Awards July 22, 2020

SOI 2020: Staffing Shakeup in Distributor Workforces

Thinned-out ranks and empty offices are here for the foreseeable future – and possibly permanently.

Joseph Sommer feels fortunate. That is, as much as one can during grim times.

Don't Miss: More SOI 2020

The owner of New York-based distributor Whitestone Branding (asi/359741) was able to hire back three of the six employees he laid off in March amid the industry sales crash. The rehiring occurred because of funds Whitestone received through the CARES Act Paycheck Protection Program (PPP).

“We were fortunate to receive government support and get some of our people back,” says Sommer. “Still, we don’t have plans to hire anyone else. It’s too hard to forecast what the third and fourth quarter will bring.”

Sommer’s uncertainty is emblematic of what many distributors feel about staffing levels in the wake of COVID-19. The pandemic swept in like a tsunami, forcing widespread layoffs. It also redefined the promo workplace, prompting countless companies to switch to work-from-home models virtually overnight.

Now, as the slow recovery begins, distributors are grappling with countless questions related to their workforce: Will the workplace changes be permanent? Will employees always work from home? And how long until staffing returns to a semblance of its previous level?

Staffing Softness

Most executives believe that hiring at distributorships will pick up as economic conditions improve and promo sales strengthen following the pandemic-fueled plummet.

It’s already happening to a degree, thanks to PPP loans, which mandate that 60% of the loan must be spent on payroll. Distributors that pivoted successfully to selling personal protective equipment have also been able to bring back some staffers.

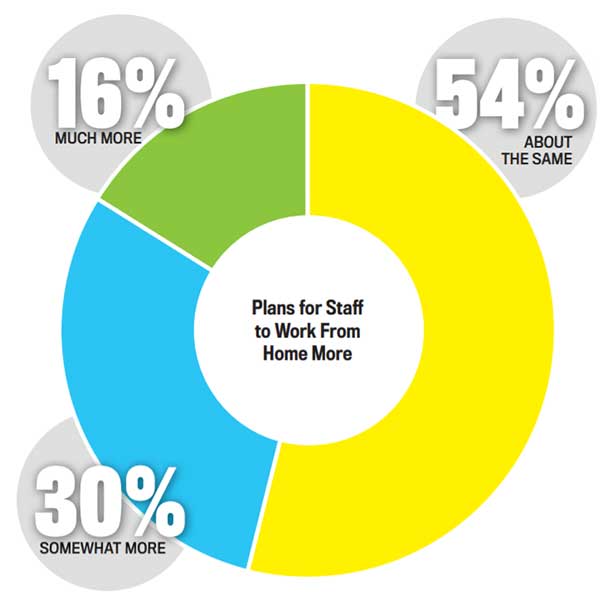

Home Sweet Home: For promo companies, the COVID-19 pandemic has opened the possibility of employees increasingly (and maybe permanently) working from home. Figures are just about identical for both distributors and suppliers.

Despite such positives, most executives believe an industry-wide staffing rebound to pre-crisis levels will fail to materialize at distributorships this year. There isn’t broad consensus on when such a bounce-back might occur – or if it ever will. Some industry executives opine that distributorships that have survived the COVID-19 disruption will never again employ as many people as they did prior to the pandemic.

“In general, distributors will see reductions in their workforces, particularly with less support roles,” says Joshua White, general counsel and senior vice president of strategic partnerships at Los Angeles-based Top 40 distributor BAMKO (asi/131431). “I don’t think distributor staffing levels will ever return to what they were pre-crisis. Firms will learn to get by on less. With a number of distributors going out of business, there will also be less industry jobs on the whole.”

Others are more optimistic. “I suspect that distributor staffing levels will return to normal some time in 2021, once large corporations get through their own challenges and can better predict what their sales channels are going to be like,” says Renya Nelson, founder of agency-style distributorship Brand+Aid (asi/145193) in Salt Lake City.

