Research January 24, 2025

Promo Industry Achieves Record Sales in 2024 Despite Challenges

ASI Research shows that distributors increased collective sales by 1.8% year over year to $26.6 billion – a new high-water mark.

Key Takeaways

• A Hard-Fought Win: Promo distributors achieved a record $26.6 billion in sales in 2024, despite a plethora of challenges.

• Slow Q4: Industry revenue increased only 1.4% compared to the previous fourth quarter.

• Bigger Fared Better: Large and extra-large distributors outperformed small and medium-sized distributors in terms of sales growth rates in 2024, and Q4 in particular.

• Looking Up: Optimism for 2025 is high, with a projected Counselor Confidence Index of 105.

Promo ended 2024 with more of a whimper than a bang, but in a year pocked by uncertainty, merch distributors still overcame a myriad of challenges to notch another industry sales record. Notably, there’s also a rising tide of optimism for 2025.

Those are the top insights from the just-released Distributor Quarterly Sales Survey from ASI Research, which showed that promotional products distributors collectively increased sales, on average, by 1.8% year over year in 2024 to $26.6 billion – a new annual record for the industry.

$26.6 billion

Promo distributors’ sales in North America in 2024 – a record. (ASI Research)

Growth in Q4 clocked in at a relatively anemic 1.4% compared to the prior year’s fourth quarter. The quarter was also a notable drop from Q3 in 2024, when sales rose 4.2%. That quarter was an outlier for the year, as sales only increased 1.3% in Q2 and declined in Q1 on an annual basis by 0.9%.

Continued challenges tied to inflation, buyer anxiety over their businesses and the direction of the economy, a tumultuous presidential election cycle, and general uncertainty in the broader marketplace all conspired to prevent stronger revenue gains.

Certain distributors also cited other factors, including drawn out sales cycles that fizzled, increased competition from online sellers and a strong 2023 that made for a difficult comparative.

Even some perennial promo powerhouses didn’t manage major gains. For instance, Counselor Top 40 distributor 4imprint (asi/197045), promo’s largest distributor, reports that annual growth slowed to 3%.

“The whole year was strange,” says Nate Kucsma, ASI’s senior executive director of research, who spearheads the Quarterly Sales Survey. “It seemed like everyone was waiting for something to happen, which would then open up the purse strings of companies. But even when things did happen, such as a presidential election with a clear winner or the Federal Reserve’s interest rate cuts, nothing truly freed up.”

The fourth quarter seemed especially disappointing for many distributors. Only 29% said sales were better than expected, while a near equal percentage said business was worse than anticipated.

The industry’s smaller distributors fared the worst in Q4. Those that generate $250,000 or less in annual revenue experienced a year-over-year sales decline of 2.2% in the fourth quarter. Medium-sized distributors, which ASI categorizes as producing between $250,001 and $1 million in revenue annually, shouldered a collective sales drop of 1.1% in Q4.

The industry’s large ($1 million to $5 million in revenue) and extra-large (above $5 million) distributors fared better in Q4, with rises of 2.7% and 1.5%, respectively.

Says Kucsma, “Q4 was a continuation of what we saw through the year: Lackluster growth with seemingly something great on the horizon that never really came to fruition.”

Optimism on the Rise

Despite the challenges in Q4 and 2024 as a whole, distributors are entering 2025 feeling more upbeat than they have in over a year.

To wit, the Counselor Confidence Index, which has a 24-year history of measuring distributor financial health and business optimism, increased in the fourth quarter back to its baseline reading of 100 – the first time it’s been at or above that baseline since Q3 of 2023.

Confidence is even higher when looking farther out.

Based on distributor feedback, the index has a projected reading of 105 for the whole of 2025. Distributors gave an array of reasons for the sunnier outlook – easing inflationary pressures, a belief that the new presidential administration will be more business-friendly (helping to free up corporate spend) and particular opportunities they see emerging for their individual businesses.

“We’re expecting a good 2025, primarily due to the impact of new programs won in 2024, combined with the stability/expansion of our existing account base,” says Mike Wolfe, CEO of Counselor Top 40 distributor Zorch (asi/366078).

105

Projection for the Counselor Confidence Index at the end of 2025

Meanwhile, Minnesota-based distributor Liquid Screen Design (asi/254663), a Counselor Best Place to Work, is projecting growth of over 20% in 2025.

Creative Director Katie Woznak says the company is working on new initiatives that will be rolled out over the next 12 to 18 months; they’re expected to spark sales momentum. The firm has advanced key staffers into leadership roles focused on operational excellence, marketing, lead generation, e-commerce and vendor relations – all of which is expected to bear fruit.

“We’re planning for significant growth,” says Woznak.

