News May 11, 2020

SBA Limits Loan Size, Access to Disaster Loans

Senators criticized the Small Business Administration for the changes, which affect the Economic Injury Disaster Loans program.

The Small Business Administration (SBA) has reduced by 92% the maximum loan amount available from an emergency disaster lending program for U.S. small businesses. Meanwhile, the SBA is currently only allowing agricultural businesses to apply to the Economic Injury Disaster Loans (EIDL) program.

The Washington Post recently exposed the changes the SBA made to the EIDL. The SBA had not publicly communicated the alterations – which included reducing the maximum loan size available from $2 million to $150,000 – to businesses or Congress.

In a May 9 letter, three Democratic senators criticized the SBA, saying the organization had mismanaged the important federal aid program at a time when it’s needed most. Societal shutdown measures aimed at checking the spread of the coronavirus have devastated the United States’ economy, with unemployment reaching its highest level since the Great Depression.

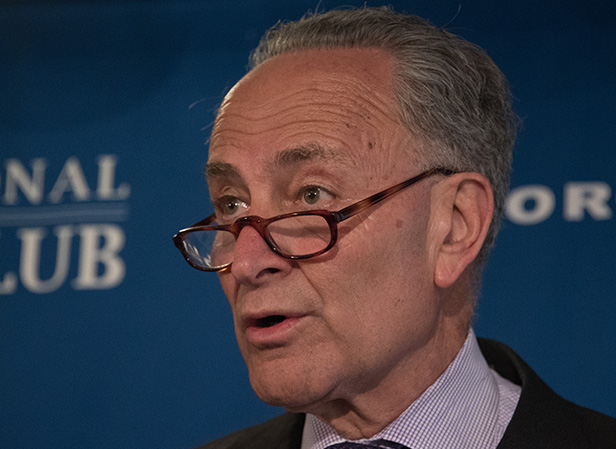

“Throughout the response to the COVID-19 pandemic, SBA has repeatedly made it harder for [the disaster loan program] to serve struggling small businesses looking to SBA for the capital they need to stay afloat,” wrote Sens. Chuck Schumer (NY), Ben Cardin (MD) and Jeanne Shaheen (NH).

Sen. Chuck Schumer of New York

In recent relief bills, congress had given the EIDL more than $50 billion in new funding. The funding infusion aimed to help accelerate quick-turnaround loans to businesses suffering amid the COVID-19 pandemic.

Reeling American business owners have flooded the SBA with EIDL applications. SBA officials told The Washington Post that the agency is facing a backlog of millions of applications.

“Agency officials have said the holdup is because of a lack of funding and an unprecedented crush of applications,” the Post reported.

The EIDL is a long-running program. Through it, small businesses affected by disasters can receive low-interest loans directly from the government. The program differs from the $669 billion Paycheck Protection Program (PPP), which works through private banks. The PPP has had issues too, with some promotional products companies reporting that they have endured a messy application process and prolonged silence from lenders.