Awards May 25, 2017

Promo Plight: Distributors Feeling the Pressure

A tech-disrupted marketplace and intensifying client demands are clamping pressure down on distributors, challenging industry firms to adapt like never before.

The oil industry company was dangling a multimillion-dollar carrot before distributors’ eyes, but the promo firms were going to have to suffer the stick to get it.

To earn the client’s business, distributors would have to navigate an RFP process that would finish up with a reverse auction. The opportunity was huge, though, so a Top 40 distributor threw its hat into the ring. But once the reverse auction began, the competition descended into farce, the distributor says.

Held online, the auction had distributors slinging bids in a desperate attempt to undercut each other for the right to fulfill the oil firm’s desired marketing basket, which contained a suite of products. Where bidding began, the Top 40 company’s margin would have stood around 25%.

But once the lowballing bonanza reached frenzy, profit eroded to 18% below the distributor’s cost. “We dropped out,” an executive at the distributor says. “It was clear the competitor was going to try a bait-and-switch if they got the business. We don’t operate that way; we operate honestly. And for us to take on the project without making money was obviously pointless. Now, if we don’t have a relationship with the buyer where we can engage in some dialog about what we’re offering, we don’t participate in these auctions.”

Unfortunately, distributors say potential customers, especially those with ample spending power, are increasingly trying to force them through the hoops of reverse auctions. Even more frustrating, the rise in auctions is just one of the weights exerting heavier pressure on distributors in a marketplace disrupted by intensifying client demands and growing e-commerce.

More and more, clients are requesting ramped-up rebates, longer net payment terms, consolidated monthly invoices, lightning-quick responsiveness and even full integration with their enterprise resource planning software. The most universal issue, however, is rampant requests for rock-bottom pricing. The demands are often spurred by clients finding merchandise online, and then insisting on match-or-better pricing for products and services that might not be a true direct comparison to what the distributor is proposing in terms of product and service. “We feel clients are taking advantage of our relationship in as many ways as they can,” says the CEO of a Top 40 distributorship.

Does any of this profit-sapping angst sound familiar? You might recall “The Big Squeeze: Part I,” which appeared in our March issue and highlighted the increased demands suppliers feel distributors are placing on them. Many points on suppliers’ lists match distributors’ complaints – the pressure just comes from a different place within the supply chain.

In this follow-up story, we give distributors a chance to explain the tensions they’re feeling and how they’re dealing with those challenges. Plus, we offer up four strategies distributors and suppliers can use to work together to be collectively more successful in the cauldron of 21st century business.

Pricing Pressure

From companies tallying nine-figure annual revenue totals to solo operators running small businesses from their homes, distributors at every level of the industry have been impacted by an internet-driven paradigm shift that empowers anyone to shop for branded merchandise online.

Howard Potter’s experience is typical of the new reality. The CEO of Utica, NY-based A&P Master Images (asi/102019) says not a week goes by in which a customer doesn’t ask him to “meet online prices from companies that are lucky if they are marking orders up 10%.”

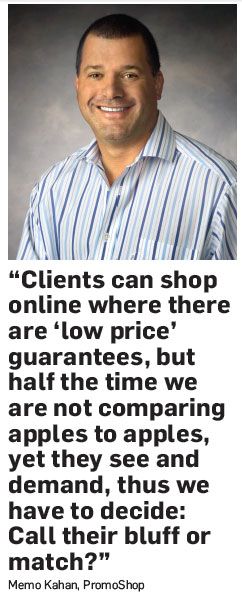

Memo Kahan can relate. “Clients can shop online where there are ‘low price’ guarantees, but half the time we are not comparing apples to apples, yet they see and demand, thus we have to decide: Call their bluff or match?” says Kahan, president of CA-based Top 40 distributor PromoShop (asi/300446). “Of course, this is after we have done the legwork, sent samples and done the creative work.”

One tactic some distributors use to counter the online price-match demand is to educate clients about the true total cost of internet-based offers. Kelly Moore takes this approach, which sometimes allows her to show clients that the competitor’s price is comparable to or even more expensive than her own. “You show that with shipping and setup charges and the rest, something that looked like a deal really isn’t and they don’t get the peace of mind of working with someone like me who is going to make sure everything gets done correctly,” says Moore, owner of FL-based distributorship Moore Promotions (asi/601617).

