Strategy February 01, 2019

Promo Market To Target: E-Sports

Filled with young consumers, million-dollar sponsorships and endless merchandise, e-sports has become an explosive market to target.

At the end of July last year, nearly 11,000 people packed Barclays Center in Brooklyn, NY. But they weren’t watching any of the professional or college sports teams who call the arena home, nor were they attending a big-ticket boxing fight or wrestling match.

As a matter of fact, the sold-out crowd was there for a different competitive event: the Overwatch League’s Grand Finals. That’s right – thousands of people paid money to watch two teams play a video game in-person. And that’s not counting all of the folks who watched it live through ESPN, Disney XD and the streaming platform Twitch. An average of nearly 1 million people worldwide tuned in across a number of TV and streaming platforms at any given minute, according to Sports Illustrated.

It’s all part of the e-sports industry: a form of organized, multiplayer video game competitions that include professional teams, live streaming play and diehard fans. Millions of viewers – predominantly male, typically between the ages of 14 to 30 – follow e-sports franchises like Fortnite Battle Royale, League of Legends, Dota 2, Hearthstone and Call of Duty. Newzoo, a provider of gaming and e-sports analytics, reports the global e-sports audience will be nearly 454 million this year.

With so many eyeballs on the industry, there’s a lot of money involved. In the Overwatch League, for example, a dozen city-based teams from around the world each paid about $20 million to secure a franchise spot, many of them backed by the same executives who own NFL and NBA franchises. The video game players are treated like blue chip athletes, recruited from different countries and signed for annual salaries that can reach six figures for better players. These gamers are playing for big money, too. In August, Dota 2 offered a $24.8 million prize pool during its premiere championship event at Rogers Arena in Vancouver.

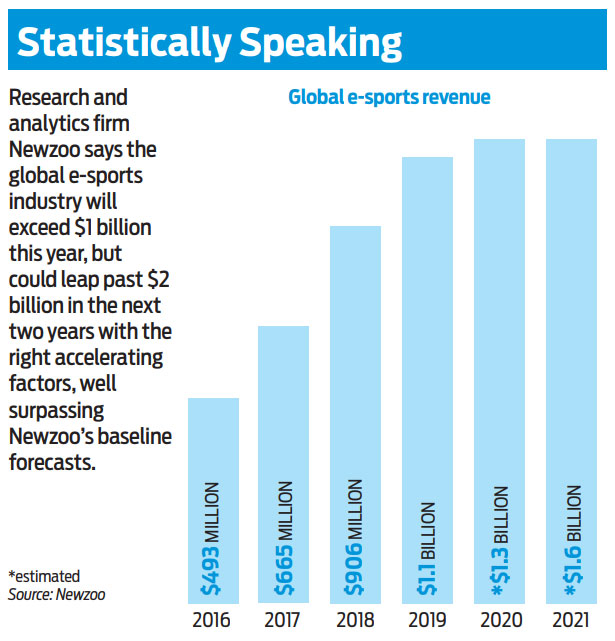

Despite all that, e-sports is still considered to be in its infancy: Goldman Sachs predicts revenue will climb to $3 billion by 2022. The market is ripe for distributors to capitalize on, with ample opportunities for promotional products, branded merchandise and marketing strategies.

The good news for promotional products companies is that brands are already getting wise to the potential of this market; in 2018, Coca-Cola, Intel, Red Bull, T-Mobile and other brands were estimated to spend $694 million in sponsorships, advertising and media rights, up 48% from the prior year, Newzoo reported.

Both merchandise and giveaways are already prevalent. Coca-Cola, for example, annually hosts viewing parties at cinemas during the League of Legends World Championship Finals and, according to EventMarketer.com, hands out the same limited-edition cups and thunder sticks that are sold on-site for the finals.

In addition, various e-commerce outlets such as ESL Shop, Meta Threads and Raven sell team-branded shirts, hoodies, hats, bags, bracelets, flags and more. These outlets even manufacture e-sports team jerseys for fans to represent their favorite players. In fact, Blizzard Entertainment (which created and controls Overwatch), recently signed a multi-year merchandise collaboration with Fanatics, an online retailer of licensed sportswear for heavy-hitters like the NBA and NFL. It’s the first e-sports merch partnership for Fanatics, which will create and manage a new e-commerce website for the Overwatch League where all fan gear will be available.

