Awards August 03, 2018

SOI 2018: Top Markets in the Promo Industry

The two largest sectors for distributor sales maintain their spots, but the gap behind them is narrowing.

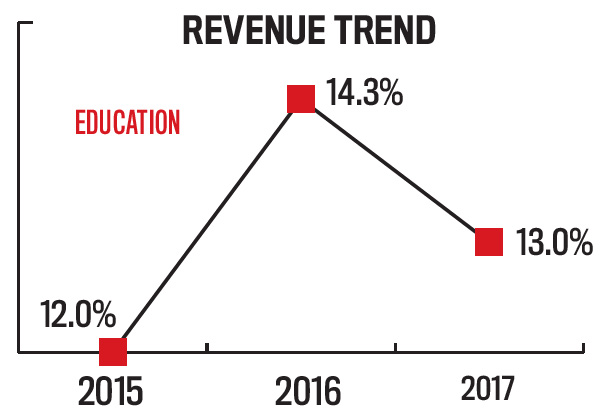

Largest Overall: Education

Largest Overall: Education

For the fourth year in a row, school-related clients contributed the most to annual distributor sales. In 2017, 13% of distributor revenues came from the education market, through everything from simple logoed picture frames for preschoolers to elaborate virtual-reality mailers from colleges looking to win the attention of elite students. What’s driving sales? On some levels, it’s simply competition.

State of the Industry 2018 Index Page

“As someone who recently went through the college recruiting process with my daughter, I’m acutely aware of how competitive it is for a college to attract the best students,” says Mitch Silver, vice president of Printable Promotions (asi/299458). “Even for schools that weren’t at the top of my daughter’s list, she received ‘lumpy mail’ filled with promotional products. This was in addition to gift bags she received during on-campus visits. Colleges need to differentiate themselves, and promotional products are a great way to do just that.”

But it’s not just collegiate customers who are caught up in this aggressive cycle. Silver says lower school levels are facing rivalries as well. “With the proliferation of charter schools and even entirely online K-12 organizations, various groups are using promotional products to draw attention to their institutions,” he says. “Public schools are ordering more and more products as they need to recruit classroom teachers, substitute teachers and even bus drivers.”

With all the opportunity here for distributors, figuring out the right approach to selling might seem overwhelming – but it doesn’t have to be. “Go after one segment first,” says Mary Picher, owner of All in the Details (asi/117299). “Earn their trust, and more business from other departments and areas can be approached with success from within the institution.”

Once they decide which submarket to target, Silver thinks distributors need to find a way to differentiate themselves from the crowded field. “For example, rather than sell a standard drawstring backpack, offer one that has a university map on it for visitation and prospective student days. Or think of clever, flat products that can be used as direct mail without increasing the cost of postage,” he says. “Just like in any other industry, decision-makers are likely loyal to their existing distributors, and you’ll need to do something different to stand out.”

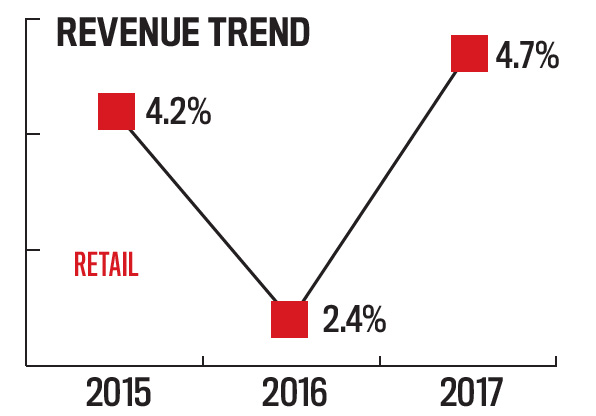

Largest Riser: Retail

Largest Riser: Retail

Jumping into the top 10 largest markets, the retail sector now makes up 4.7% of distributor sales. In 2016, retail contributed just 2.4% to distributor revenues. So why the leap?

Distributor Alex Benda believes retailers are beginning to value quality over low prices, benefitting promo firms through increased spend.

“The quality of promotional items isn’t your grandpa’s promo,” says Benda, CEO of Oh Hello Promo (asi/287160). “The word ‘promo’ is often married with cheap products, but retail companies are finding out that times are changing and promotional products, when done right, bring quality, branded items to the market.”

Jacque Lee, CEO of Silva Screenprinting (asi/326062), thinks consumer activism is a driving force behind the quality-over-cost trend in retail. “Brands that stand for something seem to have a higher perceived value and are worth a higher price point,” she says. “You have a shopping crowd that’s trying desperately to express their individuality by product examples, social media demonstrations and ideal brand consumerism. This focus is very contrary to the previous generation’s focus on ‘value’ items.”

“Colleges need to differentiate themselves, and promo products are a great way to do just that.” Mitch Silver, Printable Promotions

Some of Lee’s top retail success stories have come from her company’s understanding of a client’s social voice and offering products to match that voice.

“The current expendable income shopper is more globally connected and searching for products that reflect both a global awareness and a more corporate transparency,” she says. “Being able to supply globally sourced, socially aware products that adapt with color, fashion and pop-culture trends is critical. It shows retail purchasing teams you’re looking out for their needs, and it does reflect increases in current buying trends.”

