next presidency will begin in 2027 and run through 2028 – all potential stokers of USA-made demand, according to some suppliers.

“Companies that don’t always insist on domestic promotional products will do so during a USA-branded event,” asserts Cahn. “For example, NBC Peacock’s giveaways during the Olympics were domestic. Other media companies like Fox and CNN have bought domestically made caps during presidential elections but transitioned to imports during other periods.”

The president-elect has threatened to impose #tariffs of 25% on Mexico and Canada, and an additional 10% levy rate on China-made goods, upon taking office. What might that mean for the #promoproducts industry? Will he follow through?https://t.co/1p1M1gsgbD

— Chris Ruvo (@ChrisR_ASI) November 26, 2024

Meanwhile, there’s also a tariff-sized elephant in the room heading into 2025. President-elect Donald Trump has been rattling his international trade saber, threatening to impose heavy duties on imported products, with key trade partners like China, Mexico and Canada among those in the levy crosshairs.

Whether Trump will proceed with import tariffs and just how those might affect the promotional products market remains to be seen. Still, the looming levies have promo on alert, with industry pros concerned the duties could spike prices on products and impact supply chains. Depending on how things play out, the tariffs could, according to one current of thought in the industry, catalyze increased sales of Made-in-the-USA promos as the price gap between domestic and foreign goods possibly lessens and as distributors seek additional options for reliably available stock.

“Our Made-in-the-USA products are a main talk track for our sales team.” Trish Daly, Koozie Group (asi/40480)

As it happens, certain suppliers are already experiencing a bit of heightened interest, though not necessarily sales, in Made-in-the-USA options. Counselor Top 40 supplier NC Custom (asi/44900) is among them.

“The inquiries have mostly been as a result of the possible tariffs and relate to program business,” says NC Custom President David Miller, a member of Counselor’s Power 50 list of promo’s most influential people. “Customers are concerned with the ability to hold pricing throughout next year and also have readily available inventory.” Confectionary, lip balm, candles, hand sanitizer and specialty packaging are among NC Custom’s USA-made products, Miller says.

Counselor Top 40 supplier Koozie Group (asi/40480) also reports that tariff concerns are compelling a bump in questions about the Florida-headquartered firm’s Made-in-the-USA products, which include writing instruments, drinkware, calendars and bags. The company anticipates greater interest in 2025. “Our Made-in-the-USA products,” says Trish Daly, Koozie Group’s vice president of sales, “are a main talk track for our sales team.”

Taking Action

Making predictions is one thing. Acting on them is another. And taking action to meet the anticipated spike in requests for Made-in-the-USA products is just what some suppliers are doing.

To wit, Unionwear has been investing in automation to help rapidly scale production. In January, the firm plans to launch what Cahn describes as a fully automated canvas tote bag production line in its Newark, NJ, facility. Bags will be designed using a generative artificial intelligence platform that can produce full-bleed print files for backgrounds and logos – an enhancement that will help reduce the cost of the items while offering efficiency.

“We’re taking the increase in demand for Made in the USA as a given and basically putting all of our investments into scaling production,” says Cahn.

Nearly 16%

The percentage of global manufacturing output accounted for by the United States, making the nation second to only China (31.6%).

(United Nations Statistic Division)

NC Custom is being proactive, too.

“We’re adding capacity to our production/manufacturing facility and pushing our USA-made products,” says Miller. “We’re also adding the tag line of ‘Manufactured in our NY facility’ to products where appropriate.”

Shea shares that All American Writing Instruments has been increasing production capacity over the last several years in response to what she characterizes as a growing interest in USA-manufactured products from distributors who decided to diversify their supplier base because of the supply chain crisis that occurred during the COVID-19 pandemic.

The new high-speed, high-efficiency equipment All American Writing Instruments has in place means the firm is strongly positioned to handle an influx of business, Shea says. “As we control all aspects of our production in-house,” she states, “we can ramp up very quickly to meet what the market requires.”

$2.3 Trillion

How much manufacturing contributed to the United States’ gross domestic product in 2023 – about 10.2% of total U.S. GDP.

(Bureau of Economic Analysis)

The supplier firm doesn’t plan to sit on its hands and wait for business to arrive in 2025 and 2026. “We will be increasing our marketing efforts through advertising, social media, interviews, webinars and more,” says Shea. “We need to reach as many distributors as we can to let them know that they do have a USA writing instrument partner they can trust.”