“Similar to how an older generation watches sports, these young people love e-sports,” says Taehoon Kim, the co-founder and CEO of nWay, a multiplayer web and mobile game developer. “They follow streamers and interact with players. It’s a lifestyle. They want a community they can belong to.”

Distributors – many of them with video game connections – are beginning to embrace e-sports. Top 40 distributor Sunrise Identity Powered by HALO (asi/356000) has catered to the gaming community for 25 years by working with some of the biggest names in the industry, including Nintendo, Microsoft and GameStop. The distributor created swag bags filled with branded wristbands and headbands for the Vainglory Championship. Those types of orders are fun for the company, which has a group of game-loving employees from various departments who gather and brainstorm. “Being a gamer gives me an advantage,” says Michael Schiller, Sunrise Identity’s vice president of consumer products. “You have to understand the game to come up with great promotional campaigns and products.”

Based outside Vancouver, Patterson Brands (asi/291582) has worked with a number of entertainment clients in the television, film and gaming industries. Video game titans Nintendo and Electronic Arts (EA) are among the company’s clients; when EA finished production of the latest UFC (Ultimate Fighting Championship) video game, Patterson Brands was called upon to provide hoodies decorated with the UFC and EA logos to 300 team members. “The gaming market has been really important to us,” says Rich Patterson, owner of Patterson Brands. “If you handle the relationship correctly, it can be an excellent spinoff to other business.”

Patterson wasn’t aware of e-sports’ massive popularity until Dota 2’s championship event in Vancouver. Flabbergasted by the capacity crowd and hefty price tag, he considers e-sports a pure licensing play now. “It’s a great opportunity for the right players,” Patterson says. “If you want to be a licensee to sell the goods, distributors are set up to do that.”

To succeed in this market, distributors should have a thorough understanding of the e-sports landscape and its fans. When Bud Light started marketing to e-sports fans a couple years ago, it tried a ham-handed approach of choosing “e-sports All-Stars” who were anything but, which “resembled a dad talking about gaming with his son,” wrote one writer from VentureBeat.

That knowledge will pay off in targeted promotions that will be functional and appealing to e-sports fans. “If you understand who the audience is, the array of products will occur to you naturally,” says Nickolai Mathison, general manager and VP of sales and marketing at Sonoma Promo (asi/88188), which has been active in the gaming market by supplying patches, bag tags, scarves, water bottles and funky sunglasses.

Jerseys have been proven to be the most popular merchandise – players wear them when competing and fans wear them to cheer on their favorite team. Hats, hoodies and jackets are popular as well. Wristbands were named as popular giveaways, as well as tech products like portable chargers that fit in with the gamer lifestyle.

On the high-end side, California-based supplier Mobile Edge (asi/71854) dove headfirst into the e-sports market with its Core Gaming backpack, which garnered over $30,000 through Kickstarter last year to fund the product. The bag features an external USB Quick-Charge compatible port and built-in charging cable, checkpoint-friendly laptop compartment, headphone holder, four side accessory pockets, three large storage sections and Velcro backing for gamers to show off their patches from tournaments.

Since then, the company has expanded into a full Core Gaming product line, which also includes portable chargers and mouse pads. “Generation X is having a hard time marketing to millennial and Generation Z gamers because they don’t understand them,” says Paul June, vice president of marketing at Mobile Edge. “We’re out in the field engaging with gamers, partnering with them and influencers at the grassroots level, making sure they understand what kind of quality products we have.”

At the more advanced level, distributors with full-service capabilities can help craft a messaging campaign that extends into the digital platforms e-sports fans live in, such as social media and streaming hubs like Twitch. However, it would be a mistake to blast fans of different games with the same messaging and products. “Dota 2, Counter-Strike, StarCraft, Hearthstone could be equated to rugby league, tennis, cross-country skiing and darts – they’re very different sports,” Harry Lang, founder of marketing consultancy Brand Architects, told MarketingWeek. “Fans follow their game of choice, maybe two, but largely they’re loyal advocates of one particular e-sport, so you can’t just lump them all together under one banner. A separate targeting and communications strategy is needed for each game and audience.”

Product Showcase

Core Gaming backpack with quick-charge compatible port and built-in charging cable from Mobile Edge (asi/71854); mobileedge.com

Sublimated e-sports V-neck jersey (DLA-EVN) from Dotted Line Apparel (asi/50247); dottedlineapparel.com

John Corrigan is a staff writer for Advantages. Tweet: @Notready4Radio. Contact: jcorrigan@asicentral.com