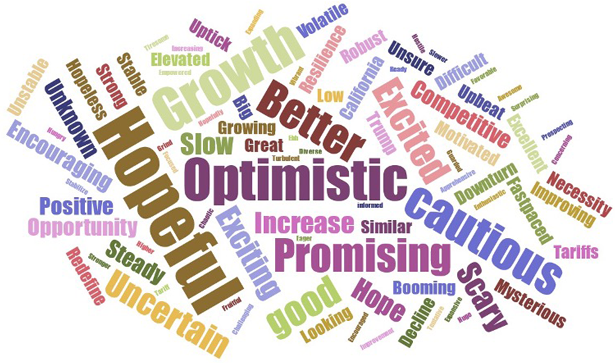

Which One Word Describes Your 2025 Expectations?

ASI Research asked distributors what one word best describes their expectations for 2025. While words like “cautious” and “uncertain” came up, positive terms like “hopeful,” “growth,” “optimistic,” “better” and “promising” took prominence.

Of course, it would be mischaracterizing things to say distributors are stress-free and over the moon about 2025. Potential issues linger, including worries over continued buyer malaise and the possibility of new import tariffs, which could inflate prices on promo products.

“I am worried with the political climate and tariffs, which could be a big issue moving forward,” says Sandy Wagie-Troemel, co-owner of distributorship Midwest Printing Services Inc. (asi/270906).

Still, for Wagie-Troemel the year is off to a solid start, and she’s keen on her Wisconsin-based company’s prospects. “January has been very good for us,” she says. “I think we’ll have a strong 2025.”

Success Stories

While 2024 didn’t deliver robust growth, the fact remains that promotional products industry revenue in 2024 increased and distributors did engineer another record-breaking year.

Especially encouraging, distributors of all revenue sizes – small, medium, large and extra-large – all executed sales gains. In total, 42% of all distributors increased sales, while 23% said revenue remained about the same.

Large-sized distributors did best in terms of percentage growth, accelerating average annual revenue by 2.6%. Liquid Screen Design was among the successful large firms. Strong relationship-building efforts, strategic warm lead generation and enhanced operational efficiencies fueled the firm’s revenue jump. “Our sales increased substantially in 2024,” says Woznak.

Proforma Key Solutions (asi/490541), an independent affiliate of Counselor Top 40 distributor Proforma (asi/300094), was another distributor in the $1 million to $5 million revenue category that increased annual sales.

Yvette Hymel, co-owner/brand marketing consultant with the New Orleans-based firm, tells ASI Media that drip campaigns, a focus on providing virtual and spec samples, and deeper partnering with valued suppliers helped ignite business. “We were up due to continued prospecting and strategic upselling,” says Hymel.

Meanwhile, medium-sized distributors had the second-highest average annual sales increase, which came in at 1.8%.

Wagie-Troemel says sales of branded wearables aided in elevating business for Midwest Printing Services, whose promo-specific sales put the firm in the medium-sized category. Midwest Printing Services scored success especially through selling apparel through company stores. “Customers are also going out more to trade shows again, and we were able to provide more solutions for them tied to that,” Wagie-Troemel says.

While education is typically the market distributors list as most robust for promo sales, in the fourth quarter of 2024 healthcare took the top spot. Education finished second. Construction, manufacturing/distribution and nonprofits rounded out the end-client sectors distributors said were best for merch sales in Q4.

Medium-sized Pinpoint Creative (asi/163343) didn’t register a big sales rise in 2024, but did manage to grow business and generate higher margins on orders. A focus on reorders, email marketing initiatives and obtaining prospect lists from shows where the firm exhibited caused sales to inch forward. The company is aiming for better in 2025 – and has strategic plans to make that improved performance a reality.

“We’re going to try some guerilla marketing this year,” says Janae Grove, Pinpoint’s promotional marketing director. “We’re committed to increasing our sales by 25%. We know it’s doable.”

Meanwhile, promo’s extra-large distributors managed to increase revenue, on average, by 1.7%. Counselor Top 40 distributor Something Inked (asi/329822) had a dynamite year, powering its way to an approximately 33% increase, according to Executive Vice President Bill Feldberg.

Feldberg says adding sales team members, expanding sales with live-event clients and touring musical acts, and providing more solutions in the corporate and destination retail channels, among other markets, were central to the revenue rev-up.

“Apparel drives about 65% of our sales and we continued to find success with our custom apparel programs, as well as expanding our art team to be able to turn custom art projects faster,” Feldberg adds.

The industry’s smallest distributors eked out a 1% annual sales increase – the weakest showing. Nonetheless, small firms had full-year wins to report.

Montana-based Branded Sign Solutions (asi/134559), who fits the small category, doing under $250,000 in promo yearly, found that effective social media marketing, strong word of mouth and leveraging solutions from ASI (including ESP+) helped move merch. “We were most successful with a partnership with the local high school, car dealerships and restaurants,” says Branded Sign Solutions’ Jackie Myers. “We were able to pick up a few new clients.”