Strategy September 19, 2018

2018 Supplier State of the Industry Report

No matter how many innovative products you develop, how strong your relationships with distributors are or how accommodating your customer service is, sometimes, business is just out of your hands.

Suppliers are finding that out the hard way as the United States engages in a historic trade war with China. Since July, a total of $50 billion of goods on each side has been taxed, with President Donald Trump threatening to levy a 25% tariff on an additional $200 billion worth of Chinese imports in September. A variety of each country’s products have been targeted, such as vehicles, fuels, plastic, recyclables and agricultural items.

A prolonged trade war between the U.S. and China could prove challenging for the promotional products market, as prices on Chinese-made imported goods would increase. Industry firms – as well as retailers – would have to decide whether to take a hit in their margins or pass the added cost on to buyers.

“We won’t know the impact on our own product assortment until the USTR (United States Trade Representative) evaluation is complete, but unfortunately, we do know that BIC Graphic will have to pass on a price increase to our customers as a result of these tariffs,” says David Klatt, CEO of BIC Graphic.

In a letter to distributor partners, David Nicholson, president of Top 40 supplier Polyconcept North America (PCNA), addressed the potential impact of the tariffs, vowing that all PCNA divisions will honor current 2018 published prices through the remainder of the year.

“However, we will be providing two prices on all quotations for WorldSource projects (long lead time, direct-import orders),” Nicholson wrote. “The second price will reflect the product cost should the tariffs go into effect. “2019 pricing will be published in late November and will be available for download from PCNA.com. Hopefully, all will be resolved successfully, but regardless of the outcome, we are committed to minimizing the extent of the increases as much as possible.”

All suppliers are probably having similar conversations, says Paul Lage, president of Top 40 supplier IMAGEN Brands, parent company of Crown Products and Vitronic. “Tariffs don’t have a significant effect right now – it’s really more about the unknown,” Lage says. “Our industry is subject to what happens in the geopolitical arena. We’re starting discussions to answer ‘what ifs’ and to try and figure out what we should do.”

In 2017, a total of $506 billion in goods were imported from China, meaning the tariffs represent over 10% of the total annual value of Chinese imports, noted Joshua White, Top 40 distributor BAMKO’s (asi/131431) general counsel and senior vice president of strategic partnerships, in a white paper.

“This is a highly fluid situation, making it difficult to accurately predict what comes next,” White said. “Should tariffs be imposed, consumers, retailers and manufacturers will all feel the pinch. The impact would disrupt global supply chains, raise input costs and consumer prices, and slow economic growth. Expect to see the financial impact start hitting consumers and retailers in the 2018 holiday season.”

History may show that 2017 was the calm before the storm. If so, how did suppliers fare before such uncertainty?

Best for Business

The 2018 ASI State of the Industry survey shows the industry health score for suppliers was up from 2017, and suppliers with more than $1 million in revenues thrived in particular. Reversing a three-year downward trend, the number of suppliers reporting an increase in sales rose last year, climbing nine points to 50%. Of that number, larger revenue suppliers were more likely to report an increase than their smaller-revenue counterparts.

In more good news, the average dollar value per order ticked up in 2017, with a median order size increasing to $716. Additionally, profit margins have remained stable since 2009.

“We’ve experienced a lot of positive momentum in the last 12-18 months,” Lage says. “We’re seeing it across the industry as well as in the overall economy. Although our industry is primarily driven by the economy, we continue to evolve and mature and improve on our own terms.”

