Awards August 03, 2018

SOI 2018: Distributor Size Matters in the Promo Industry

The differences between large distributors and their smaller competitors are as striking as ever before.

In the promotional products market, it’s clear that size tells a story. This year’s SOI takes into account five revenue classes: distributors with annual sales of $100,000 and under; sales of $100,001-$250,000; $250,001 to $1 million; $1,000,001 to $5 million; and greater than $5 million. What we found were some interesting contrasts – especially between the largest class and the other groups.

State of the Industry 2018 Index Page

For example, distributors of all sizes continue to cite e-commerce as the largest threat to their business. But while 55% of distributors in the $1,000,001 to $5 million range view web-based businesses as the top threat, that number drops to just 33% for distributors with more than $5 million in annual sales.

Notably, these largest firms are equally concerned with another type of threat: each other. One-third of respondents in this high-revenue ($5m +) class report that other large distributors in their territory are their biggest concern – a fear shared by only 8% of the industry as a whole.

“We’re an $85 million company, and we can provide all the major services. I know the other big companies I compete with can pretty much do everything we can do,” says Bob Herzog, CEO of Corporate Imaging Concepts (asi/168962). “It can end up being a real dog fight to win the business.”

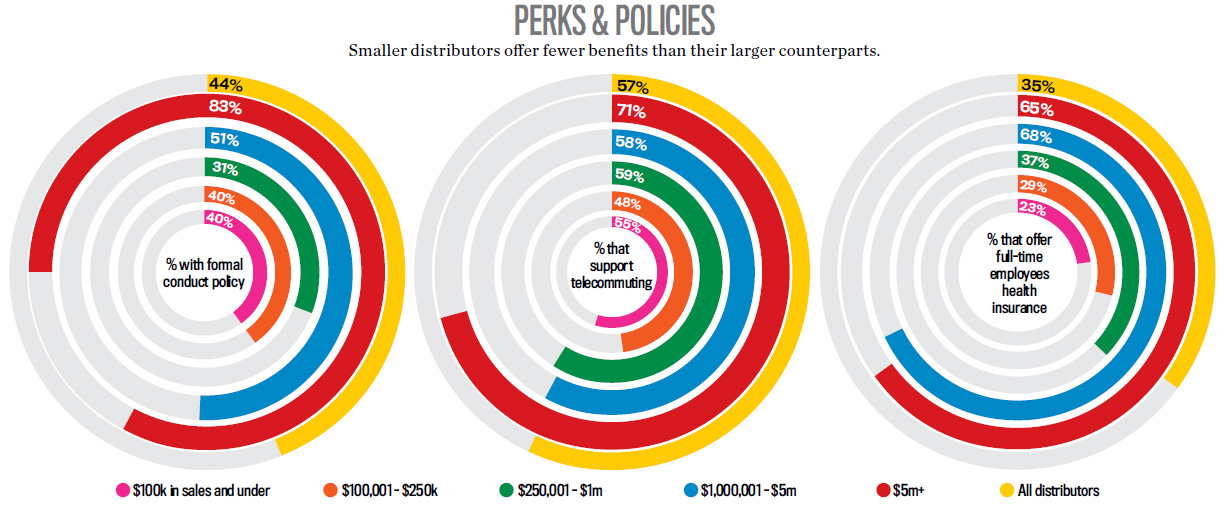

There are many other ways that multimillion-dollar distributors differ from the rest of the industry. Big distributors tend to have various attitudes toward internal policies, offering attractive workplace benefits to employees at higher-than-average rates. Associates at larger firms are more likely to enjoy health insurance options and telecommuting opportunities than their peers at smaller distributors. Top-revenue distributors are also twice as likely to implement formal personal conduct policies to protect the rights of their workers.

“We do many of these things, and a good deal more, simply because they’re the right things to do in order to draw and retain the best possible talent to serve our customers,” says Marc Simon, CEO of Top 40 distributor HALO Branded Solutions (asi/356000). “If you want to provide the best customer experience, you need the best people to achieve it.”

“It can end up being a real dog fight to win the business.” Bob Herzog, Corporate Imaging Concepts

One area where the largest revenue distributors aren’t the biggest outlier is in their number of annual customers. While the largest companies serve more than twice the median number of clients – 125 vs. 55 – it’s distributors in the $1,000,001 to $5 million bracket who serve the most clients, with an annual median of 200. According to Herzog, the industry’s largest distributors are focusing on fewer – and bigger – fish.

“The price of admission with these high-profile customers is high: They’re going to ask what your sales were last year, how many employees you have, how many locations, and you’ve got to be able to answer that successfully to even talk to them,” he says. “Once you can clear those hurdles, the chance of landing a six- or seven-figure deal jumps tremendously.”

