Awards July 22, 2020

SOI 2020: Shifting the Supply Chain

The traditional industry sourcing model has weathered disruption before. Will this time be different?

This spring, suppliers and distributors quickly pivoted to selling personal protective equipment to keep revenue flowing and to help the country in its hour of need as demand skyrocketed.

Don't Miss: More SOI 2020

Still, in the rush to provide PPE and survive the economic maelstrom of COVID-19, many suppliers and distributors stepped outside their traditional roles in promo’s long-standing supply chain. More distributors began sourcing PPE directly from factories, particularly in China; some even began manufacturing those items in-house. Meanwhile, certain suppliers that never carried such items before quickly expanded their collection and started selling PPE direct to end-buyers.

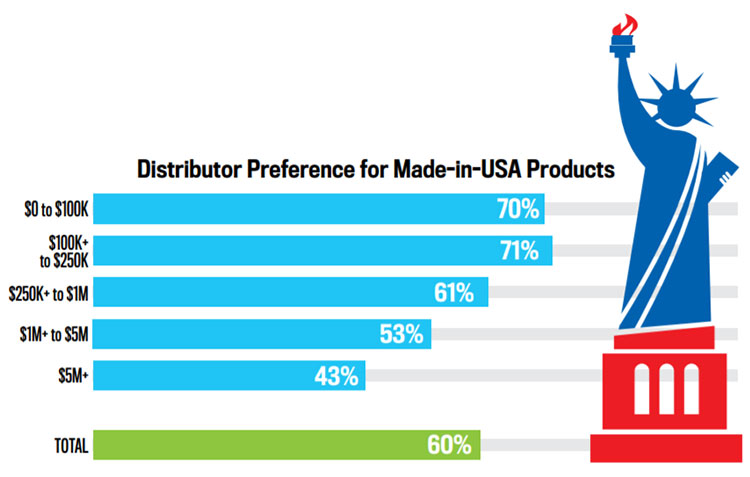

Driving Domestic Sales: Small distributors have a much greater affinity for items made in the U.S.

While not a universally held opinion, there’s a general sense among executives that direct sourcing and direct selling of traditional promotional products will increase because of COVID-19. Given wider-spread usage of the practices relative to PPE during the crisis, it makes it harder to put the genie back into the bottle.

“This crisis will accelerate an already existing trend for manufacturers to reach buyers directly and to reduce the participation of agents/intermediaries if they don’t bring value,” says Jose Gomez, senior vice president of operations at Kalamazoo, MI-based Top 40 supplier Edwards Garment (asi/51752).

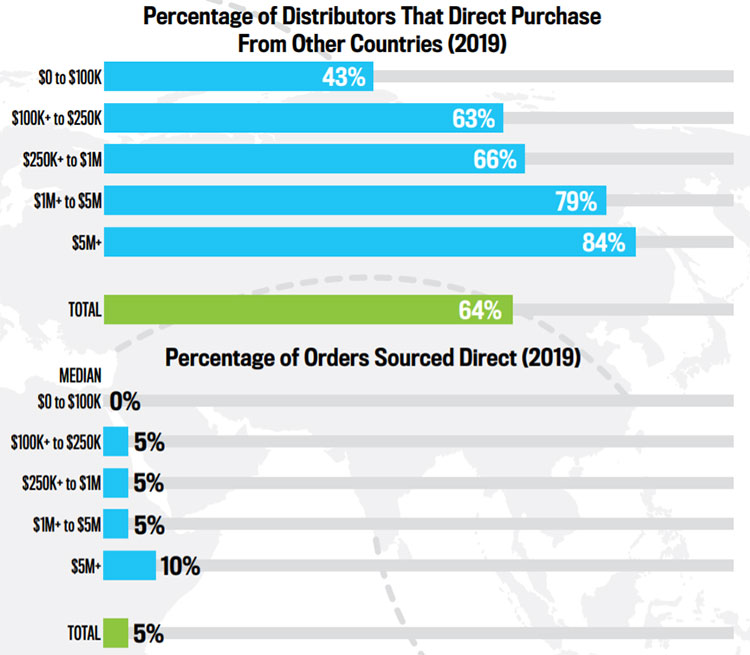

Still, the more difficult question to answer is the extent to which direct sourcing and direct selling could rise. While nearly two-thirds (64%) of distributors have sourced an order directly overseas, a typical distributor still places 95% of its orders through traditional channels. In other words, the traditional model generally persists.

