Product Hub CANADIAN NEWS April 25, 2025

‘Made in Canada’ ESP Searches Surge as Trade Uncertainty Continues

New data from ASI Research indicates that, while classic categories once again took the top search spots in Q1, Canadian distributors also expressed growing interest in domestic items.

Tariff wrangling and trade woes are causing shifts in buyer habits in the promo industry, including in Canada.

New data from ASI Research reveals that Q1 ESP searches for “made in Canada” increased 2,218% year over year. The results follow several weeks of cross-border trade ambiguity ahead of Canada’s federal election on April 28.

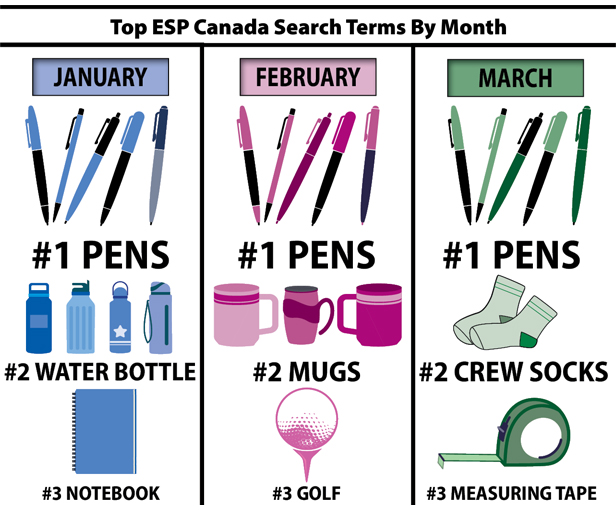

Meanwhile, traditional categories such as “pens,” “water bottle” and “golf” were the three most popular terms for the quarter.

By first-quarter months, “pens” searches were number-one in all three. “Water bottle” and “notepad” were second and third in January, while “mugs” and “golf” took the second and third spots in February, ahead of spring tournaments on the links, and “crew socks” and “measuring tape” rounded out the top three search terms in March, most likely as uniform program revamps and spring contractor projects heated up.

“Socks have definitely been having a moment in retail, so it’s no surprise that the trend heavily translated over to promo last quarter,” says Hannah Rosenberger, data analytics editor. “And it’s also unsurprising that Canadian distributors are looking for more domestically made items right now. With tariff uncertainty continuing, I anticipate that’s a trend we’ll see continue through at least the next few months.”

Among the largest year-over-year decreases for the quarter were “backpack” (down 61%), “luggage tag” (down 42%) and “power bank” (down 30%). Drinkware brand demand also continues to shift among Canadian distributors – while searches for “Yeti” fell 34% year over year in the first quarter, and queries for “Owala” surged 368%. Last year, queries for “Owala,” available in the promo industry from Diamondback Branding (asi/49546) and ETS Express, (asi/51197), an independent subsidiary of Counselor Top 40 supplier PCNA (asi/66887), increased 1,014%.

Meanwhile, reports indicate that, in reaction to an ongoing trade tussle with their neighbor to the south, Canadians have significantly scaled back or outright canceled planned trips to the U.S. and booked Canadian vacations instead in an effort to keep their dollars in Canada and support domestic businesses – at the same time in Q1, searches for “fishing” surged 694% year over year, “hand sanitizer” increased 197% and “waist pack” rose 156%.

Searches for “made in Canada” increased 2,218% year over year in Q1 2025. (ASI Research)

Kim Ewchuk, director of sales and marketing at Botanical PaperWorks (asi/41273), a certified B Corp in Winnipeg that specializes in Canada-made seed paper, handmade soap and soy/coconut candles, says the company has noticed an increase in customer queries for their products in recent months. The supplier’s items can also be shipped into the U.S. tariff-free under CUSMA.

Still, Ewchuk says she and her team expect tempered sales in the quarters to come due to ongoing economic haziness. “We’re hopeful that recent interest in our products translates into real and sustained buying patterns, but we’re staying grounded in the reality of today’s market,” she says. “We anticipate cautious spending to continue through 2025, which could impact the size and volume of orders.”

Mike Yager, president of Spotlight Sport & Corporate Wear (asi/332753) in Humboldt, SK, says Q1 was “extremely challenging” and he’s not alone – distributor sales across North America fell 3.6% year over year in Q1.

Searches for “backpack” and “luggage tag” fell 61% and 42%, respectively, year over year in Q1 2025. (ASI Research)

Popular items in the first quarter among Yager’s end-buyers were pens, caps and apparel, with fleece at the top of the list. Mostly, customers have been favoring items at a lower price point and foregoing brand names.

“They remain very cautious, due to the recent on-again/off-again tariffs and the ability of a prime minister to deal with the U.S.,” he says. “Many businesses in our rural area still don’t understand fully how tariffs and trade wars will directly affect them long term, so it’s very much a waiting game.”

Product Hub

Find the latest in quality products, must-know trends and fresh ideas for upcoming end-buyer campaigns.