News August 05, 2019

Promo Distributors Increase Sales 4.9% in Q2 2019

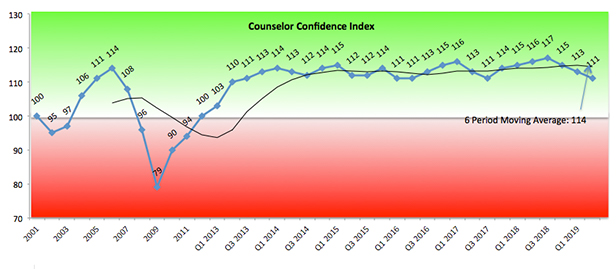

The Counselor Confidence Index, however, hit a near two-year low amid mounting concerns about import tariffs and trade tensions with China.

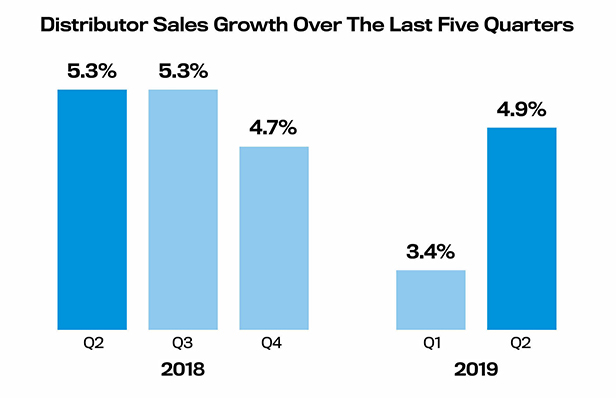

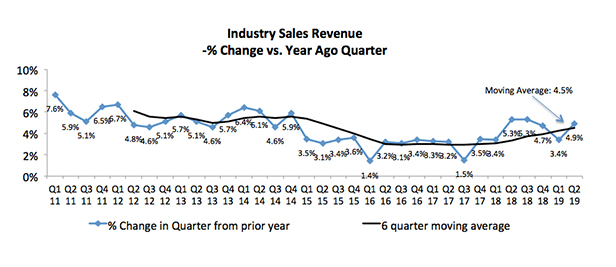

In 2019’s second quarter, promotional products distributors increased sales by an average of 4.9%, a rise that more than doubled U.S. GDP’s Q2 gain and reversed a recent trend of slowing quarterly growth in the ad specialty industry, according to just-released exclusive research from ASI.

Overall, 39% of distributors generated greater sales in the second quarter of 2019 compared to the same three-month period the prior year, ASI’s Quarterly Sales Survey showed. Some 18% of distributors reported a decline, with 43% saying sales were static.

In Q1 2019, distributors increased sales on average by 3.4%. “Q1 was artificially depressed because of concerns over import tariffs and related issues, whereas in Q2, those anxieties alleviated somewhat and helped lead to more money being spent on promo,” said Nathaniel Kucsma, ASI’s executive director of research and corporate marketing.

The largest distributors – those with revenue in excess of $1 million – fared the best in the second quarter, collectively increasing sales 7.1%. Some 58% of such distributors reported that sales rose year-over-year in the quarter, with only 15% reporting a decline.

The industry’s smallest distributors – those with sales of $250,000 or below – engineered an average 4.9% revenue rise in the quarter. Of those firms, 34% said they accelerated sales, while 22% indicated a revenue decline.

Meanwhile, the ASI survey found that medium-sized distributors – businesses with sales of $250,001 to $1 million – were struggling to keep pace, generating a sales increase of 2.1%. While lower than the growth rate of the largest and smallest distributors, the increase rate was level with U.S. gross domestic product growth (2.1%) in the second quarter. Even so, 30% of medium-sized distributors told ASI their sales decreased, with 35% saying sales were up.

“Mid-sized distributors are not benefiting from economies of scale, and larger distributors are increasingly moving in to take their customers,” said Kucsma.

As part of its research, ASI tallies a rolling six-quarter average score for quarterly increases of distributor sales. The quarterly average for the last six quarters is a growth rate of 4.5%. During the previous two quarters, actual average sales growth was 3.4% (Q1 2019) and 4.7% (Q4 2018), which were both down from the 5.3% growth seen in the second and third quarters of 2018.

In speaking to Counselor, distributors gave a variety of reasons why their firms saw strong sales in Q2 2019 – snapshots of what helped drive the broader return to escalated growth across the industry.

“We were up 24% over Q2 2018,” said John Henry III, Counselor’s 2019 Distributor Entrepreneur of the Year and CEO of Indiana-based JH Specialty (asi/232445), which does about $7 million in sales annually. “We nurtured and acted as consultants to our current customer base, and were able to impress prospects out of the gate to make the most of new opportunities.”

New York City-based distributor Whitestone Branding engineered a 115% year-on-year increase in Q2 sales. “Our growth is due to our unique position in the market and our account-based marketing campaigns over the last 12 months,” Owner Joseph Sommer told Counselor. “Some opportunities we made the most of were fulfilling several high-volume kitting and fulfillment projects for large banks and spirits brands. Six of our top 10 projects from the quarter involved fulfillment, kitting and drop-shipping.”

Out west, Arizona-based distributor Stowebridge (asi/337500) orchestrated a Q2 sales spike thanks to some major wins, including providing branded apparel to a convention store serving more than 10,000 people. “We were selected based on our creativity of design and in-house decorating capability, which allowed us to create designs way beyond their expectations,” said Stowebridge President Kathy Finnerty Thomas. “We have an outstanding staff that is very creative and committed – that’s the secret to a great business.”

Despite such success stories and the top-line surge in distributor sales, ASI data harbingered a few potential headwinds. The Counselor Confidence Index, which measures the current health of distributor firms and how they feel about the marketplace going forward, declined for a third consecutive quarter, falling to its lowest level since the third quarter of 2017.

While the reading of 111 still indicates that distributors are generally feeling good about their prospects, there’s a deepening sense of uncertainty as the potential for an economic slowdown looms. “Looking forward to Q3 and Q4, there’s definitely some apprehension,” said Kucsma. The worry is, in significant part, a consequence of the trade war between the U.S. and China, which has led to tariffs on imported Chinese goods. The levies have driven up prices on certain promotional products made in China, while otherwise negatively impacting the promo space. More tariffs – and likely price increases – appear to be on the way.

“This will absolutely affect promo,” Brandon Mackay, CEO of Top 40 supplier SnugZ/USA (asi/88060), told Counselor about the new tariffs that are set to take effect Sept. 1. “People, after hearing of the constant threat of higher prices, tend to change their optimism and begin a mindset of scarcity, which will curb spending.”

Nonetheless, a number of distributors said they remain upbeat about the second half of 2019. “I am anticipating a fairly strong end-of-year, with the hope that we will double 4th quarter totals from last year,” Sommer told Counselor. Added Henry: “I believe the economy and our positive momentum should maintain through the year. It won’t happen passively though; it will happen through proactive measures.”

In responding to ASI's survey, distributors most frequently used words like "competitive," "good," "slow" and "steady" to describe the Q2 promo sales environment.