News April 17, 2019

Q1 Distributor Sales Rise 3.4%

Despite macroeconomic challenges like import tariffs, the promo industry still made gains at the start of the year. However, there were some signs that market growth is slowing a bit.

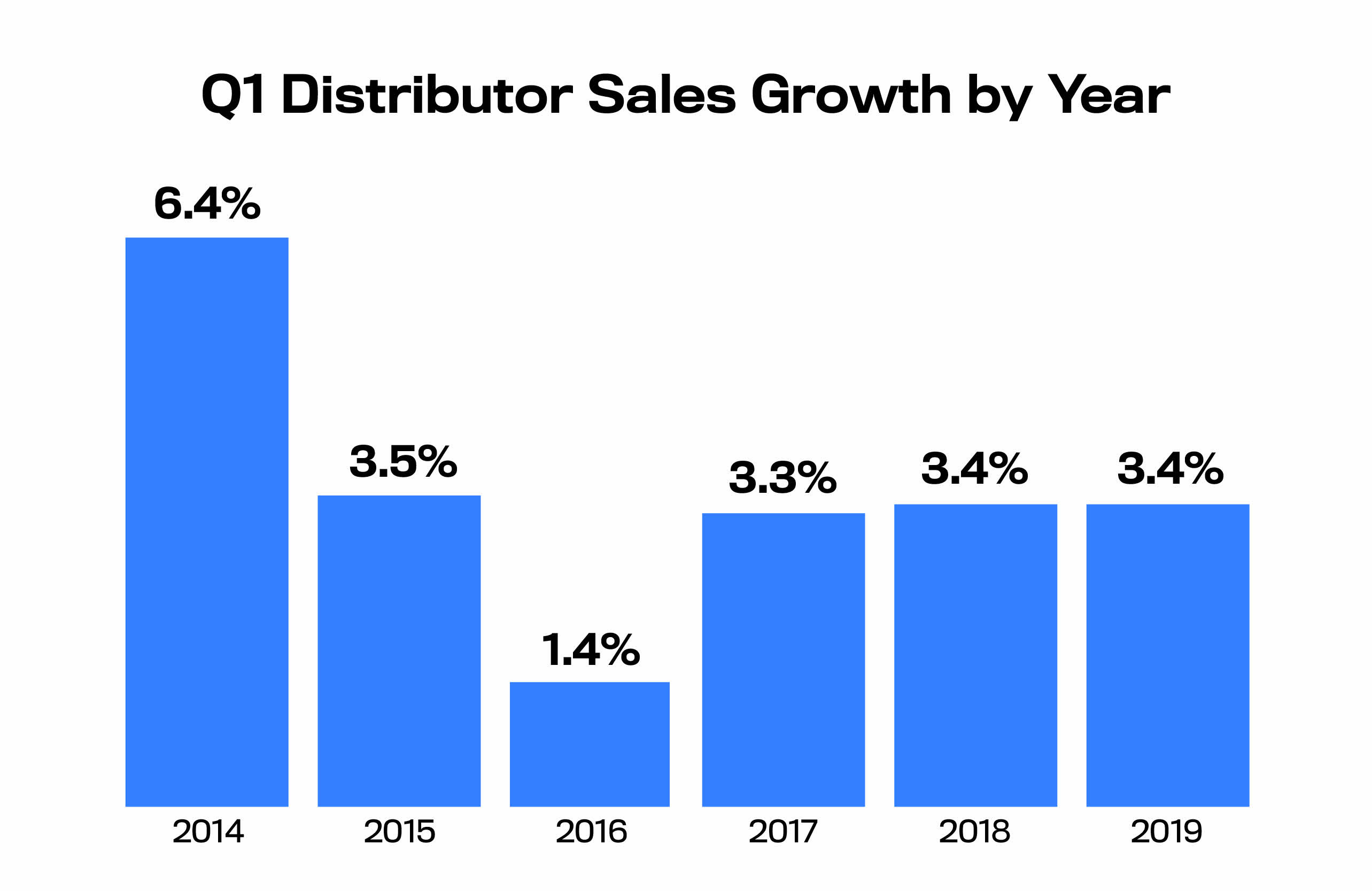

Promotional products distributors increased sales by 3.4% on average in the first quarter of 2019, according to exclusive data released by ASI. While industry firms engineered the gain despite challenges posed by import tariffs, stock market volatility and the partial federal government shutdown, the growth rate was nonetheless down from the fourth quarter of 2018 (4.7%) and flat compared to last year’s Q1 figure.

Podcast

Counselor Editor-in-Chief Dave Vagnoni and ASI Research Director Nate Kucsma analyze the first quarter’s 3.4% increase in distributor revenue.

