Research CANADIAN NEWS July 21, 2025

Promo Sales Drop for Second Consecutive Quarter, but Optimism Up for Rest of 2025

Distributor sales collectively declined by 3.2% in Q2 2025, according to new findings from ASI Research, due to tariffs and buyer hesitancy.

Key Takeaways

• Distributor sales in the promotional products industry declined for the second consecutive quarter in Q2 2025, down 3.2% year-over-year amid tariff uncertainty and economic hesitation.

• Tariff fluctuations, especially on Chinese and Canadian imports, created widespread concern and disrupted sales momentum, though the intensity of that concern eased slightly by the end of the quarter.

• Small and mid-sized distributors were hit hardest, as were sectors like education that have been most affected by budget cuts.

• Despite a dip in the Counselor Confidence Index, year-end projections improved slightly, with many distributors expecting delayed client projects to materialize in Q3 and Q4.

• Sales trends varied month-to-month, with April being the weakest due to peak tariff concerns, followed by a rebound in May and June as clients cautiously resumed spending.

2025 has been a tough one so far for the promo industry.

Distributor sales declined in Q2 for the second consecutive quarter, falling 3.2% compared to the same three-month period last year, according to the just-released Distributor Quarterly Sales Survey from ASI Research. It’s the first time since the COVID-19 pandemic that promo has dealt with back-to-back quarterly sales drops, as the industry navigated a whirlwind of sweeping tariff announcements, rollbacks and overall marketplace uncertainty throughout the first half of 2025.

3.2%

The decline in promo distributors’ sales in the first quarter of 2025 compared to the same quarter last year.

(ASI Research)

In part thanks to that volatility, ASI Research surveyed suppliers as well as distributors – the typical focus of the quarterly sales survey – for both the Q1 and Q2 iterations of this report. And things were challenging on the supplier side as well, with quarterly sales down a similar percentage year over year.

“The second quarter was a continuation of the tough market we saw in Q1, and even at the end of a generally slow 2024,” said Nate Kucsma, ASI’s senior executive director of research and the lead on the quarterly sales surveys. “Overall economic uncertainty and instability meant that clients were still largely hesitant to start spending again.”

A massive slate of “reciprocal tariffs” was announced in early Q2, but its implementation was delayed – first until July 8, and then delayed again until August 1. (The announcement of the second delay came while the ASI Research survey was in the field.) And tariffs on China did lower some from their peak of 145% after negotiations between the Trump administration and China throughout the quarter, though they remain significantly higher than 2024 levels.

The majority of distributors remain concerned about the effect that tariffs and the trade war will have on their 2025 business, with nearly half of distributors reporting year-over-year sales declines on the quarter, compared with about a third who reported increases. On the supplier side, the breakdown was nearly identical, with the majority of companies reporting decreased or flat sales in Q2.

The sales slump is a likely indicator as to why the Counselor Confidence Index – Counselor’s measure of distributor financial health and business optimism – ticked down again from its Q1 reading of 87 to 85. At the end of 2024, it was at an Index baseline of 100.

However, 2025 year-end projections did improve significantly from their Q1 reading. Though a score of 88 is a far cry from the positive outlook of 105 the industry had for the year to close out 2024, the jump up is a sign that the second half of the year is starting to hold more promise. Roughly three-quarters of distributors noted that they think clients are delaying projects into Q3 or Q4 because of economic or budget uncertainties, the quarterly study found – meaning opportunity for more business in the second half of the year.

And while, as mentioned, the majority of distributors remain concerned about tariffs, the strength of that concern has dropped significantly between the first and second quarters, particularly among the largest class of distributors surveyed by ASI Research.

For many, it’s become about buckling down on business despite the outside noise – like at Counselor Best Place to Work Whitestone Branding (asi/359741), where sales were up more than 80% last quarter, thanks both to an acquisition and organic growth. CEO Joseph Sommer has done his best to focus on taking care of existing customers and scaling sales through active outreach, despite a challenging economic atmosphere.

