Awards July 22, 2020

SOI 2020: Top 40 Outlook

Sales are down overall, but the industry’s largest firms are finding ways to adapt.

Would that it could be 2019 again.

Last year was a record-breaker for promo. Collective distributor sales hit an all-time high of $25.8 billion, and the performance of Top 40 firms was instrumental in propelling the historic success. Through the first 10 weeks of 2020, industry sales were again ascending.

Don't Miss: More Counselor Awards

Then coronavirus invaded North America, triggering widespread societal shutdown mandates that suddenly shocked the U.S. economy into an even worse downturn than the Great Depression. Companies that could proudly point to their results in 2019 quickly realized that 2020 would be a vastly different year.

So while Counselor’s State of the Industry, as always, examines the sales of the Top 40 distributors and suppliers of the past year, it’s especially crucial to see how those companies are faring right now and what the future holds for them.

Like all businesses, the Top 40 have faced their struggles in the wake of the pandemic. But they’re also adapting and leveraging their considerable buying power to position themselves best on the road back to recovery.

The Picture So Far

Taken as a whole, Top 40 firms’ sales are down, of course, in 2020 over 2019. The extent of how individual companies are doing, however, certainly varies.

At the extreme, some companies were experiencing sales declines of between 60% and 80%. A number of others were reporting revenue descents in the range of 25% to 40% or even less severe sales erosion. “Speaking to my colleagues, all have been negatively impacted,” says Jim Hagan, CEO of California-based Top 40 supplier Sweda (asi/90305). “Some are faring better than others but most are dealing with a decline from 2019.”

There are exceptions, though.

“Sales have been rebounding slowly but surely. It’s giving us cautious optimism for the balance of the year.” Bill Korowitz, The Magnet Group

Wayland, MA-based Top 40 distributor iPROMOTEu (asi/232119), which contended with a sales slip in 2019 after parting ways with a top affiliate, says its order volume through the end of May 2020 was up nearly 13% year-over-year. “We strategically managed our cash in order to secure many large orders for personal protective equipment (PPE), and we worked closely with our longstanding supplier partners to come through,” says President/CEO Ross Silverstein. “We provided all sorts of tools and resources to help our affiliates prospect for and generate more business.”

Waukegan, IL-based Top 40 distributor Overture Promotions (asi/288473) says sales for the first half of 2020 were up over 2019. The gain is the result of selling volumes of PPE to new and pre-existing customers, as well as providing ongoing solutions for high-spend clients whose businesses are among the rare few that have thrived amid the COVID-19 crisis. “Overall, we’ve done well,” says Overture CEO Jo Gilley.

Many other distributors and suppliers throughout the Top 40 have pivoted to selling PPE. While success has varied, generally the sales of personal protective equipment injected life into their businesses at a time when demand for traditional promo products flat-lined.

“Our sales are down, but not nearly as bad as we anticipated because we became the source for all things PPE for many of our clients,” says Noel Garcia, managing director at Austin, TX-headquartered Top 40 distributor Boundless (asi/143717). “With most events canceled or postponed, the economic hit from the pandemic should’ve been much worse; that’s a huge blow to our industry. Without PPE, most of us would be in a far worse situation.”

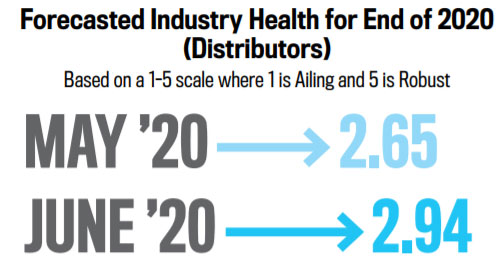

Signs of Optimism: As the pandemic wore on, distributors were cautiously more optimistic about the rest of the year.

Supplier leaders like Maribeth Sandford, the CEO of Union, IL-based Top 40 supplier Bag Makers (asi/37940), offer a similar analysis. She and others say that incorporating PPE into their lines – and sometimes other new products to meet end-user needs specific to the pandemic – has been essential to generating revenue streams that otherwise would be dry. Sandford notes that her firm began selling plain and printed face masks, including 3-ply, KN95 and 2-ply styles.

“We also introduced plastic grab-and-go bags to accommodate the increased demand for carryout meals, as well as healthcare packaging needs,” explains Sandford. “We added products to help businesses create safer workplaces and manage social distancing requirements, such as clear plastic chair covers, printable banners/signs, and paper and plastic mailers. These products have helped supplement our core bag business.”

Adapting Rapidly

Some Top 40 companies feel that, as firms with more revenue and what was described as certain operational advantages, they were in a better position to pivot to PPE than smaller industry players. “The larger distributors that had the financial resources and experience were able to secure the PPE product earlier, so from a financial standpoint the smaller distributors may not have been able to react as fast or compete,” says Steve Paradiso, president/CEO of St. Cloud, MN-based Top 40 distributor ePromos Promotional Products (asi/188515).