“Longer-term, the pandemic will further the trend against globalization and the move to more resilient – and likely more local – supply options.” David Nicholson, PCNA

Will that change significantly? Some are skeptical.

“Certainly, with respect to PPE, the crisis has forced the hands of distributors and some suppliers to disrupt our industry supply chain more than normal, but I don’t think it will continue at the pace seen during the pandemic,” says Jeff Lederer, president at Prime Line (asi/79530), the hard goods division of Trevose, PA-based Top 40 supplier alphabroder (asi/34063).

David Nicholson, president of New Kensington, PA-based Top 40 supplier Polyconcept North America (PCNA; asi/78897), believes the greater prevalence of stepping outside of typical distributor and supplier roles should, for now, be viewed as temporary and “in some cases a matter of survival. It will be interesting to see if the depth and severity of this crisis does lead to some more permanent changes in the industry’s traditional supply chain. That’s hard to predict right now. It will depend on how long industry volumes are impacted.”

The argument for the continuation of the traditional model is a simple one: it provides the most benefit to the most suppliers and distributors. “I believe most distributors will continue to rely on the core competencies of strong suppliers to handle the challenges of sourcing overseas,” says Bruce Barnet, chief operating officer at Sharon, MA-based Top 40 supplier Charles River Apparel (asi/44620), “so they can focus on their strengths of creative product offerings and services.”

Expanding Geographic Reach

During the winter of 2020, government-mandated closures caused factories to temporarily shutter in China. That triggered significant inventory concerns for the North American promo industry, which sources the majority of promo products from Chinese manufacturers.

After two years of handwringing over increasing prices on imported goods due to tariffs, it certainly wasn’t the first recent headache with China. It wouldn’t be the last either – as the pandemic progressed, additional supply issues reared, including Beijing-backed quality control measures that slowed down PPE exports following a flood of shoddy U.S. imports.

For many suppliers, all those issues reaffirmed the necessity of reducing reliance on Chinese production and expanding to a broader range of countries. “The virus has further elevated the need to diversify out of China,” says Nicholson.

In fact, many promo suppliers were already moving some manufacturing away from China. “Our supply chain diversification really came with the tariffs,” says Dan Jellinek, executive vice president of Top 40 supplier The Magnet Group (asi/68507). “It forced us to look outside of China. We currently source more products from countries like Vietnam, Myanmar, Pakistan and India.”

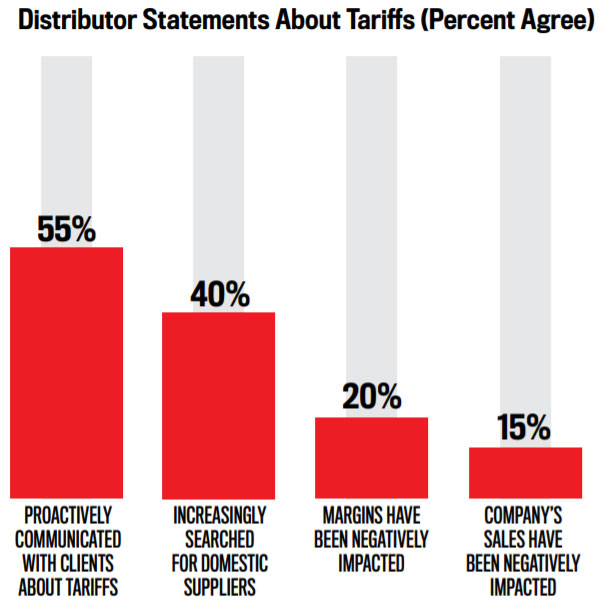

Much Ado About Nothing? For all the worry about tariffs driving up the costs on imported goods from China and hurting sales, the impact has been fairly minor.