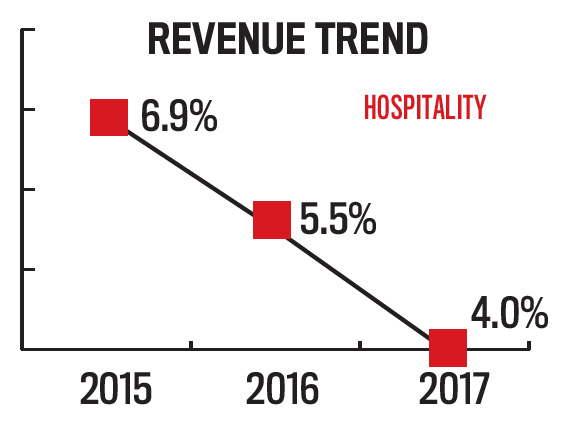

Largest Decliner: Hospitality

Largest Decliner: Hospitality

After representing nearly 7% of distributor sales in 2015, revenues in the hospitality sector declined in each of the last two years. In 2017, this market made up just 4% of distributor sales.

Benda thinks sales reps’ inability to adapt to a changing demographic is the top reason for the sharp decline. “This is a rough one to hear, but what’s important to the hospitality industry has changed,” he says. “Having a luxury brand isn’t important to millennials, who make up 25% of the population.”

What’s the solution? “Stop being reactive – dig deep and get creative,” Benda says, noting experiences are a driving factor behind millennials’ buying decisions. “With everyone documenting their trips, the right promo item might end up in more photos than your kids,” he says.

For example, branded sunglasses or a T-shirt featuring a local landmark and your client’s logo could be featured in photos shared on social media during vacations. “Give people the first souvenir they’re going to bring home,” Benda says.

Being a one-stop shop doesn’t hurt either. Mark Ziskind, president of CSE powered by HALO (asi/356000), continues to have success within the restaurant and hotel sectors by being a total solutions provider. “By making our clients’ lives easier with uniforms, name badges and promotional merchandise, they’re able to focus on their daily operational and marketing initiatives,” he says.

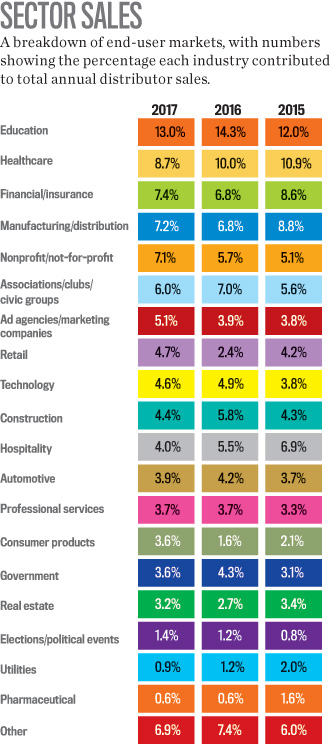

Facts & Figures

1. While their individual rankings have changed, the six largest distributor markets a decade ago are still the six largest today.

2. Even though 2017 wasn’t a presidential campaign year, the elections market contributed 1.4% to distributor sales, the second highest number since 2011.

3. In terms of percentage of distributor sales, the healthcare sector has declined every year since 2012.

4. Before 2017, the last time sales to ad agencies made up more than 5% of distributor revenues was 2009.

5. The financial/insurance segment has alternated percentage increases and decreases each year since 2012.

6. The three largest distributor markets generated $6.87 billion in sales in 2017.

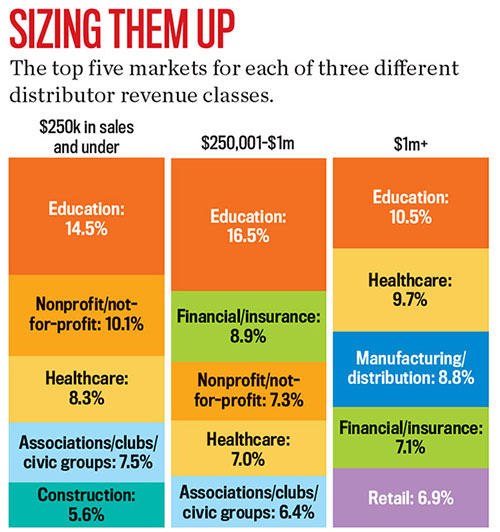

Click here for a larger image of the above graphic.

Click here for a larger image of the above graphic.

4 ways to improve sales to nonprofits

Follow these strategies to tap into a growing segment that represented 7.1% of distributor revenues in 2017.

1. Participate in client events. “What’s worked for me is getting involved with the charities – going to their golf outings, going to their large galas every year, buying a whole table and inviting other customers to spend money for a great cause,” says Rob Marshall, owner of Universal Marketing (asi/349570). “The number of people I’ve been referred to because of my good-faith donations has been huge, and it’s only because I was trying to do some good along the way.”

2. Give back. “I’ll offer to donate a percentage of proceeds back to a nonprofit, or offer a significant discount on their order,” says Kayla Wright, marketing director of Pro Design Graphics Co. (asi/590153). “In doing this, the nonprofit may be more likely to feel their time and effort are valued and appreciated, and it also presents an opportunity to get involved with the local community and develop a sponsorship.”

3. Help them recruit. “If you’re able to think of products and distribution plans that can help increase membership and draw additional recruits, then you’re heading down the right track,” says Mitch Silver, vice president of Printable Promotions (asi/299458).

4. Help them retain. “If you have an idea for a retention plan that’ll keep the nonprofit coffers filled, share that idea and you’ll likely become a trusted resource for that nonprofit for years to come,” Silver says.