News Last Updated: April 10, 2025

Tariff Turmoil Ignites Red-Hot Demand for American-Made Merch

Distributors are flocking to suppliers that can offer domestically manufactured solutions amid trade war volatility.

Key Takeaways

• Surge in U.S.-Made Product Demand: Promo distributors are increasingly prioritizing Made-in-USA promotional items due to tariff instability and global trade uncertainty.

• Domestic Suppliers Reap Rewards: Suppliers All American Writing Instruments (asi/76811), Royal Apparel (asi/83731) and LBU Inc. (asi/65952) report significant sales growth, driven by heightened demand for American-made goods across various product categories.

• Long-Term Growth Potential & Limits: While interest in U.S.-made promo products is rising, experts caution that various domestic production limitations will prevent a widescale shift from global to domestic production in the promo industry.

All American Writing Instruments (AAWI; asi/76811) is inking a success story in 2025.

The Linden, NJ-based penmaker has increased sales 25% year to date compared to the same period in 2024. The number of unique promotional products distributors who have ordered from the supplier has doubled during the comparative span. Distributor inquiries have soared. AAWI manufactures all its writing instruments from scratch in the Garden State.

“I am certain,” says AAWI Vice President of Sales Colleen Shea, “that our position as a USA manufacturer has had a strong impact on our positive numbers so far this year.”

AAWI’s experience speaks to a notable trend permeating the promo industry through the opening months of 2025. Namely, distributors are increasingly interested in sourcing Made-in-USA promo products. They’re inquiring more with suppliers who can provide those domestically manufactured goods and frequently following through with orders, leading to sales increases on U.S.-produced goods, according to suppliers with whom ASI Media spoke.

President Donald Trump’s dizzying import tariff policy is a fundamental factor driving the intensified distributor focus on Made in the USA, industry executives say.

Trump has hit China-made imports with a 145% additional tariff rate so far in 2025, implemented import levies on Canadian and Mexican products not covered by the United States-Mexico-Canada Agreement and announced a baseline tariff of 10% on products being brought stateside from nations around the globe, in addition to duties on specific products like steel, aluminum and automobiles.

“We’ve seen a significant increase in inquiries for Made-in-USA products, and much of that surge is tied directly to the tariffs and broader economic uncertainty surrounding global trade.” Jordan Scaduto, LBU Inc. (asi/65952)

The president has also made a habit of announcing tariffs, then pausing or downscaling them, as he did in early April with so-called reciprocal tariffs on upward of 100 countries, which he paused for many nations for 90 days just one week after announcing them, dropping the levy rates to the baseline 10%.

Trump’s moves are part of what some analysts view as a negotiating strategy aimed at strengthening the United States’ position in international trade. However, a consequence of this fast-changing approach has been widespread uncertainty across industries in America.

The anxiousness has inserted itself into promo too, where the levies are driving higher prices on imported promo items and breeding lack of clarity on how high those prices might go. Amid the turmoil, distributors are keen for what stability they can find. In that, distributors are intensifying their focus on Made-in-the-USA promo options.

“USA-made has been a hot topic since the January trade shows, but we have seen a significant increase in interest and urgency since the tariffs were implemented.” Glen Brumer, Royal Apparel (asi/83731)

It’s a phenomenon evidenced both by supplier experience and data from ASI that shows use of the “Made in the USA” search filter in ESP and ESP+, ASI solution platforms that enable sourcing of products from across promo and other benefits, was the highest it has been in the last year in January, February and March of 2025. April activity is on the upswing, too.

“We’ve seen a significant increase in inquiries for Made-in-USA products, and much of that surge is tied directly to the tariffs and broader economic uncertainty surrounding global trade,” says Jordan Scaduto, partner/executive vice president at LBU Inc. (asi/65952), a Paterson, NJ-based supplier whose core solutions include domestic cut-and-sew manufacturing of products like bags, packaging, aprons and pillows.