Quinn has been busy as well. “We’ve purchased a large digital format printer and are implementing a new ERP system,” explains executive Matt Quinn. “The new system will allow us to support a smoother flow of processes internally and for our customers.”

Quinn has also established a Made-in-USA products website category that has its own button on the site away from the usual categories, a move intended to help make it easy for distributors to locate domestic-made items. “We’ll be increasing our digital marketing for new products, especially Made-in-the-USA products,” Matt Quinn says.

Koozie Group has a robust USA-made product portfolio and manufactures many of its most popular items stateside, including BIC writing instruments, calendars and Souvenir Sticky Note adhesive pads. The onshore production means the company can accommodate large orders with quick turn times, according to the firm.

Koozie Group is even developing special products with American milestones in mind. In anticipation of the 250th anniversary of the signing of the Declaration of Independence, the cover of the company’s 2026 Good Value Daily History calendar features that event. “Made-in-the-USA products present unique and customizable opportunities,” says Daly.

End-Buyers Eager for Made-in-USA Products

Domestic Manufacturers

Government Organizations

Political Campaigns

Labor Unions

Ethics-Driven Brands

Buyers Needing Small-Batch Customization

Companies Who Are Visibly Patriotic

The Long-Term Outlook

While there’s buoyance about the potential for USA-made promo sales, the sizable increase some suppliers believe is on the way isn’t manifesting just yet. Distributors ASI Media spoke with say they haven’t seen a major spike in requests for U.S.-made products from end-clients, though ASI Research shows that 42% of distributors say that clients did ask for more made-in-the-USA items in 2024 than 2023.

Even so, a review of search data in ESP and ESP+, ASI’s promo business management platform that includes a database of products from across the industry, shows that Made-in-the-USA-related product searches through the first 11 months of 2024 account for essentially the same percentage of overall searches as they did in 2023. In fact, the average percentage in October and November of this year even dipped below the 2024 to-date annual average, research shows.

Still, Made-in-the-USA proponents say none of that is necessarily surprising. It’s early days. The mainstay events that could drive the upsurge lie ahead, and it’s uncertain what will happen with tariffs.

“I’ve never seen so much potential to raise the sales volume of domestically made products. It may or may not be a tipping point to bring more promo manufacturing back to the U.S., but either way it’s definitely a once-in-a-lifetime possibility.” Kevin O’Brien, Worx Printing Cooperative

“We’ve had new inquiries but not new spikes,” says Kevin O’Brien, of Massachusetts-based Worx Printing Cooperative, a distributor/union shop that specializes in print-on-demand merchandise, selling exclusively Made-in-the-USA products. “It will take some time for clients to become aware of all the major events that are on the way before they start to commit to programs.”

Nonetheless, some distributors are skeptical of a major increase even as they remain open to the possibility of a slight uptick in USA-made sales, stating that many end-clients simply don’t care where products are made as long as the items are quality at a good price point.

Even if there is a major boost, some distributors and suppliers don’t believe it will lead to domestic products accounting for a larger percentage of industry sales over the long haul. Relatedly, most don’t foresee a sweeping return to Made-in-the-USA manufacturing for the branded merch industry. They say there doesn’t exist the production scales required to manufacture swag items at levels the entire promo industry requires.

“The demand for Made-in-the-USA products may increase over the next few years, but the feasibility of reshoring large amounts of production remains limited,” says Joseph Shusterman, CEO/co-founder of California-based distributor BlueMark (asi/142002). “The U.S. manufacturing ecosystem faces structural challenges compared to established hubs like China. These challenges include limited access to raw materials, specialized equipment and an experienced and affordable labor force necessary for cost-effective production at scale.”

42%

of distributors agree that clients asked for more Made in the-USA products in 2024 than 2023.

(ASI Research)

Regardless of the long-term outcome for Made in the USA in promo, domestic proponents in the industry maintain that the events and happenings of the next few years present prime opportunity to sell more U.S.-produced goods – and distributors can help make the most of it by proactively educating clients, which suppliers say can benefit end-clients and their brands.

For sure, O’Brien will stay true to his business model of selling USA-made products. He’s been in the promo/print space for nearly 25 years doing just that, and he’s excited for what the next few years could hold.

“In all my time in this business, I’ve never seen so much potential to raise the sales volume of domestically made products,” O’Brien tells ASI Media. “It may or may not be a tipping point to bring more promo manufacturing back to the U.S., but either way it’s definitely a once-in-a-lifetime possibility. We’ll take it.”