Nonetheless, it’s also often the case that the online offers are less expensive. As Proforma (asi/300094) founder Greg Muzzillo sees it, top web-based sellers purchase at volumes that command better pricing than average industry distributors, are large enough to sell select products below cost knowing they’ll make money elsewhere, and can deliver efficiencies through their technology platforms and interfaces with suppliers that everyday distributors could struggle to match. In the case of some e-commerce companies, customer service standards are high, too.

So what to do?

There isn’t a silver bullet answer, but some distributors are fighting fire with fire. Top 40 distributor Overture Premiums & Promotions (asi/288473) has launched its own direct-to-end-buyer e-commerce platform (www.bluesodapromo.com), which is boosting sales. Proforma, the third largest distributor in the industry, is taking tech action, too. “We have invested more than $10 million in developing a technology platform that alleviates many of the workflow challenges distributors and suppliers face on a daily basis to increase efficiencies and lower the cost of doing business,” says Muzzillo. “Technology will disrupt our industry. We are investing to empower our owners to win through the disruption.”

Meanwhile, independent small and mid-sized firms like A&P Master Images, which does a little less than $2 million in annual sales, aim to excel with personalized, highly responsive service – a strategy that includes educating clients about the advantages they deliver. “Our loyal clients come to us for our customer service, quality in-house printing, careful product and manufacturer vetting, turnaround time, and commitment to handling all art work on every order to ensure art always prints correctly,” says Potter. “We keep growing under this model. We refuse to play the online bidding game.”

But will delivering creative solutions and excellent service be enough to keep traditional distributors in the game over the long haul as younger buyers, accustomed to doing everything online, swell the corporate ranks? Some say yes, arguing there will always be a place for boots-on-the-ground distributors who differentiate themselves. Others, however, aren’t so sure. “A big fear for people like me is that we’re going to be squeezed out of the business,” says Moore. “We have advantages – I can give that personal touch, take care of everything for them, do the research, find the products, etc. – but I still worry it will all eventually move online.”

The Plight of Getting Paid

These days, distributors aren’t just reaching for the ibuprofen over the excessively cheap price clients want to pay; they’re also massaging away migraines regarding how customers go about compensating them.

Increasingly, clients are demanding longer net payment terms in the range of 90 to 120 days. “It’s not the smaller clients of course,” says Kahan. “It’s the big, wealthy Fortune 100 clients who think they can mandate and that we must oblige.”

On the flipside, other customers are willing to pay quickly, but insist upon a discount for doing so. More want terms like “2/10,” which allows 2% to be shaved off invoices paid within 10 days. Distributors say customers are also becoming bolder about demanding rebates as a matter of course. Rates can run several points and above.

Elsewhere, certain buyers are adamant that they be billed through consolidated monthly invoices. “The consolidation extends net 60 terms because of ship dates,” says Jo-an Lantz, chief operating officer/executive vice president at Top 40 distributor Geiger (asi/202900). “An item may be shipped on a certain date, but we can only submit the invoice at the end of the month.”

When it takes longer to get paid, the natural consequence is a detrimental impact on cash flow. “We have definitely become much more cash-flow negative,” says Kahan. Still, distributors aren’t defenseless against unfavorable payment terms and rebate ratchet-up. Some firms, including PromoShop, are pushing back proactively. “We educate our clients about the services we provide and convey that if they want them to continue at the level they are, we need a bit of their help,” says Kahan. “We understand procurement is driving most of the demands, yet we need them to become our champions and get us closer to our terms.”

Top 40 distributor HALO Branded Solutions (asi/356000) makes payment terms and rebates part of a broader consultation and negotiation process, says Jim Stutz, executive vice president of sales and business development. It begins with identifying customer needs and priorities, and then setting honest expectations about what can be achieved. This helps engender trust and goodwill that can be advantageous in navigating tricky negotiations, which include HALO determining what bargaining points – like pricing demands, turnaround times and payment terms – are most essential to the client. “Isolating which is most important allows you to stretch in the area that means the most to them,” says Stutz.

In practice, this could involve HALO reaching to meet a customer’s need on pricing, but then standing its ground on payment terms that are favorable to the distributorship – or vice versa. “Every client has their key impactors that are the most important,” says Stutz. “Once identified, we can accommodate, but may need to hold firm somewhere else.”

The Need for Speed

In recent years, the so-called “Amazon effect” has invaded the promotional products industry. More buyers expect the fast-fulfillment shopping experiences they’ve grown accustomed to as consumers to be replicated in the B2B realm, thereby putting pressure on distributors and suppliers to respond faster and produce orders within tighter timeframes. While not limited to younger buyers, the expectation is especially prevalent among them, distributors say.

