News November 19, 2020

How Will the COVID Surge Affect Promo?

Leaders from the promotional products industry weigh in about the latest coronavirus surge’s potential impact on end-of-year sales, Q1 performance, PPE business and more, including insights on how companies can best navigate the trying times.

UPDATE: 8 A.M. EST Friday Nov. 20

The U.S. reported 187,833 new COVID-19 cases for Thursday, Nov. 19, according to data compiled by Johns Hopkins University. That exceeded the previous daily record by more than 10,000. There were 80,698 people hospitalized with the disease as of Thursday, also a record, according to The Wall Street Journal.

The next big surge of COVID-19 is here, but promotional products executives are optimistic that the precipitous declines in sales experienced when the pandemic roared onto American shores in March and April will be avoided this time around. Still, many expect a bumpy ride from a business standpoint during the winter months.

COVID-19 case counts are soaring, setting daily records for the number of people diagnosed with the virus. On Friday, Nov. 13 alone, new infections tallied 177,224 in the U.S.; about 166,000 new cases were documented Monday, Nov. 16. The country also recently set a record for coronavirus hospitalizations, with 73,014 as of Monday, Nov. 16. As the virus spreads in all corners of the U.S., some cities and states, such as Philadelphia and Michigan and Washington, have moved to reimplement certain societal and business restrictions.

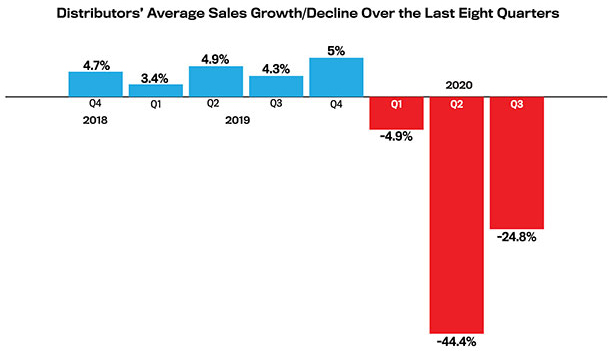

In spring 2020, widespread lockdowns and event cancellations caused promotional products sales to virtually disappear. 4imprint (asi/197045), the largest distributor in North America and in some respects a bellwether for the industry, reported that at one point its order counts were down more than 80%. In the second quarter, promo distributors’ collective sales declined, on average, by 44.4%. The performance would have been far worse if so many promo firms hadn’t started selling personal protective equipment (PPE) to keep some business moving.

Things improved in Q3, with distributors’ sales being down nearly 25% year on year, and there’s anecdotal evidence from industry firms that momentum has built in the fourth quarter as end-clients focus on year-end gifting and spending unused budget funds.

Distributor sales have now declined, on average, for three straight quarters.

But now, with COVID raging at unprecedented levels and fears of lockdowns intensifying, the question has arisen if the tentative recovery will be derailed. Many promo industry leaders, however, don’t think it will.

“The surge will have an obvious impact on staffing for industry suppliers and distributors, but the impact on business should be far less dramatic than it was in the spring,” said Marc Simon, CEO of Sterling, IL-headquartered Top 40 distributor HALO Branded Solutions (asi/356000). “Customers have adapted, and as a country we are still moving business forward despite the risks.”

David Nicholson, president of New Kensington, PA-based Top 40 supplier Polyconcept North America (PCNA, asi/78897), believes the current COVID surge is not “going to be nearly as bad for our industry as what we experienced in Q2. While it may result in more restrictions, that is likely to impact our personal lives more than our business lives. The reality is most businesses still haven’t returned to normal operations and have adjusted to remote work, new ways of communicating and more. So, this recent surge won’t really change any of that.”

Mike Wolfe, CEO of Chicago-based Top 40 distributor Zorch (asi/366078), said the COVID resurgence doesn’t bode well for promo demand as it will continue to limit person-to-person contact and largely eliminate or significantly reduce the size of in-person events. “But even with that in mind,” Wolfe continued, “I don’t think the falloff in business will be as precipitous as it was in April/May because society is more familiar with the illness and complete shutdowns are less likely.”

Melissa Ralston sounded one of the most optimistic notes of all.

“We expect to continue seeing signs of recovery,” said Ralston, chief marketing officer at Florida-based Top 40 supplier BIC Graphic North America (asi/40480). “People are more comfortable with the recommended precautions now and most have found a way to balance being safe with living their daily lives. Our sales continue to increase every month, and we see that as a sign that spending is increasing in sectors like small business, technology, business services and education/collegiate. These markets are big purchasers of promotional products and are using them to reconnect with their customers and recognize their employees.”