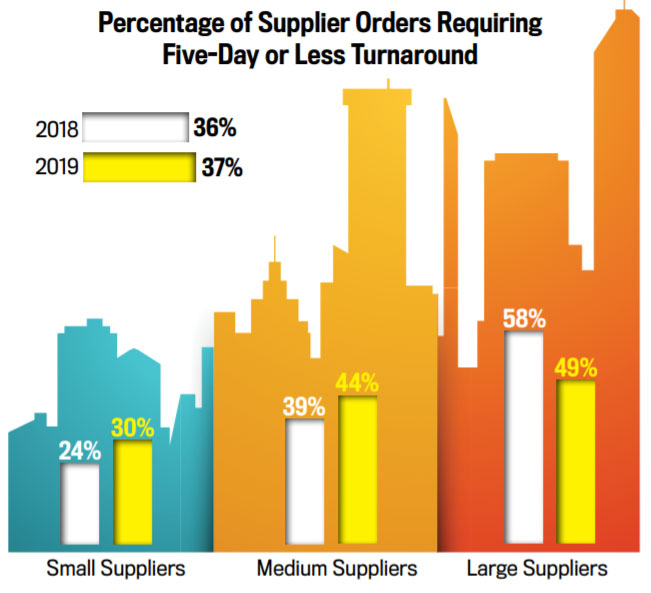

Rush Realignment: While the total percentage of rush orders taken by suppliers remained the same, distributors are shifting those rush orders to small and mid-size suppliers.

Indeed, countries in eastern Asia have been popular places for promo suppliers to seek new production partners. Such countries tend to have an existing manufacturing base, cost-effective labor and access to necessary raw materials. Expect more manufacturing on both the apparel and hard good sides of the business to move to such countries.

“There were still some small and mid-sized companies that were doing China-only sourcing, but I believe that’s now going to change because of the pandemic,” says Gomez. “More of these companies are going to make sure they source in multiple countries.”

As part of the diversification, apparel suppliers in particular have also been focusing on sourcing from sub-Saharan African countries, such as Ethiopia and Lesotho, as well as nations in the Middle East, including Turkey, Egypt and Jordan. Some suppliers have turned to manufacturing in the Americas and Caribbean, or are interested in doing so. That’s because manufacturing closer to the U.S. and Canada allows for faster speed-to-market.

“Longer-term, the pandemic will further the trend against globalization and the move to more resilient – and likely more local – supply options,” says Nicholson. “For our industry, that presents a challenge, but it will have to be a more important component of the industry’s strategy.”

Will that include the U.S.? Some Top 40 suppliers, including The Magnet Group and Florida-based BIC Graphic (asi/40480), produce a significant amount of product in the United States. Others, such as Seattle-based Top 40 apparel supplier Cutter & Buck (asi/47965), say they’re interested in increasing the percentage of items they make in the U.S. BIC notes it’s considering onshoring or dual-sourcing a limited number of products it currently sources from China.

“We’re seeing more interest in our domestic, USA-made items,” says Melissa Ralston, BIC’s chief marketing officer.

Nonetheless, the consensus among suppliers is that there won’t be a big return of production to the United States. Expensive labor and lack of the right kind of manufacturing are among the factors preventing massive repatriation of production.

More broadly, many believe that China will continue to be the promo industry’s primary source for production for the foreseeable future, even if its piece of the manufacturing pie is smaller than in the past.

“China,” says Eddie Blau, CEO of Culver City, CA-based Top 40 supplier Innovation Line (asi/62660), “still has the infrastructure, manufacturing know-how and deep component supply chain in place to keep the vast majority of promo manufacturing in its country.”

