News November 05, 2020

European Promo Market Braces Amid New Lockdowns

The renewed stay-at-home orders and related restrictions threaten to derail what had been a partial rebound in business in recent months.

A surge in COVID-19 cases and hospitalizations is prompting key European countries to institute nationwide lockdowns or restrictions that now threaten the modest recovery in business that promotional products firms there have engineered in recent months.

France began a nationwide lockdown on Friday, Oct. 30; people can face fines or prosecution if they’re outside for anything other than essential tasks like getting groceries. The United Kingdom begins Thursday, Nov. 5 a similar four-week stay-at-home order; it allows people to leave their homes only for things like going to school, the doctor and grocery shopping.

BREAKING: French President Emmanuel Macron announces a new national lockdown because of a spike in coronavirus cases. Macron says one exception is schools, which will stay open. https://t.co/iKbIEqvir3

— The Associated Press (@AP) October 28, 2020

Germany has imposed a “partial lockdown” that includes the closing of bars, theaters and clubs, while limiting restaurants to carryout and delivery service. Italy is implementing nationwide restrictions that include a nighttime curfew, shop closures and travel limitations. Large parts of Portugal went into partial lockdown on Wednesday, Nov. 4, but the government there has warned it might have to impose even tighter restrictions to slow the spread of the coronavirus.

Partial lockdowns in France, Germany, Italy, and Spain to contain rapidly rising virus counts have raised the likelihood that Europe will experience a double-dip recession https://t.co/d115irsVLw via @BW

— Bloomberg (@business) November 5, 2020

For some European promo pros, it’s a grim, wearying set of circumstances to be dealing with personally and professionally as winter looms.

“It’s going to be a tough month as the situation is changing quickly and no real forecasts are possible,” said Tobias Roesch, purchasing manager at Germany-based promo supplier Elasto Form KG.

Certain European ad specialty executives expect the renewed restrictions and lockdowns to negatively affect sales industry-wide but maintain it’s too soon to say how significant the impacts will be.

“We assume that this will certainly have an impact on business, but at present we do not yet see that in our figures,” said Ralf Oster, CEO of PFConcept International, an overseas arm of supplier juggernaut Polyconcept, parent firm of Top 40 North American promo supplier PCNA (asi/78897).

Some European promo leaders are optimistic that the potential decline in business won’t be as dramatic in this wave of lockdowns/restrictions as it was when COVID spread compelled national leaders to enact similar societal shuttering in the late winter and spring of 2020. As in North America, the pandemic devastated promo sales in Europe earlier this year.

“Despite the current figures of the pandemic being way worse than during the spring, the market has not imploded as much as during that period,” said Alexandre Gil, chief financial officer of Portugal-headquartered supplier Stricker. “We have a feeling that the economic agents kind of accommodate themselves, both operationally and mentally, to this new reality we are living in.”

Alexandre Gil, Stricker

Even so, the renewed lockdowns and restrictions, coupled with what are traditionally slow sales months in at least some markets, have certain European promo executives prepared for a long slog.

“The U.K. market is unlikely to improve over the next couple months,” said David Long, CEO/executive chairman of Sourcing City, a trade service organization that provides a suite of solutions to the U.K. promotional products industry. “The reintroduction of lockdown will be hard for many. And beyond that, December and January are historically quiet months.”

January will be even a little quieter than normal this year on the European promo front. PSI, Europe’s largest network of promotional products companies, announced on Wednesday, Nov. 4 that it was postponing its Dusseldorf-hosted PSI, PromoTex Expo and viscom event from January to May because of COVID-19. PSI Dusseldorf is the European promo industry’s largest trade show. PSI and Sourcing City belong to an international promo industry partnership with ASI called Promo Alliance.

A Partial Rebound & PPE Adaptation

European promo leaders Counselor spoke with described a business pattern to 2020 that closely mirrored the reality in the North American market. On this side of the pond, promo distributors’ sales plunged, on average, by 44.4% year over year in the second quarter, according to data from ASI, Counselor’s parent company. In the third quarter, sales picked up and the year-on-year drop, while still a nearly 25% decline, wasn’t as steep.

The situation was similar in Europe.