Scaduto says that distributor customers are confused by the swiftly shifting landscape of international tariffs – “the different rates from different countries, sudden changes and unexpected costs. With domestic production, there’s a sense of stability and transparency – no surprise fees, no customs issues and no delays at ports. Buyers know what they’re getting when they choose Made in USA: predictable pricing, high quality and peace of mind.”

Distributors: Customers Want Made-in-USA Options

Scaduto indeed may be onto something. Certainly, some industry distributors say they’re keying in more on Made in the USA.

Take BAMKO (asi/131431). The Counselor Top 40 distributor has developed a dedicated “Made in USA” product platform that the firm says features a curated collection of domestically manufactured promo products in categories that include apparel, drinkware, bags and writing instruments. “This strategic investment allows businesses to source premium, tariff-free products with the assurance of domestic production reliability,” BAMKO notes in a blog that discusses the platform.

Confused and/or concerned about #tariffs and the #promoproducts industry? This webinar from ASI can help orient you.

— Chris Ruvo (@ChrisR_ASI) April 9, 2025

Nearly 1,000 Tune Into ASI Tariff Webinar Featuring Expert Panelists https://t.co/RBriZgbFtn

Meanwhile, curiosity about Made in the USA is surging among Counselor Top 40 distributor Geiger’s (asi/202900) network of sales professionals in the U.S., compelled at least in part by end-client interest, according to Chief Revenue Officer Chris McKee. “Over the last week, this question on ‘Made in the USA’ has been asked by a bunch of customers,” McKee states in an April 8 ASI webinar about navigating tariff impacts. “They want to know what the options are.”

Andy Shape, a member of Counselor’s Power 50 list of the promotional products industry’s most influential people, says Counselor Top 40 distributor Stran Promotional Solutions (asi/337725) is prioritizing having Made-in-USA options at the ready for clients.

“We’ve been closely monitoring the tariff situation for several months,” says Shape, Stran’s CEO, “and have proactively explored alternative sourcing options, including U.S.-manufactured products.”

Rising Sales & Inquiries

The heightened distributor and end-client interest is propelling business for some suppliers who offer Made-in-the-USA products.

Hauppauge, NY-based Royal Apparel (asi/83731), which has produced garments in the United States since 1992, tells ASI Media that sales were up 13% in March compared to the same month last year. First-quarter custom project quotes spiked 50%. And, onsite and referring keyword searches have accelerated about 30% within roughly the last month.

“Searches on our USA Proud-related web pages have increased over 700% since the inauguration, with most of that growth coming in the last two months.” Trish Daly, Koozie Group (asi/40480)

With summer on the horizon, distributors contacting Royal Apparel are especially focused on T-shirts, but there’s also desire for sweatshirts, hats, kids’ apparel and tote bags – you name it, says Glen Brumer, Royal Apparel’s sales director. “USA-made has been a hot topic since the January trade shows, but we have seen a significant increase in interest and urgency since the tariffs were implemented,” Brumer shares.

Counselor Top 40 supplier Koozie Group (asi/40480) reports that about 30% of its product portfolio falls within its “USA Proud” designation, which includes products that are made in the USA, assembled in the USA or printed in the USA (see sidebar below for explanations on such distinctions).

“Searches on our USA Proud-related web pages have increased over 700% since the inauguration, with most of that growth coming in the last two months,” says Trish Daly, vice president of sales operations at Koozie Group, who notes the Florida-based firm intends to hold pricing on its more than 600 USA Proud items through the end of the year.

Daly continues: “Distributors are primarily looking for options. We take this opportunity to explain how they can evaluate USA-made claims, the nuances around our USA Proud items and the breadth of our USA Proud offerings, which span 12 product categories.”

“Sourcing and manufacturing our products in the United States when we started was not an emotionally driven decision. It was a decision rooted in what we thought was best for the business.” Noah Lee, Sock Club (asi/88072)

Elsewhere, LBU Inc.’s sales have soared, rising 70% year over year through the opening months of 2025, Scaduto says. That’s not all due to Made in the USA, as the firm also executes custom cut-and-sew projects overseas depending on client need. Still, Made-in-USA business is the primary propeller of the top-line gain, as customers clamor for bags, backpacks, aprons and pillows.

