News October 30, 2025

What Will the Future of Tariffs Look Like? The Supreme Court Could Help Decide

After a federal court struck down many of President Trump’s tariffs, the Supreme Court’s ruling could mean anything from business refunds to a major boost in presidential authority over trade.

Key Takeaways

• On November 5, the U.S. Supreme Court will hear a pivotal case questioning whether President Trump’s tariffs – imposed under the International Emergency Economic Powers Act – are constitutional. Lower courts have ruled against the tariffs, and the decision could redefine presidential authority over trade policy.

• The promo industry is grappling with unpredictability in global sourcing and manufacturing due to fluctuating tariff policies. Industry leaders are urging the court to deliver a clear ruling to enable long-term planning and stability.

• If the Supreme Court rules the tariffs illegal, affected companies may be eligible for refunds. Regardless of the outcome, experts warn that tariff-related disruptions are likely to persist, prompting businesses to diversify supply chains and closely monitor trade compliance.

Jing Rong wants answers.

The VP of global supply chain and sustainability at Counselor Top 40 supplier HPG (asi/61966) has spent the last several months trying to understand how President Trump’s barrage of tariffs will impact business operations. She’s planned, she’s pivoted, she’s diversified, and still, Rong says an overarching sense of uncertainty remains.

“We’re always one social media post away from things being turned upside down,” she says. “We’re stuck having to guess what the law is rather than getting to interpret it.”

That may change soon. On November 5, the United States Supreme Court will decide a pivotal case to determine whether some of the sweeping tariffs Trump has imposed over the last several months are constitutional under the court of law. It’s poised to have major implications for the future of international trade and potentially redefine the power of the executive branch to enact tariffs without congressional oversight.

The promo industry, which relies on global trade activity to inform manufacturing and sourcing decisions, has a close eye on this case. Rong, for one, is looking to the Supreme Court tariff ruling to offer some much-needed clarity.

“I hope they can make a decision rather than drag this out because this has been going on for so long,” she says. “Whether they uphold or strike it down, they just need to make a decision so businesses can plan.”

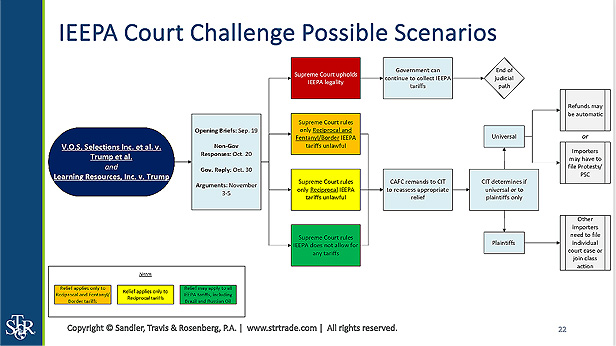

The hearing combines two cases,V.O.S. Selections, Inc. v. United States and Learning Resources, Inc. v. Donald Trump, into a single case that will ultimately determine the legality of Trump’s tariffs under the International Emergency Economic Powers Act (IEEPA). The court will rule on tariffs authorized under IEEPA – notably the initial 10% base tariff, the targeted ‘reciprocal tariffs’ and the ‘trafficked tariffs’ designed to curb the flow of illegal drugs into the U.S. The case, however, will not apply to tariffs enacted using other legal vehicles, such as steel and aluminum, automobiles, auto parts and copper tariffs imposed under Section 232 of the Trade Expansion Act of 1962.

ASI Media spoke to experts across global economics, trade law and government affairs to understand how this case could play out – and what it will mean for the promo industry moving forward.

A Unique Case

Since he took office, the president has overdelivered on a promise he made on the campaign trail: enact tariffs on foreign goods to future-proof the economy and preserve national security. In February, he announced the first in a series of executive orders imposing what would become known as trafficked tariffs – levies on China, Canada and Mexico meant to slow these countries’ alleged role in the flow of drugs into the U.S. Then, in April, the president announced an onslaught of reciprocal tariffs, placing a baseline levy of 10% on most countries. He proceeded to gradually slap additional taxes on a broad range of goods and products, including steel and aluminum, steel derivative products, auto parts, softwood lumber, and cabinets and vanities.