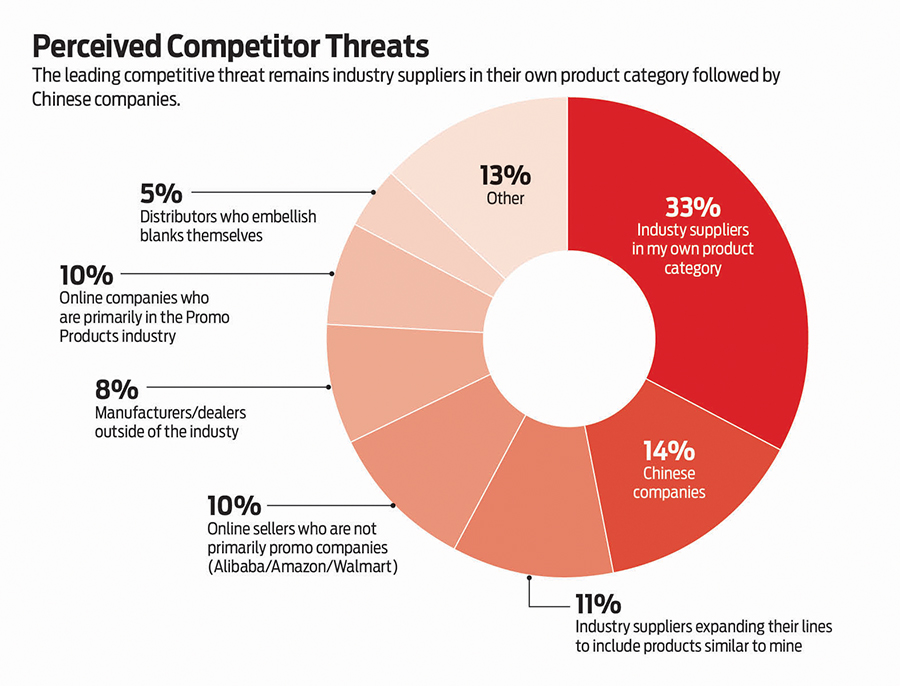

Though the leading competitive threat remains industry suppliers in their product category, another fear is on the rise: Chinese companies that sell direct. “There are always a number of competitive threats out there,” says Jonathan Isaacson, president of Top 40 supplier Gemline. “Chinese companies are one, as well as the potential for some sort of disruption driven by changes in technology.” While overseas factories are disrupting the domestic market, about half of suppliers (58%) report that they don’t sell outside the U.S. Furthermore, most suppliers (68%) do not plan on expanding beyond where they are currently operating.

Perhaps the unstable political climate has suppliers treading cautiously, or maybe it’s part of an overall stagnation throughout the industry. The average turnaround time for orders has mostly followed a six-year trend of 11 days. On average, three days will pass after a trade show before a supplier responds to a distributor’s request. Suppliers also report that one in three orders require a turnaround time of five days or less, unchanged from 2015.

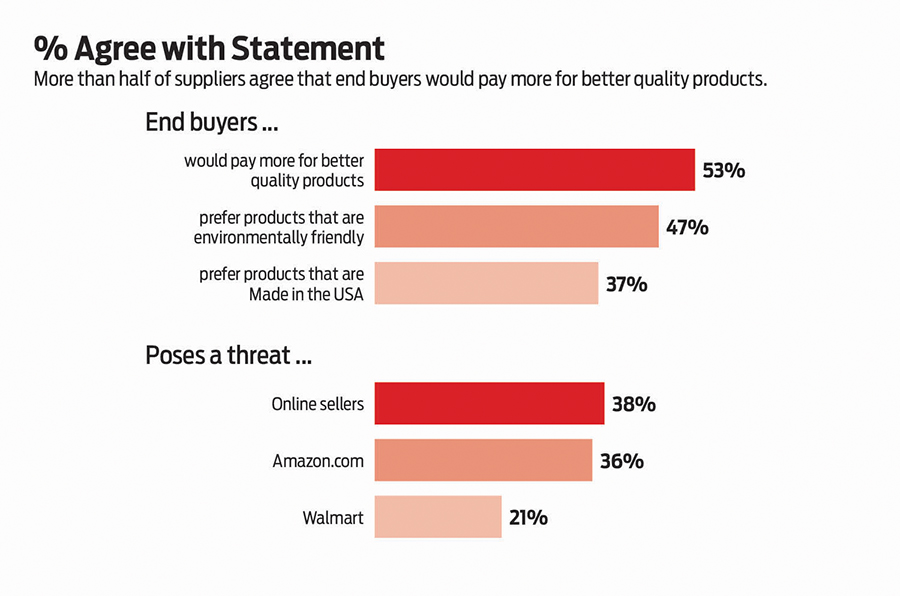

As Walmart and Amazon make plays that could shift the traditional business model, the industry supply chain remains intact with suppliers generating 60% of their overall company revenue from sales of promotional products. As a result of the overall growth, suppliers are much more likely to report that they increased their employee count in 2017. “We’ve had a very strong year, so there have been more business opportunities,” says Ira Neaman, president of Top 40 supplier Vantage Apparel.

