News November 18, 2024

Port Worker Contract Talks Break Down, Reigniting Strike Concerns

Flash points related to semi-automation and automation sparked, ending what was supposed to be four days of talks in just two.

Key Takeaways

• Automation Concerns: Port worker union leaders halted contract talks over automation, raising fears a strike will occur in January

• Supply Chain Impact: A strike could disrupt the supply chains of the promotional products industry and other sectors.

• Previous Strike A three-day strike in October caused delays and backlogs at ports.

Union leaders have cut off negotiations for a new contract for port workers on the East and Gulf Coasts over automation concerns, a development that comes with less than two months to go before the docksiders say they’ll again strike if a fresh six-year deal for them isn’t inked.

It’s a notable development for the promotional products market, which imports the vast majority of products it sells in North America on ships that bring goods from Asia and other parts of the world. A lengthy strike on the East and Gulf Coasts could seriously snarl the supply chain of the promo products industry and other sectors.

In October, workers for the International Longshoreman Association (ILA) went on a three-day strike that caused delays and backlogs that lasted weeks after they didn’t receive a final contract following the Sept. 30 expiration of their previous deal.

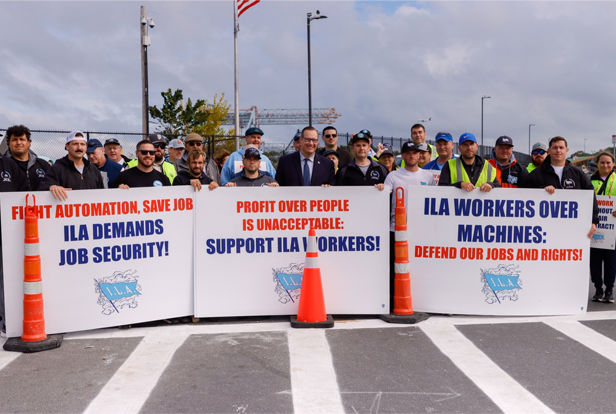

ILA port workers in Boston protest automation during the union’s three-day strike in October.

Still, the ILA and the United States Maritime Alliance (USMX), which represents management, reached a tentative agreement on wages. That proposed 62% pay hike over the life of the contract was enough to end the immediate strike with the understanding that the union and USMX would return to the bargaining table to hash out a final full deal.

Those renewed talks got underway last week and were supposed to last four days. They ended after just two days when ILA leadership walked away over what it characterized as USMX’s proposal for semi-automation at East and Gulf Coast ports.

USMX’s “endgame is clear: establish semi-automation now and pave the way for full automation later,” the ILA said in a statement. “We’ve seen this bait-and-switch strategy in other parts of the world and in other industries, and we will not let it happen on the East and Gulf coasts. … Automation, whether full or semi, replaces jobs and erodes the historical work functions we’ve fought hard to protect.”

ILA President Harold Daggett has said he wants “airtight language” in the new contract that there will be “no automation or semi-automation” at ports. His son, ILA Executive Vice President Dennis Daggett, has said that “we do not believe that robotics should take over a human being’s job, especially a human being that’s historically performed that job, so we’re going to continue to fight that from now to the rest of our existence.”

Another strike? Let's hope not but a new master contract for dockworkers still needs to be inked and considerable impasses – particularly involving automation – are in play. Promo sourcing leaders are watching closely. https://t.co/CfR8kl5uTT

— Chris Ruvo (@ChrisR_ASI) October 10, 2024

According to reports, a top issue relates to the use of cranes with semi-automated capabilities. Humans control these cranes using a remote control but are not on the cranes themselves.

USMX said in a statement that there was positive progress on a number of negotiating points during the two days of renewed contract talks but asserted that ILA’s stance on “technology issues” would “move our industry backward by restricting the future use of technology that has existed in some of our ports for nearly two decades – making it impossible to evolve to meet the nation’s future supply chain demands.”

The statement continued: “USMX has been clear that we are not seeking technology that would eliminate jobs. What we need is continued modernization that is essential to improve worker safety, increase efficiency in a way that protects and grows jobs, keeps supply chains strong and increases capacity that will financially benefit American businesses and workers alike.”

Promo industry leaders breathed sighs of relief in October after the ILA strike proved short-lived, saying that any deleterious effects on the industry’s supply lines would be minimal. A strike that stretches into weeks instead of days, however, could have more dire consequences, including causing considerable delays in getting products made overseas landed and stocked stateside, while sending importing/shipping costs soaring. Such ills, if protracted enough, could lead to stock gaps in promo and higher pricing on products.

In other port issue news, Canada’s labor minister last week ordered binding arbitration to end port strikes in that nation.