Trump has levied other tariffs under the auspices of IEEPA. In July, the president enacted tariffs on Brazilian exports, citing actions of the Brazilian government that threaten the American economy, national security and foreign policy. Then, in August, the president imposed tariffs on India due to its importation of Russian oil and oil products. Trade talks between U.S. officials and foreign leaders are expected to ease some of these tensions, though the result of many of these conversations remains unclear.

“We’re always one social media post away from things being turned upside down. We’re stuck having to guess what the law is rather than getting to interpret it.” Jing Rong, HPG (asi/61966)

The question on the docket now is whether Trump’s use of IEEPA as a basis for imposing tariffs is constitutional. The case applies specifically to trafficked tariffs and reciprocal tariffs issued under the federal law. Enacted in 1977, IEEPA authorizes the president to regulate international transactions following the declaration of a national emergency.

“Under IEEPA, it doesn’t say the word ‘tariffs,’” explains Nicole Bivens Collinson, a managing principal and operating committee member who leads the government relations and international trade practice group at Sandler, Travis & Rosenberg, P.A. “So, the question is, is it legal to use tariffs in the context of IEEPA?”

This case, Collinson says, is a unique one, because it has already gone through a district court and the Court of International Trade, a nationwide jurisdiction that aims to resolve matters of customs and international trade law.

“Some people thought because it’s not legal to impose tariffs, there’s no reason to go to the CIT and instead they can take it to the district court,” Collinson says. Others believed the Court of International Trade (CIT) needed to hear the case because the issue of tariffs is front and center. Cases were brought in each of those lower courts, Collinson explained.

“The case is really a coin toss. The Court of Appeals ruled against the tariffs, but it was by no means unanimous.”Nicole Bivens Collinson, Sandler, Travis & Rosenberg, P.A.

The CIT ultimately ruled Trump’s imposition of tariffs under IEEPA illegal, moving it to the Federal Court of Appeals.

“And the unusual aspect about that was they had the hearing en bloc, which meant all the judges were there,” Collinson says. “There are 11 judges sitting and we had seven say that they agree with the lower courts that these tariffs are not legal and four who said I think they’re legal.”

Now, businesses across the country are looking to the Supreme Court to make a final decision.

Several Possible Scenarios

This wouldn’t be the first time the Supreme Court hears a case concerning IEEPA. For example, in 1979, former President Jimmy Carter leveraged his powers under IEEPA to freeze Iranian assets in response to the Iranian hostage crisis. In an 8-1 decision, the court found the administration’s actions were in fact authorized under IEEPA.

However, the jury’s still out as to whether Trump’s tariffs are justified under IEEPA, or if they exceed his power under the federal law.

“It’s really a coin toss,” Collinson says. “The Court of Appeals ruled against the tariffs, but it was by no means unanimous.”

Adrienne Braumiller, the founder and partner of Braumiller Law Group PLLC, an international trade law firm based in Dallas, TX, is a bit more confident that the Supreme Court will rule against Trump’s use of the tariffs.

“If ever there was a lawsuit that could be successful, it’s this one,” she says. “Honestly, these tariffs are not constitutional. I think you’re going to see these be challenged successfully.”

However, while the Supreme Court will decide the constitutionality of Trump’s IEEPA tariffs, it will be up to businesses to understand how to proceed depending on each outcome.And there are a few different ways the case could play out.

November’s Supreme Court hearing on the legality of tariffs could play out a few different ways. This chart shows those outcomes and what they might mean. (Courtesy of Sandler, Travis & Rosenberg, P.A.)

Outcome #1: The Court Rules in Favor of Trump’s Tariffs Under IEEPA

In one scenario, the Supreme Court could rule that President Trump retains legal authority to impose tariffs under IEEPA. In this case, not much changes. Moving forward, though, it could set a precedent for the level of power a president exudes.

“It would broaden the authority of the presidency, no matter who the president is,” said Babak Hafezi, professor of international business at American University and CEO of Hafezi Capital, an international consulting firm that helps organizations navigate various trade issues. “They could use it against industries and abuse those powers.”

Hafezi adds that, if the Supreme Court upholds these powers, it will amplify existing trade challenges for promo businesses.

“One of the key things that you need when you’re building a factory somewhere else in the world and you’re trying to create an entire infrastructure is transparency,” he said. “You want to be able to model things out for 10 to 30 years, because that’s how long it takes for you to understand the financial impact. So, if any president can come and just arbitrarily change it, it completely changes your timeline of return-on-equity and I think that’s a very, very negative [consequence] of this that will impact organizations globally.”