Eyes on Q1 2021

Through the final weeks of 2020, certain promo leaders said they, like Ralston, expect continued sales growth relative to what was experienced earlier this year. Direct mail drop-shipment initiatives, many of which are centered on holiday gifting, are helping to drive the reported increases.

“The promo industry has pivoted to single-piece dropship employee gifts at a crazy pace and that’s helping fuel business in Q4,” said Brandon Mackay, CEO of West Jordan, UT-based Top 40 supplier SnugZ/USA (asi/88060). “I don’t foresee the spike in COVID diminishing that.”

Still, the holiday season ends in a matter of weeks and soon begins the first quarter, traditionally promo’s slowest time of the year for sales. Overall, promo executives expect industry Q1 2021 sales to be down compared to Q1 2020, but they generally don’t think that the COVID surge is going to devastate business for 2021’s first three months, even if they are expecting the quarter to be something of a slog.

🏥 Two Covid vaccine makers have said early results show their vaccines are strongly protective.

— Sam Meredith (@smeredith19) November 17, 2020

❓ Huge challenges remain before they can be rolled out, however.

🔍 Here's a look at some of the leading candidates as the race enters a critical stretch.https://t.co/3OMsma1yOU

“I don’t believe we will be back to the revenue trends we all enjoyed in Q1 of 2019, but we will recover from the precipitous business decline the industry experienced in the last month of Q1 2020 and all of Q2 of 2020,” Simon said.

PCNA has experienced what Nicholson described as a meaningful uptick in sales over the last two months. He believes the positive momentum will continue in the new year.

“Companies are realizing they need to restart much of what was put on hold in Q2 – marketing to customers, recognizing employees, planning events,” said Nicholson. “We may see some darker days over the winter with the rise in cases and more restrictions, but there is still a lot of pent up demand and unspent budgets. We’ll see that continue to benefit our industry, especially as we get closer to a vaccine release.”

Not everyone shares that outlook. Even if sales do continue to climb from their Q2 2020 lows, there’s a sense among some industry leaders that the first quarter is going to be difficult.

“With no holiday gifting or events planned in Q1, it will be a tough quarter especially as compared to 2020 sales,” said Dale Denham, senior vice president and chief information officer at Lewiston, ME-headquartered Top 40 distributor Geiger (asi/202900). “There are sales to be made but many budgets will be tighter, especially in reliable areas such as government and education. Even if the government provides stimulus to states, budgets will remain tight for promotional products in previously very reliable categories”

Joshua White, senior vice president of strategic partnerships at Los Angeles-based Top 40 distributor BAMKO (asi/131431), also thinks Q1 will prove rough sledding for many industry companies. While he believes BAMKO will continue the robust pace of business that’s seen the firm increase sales year over year in 2020, White feels that, on the whole, promo will fare poorly in Q1, even if business remains above earlier COVID-caused depths.

“Live events and marketing budgets will remain greatly restrained,” White said. “Order counts will be down. Distributors who are already on the ropes financially might not make it to spring.”

Wolfe said he’s bearish on the first quarter for industry-wide sales, but he sees a dawn on the horizon. “I am holding out hope for Q2, provided the vaccine news continues to be positive and they begin to get a significant amount of doses administered over the winter,” he said.

Ralston is more upbeat about promo’s prospects for Q1 and beyond.

Melissa Ralston, BIC Graphic

“We’ve moved past the initial shock of the pandemic, and now companies are figuring out how to succeed despite limitations due to coronavirus,” Ralston said. “Both distributors and suppliers in the industry have stepped up their efforts and creativity throughout 2020 to help those businesses and the payoff is going to be a strong recovery for everyone.”

What Will PPE’s Role Be?

During the initial months of the pandemic, promo sold large quantities of face masks and other PPE. Some industry pros even scored their largest-ever single sales because of PPE. Demand was rampant, and traditional supply chains for such products couldn’t keep up, creating opportunity for the ad specialty industry.

Amid the current COVID surge and into Q1, however, the common consensus is that a similar PPE windfall is not in the cards. Simon describes an industry-wide trend when he notes that “PPE sales have fallen off since Q2,” something further reflected by data from ESP, ASI’s database of products from throughout the promo industry, that shows searches for traditional promo items have increased in recent months, with searches for PPE-related products receding.

One reason for the wane is that established supply chains for PPE have caught up. Another is that a lot of end-clients are already well-stocked. “In Q1 2021, we expect a decline in demand for PPE relative to Q3 and Q4 as many clients have stocked up on their PPE needs,” said Mark Lenox, vice president of brand and creative at Morton Grove, IL-based Top 40 distributor IMS (asi/215310).