The data comes from ASI’s just-released Quarterly Sales Survey, which showed Q1 marked the second straight quarter in which distributor growth slowed. Last year’s fourth quarter was off from Q3’s 5.3% average sales increase.

“Coming into 2019, expectations were high, especially after the strong growth experienced in 2018,” said Nathaniel Kucsma, at right, ASI’s executive director of research and corporate marketing. “Unfortunately, reality didn’t meet up with expectations, as Q1 2019 sales proved to be much more muted than anticipated.”

“Coming into 2019, expectations were high, especially after the strong growth experienced in 2018,” said Nathaniel Kucsma, at right, ASI’s executive director of research and corporate marketing. “Unfortunately, reality didn’t meet up with expectations, as Q1 2019 sales proved to be much more muted than anticipated.”

Nonetheless, another significant survey takeaway is that despite macroeconomic factors beyond the industry’s control – a trade war with China, for instance – distributors still powered their way to a collectively positive quarterly sales performance. Indeed, more than one-third (36%) of distributors reported revenue rises in Q1 – nearly on par with a rolling average of recent quarters. During 2019’s first quarter, just 21% of distributors reported a sales decline.

Ohio-based Proforma 3rd Degree Marketing (asi/300094) was among the multimillion-dollar distributorships that executed an especially strong first quarter. CEO/President Steve Flaughers said revenue rose about 15% year-over-year. An emphasis on cross-selling and upselling helped – as did, somewhat ironically, import tariffs. Flaughers told Counselor that clients were eager to order early in the year to beat what was then a looming increase of the Trump Administration’s levies on Chinese imports from 10% to 25%. President Donald Trump has since shelved talk of the tariff rate rise.

“Additionally, we worked really hard last Q4 in growing our business with current clients and new clients,” said Flaughers. “Some waited until the new year to make purchases, and then really came on strong.”

Steve Flaughers, Proforma 3rd Degree Marketing

Back at the industry-wide level, nearly half (48%) of distributors that generate more than $1 million in annual revenue reported a sales increase in the year’s initial quarter. Some 40% of distributors in the $250,001 to $1 million revenue range also increased sales. Meanwhile, three in 10 distributors bringing in $250,000 or less said sales accelerated. The largest distributors – $1 million-plus category – produced the greatest average increase at 3.6%. Medium-sized distributors were just behind at 3.5%; the industry’s smallest firms posted an average rise of 1.9%.

A solo-operating independent distributor based in Florida, Kelly Moore of Moore Promotions (asi/601617) produced one of the first quarter’s success stories, hustling her way to a sales increase of about 20%. “I’ve had a lot of success so far with repeat business and client referrals,” Moore told Counselor. “Many clients are ordering small, but often. And when I’ve landed big orders, they’ve been huge.”