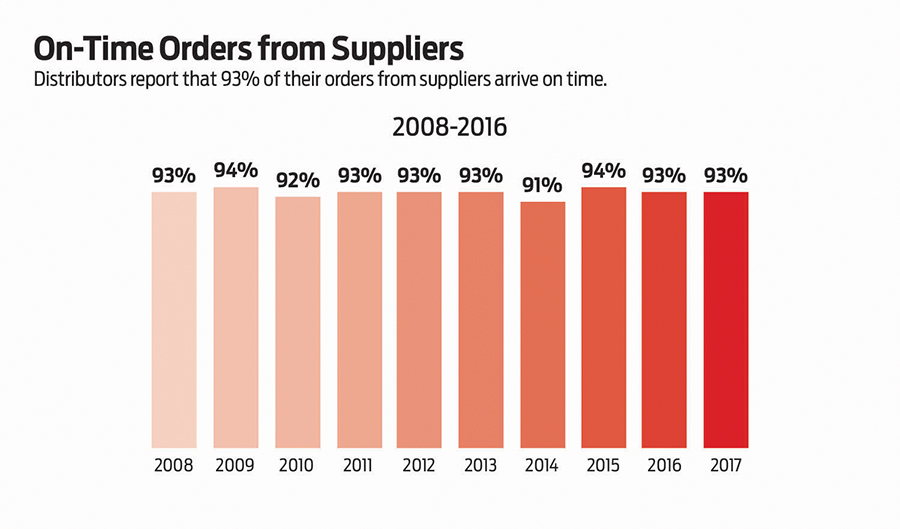

Suppliers overwhelmingly anticipate an even better 2018 than 2017, encouraged by their satisfaction with delivery reliability and order accuracy. “We are a naturally optimistic industry – it’s a personality trait of people attracted to a business like this,” Isaacson says.

“This is an industry of salespeople and entrepreneurs. You’re selling items that often have to be resold the next year. You have to be optimistic to go out and make it happen.”

