News April 27, 2020

Promo Distributor Sales Drop 4.9% In Q1

Sales were strong through early March but were then torpedoed by the coronavirus, triggering the first quarterly decline in more than a decade.

From January 1 through March 10, the daily order count at Top 40 distributor 4imprint (asi/197045) was running about 13% above the tally from the same period in 2019.

Since that day, the order count at the e-commerce company declined by as much as 80%.

The marked disruption from COVID-19 caused orders to plummet at the largest promo distributor in North America. And judging by new data in ASI’s just-released Distributor Quarterly Sales Survey, it can be confirmed that the same phenomenon played out across the entire promotional products industry in Q1 2020.

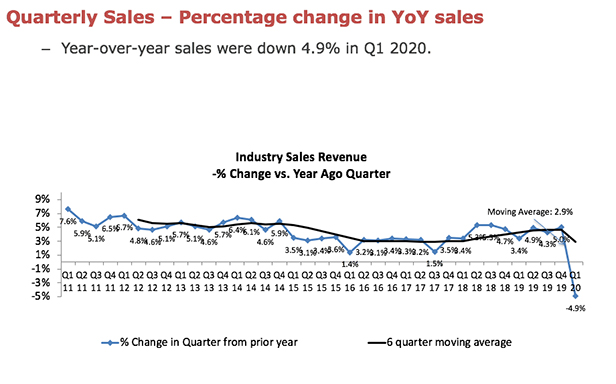

“The last two weeks of March completely undid the first 10 weeks of the year which, by all accounts, were looking very strong for the industry,” said Nathaniel Kucsma, ASI’s executive director of research and corporate marketing. “I don’t know that anyone has ever seen anything like this before on such a nationwide level.”

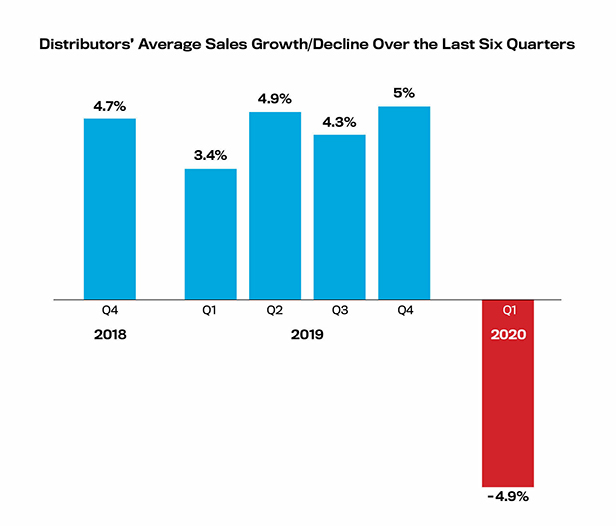

On average, distributors’ sales declined 4.9% in the first quarter of 2020 compared to the same quarter in 2019, ASI research shows. It was the first year-over-year quarterly decline in more than a decade – a stretch of growth that mirrored the U.S. economy’s record run of nearly 130 straight months of economic expansion.