For example, LBU recently fulfilled one of its largest domestic orders ever – a more than $1 million job tied to Nurses Week. It included 128,000 fully custom totes and packing cubes. “We’re fielding daily calls and quote requests from companies actively looking to shift production stateside,” Scaduto says.

Austin, TX-based Sock Club (asi/88072) makes custom socks in the United States. The supplier’s sales were already on an upward trajectory in recent years, but business has grown about 20% on an annual basis to date in 2025. “Our vertically integrated, USA-based production model is proving to be a strategic advantage as competitors struggle with international supply chain disruptions, pricing volatility and extended lead times,” says Sock Club CEO Noah Lee.

Making the Most of It

Acutely aware of the ascending demand for domestic, suppliers are taking proactive steps to capitalize.

Unionwear (asi/73775), a supplier that specializes in American-made headwear, bags and portfolios, has been investing in automation to help rapidly scale production. The firm is this week installing machinery at its Newark, NJ, facility that will allow it to fully automate canvas tote bag production. The system enables bags to be designed using a generative artificial intelligence platform that can produce full-bleed print files for backgrounds and logos – an enhancement that will help reduce the cost of the items while offering efficiency.

“We’re taking the increase in demand for Made in the USA as a given and basically putting all of our investments into scaling production,” says Mitch Cahn, Unionwear’s founder and president.

Nearly 16%

The percentage of global manufacturing output accounted for by the United States, making the nation second only to China (31.6%).

(United Nations Statistic Division)

AAWI is intensifying marketing efforts to ensure customers know they have, as sales VP Shea says, “a USA-made partner in the writing instrument category. We have also accelerated the release of our new sustainable pen, which will now launch in June 2025. Originally slated for January 2026, we have worked diligently over the last several months to move up our release date to give distributors an exciting, new USA-made product sooner than later.”

Anticipating a sales surge, Royal Apparel heavily stocked up on both inventory and the raw materials it will need to swiftly produce more apparel and related products. “Most items are now at an all-time high,” says Brumer.

Operationally, Sock Club is working its vendor partnerships and has ensured it will have dedicated capacity that will allow rapid scaling of production to meet client need while providing quick fulfillment, Lee says. The firm is also more actively promoting its capabilities through news sources and planning to create new video content that showcases its production process from seed to sock – a strategic marketing move.

“Sourcing and manufacturing our products in the United States when we started was not an emotionally driven decision,” Lee shares. “It was a decision rooted in what we thought was best for the business. It was, and continues to be, the best way to assure reliable sourcing of high-quality materials, low minimum orders, fast production time and a superior quality product.”

ESP & Made in USA

In response to the mounting impact of U.S. trade tariffs, ASI is taking swift action to support the promo products industry through its ESP platform, which features over 1 million supplier products searchable by tens of thousands of distributors. Distributors can search and filter for products marked “Made in USA” or “Made in Canada” in ESP+ and for “Made in USA” in ESP Web.

As interest in U.S.-made items rises, ASI is proactively auditing products labeled as American made and reaching out to suppliers to certify that items are fully sourced and manufactured in the United States, helping protect distributors from unintended tariff exposure. Meanwhile, ASI’s data team works closely with more than 3,000 suppliers to ensure tariff-related product and pricing changes appear in ESP in as little as 15–30 minutes.

“We know how fast things are moving, and ASI is moving just as fast,” says Tim Andrews, ASI president and chief executive officer. “We’re helping suppliers update their data quickly and giving distributors powerful tools in ESP to filter for U.S.- or Canadian-made goods. We’re auditing ‘Made in USA’ claims to make sure what’s labeled as such truly meets the mark. In uncertain economic times, ASI is focused on being a trusted, responsive partner for the entire supply chain.”