Safety Last

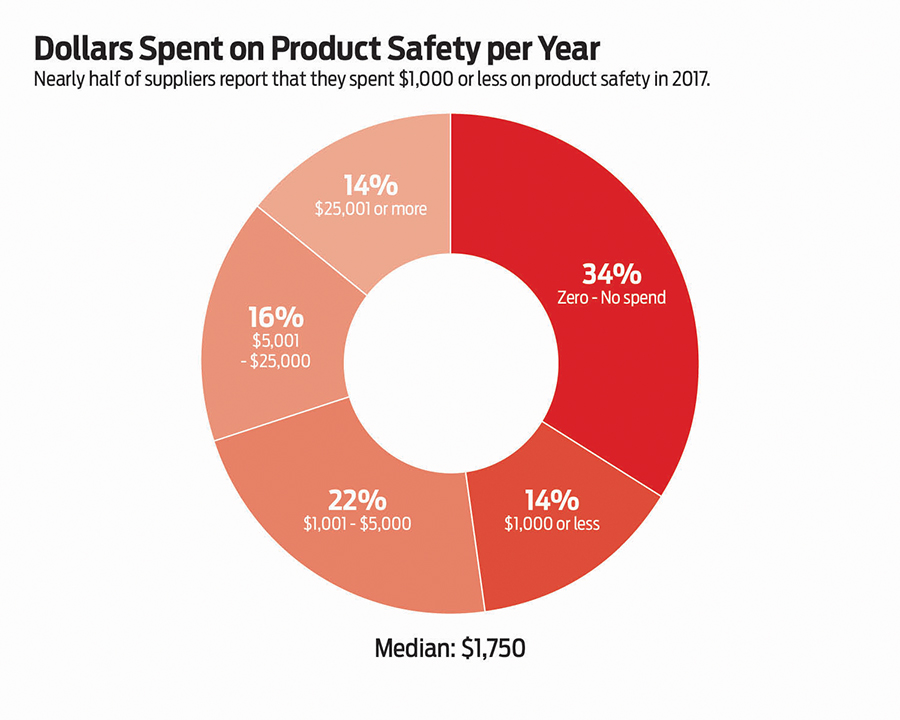

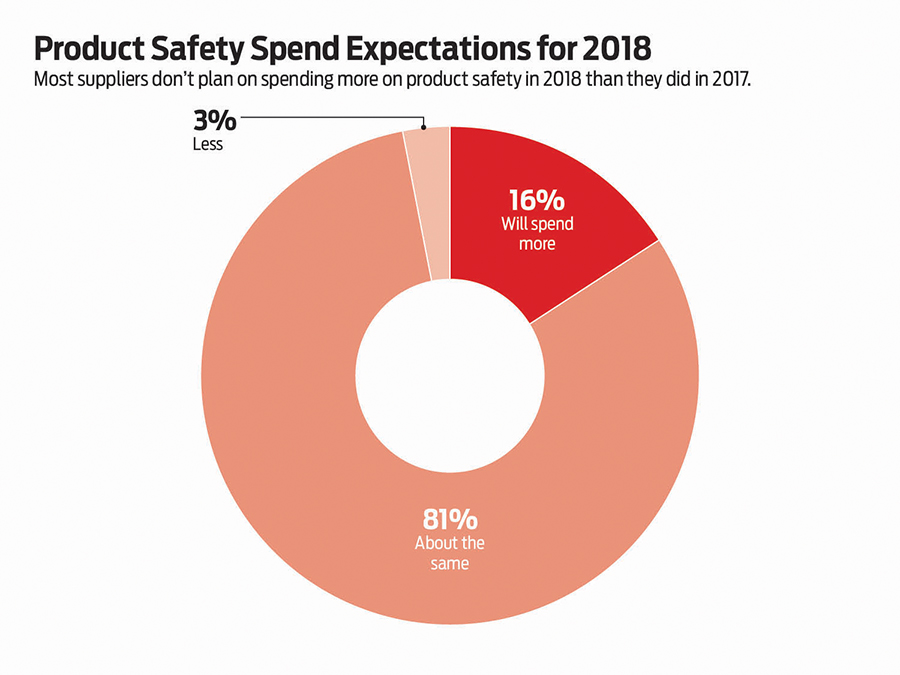

There’s something to be said for getting out in front of a disaster before it happens. In alarming news for the industry, one-third of suppliers spent no money on product safety in 2017. Out of those that did, nearly a half spent $1,000 or less. Overall, most suppliers don’t plan on increasing their investment in 2018.

That’s basically the same results as last year’s survey, signifying that most suppliers have taken a laissez-faire approach to product safety. It’s very concerning because of recent federal regulations affecting the industry – perhaps most important of which are the sweeping changes to Proposition 65, legislation that requires businesses to notify Californians about significant amounts of chemicals in the products they purchase.

“Product safety is one of the biggest moving targets we have as suppliers,” Lage says. “Look at California – they just keep piling on regulations. It’s daunting to say the least to even imagine how you’re going to comply with all the various regulations out there. We’re trying to come up with the most efficient product safety investment and push it to our distributors and vendors just as they do with us. If you’re not investing, you’re just taking on a big risk.”

As of August 30, Prop 65 required more rigorous warnings for products that contain chemicals the state has deemed to cause cancer or reproductive toxicity. The new warning labels will be hard to ignore as they’ll feature a triangular yellow warning symbol with an exclamation point. In addition, the new warnings will say a product “can expose you to” a Prop 65 chemical rather than saying the product “contains” the chemical. Other guidelines include having the name of at least one chemical of the more than 850 listed by California that prompted the warning, and the internet address for OEHHA’s Proposition 65 warnings website, www.P65Warnings.ca.gov, which includes additional information on the health effects of listed chemicals and ways to reduce or eliminate exposure.

“If you haven’t been investing in product safety, it’s either stupidity or arrogance,” says Trevor Gnesin, CEO of Top 40 supplier Logomark. “People are going to be searching websites to see if a company shows they’re compliant or at least making an effort to be compliant. If a lawyer sees no indication, suppliers are going to find themselves in some deep water.”

In addition to facing financial and logistical challenges, these new guidelines force promotional products companies to increase their due diligence. In order to comply with these regulations and avoid vulnerability, manufacturers, suppliers and distributors have to communicate with each other to make sure all parties are on the same page.

“The top distributors in this industry are keeping a close eye on suppliers,” says David Miller, president of Top 40 supplier Chocolate Inn/Lanco. “Unless you allocate significant resources to product safety and can show tangible results, they’re not willing to put their relationship with clients at risk.”