“The promo market in Europe registered a partial and progressive recovery after the negatively impacted months of March to May,” said Gil. “However, the progression on the sales of promo products, excluding the sales of COVID-19 related products, was slow and the gap compared to last year’s performance continued to be significant.”

Adds Oster: “The dramatic slowdown of the promo market in the second quarter of 2020 was followed by a modest recovery in the market in the summer. However, the hoped-for stronger recovery for September/October remained only marginal from PFConcept’s point of view. This coincides with the overall performance of the industry.”

There are some macro numbers to back up the anecdotes.

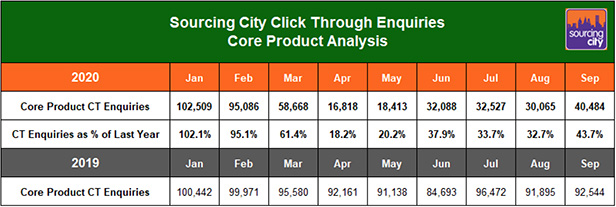

Sourcing City provides a searchable online database where promo pros source a gamut of promotional products. It’s used by distributors that represent in excess of 60% of the entire U.K. promo market spend. Sourcing City data shows that, overall for 2020, click-through product inquiries are down 58% compared to 2019. Even that marked decline has been beefed up by inquiries for personal protective equipment. The decline in searches specific to core products – promo items typically sold by the industry, not PPE – is even worse at about 65%.

Still, there had been a pattern of improvement. Searches on core products were off year on year by about 80% in April and May. That improved to down 62% in June, slipped slightly to down about 67% in July and August, and then rose to down about 56% in September, the most recent month for which numbers were available.

“Outstanding Branding has dropped to about 45% of pre-COVID sales, but there was what looked like a rebound toward the end of the summer and a big step up in October – something we hope is repeated in the coming months,” said Sarah Penn, CEO of London-based distributor Outstanding Branding (asi/288519).

Many promo companies in North America began selling PPE this year to keep some business moving and to help meet society’s demand for the products amid the health crisis of the pandemic. Certainly, European promo firms have made a similar pivot. Consider: Click-through inquiries in Sourcing City for PPE products typically run at a rate of about 0.6% of all such inquiries. This year, they’re 16.4%.

Some caution that the PPE market is nearing maturity and margins are suffering, but others in the European promo sphere believe they’re in a strong position to capitalize and meet an important end-market need.

“We are lucky in that we have built a huge collection of PPE products, which we produce by ourselves Made-in-Germany,” noted Roesch. “That part of our business is growing rapidly, and if cases are increasing, the demand for those products is increasing as well.”

Tobias Roesch, Elasto Form KG

Adds Gil: “The resilience level of our market is notable. The majority of players were able to reinvent themselves in a span of months. I don’t know how many sectors of the economy could react in such a way.”

Eyes on the New Normal

The general consensus among European promo leaders is that the ad specialty market won’t fully stabilize and return to growth until COVID-19 can effectively be controlled – something not likely to happen until a safe vaccine is available to the masses.

The big question, of course, is when that will happen. “From today’s perspective, it will probably not happen before mid-2021,” said Oster. “Overall, I do not expect a full business recovery before two years.”

In a report to members, Sourcing City noted that the amount of liquid money in the U.K. is three times normal, while in the European Union it’s about twice normal, due mainly to heavy governmental spending. Once the pandemic is finally under control, this could mean many entities will have cash to spend and a relatively quick return to profit, something further helped by the leaning down of their spend amid COVID. Promo should be ready to capitalize on that, Sourcing City noted.

🇬🇧 The Bank of England boosts its bond-buying program by £150 billion in another round of stimulus to help the economy as England enters a second #Covid19 lockdown https://t.co/NXBuUWMQr3 pic.twitter.com/Tj8qok4rZj

— Bloomberg QuickTake (@QuickTake) November 5, 2020

Gil also sounds some notes of optimism.

“We are expecting the second half of 2021 to be way better than the majority of people might guess right now,” Gil said. “A large number of events for 2020 were simply postponed and are expected to go forward. Also, after such a long period of restraint and confinement, and assuming vaccines will already be fully operational, people will be super eager to be outside and immersed in big events and spectacles.”