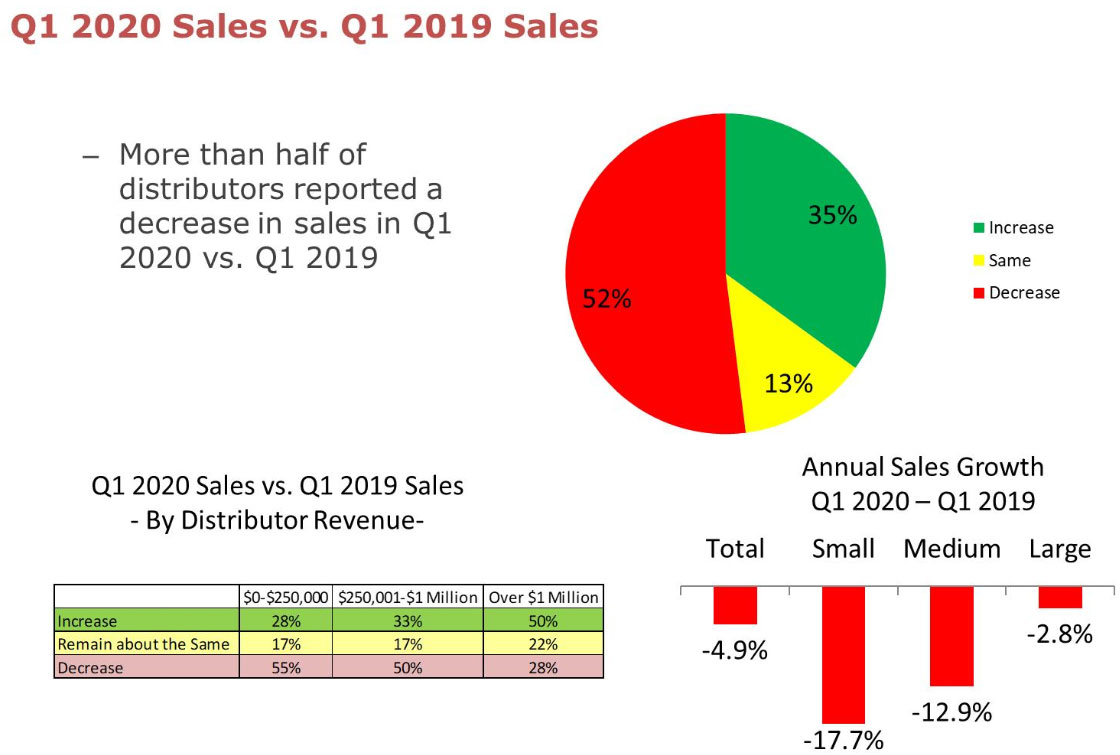

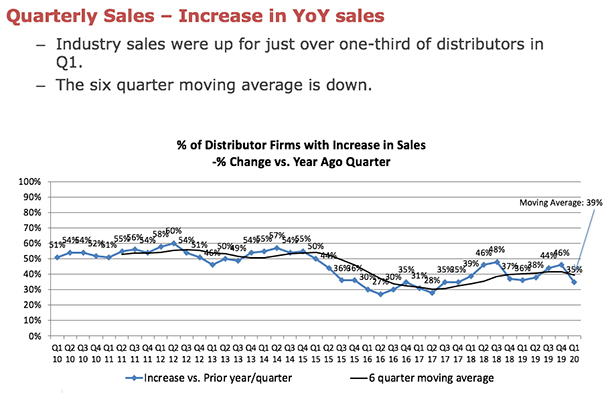

The promo industry’s smallest distributors (revenue $250,000 and below) fared the worst in Q1, reporting that sales were off nearly 18% from the same three months the prior year. Distributors with annual sales of $250,001 to $1 million said sales were down almost 13% year-over-year. Distributors with more than $1 million in annual sales appear to have best weathered the initial economic storm, with sales declining only 2.8%. Overall, more than half of distributors (52%) reported a Q1 year-over-year sales decrease. Just over a third (35%) said sales were up, while 23% reported that sales were flat.

“It’s been brutal,” John Resnick, partner at Boston-based Proforma Printing & Promotion (asi/300094), told Counselor. “We’ve sold some PPE masks, but other than that, sales of everything else for us have been way off.”

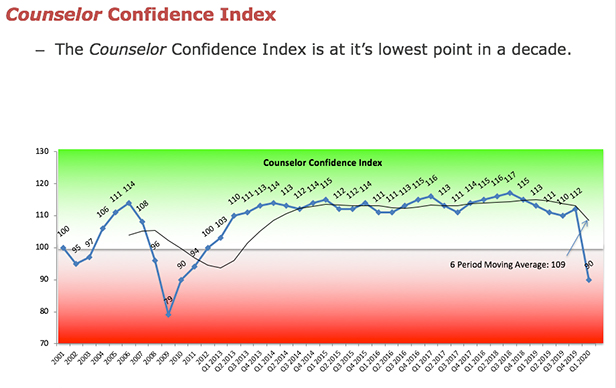

The Counselor Confidence Index, which measures distributors’ financial health and optimism about business conditions, experienced its steepest quarter-to-quarter decline ever. The index dropped from Q4 2019’s strong reading of 112 to 90 in Q1 2020, which is below the baseline reading of 100 that would signal relative healthiness.

The index’s reading remains above the worst ever tally of 79, which occurred in 2009 during the Great Recession. Still, Q1’s 22-point decline in the Confidence Index from Q4 is representative of the eroded economic landscape distributors are facing.

Renya Nelson, founder of Salt Lake City-based distributor Brand+Aid (asi/145193), told Counselor in a recent webinar that some clients, such as those in the technology field, are still ordering. Nonetheless, sales in the short term have mostly dried up. “Business seems to have halted. It’s almost as if everything stopped dead in its tracks,” Nelson said. “We’ve got some orders out there, but March-over-March we’re down 75%.”

In this ASI webinar, mid-sized distributors discuss the impact of COVID-19 on their businesses and share strategies they’re using to survive and, one day, thrive again.

Despite the hard times, distributors haven’t thrown in the towel. Joseph Sommer, founder/owner of New York City-based Whitestone Branding (asi/359741), said in the webinar that it remains to be seen how annual sales will ultimately be affected at his distributorship. He’s hopeful that once shutdown restrictions ease, allowing economic activity to resume, there’ll be a surge in marketing/advertising activity that will benefit his firm and other distributors. Memorial Day, he believes, could be a real turning point.

Resnick is looking to the summer with hopeful eyes, too. His company does a significant amount of business with the craft brewery industry, a niche in which he sees potential to score ample sales.

“We have a lot of optimism for that space,” Resnick told Counselor. “Our biggest brewery client crushes it in the summer, so that could be a saving grace for us as long as the coronavirus shutdowns don’t drag into the summer. We also have a great opportunity to make inroads at another large craft brewer. My fingers are crossed. I’m so tired of trying to sell masks.”