“The incoming generation of clients grew up accustomed to instant access to information and answers,” says Mark Ziskind, chief operating officer at Top 40 distributor CSE (asi/155807). “Combine that with Google Shopping, Amazon same-day delivery, and smart products like Samsung refrigerators that text images of contents and it all adds up to an expectation of instant information and rapid service.”

As part of efforts to stay competitive, leading distributors are cultivating what Ziskind describes as a “culture of responsiveness.” At CSE, this culture is a cross-section of things like efficiency-enhancing technology, people power, supplier partnerships and in-house imprinting abilities.

“It’s about having the requisite staffing and developing a system to get clients ideas, quotes and other information they want as fast as possible,” Ziskind says. “It’s about winning orders and – with our supplier partners – fulfilling them with maximum speed. It’s also about leveraging things like our in-house embroidery, laser engraving and large format digital printing to be fast with creative ideas and to turn orders quickly.”

In totality, the effort results in enhanced competiveness on service and cost. “We feel this is what you need to do to excel in the game today,” Ziskind says.

Upgrade Required

In the age of digital business, clients – especially big money accounts – desire more sophisticated technological service and responsiveness from distributors. Top 40 distributors have, perhaps, encountered the phenomenon most frequently because of their work with large-scale organizations.

Lantz, for instance, says that more clients want Geiger to integrate fully with their enterprise resource planning software. Depending on the requirements, costs to integrate can range from $20,000 to $100,000, Lantz says. Still, it’s an investment Geiger believes is necessary. “We must respond to client demands,” says Lantz. “Our approach is to provide a seamless customer experience.”

Boundless (asi/143717) aims for the same in its bid to exceed client expectations. Managing Director Noel Garcia says the Austin, TX-based Top 40 distributor is continually improving its technology platform to make it easier for clients to identify, pay for and analyze data about branded merchandise. This mission includes using big data to connect clients with products that will be best for their particular promotions. “We try to focus on the process, on the technology solutions we offer,” says Garcia. “I feel clients see great value in what we bring to the table with our technology.”

4 Ways to Ease the Squeeze

As end-buyer demands clamp down on promotional product firms, industry executives believe some of the pressure can be relieved if distributors and suppliers enact strategies for working together better – something that, if done right, could lead to improved cash flow and enhanced profitability. Here are four strategies that could help.

1. Integrate Electronically: Suppliers and distributors need to integrate their electronic business systems. “It’s complicated, expensive and in the short term will add pressure,” says Jo-an Lantz, COO/Executive VP at Geiger (asi/202900). “But in the long run, it’s how we need to work together.” Integration will substantially streamline the order flow process, leading to far less back-and-forth between distributors and suppliers, Lantz maintains. Orders will get to production floors quicker, and be produced accurately with greater speed. Of course, this all benefits the end-buyer and helps distributors and suppliers compete.

2. Be More Open & Honest: Industry executives say firms need to communicate honestly about the challenges they’re facing, especially on costs and revenue, and make strides to better understand each other’s profitability drivers. Yuhling Lu, VP at Ariel Premium Supply (asi/36730), says this could provide the basis for developing solutions that help both suppliers and distributors strengthen their position in the marketplace, with each ultimately earning better margins. “By keeping a true eye on the entire financial landscape, we can manage the pressures by better managing the expectations of the end-buyers,” says Lu.

3. Collaborate on the Core: In Lu’s view, honesty and transparency could also allow distributors and suppliers to progress beyond the historical scope of the manufacturer/customer relationship to collaborate deeply on core competencies, such as product development, sourcing, product safety compliance, financing, logistics and more. This could lead to improved efficiency throughout the industry. “The most beneficial course of action is for suppliers and distributors to look for ways to work even closer together,” says Lu.

4. Make the Most of Suppliers’ Expertise: “I believe there should be tighter integration between suppliers and distributors with the initial ideation stage the distributor goes through with end-user requests,” says Jeff Lederer, CEO at Prime Line (asi/79530). “Suppliers like Prime have a tremendous amount of knowledge that can help distributors with presenting amazing ideas to their end-customers.”

In practice, this can even include supplier reps going on end-buyer calls with distributors – something that Barry Lipsett says is a benefit to both parties. “The combined expertise of the distributor and our reps results in a win-win that gets the end-customer something they will love,” says Lipsett, president of Charles River Apparel (asi/44620).

– Email: cruvo@asicentral.com; Twitter: @ChrisR_ASI