“Don’t get distracted by the news. Don’t get distracted by what others are saying,” Sommer says. “Our company is always thinking about how business isn’t cyclical. It’s compounding – you have to always be focused on the business development.”

Month to Month

Distributors of all sizes, on average, experienced sales declines. However, small and medium-sized firms – those with an annual revenue of less than $1 million – were the hardest hit, with declines of more than 5% year over year, while larger firms’ decreases were closer to 2% on the quarter.

Even though promotional products industry sales in Q2 2025 were down on average, month-to-month sales varied widely in accordance with shifting tariffs and changes in sentiment. April was particularly challenging for distributors as the industry grappled with the high point of tariffs on imports from China. (ASI Research surveyed suppliers and distributors monthly in Q2 to accurately assess the effects of tariffs, and the highest levels of tariff concern and lowest levels of 2025 business optimism came that month.)

At IdentiBrands, an affiliate of Counselor Top 40 distributor Proforma (asi/300094), for example, Owner and President Greg Marks noted April was down for bookings, while May was way up. For Logan King at apparel decorator Express Screen Printing (asi/53413), it felt like sales fired back up out of nowhere in May after a concerningly quiet first month to the quarter.

“In April we were getting nervous,” King says, “And then things came roaring back – which was also pent-up demand that would have come in April, if people wouldn’t have been so cautious.”

For others, the rebound was slower, with sales trickling back to end the quarter as clients began to finally pull the trigger on proposals that may have been in the field for months.

73%

The percentage of distributors who believe clients have been delaying projects to the second half of the year due to economic uncertainty.

(ASI Research)

Rob Watson, CEO of Counselor Top 40 supplier Vantage Apparel (asi/93390) and a member of Counselor’s Power 50 list of the most influential people in promo, noted a difference in the type of projects clients are looking for in Q2. As price hikes took effect in June for some suppliers, including Vantage, some end-buyers shied away from large-scale orders in favor of more one-off items. The apparel supplier’s sales were up year over year, Watson said, but that spending shift was where he noted end-buyer hesitancy despite the sales increase.

Andrew Haslam, an account executive at Grossman Marketing Group (asi/215205), recognized a similar phenomenon. Whereas his clients started the year with an especially cautious attitude toward spending, he thinks that more people got the green light on budgets as the second quarter progressed.

“People were afraid to reach into the war chest and do anything new, or invest in any new ideas or aggressive promotional products,” he says. “But I’m seeing some turnaround now where we’re starting to discuss these bigger projects.”

Market Watch

Outside of blanket tariff impacts on pricing, some of promo’s top verticals have been hit harder than others by budget cuts or marketing pullbacks – while others haven’t been affected as much as anticipated. In fact, for industries on the upswing, prospects have been positive.

While the construction sector is facing the same heightened costs as other industries thanks to tariffs on materials, companies in that vertical are anticipating a boom in construction similar to the pandemic and are planning accordingly with their promo and marketing orders, says Daniel Gottlieb, president of Gott Marketing (asi/212278), a distributorship that primarily serves the building products sector – companies like lumber yards and manufacturers.

“Construction grew during COVID,” Gottlieb said. “And so I think the threat of tariffs and the economy slowing didn’t faze them as much as it did during COVID – sales really haven’t slowed at all.”

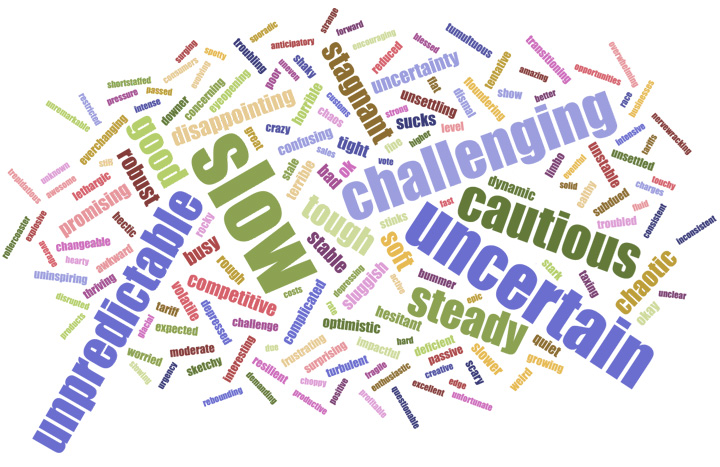

What one word describes Q2 2025? (Distributors)