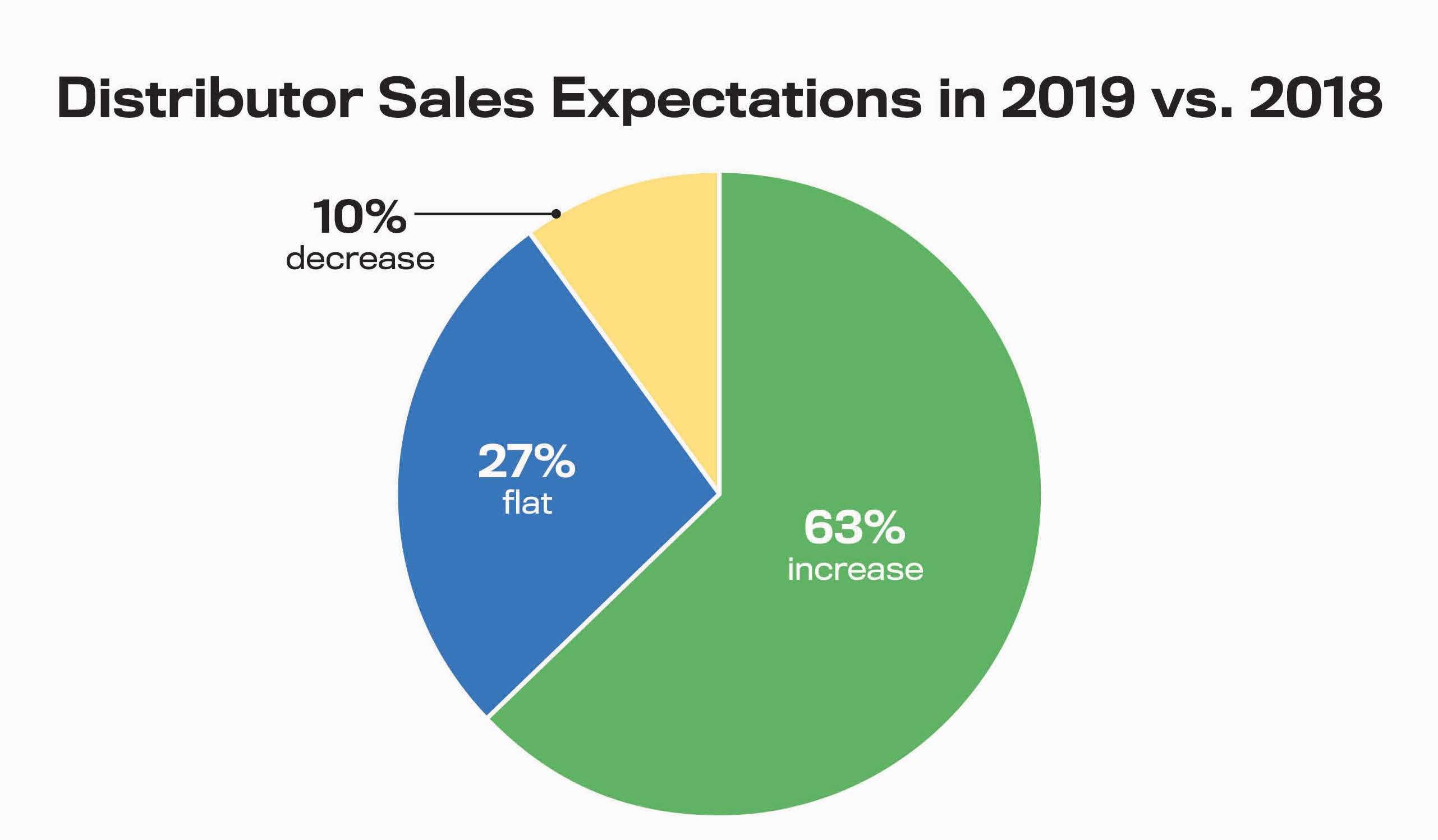

Nearly two-thirds of distributors anticipate their full-year 2019 sales will be higher than their 2018 revenue.

Consistent with the industry’s sales growth rate trajectory, the Counselor Confidence Index declined for the second straight quarter. In Q3 2018, the index registered an all-time high of 117. It retreated to 115 in last year’s fourth quarter, and fell further to 113 in Q1 2019. Still, the 113 tally – which is below the six-quarter moving average of 115 – demonstrates a strong showing, suggesting that distributors on the whole remain upbeat about their prospects. Nearly two-thirds reported they expect annual sales to increase in 2019; only 10% expect a revenue decline.

“We’re anticipating a very strong year,” said Flaughers. “Our goal is to be up about 20%. We believe we have the right plan in place to do it.”

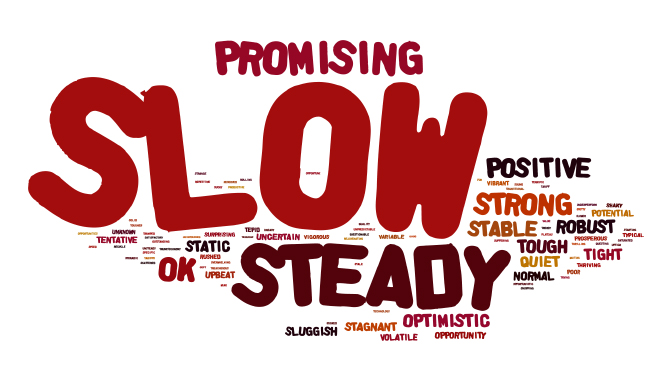

Sales Word Cloud: Distributors used these words to describe the selling environment in the first quarter of 2019. The larger the word, the more often it was used by survey respondents.

Memo Kahan is optimistic, too. The owner of Top 40 distributor PromoShop (asi/300446) said Q1 sales were flat with what was a strong first quarter 2018 -- partially a consequence of tariffs. Still, he believes robust increases are in the cards for the Los Angeles-based firm. "We expect same store sales to increase no less than 5%," Kahan said. "Together with recent team additions, double-digit growth is still our plan."

Kahan isn’t the only one thinking big. Top 40 distributor Zorch (asi/366078) increased sales between 10% and 15% in the first quarter – a range CEO Mike Wolfe expects to improve upon when it comes to year-over-year revenue for the whole of 2019. “Q1 is historically a slow quarter for the industry, so given its relative strength, I believe it bodes well for the year,” Wolfe told Counselor. “We would expect to be up in the 15% - 20% range based on trends with our existing accounts, as well as the addition of new clients.”