Dealing With China

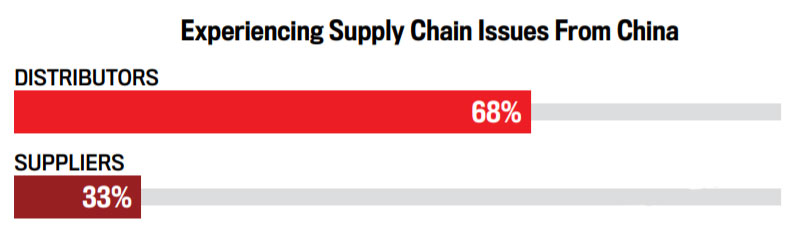

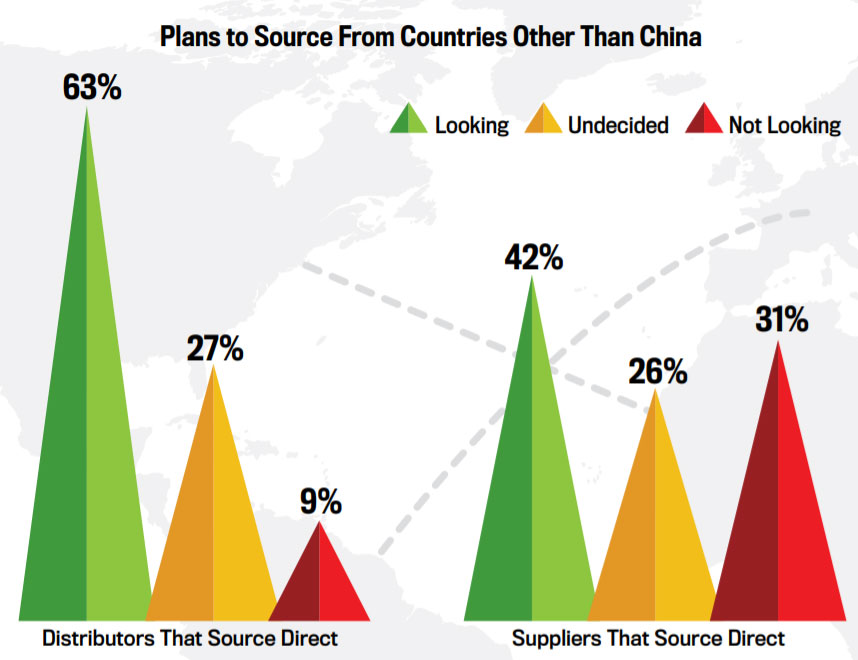

Distributors that source direct from China have more pronounced troubles in their supply chain than suppliers that source from the country. In response, distributors are more likely to seek out other countries to source from instead of shutting down their direct sourcing.

Wide, Not Deep: Nearly two-thirds of distributors direct-source from overseas. However, the typical distributor only sources 5% of its orders outside of the traditional promo supply chain.