False Promises

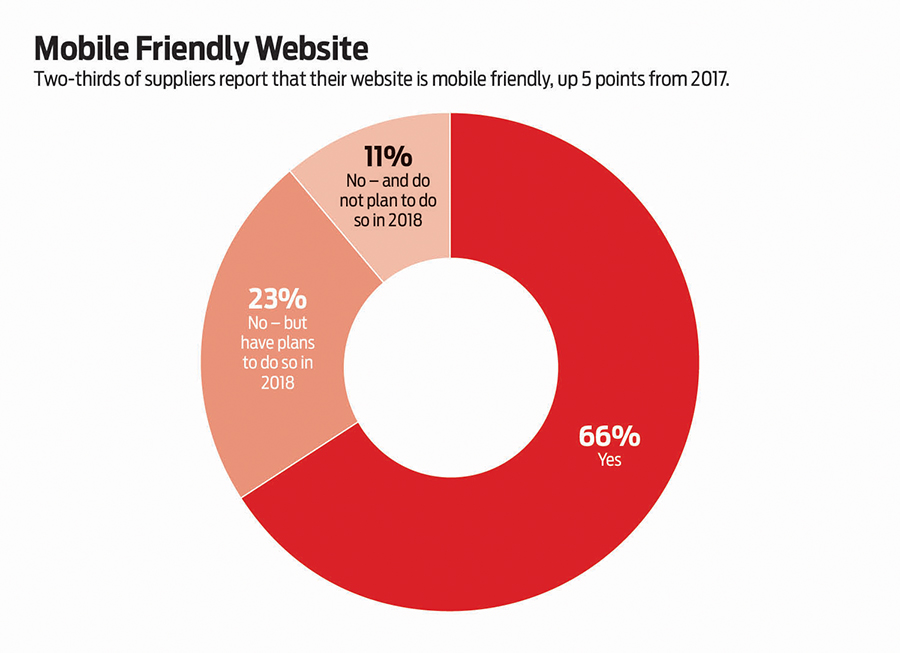

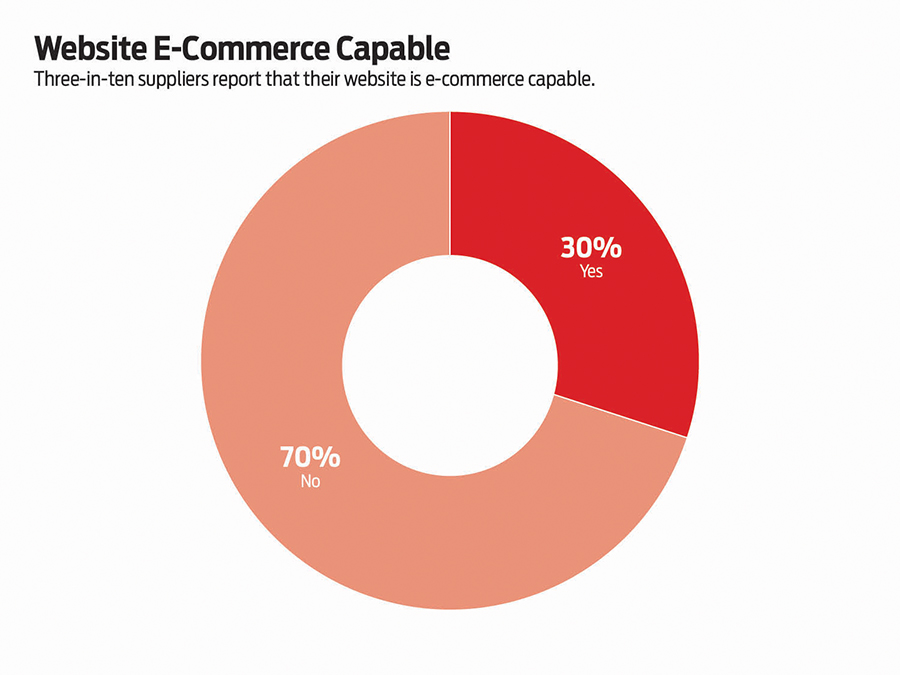

Although suppliers indicate the importance of maintaining a web presence, many aren’t practicing what they preach. Only two-thirds of suppliers reported that their website is mobile-friendly, and only 30% consider their website e-commerce-capable. While 22% claim they have plans to go mobile-friendly in 2018, 17% remain reluctant to change with the times.