What does 2021 have in store for the #promotionalproducts industry? 🤔

— Maple Ridge Farms (@MapleRidgeFarms) November 16, 2020

Industry Leaders Share 21 Predictions For 2021: https://t.co/bqr4BlhC1q by @ChrisR_ASI #promoproducts

What do you think? pic.twitter.com/V2RiJ7GlQ2

Others, like White and Denham, believe that PPE sales in the first quarter will be roughly on par with Q3 and Q4 levels. “PPE isn’t going anywhere anytime soon,” said Ralston. “Sales may slow down with the development and distribution of a vaccine, but people will still want to be cautious. Items like imprinted masks, PrevaGuard products and hand sanitizers could remain a permanent precaution in industries like travel, healthcare and food/beverage.”

It’s a point other executives also believe will hold true, noting that PPE revenue won’t reach the heights seen in the early days of the coronavirus, but that demand for it will evolve and continue to be a source of sales.

“Many large companies have found more efficient ways to directly source main/generic PPE items, like surgical masks and bulk hand sanitizer, so I don’t think that those items will continue to be sourced in a widespread fashion in our industry,” Wolfe said. “That said, branded versions of these types of items – where, for instance, a mask becomes a longer-term element of a company’s uniform – will likely continue to be sought out by promotional product buyers.”

Added Denham: “PPE remains a highly desired item and a chance to personally connect with employees and customers.”

Even so, Mackay foresees a potential issue arising relative to promo and PPE, depending on how much product moves in the coming months.

“My concern is the number of suppliers who jumped in the category and stocked up on regulated and time-sensitive products such as sanitizer and wipes that are not moving as quickly as they had hoped,” Mackay said. “These products, when brought in as finished goods, have expiration dates. With products aging, it concerns me that the market will get a dump of discounted and dated product early to mid-2021.”

Navigating the Surge

Grit and a sound, properly implemented strategy will again be essential to making it through the latest coronavirus outbreak with one’s business intact, executives said.

White believes it’s wise to plan for the worst. He advised industry firms to think about and plan for what it would mean for their companies if promo sales are significantly depressed by lockdowns without being offset by substantial PPE sales. “How will your business survive until fall of 2021?” White asks. “Develop that plan now and hope you never need it.”

Marc Simon, CEO, HALO

Simon said controlling operating expenses and managing liquidity will be critically important, but that’s not all. “The key to survival and, in our case, increasing our business in this challenging environment is early engagement with key stakeholders, planning for every possible contingency, and clearly articulating the path forward for your company,” said Simon. “Consistency and clarity greatly reduce anxiety for employees, clients and suppliers.”

That engagement should include verifying your supply-base’s ability to remain open and services they can offer during a shutdown, said Eric West, IMS’ senior vice president of strategy and operations.

For sales pros in particular, industry leaders said it’s important to be proactive. Continue to connect with clients on an empathetic, human level and work to understand what challenges they face. You might be able to help provide novel solutions, making you a good partner and thereby keeping sales going. “Plan ahead with your clients as much as possible,” Nicholson advised.

For companies with work-from-home practices in place, it will be essential to ensure team members have the technology and other supports they need to function at a high level. This includes a stout cybersecurity position. “Risks are growing and while budgets are tight, this is the time to spend more on IT not less,” said Denham. “IT spending should be looked at as a long-term investment as well so that you are able to handle future business interruptions as well as get the best candidates on your team.”

Beyond cybersecurity, Denham additionally advised that firms must ensure staffing levels are appropriate to handle potential lower sales volumes and have plans on how to leverage associates during slower times to improve business fundamentals. “Any slowdown will be temporary and the goal is to emerge stronger,” he said.

Industry firms that have workers coming into offices and laboring in production, decoration, warehousing and other jobs in which work-from-home simply isn’t possible must take intelligent precautions to ensure employee safety and to minimize the chance for COVID spread. This includes everything from universal mask-wearing and providing sanitizer, to a clearly articulated and enforced policy on social distancing.

“We are reinforcing our safety protocols and exploring new screening tests to limit the risk of an outbreak within our plants,” said Nicholson. “At the same time, we are adding extra capacity and staffing levels to give us more flexibility across all of our locations should there be any business interruptions.”

Added Mackay: “Do all in your power to help employees stay safe and provide access to all the PPE they need. We’re doing all we can to educate, practice and encourage our employees to be vigilant to help reduce potential exposure and transmission. This is absolutely no joke, and we must do all we can.”