Outlook: Sales Gains Predicted, but No Supply Chain Overhaul for Promo

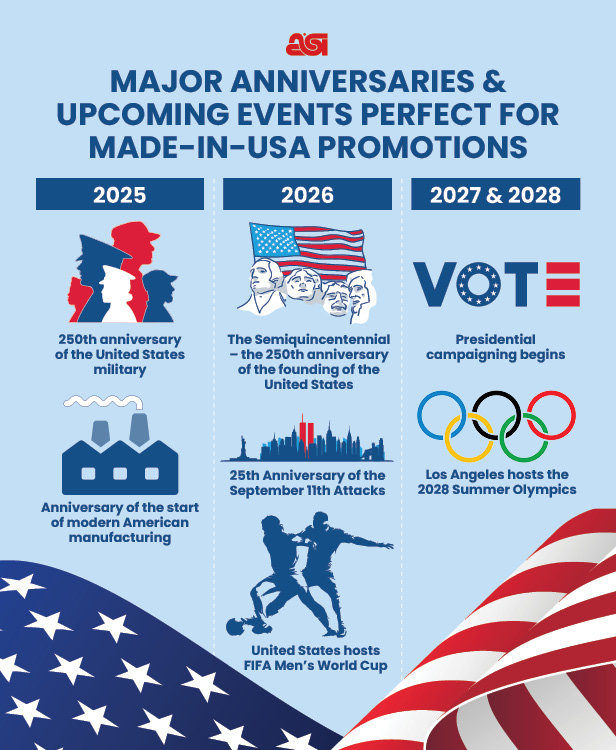

In December 2024, ASI Media reported that Made-in-USA promo sales were potentially poised to surge in 2025 and the several years to follow. That’s not just because of tariffs and related federal actions.

Historical milestones, like the 250th anniversary of the U.S. military and America’s Semiquincentennial, as well as major sporting events, like the United States hosting the World Cup in 2026, are among factors suppliers say could spur sales increases of domestically built promo products.

While marketplace dynamics are volatile and things can change quickly, some suppliers believe heightened demand for Made-in-the-USA solutions will continue through this year at least. “The instability of the tariff situation will continue to drive this,” says Shea of AAWI. “In a world of what seems like daily changes, we bring a ‘business as usual’ option to customers.”

Brumer anticipates that Royal Apparel’s sales will be strong. “Previous to tariff news, we were already seeing elevated consumer interest for American-made. With that, paired with elevated tariffs, we expect to be busy through the rest of the year,” he shares.

LBU predicts demand for U.S.-based cut-and-sew solutions will continue elevating. “The tariff situation is far from settled, and negotiations could continue for months,” Scaduto says. “As more businesses experience delays, unexpected costs and complications from overseas sourcing, we believe buying domestically will become a strategic decision, not just a patriotic one. The value of certainty, control and reliability is becoming more apparent to everyone in the supply chain.”

$2.3 Trillion

How much manufacturing contributed to the United States’ gross domestic product in 2023 – about 10.2% of total U.S. GDP.

(Bureau of Economic Analysis)

Still, while USA-made promo sales could rise, it would be painting an inaccurate picture to indicate they’re going become a vastly higher percentage of the $26.6 billion promotional products industry’s business, or that promo is suddenly going to go from an industry reliant on importing to one that produces most of its goods domestically.

Supplier executives and promo sourcing experts say that the branded merchandise market will continue to produce the vast majority of products it sells in the United States overseas. They say there doesn’t exist the infrastructure, workforce, materials or supply lines to service promo’s needs at industrywide scale in the U.S. – and likely won’t in a cost-effective way anytime soon.

“Realistically, you can’t set up a factory overnight and start producing complex products like stainless-steel bottles or premium backpacks at a promo price,” says Power 50 member Heather Smartt, head of Counselor Top 40 supplier Goldstar (asi/73295), a hard goods supplier.

Nonetheless, while Smartt and others believe it’s unlikely that suppliers can shift the lion’s share of their extensive production to the United States, she does feel that Goldstar’s range of USA-made drinkware and pens are poised to perform well in the months ahead. “We think,” she says, “they’re going to be strong sellers.”