Brandon McKay, president and CEO of Top 40 supplier SnugZ USA, sees other’s reluctance to adapt as an opportunity to capitalize. “It allows more mobile-friendly suppliers to grow their business quicker,” McKay says. “I hope it doesn’t change.”

Meanwhile, Chocolate Inn/Lanco falls somewhere in the middle. “We are trying to be more mobile-friendly,” Miller says. “We print two smaller catalogs and have moved the full catalog to a digital base.”

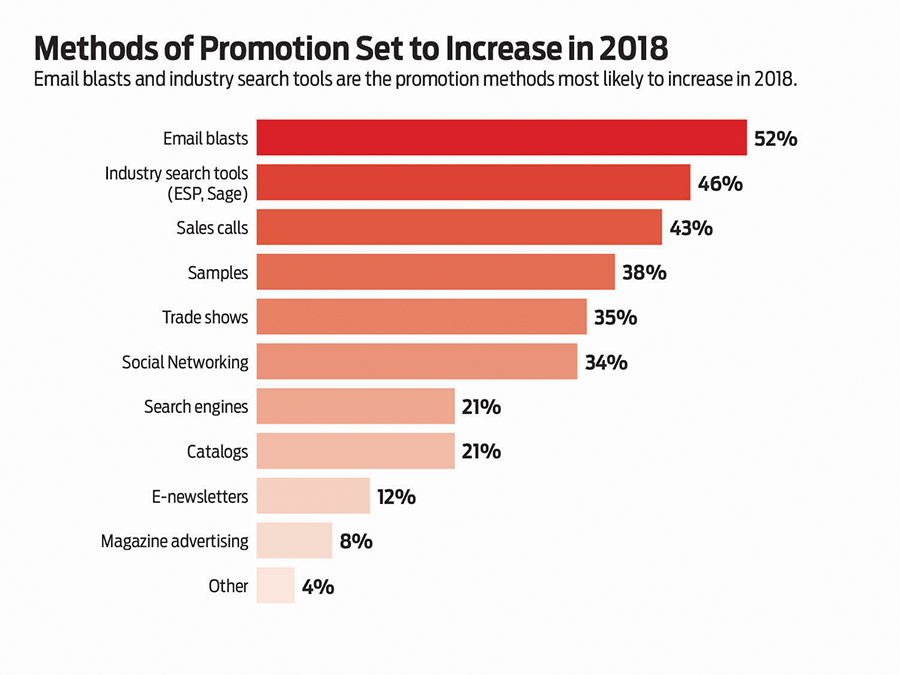

Additionally, both large and small suppliers (34% total) claim they are going to increase their usage of social networking; only 9% of suppliers consider it one of the most successful methods of marketing, up slightly from last year.

“We view our social media channels as a resource for our distributor customers,” Klatt says. “Our intention is to regularly publish useful and relevant content that strengthens our industry as a whole, and for distributors to repurpose that content in their own voice to benefit the end-user. Social media, especially LinkedIn, has also been a valuable tool for our sales team to further cultivate relationships and human resources, which has brought some dynamic new talent to the BIC Graphic family.”

The most successful methods of promotion continue to be industry search tools (50%) and samples (46%), a trend likely to continue in 2018. Larger suppliers use trade shows as a leading means of promotion much more so than smaller suppliers. Meanwhile, smaller suppliers use search engines and social media more often – though even here usage is very low. More than half of suppliers (52%) say they’re likely to increase email blasts in 2018, and larger suppliers are more likely to increase sales calls than their counterparts by 30%.

“Email is more of a communication tool than a means of advertising,” McKay says. “We’re pretty dominant on social media and video content. The smallest portion of our budget is for email – we spend a lot more money on video because we’re cool.”

Suppliers continue to feel the pressure to increase the size of their customer base, with more than a quarter of all respondents naming it their primary concern. On average, suppliers retained two-thirds of their clients from the prior year, with larger suppliers retaining a higher percentage. While smaller suppliers are more concerned with growing their business and remaining profitable, larger suppliers are more worried about recruiting and retaining employees.

In order to increase that size, suppliers need to accentuate their strengths and improve their weaknesses. “Although we’re optimistic, there is more uncertainty ahead of us,” Lage says.

“Preparing for next year is probably going to unveil some unique approaches from the supplier side, particularly in how they handle pricing.”

John Corrigan is staff writer for SGROnline and its sister publications: Counselor, Advantages and Wearables.