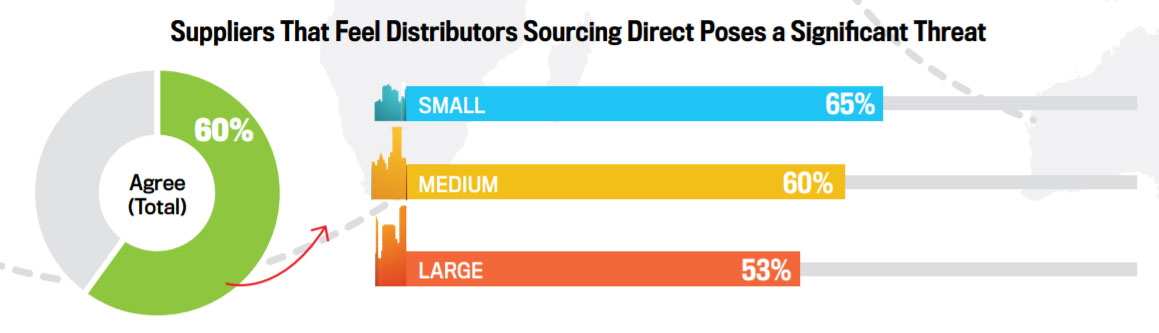

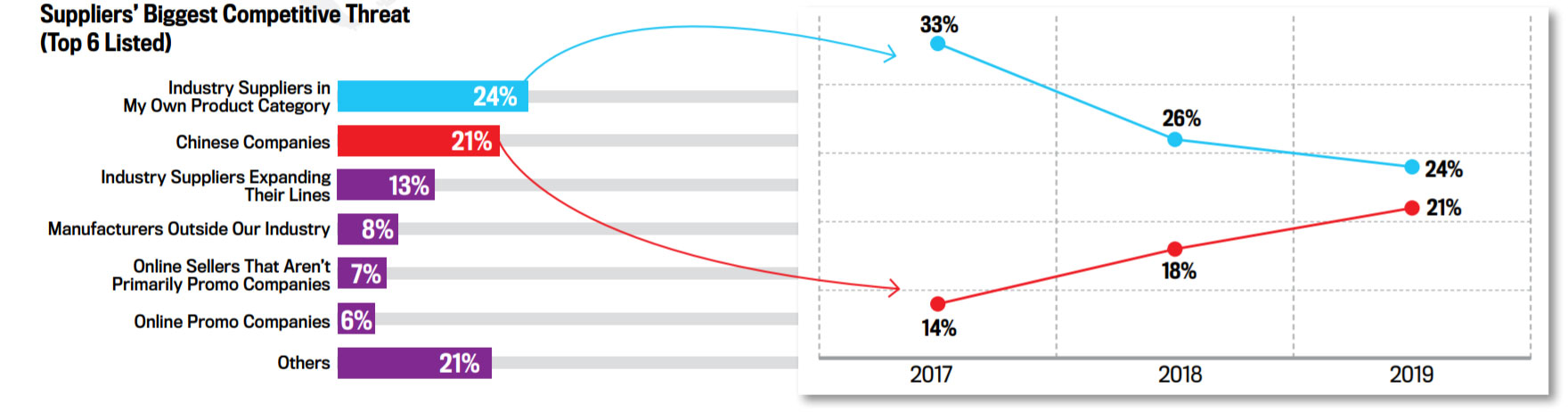

Growing Concern: Even though the vast majority of products are still sourced through the traditional supply chain, suppliers see sourcing direct and overseas suppliers as an increasing threat. Click here for a larger image of the above chart.

Growing Demand for On-Demand

The way Ira Neaman sees it, the coronavirus pandemic will accelerate the already growing trend of relying on suppliers for on-demand ordering and just-in-time delivery without inventory.

“The financial and logistical benefits of on-demand ordering are more important now that many companies will not have the capital to put into inventory or the resources to manage stock,” says Neaman, president of Avenel, NJ-based Top 40 supplier Vantage Apparel (asi/93390).

Many other promo executives believe the trend will grow for both apparel and hard good categories – and for similar reasons that Neaman articulates.

“I believe we’ll see an increase as a result of the crisis,” says David Nicholson, president of Top 40 supplier Polyconcept North America (asi/78897). “With tighter budgets and a more conservative outlook for businesses, it’s likely that end-buyers and their distributors will be looking for opportunities to reduce costs and improve cash flow.”

Jose Gomez expects increased interest in on-demand and just-in-time delivery. “In some cases, it will be more popular given demand uncertainty and financial pressure to operate with much lower inventory,” says Gomez, senior vice president of operations at Top 40 supplier Edwards Garment (asi/51752).

Suppliers will have to be prepared to handle the on-demand expectations. Certain leading firms say they’re ready and able. “Prime has always had an on-demand offering through its Source Abroad division – and this will continue,” says Jeff Lederer, president of Prime Line (asi/79530), the hard goods division of Top 40 supplier alpha-broder (asi/34063). “We believe it will be a compelling offering for our customers for many years.”