Because of that, Gott had a banner quarter, up significantly over his Q1 and Q2 sales numbers from 2024, and his July sales so far have already surpassed last year’s. Similarly, Counselor Top 40 supplier Goldstar (asi/73295) noted significant gains for its national accounts in Q2, especially in the healthcare, hospitality and employee engagement sectors, said Global Marketing Manager Lane Hokanson.

“Although it’s a sector that can get cut first from a budgetary standpoint,” she said, “it’s also something that people put a lot of stake in.”

But some of promo’s other top sectors are facing more challenges as budget cuts and increased prices take their toll on profits.

For example, Aaron LaBarbera, the owner of Freelance Print Solutions (asi/198284) in Caldwell, ID, has primarily worked with a variety of colleges for their branded apparel, hard goods and printing needs since he first started his company in 2011. But as the education market – historically, promo’s top vertical – braces for expected cuts to federal student aid and other funding, all of his clients have pulled back on spending.

“That’s something we’ve been seeing across the board – everybody is tightening up,” he says. “First thing to go is their outreach programs and the promo items.”

He’s been able to take on some additional work by partnering with local printers who don’t want to decorate promo for their customers, but his existing client base is extremely hesitant to spend – as is sales manager Jim Palmer’s biggest corporate account at Phoenix, AZ-based HP2 Promotions (asi/217284).

88%

The percentage of distributors who are at least slightly concerned about the impact of tariffs on 2025 business, down from 93% in Q1.

(ASI Research)

The client, a large beverage company, sources all the aluminum for their cans from Canada, meaning they’ve taken a massive hit to profits so far this year thanks to 50% tariffs on steel and aluminum, and cut marketing budgets as a result. Combine that with an additional 35% blanket tariff on goods from Canada expected to go into effect on August 1 – the client also sources hops for their beers from the nation – and Palmer is less than optimistic about their spend, and his sales, for the rest of the year.

“Not only is that going to cause a big price increase in the fall for consumers,” Palmer says, “but it still doesn’t let me have any money to work with.”

Moving Along

The majority of suppliers and distributors have implemented some level of price hikes – even small ones – to account for raised prices due to heightened import tariffs. Goldstar, for example, took it category by category, with increases across the board based on how much individual product types were being affected, says Hokanson. LaBarbera has tried to eat costs where he can for now – especially considering he tries to give the education market a solid deal as is – but there’s some places where he just can’t quite wrangle it.

Another price-specific challenge, though, has become navigating quotes where clients took too long to pull the trigger. Palmer, of HP2 Promotions, says he thinks that because budgets are a bit tighter, even if clients have money to spend, it’s more of a process to get access to those funds. He quoted a client for a project in March, for example, and then when he had to quote it again in June, his price per item had basically doubled.

“It’s taking a lot longer for people to make up their minds,” he said. “I think people are having to go to their superiors to get approvals that they didn’t need to do before, which can cause time delays and all kinds of chaos.”

Again, though, hope for the rest of the year hasn’t entirely gone away. Debbie Behle, owner and co-founder of Behle Branding (asi/177789), says she was disappointed to be down from the company’s targets in the second quarter because the Utah-based distributor had one of their best quarters ever in Q1. But she’s already seen business start to pick up as orders she suspected were held off during the slow period of Q2 start to come in.

“Businesses ebb and flow,” she says. “The economy ebbs and flows, obviously. And if you can figure out how to ride it through, be upfront, be honest with your customers – then you’re going to make it through.”