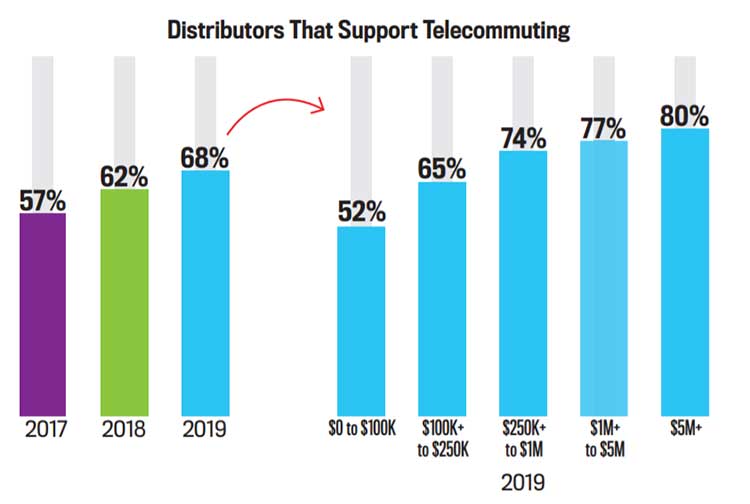

Ratcheting Up Remote Work: In the past three years, distributors have increasingly allowed remote work. The larger the company, the more likely that employees are working from home.

Memo Kahan, president of Los Angeles-based Top 40 distributor PromoShop (asi/300446), believes staffing will ultimately rebound to employee counts seen before COVID-19 – it’s just going to take a while. “Unfortunately, we believe it will be one to two years before staffing gets back to pre-coronavirus levels,” Kahan says.

Mike Wolfe thinks the answer to the staffing question is nuanced. The CEO of Chicago-based Top 40 distributor Zorch (asi/366078) asserts that staffing through the end of 2020 and into 2021 will depend to a degree on each distributorship’s structure. “In some cases, where a distributor has a larger variable cost structure for services like manufacturing and warehousing, staffing will likely need to track with lower volumes,” Wolfe says. “For other distributors that may have a leaner structure that’s more focused on account management and customer service, they may have the need – and ability – to keep staffing levels closer to pre-pandemic levels.”

Permanent Work From Home

In 2017, 5.2% of Americans worked remotely, according to the U.S. Census. After the pandemic struck, a study by software firm Clutch found that 66% of employees were working from home at least part of the week during the pandemic, with 44% working remotely all week long.

“Companies everywhere are realizing that many employees prefer more time at home.” Renya Nelson, Brand+Aid

Against that backdrop, one prediction many executives are confident about is the more pervasive practice of working remotely. “Working from home will be a standard for the foreseeable future,” says Kahan.

Explains Nelson: “Companies everywhere are realizing that many employees prefer more time at home. Employers are also looking at their office-related expenses and wondering if it’s worth keeping as much space when work-from-home productivity levels are close to or as good as what they were without desks, printers, showrooms and kitchens to upkeep.”

Some distributorships, thanks to their corporate model and philosophies, already had the technological infrastructure in place to facilitate efficient remote work before the pandemic. COVID-19 drove further refining of that. “Our goal is to have the most talented employees possible, regardless of geography,” says White. “We’ll continue to evolve in that direction.”

Distributorships will have to adapt to the work-from-home reality. Sommer shares that remote work has been part of Whitestone Branding’s model but notes that there was always a “strong core” at office headquarters. That’s changing a bit.

“Because of the coronavirus, three people who used to commute to our office have decided to move from New York City, which will shift our workplace dynamic,” he explains. “We’ll now have more people working remotely than reporting to an office. To adapt, we’ve added two more weekly meetings beyond our daily huddles and weekly kick-off meeting. It will help keep everyone on the same page.”

As remote work rates increase, distributors will need to ensure they have the technology in place to protect sensitive data in the age of rampant hacking. They also must enable employees to communicate easily. The communication aspect, at least, doesn’t have to be a huge hill to climb, thanks to a bevy of readily available solutions. “With tools like Slack, Dropbox, Google Drive and Zoom, the virtual office is a breeze to work from,” says Nelson.