Outcome #2: The Supreme Court Rules the Tariffs Under IEEPA Are Illegal

The next scenario that could play out is that the court could rule that all tariffs imposed under IEEPA are illegal. This could apply solely to the reciprocal tariffs if the court rules narrowly, or it could encompass all tariffs imposed under IEEPA, including the reciprocal tariffs, trafficking tariffs, Russia oil tariffs and the Brazil tariffs if the ruling extends more broadly.

What Happens Next

The question isn’t simply how the Supreme Court will rule; it’s also what will happen once it does.

In the event that the court deems the tariffs illegal, businesses that have already paid levies could be eligible for a refund. But first, the Court of Appeals for the Federal Circuit would need to bring the case back to the CIT to determine how to proceed with providing relief to businesses who have already paid tariffs on exported goods levied under IEEPA. Then it’s up to the CIT to decide who gets a refund.

If the court issues a universal refund to businesses across the board, the impacted companies should see automatic refunds, Braumiller said. But she isn’t convinced that the process will be a smooth one.

“I don’t think it’s going to be like a tax refund, where you press a button and you get it back,” she says. “I think they’re going to make it more involved than that to get a refund.”

There’s also a world where the government only issues tariff refunds to plaintiffs who have filed lawsuits, a scenario that could lead more companies to take legal action.

Additionally, some importers will need to file protests if any of their payment entries are liquidated. These businesses must file a protest within 180 days – or they lose their right to do so.

Collinson’s advice? Keep tabs on your automated commercial environment (ACE) account, the commercial processing system used by U.S. Customs and Border Protection to process imports and exports.

“Every importer is given an ACE account,” she explains. “Either the company has access to it themselves or they can get access to it through the customs broker that manages it,” she explains. “If you’re a company and you don’t have access to your ACE account, then you’re not practicing proper oversight.”

Using this account, promo businesses can review transactions where they paid IEEPA tariffs from February 2025 on. Maintaining these records, including all documents associated with the entries, is an important step to help businesses ensure the proper materials and justifications for a refund are in place.

It’s the sort of situation where it pays to overprepare.

“Look at your ACE data, know your liquidation dates, calculate the date that’s 180 days later,” Collinson says. “Monitor this periodically … to check to see if anything liquidated early. Because it happens, and if it liquidates early and you didn’t catch it, you can lose that opportunity.”

She adds that businesses should leave their protests open if there are any other problems they need to address. To correct any errors in the initial entry after submission but before liquidation, importers will need to submit what’s known as a post-summary correction.

“You want to make sure you have all the documents you’re going to need to demonstrate your case,” explains Collinson, adding that importers should also know where their goods live. “Are they in a bonded warehouse? Are they in a foreign trade zone? Have they entered the commerce of the U.S.? Get all your ducks lined up now.”

Not the Final Chapter

The Supreme Court case is unlikely to produce a definitive resolution to Trump’s tariffs. Even if the court rules the tariffs under IEEPA unconstitutional, the Trump administration can continue to impose tariffs under different justifications.

Hafezi expects President Trump to continue tariffing goods using these justifications. “There’s a very strong chance that we come back to the table and see new sanctions being imposed in new ways, and that will take another 18 to 20 months to clear itself out,” he says.

Still, businesses need to respond to these tariffs strategically – and time is of the essence. Hafezi forecasts that the tariffs are shrinking the U.S. economy somewhere between 0.8% to 2% of GDP – and he said consumers and businesses alike are only just beginning to feel the impact. (America’s GDP grew 3.8% in the second quarter, according to the U.S. Commerce Department.)

“There’s a very strong chance that we come back to the table and see new sanctions being imposed in new ways, and that will take another 18 to 20 months to clear itself out.”Babak Hafezi, Hafezi Capital and American University

“The broader implications in the next quarters are going to be farworse and the reasoning is that the entire supply chain will have to change, which will create costs on development of infrastructure to be able to adhere to the new supply chain needs,” Hafezi says.

When it comes to tariffs, change seems to be the only constant. To mitigate potential risk, Rong and her colleagues at HPG are diversifying the supply chain to include several different countries – regardless of how the Supreme Court rules.

“That way, whatever the decision is, we have a diverse base that we can pull from,” she says.

“Things can change tomorrow, so we need to be prepared for when they do.”