Even so, Top 40 firms have had to adapt nimbly to more than just a sea change in the products they sell in 2020. There have been numerous hurdles: managing cash flow, applying for Paycheck Protection Program loans, ensuring employees have adequate support to do their jobs and much more. While companies across the industry and country faced similar challenges, Top 40 firms had to solve these problems on a larger scale. As such, having a higher revenue number doesn’t mean you were necessarily better prepared to navigate COVID-19.

“Larger companies typically have more overhead and more fixed expenses that are very challenging to modify quickly,” says Chris Vernon, president/CEO of Newton, IA-based Top 40 distributor The Vernon Company (asi/351700). “This presents a significant challenge for those companies, especially ones that are highly leveraged. The financial stability of companies, whether they’re large or small, is a better predictor of how a firm can weather any large storm or disaster.”

Noting that The Vernon Company has adapted well and is optimistic for the future, Vernon says a firm’s ability to persevere, regardless of size, comes down to factors like whether or not it has money saved and/or strong credit lines in place to get through tough times. Companies, large or small, also need a good, close relationship with their bank, he says.

“I think our size helped us,” says Overture’s Gilley, “but there are certainly other factors that affect how a company will do in a crisis like this – financial position prior to the shutdown, A/R position and available line of credit.”

Furthermore, there needs to be a willingness from leadership to make tough decisions – furloughs, budget freezes, strategic reductions in hours, pay cuts for managers, etc. – if they’re warranted. That has nothing to do with being a big or small company, Vernon opines, but rather with capable leadership.

Outlook for 2020

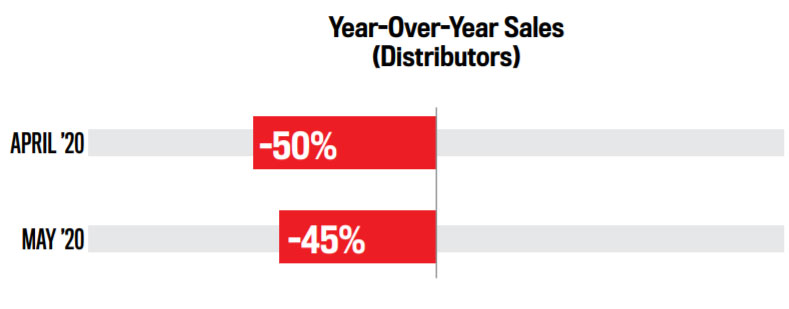

ASI research shows that distributors and suppliers, both Top 40 and otherwise, feel that industry sales could retreat on average by about 30% in 2020 compared to 2019.

“There’s tough sledding ahead,” says Jeff Becker, president of Seattle, WA-based Top 40 distributor Kotis Design (asi/244898). “Trade shows and events are on hold. There’s a lot of unemployed people and very limited hiring. All of that bodes badly for our industry.”

Nonetheless, some leaders at the industry’s largest firms are preparing for what they believe will be a sales surge – if not industry-wide – at least at their particular firms. Some believe the momentum will lead to their 2020 revenue outpacing 2019.

“We think there will be substantially more than six months of business activity in the last six months of the year as pent up demand with consumers and businesses will drive sales up,” says Mike Brugger, president of Florida-based Top 40 distributor Fully Promoted (asi/384000). “We’re adding locations and sales staff now to prepare for the flood of activity and upgrading our online site to handle the business. Now is the time to invest to get ready for growth.”

Some Top 40 companies were starting to see sales pick up in May and June over their early-to-mid spring lows. In mid-June, for instance, promo’s largest distributor by revenue, 4imprint (asi/197045), noted that weekly order counts were running at about half of what they were during the same period in 2019. While still a sizable year-over-year decline, the performance was an improvement over late March and early April, when daily order counts were down about 80% compared to the prior year.

"The financial stability of companies, whether they’re large or small, is a better predictor of how a firm can weather any large storm or disaster.” Chris Vernon, The Vernon Company

From early May on, Vernon was experiencing week-to-week improvements in sales of traditional promotional products as more states eased or lifted lockdown measures. As summer neared, sales volumes were trending up for Bag Makers, too, Sandford says.

“Year-to-date we’re behind last year, but sales have been rebounding slowly but surely,” says Bill Korowitz, CEO of Top 40 supplier The Magnet Group (asi/68507). “It’s giving us cautious optimism for the balance of the year.”

Even so, as press time came, it was clear that promo – and the American economy as a whole – was not out of the woods yet. Resurgences of the virus in particular areas of the country, such as Sun Belt states like Florida, Texas, Georgia, Arizona and California, were again wreaking havoc, prompting partial rollbacks of societal reopening initiatives in various locales. That was putting promo’s tentative turn toward recovery into question.

“The uptick in cases is happening so fast that I don’t believe we’ve felt the full negative impact it will have,” Bob Lilly Jr., president and CEO of Dallas-based Bob Lilly Professional Promotions (asi/254138), told Counselor at the end of June. “We expect a bumpy ride for the remainder of 2020, with the only lasting recovery coming in the form of a significant treatment option or vaccine.”

Christopher Ruvo is executive editor for Counselor. Tweet: @ChrisR_ASI; email: cruvo@asicentral.com