When larger distributors start winning some big customer orders, they realize that’s the type of business they want. “You don’t spend much more time doing that if you were going after someone smaller,” Herzog says.

Data Collection Divide

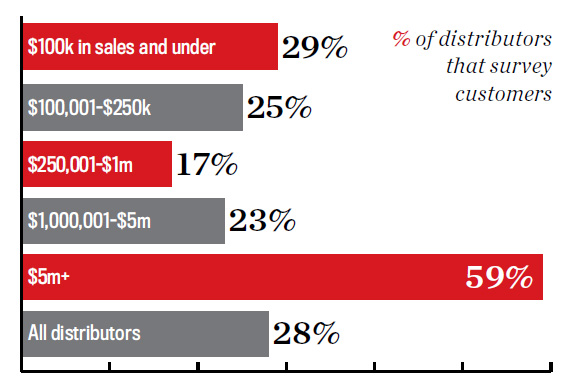

While customer surveying isn’t a new idea, it hasn’t caught on among distributors, as less than one-third sent questionnaires to customers in 2017. But when it comes to distributors with annual sales greater than $5 million, about 60% – more than double the average – poll clients about their satisfaction.

According to Jo-an Lantz, COO and EVP of Top 40 firm Geiger (asi/202900), surveys are instrumental in driving business decisions for the Lewiston, ME-based company. “We use a one-to-five survey, and any answer three or lower triggers an immediate email chain to the salesperson, his or her manager, our manager of supply chain, our customer service vice president and me,” Lantz says. “It helps us take care of the issue immediately.”

Surveys like this allow Geiger to respond to problems in real time. When an unsatisfactory survey result comes in, it provides a wealth of information: what the product was, what the issue was, who manufactured the product and so on. When an issue is easily fixable – if an item is the wrong size or there was an issue with the delivery – Geiger can send out replacements to keep the customer happy. Even when an issue isn’t so easily solvable, the data generated can result in action.

“We consolidated that information to look at supplier trends,” Lantz says. “There’s a link between certain suppliers with high marks, and other suppliers with low marks.” When a specific item continually leads to poor survey responses, the company will see that, and can decide whether it’s worth it to continue working with that item – or that supplier. “Quick response to survey information has changed our business tremendously,” Lantz says.

Click here for a larger image of the above graphic.

Click here for a larger image of the above graphic.

Time Is Money

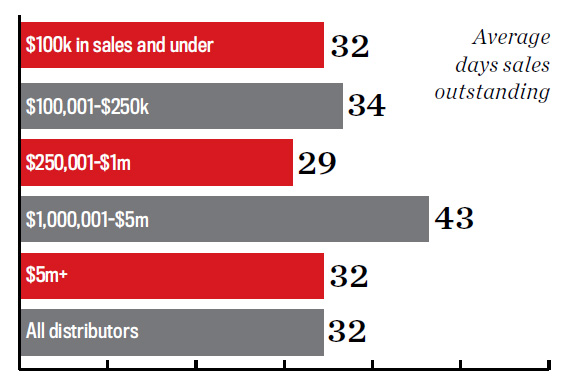

Distributors that earn between $1,000,001 and $5 million annually report clients took nearly 50% longer to pay them back in 2017 compared to other distributors. Outstanding payments were paid on average in 43 days for this group, as opposed to 32 days for the entire industry.

Why is that?

For some distributors, offering longer net terms is a competitive advantage. Where the largest revenue distributors can offer the strongest buying power, companies in the $1 million range can provide clients something possibly even more valuable: time. For small and mid-sized customers, an extra 15 to 30 days to make final payment can be the difference between funding a full-fledged marketing campaign and deciding just to send a tweet.

Distributors with sales in the low millions are also at a turning point in their business where they may be transitioning to larger national customers and government organizations – and if you’ve ever had to deal with the government, you know “fast” isn’t in its vocabulary.

According to Jessica Johnson, co-owner of Production Creek (asi/299743) in Lincoln, NE, her company has gained several high-profile customers as it’s grown and has “accommodated to ensure their business.” That means contracts with more lenient payment terms to account for slow-moving organizations. “I think the larger accounts and government clients have more hoops to go through in order to get an invoice paid,” she says.

According to distributors, another benefit of clients slower to make a payment is that they’re also typically slow to change vendors. The internal red tape surrounding contracts makes these organizations more likely to stick with what works than to jockey between distributors trying to eke out a couple more cents in savings. For distributors, that means waiting a few more days for payment could add more years to your relationship.