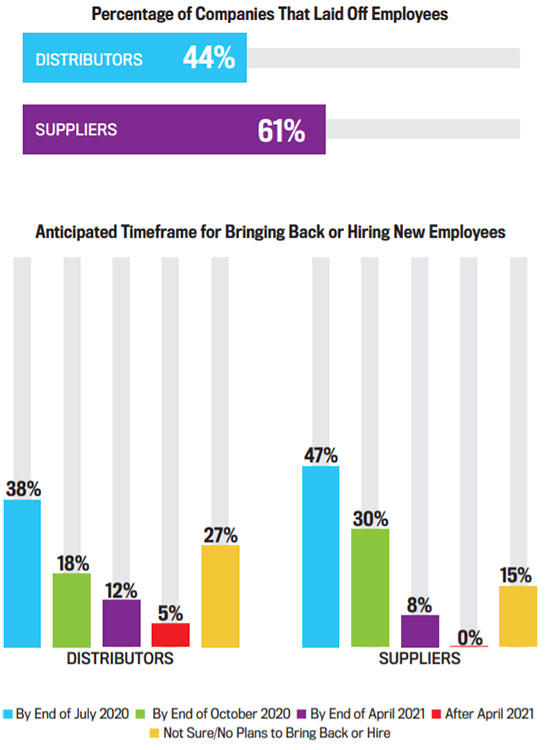

Gone, But Back Again? Devastating shutdowns predictably caused layoffs, affecting suppliers more than distributors. On the flip side, suppliers are more optimistic about bringing employees back or hiring new ones by the end of the year.

Distributors will also need to decide if they’ll help offset certain costs employees might incur when working from home. Will firms help with electrical bills, high-speed internet costs and office essentials like printing ink and paper?

As of yet, there doesn’t appear to be a uniform approach.

“A lot could depend on the demographics of your employee base and the infrastructure of your company,” says Wolfe. “For example, our systems (including phones) were designed to enable our employees to work remotely. To further enhance employee mobility, we only use laptops, which they can take with them. Everything we do is electronic, so all our team members need, aside from their laptop, is a cellphone and Wi-Fi.”

Some distributorships are considering helping defray potential remote work costs. “Employers should try to make working from home as comfortable and convenient as possible, potentially giving employees $500 to do with what they wish, such as buying a desk, a printer or a new chair,” says Sommer.

While he is open to providing such support and willing to adapt to more remote working with his team, Sommer is also among the contingent of industry pros who aren’t thrilled with the move to increased working from home.

“You want to value your people and show flexibility, but from my standpoint, I don’t want a remote culture,” he says. “I want to build a great internal culture and create a space where people enjoy coming in and collaborating.”

Shift Back to Straight Commission?

The coronavirus pandemic is poised to impact how distributors’ sales reps are paid. Some executives believe it could prompt a return to straight commission being the industry’s dominant compensation model, with more reps working as independent contractors than full-time employees.

In recent years, salary-based compensation models have overtaken straight commission. It happened for the first time in 2017 and continued the following year, when more than 50% of industry reps reported that they receive either straight salary (14%) or salary plus some other form of recompense, according to ASI Research. (Salary-plus-commission, the model that 22% of distributor reps are paid under, is the most common of the various “salary-plus” models.)

Distributors have also been increasingly offering reps benefits such as PTO, retirement plans and insurance, signaling a switch to adding reps as full-time employees rather than independent contractors.

But with a long road back to recovery and a fear of taking on too many fixed costs, those trends could reverse.

“Distributors will be less likely to offer compensation packages with extensive benefits and more likely to look to the commission-only model, hiring salespeople with experience outside of where they’re headquartered,” says Renya Nelson, founder of Brand+Aid (asi/145193).

California this year enacted new regulations for freelance and gig work, essentially turning reps into employees, says Memo Kahan, president of Los Angeles-based Top 40 distributor PromoShop (asi/300446). As such, the distributor is planning to continue having reps as full-timers. Meanwhile, Joseph Sommer, owner of New York-based distributor Whitestone Branding (asi/359741), will be compensating his sales reps with salary-plus-commission as he’s always done. “We don’t have plans to change,” Sommer says.

While some feel a high-reward-potential straight commission model is best for attracting capable/ambitious reps, others think the relative stability offered under salary-based structures can be a differentiator for distributors eager to score top talent.

“Distributorships that keep or even add to the safer compensation model,” says Nelson, “will stand to benefit from a broader talent pool ready to work hard for a distributor that looks out for them.”