Awards June 07, 2019

Is Blockchain the Next Great Disruptor?

As global trade gets more complex, a new technology offers potential to reduce costs, but it also poses serious questions.

Global trade is an enormous commercial ecosystem. According to the World Trade Organization (WTO), this ecosystem is valued at more than $22 trillion. In order to facilitate these cross-border product and service flows, trade requires financial complexities and transfer of ownership processes. And despite the size of the global trade market, much of the system relies on antiquated processes that are ripe for disruption.

According to The Economist magazine, the last major disruption to global trade was the standardization of shipping containers in 1956. Invented by American transportation mogul Malcom McLean, the standard shipping container replaced nonconforming crates and boxes previously used by individual companies around the world.

While this innovation helped facilitate the growth of global trade, it happened more than 60 years ago. The cross-border movement of goods still requires thick stacks of paper to transfer ownership and pass through customs and border controls. Per the World Economic Forum, moving a shipment of roses across borders could require a stack of papers almost 10 inches thick. And trade finance continues to be an opaque process, which can exclude small and medium-sized businesses from participating in the global marketplace.

Trade is about to be disrupted by one of the more controversial new technologies on the market: blockchain. It promises to be one of the most revolutionary changes to global trade since the standardization of shipping containers. The World Economic Forum estimates that the financial and time savings generated by the implementation of blockchain applications and solutions could increase global trade by more than $1 trillion.

Blockchain technology and its applications are still in their infancy. Approximately a decade old, the first major blockchain innovation was the launch of bitcoin in 2009. And while blockchain has sometimes been undeniably tied to bitcoin, it’s becoming clear that there are many more uses for the technology other than cryptocurrency. According to some experts, blockchain is to bitcoin what the internet is to email – bitcoin is but one application within the blockchain universe. Industries and functions like healthcare, financial services, government record keeping and supply chain security could all be revolutionized by this new technology.

The potential for blockchain can’t be overestimated. Cryptocurrencies like bitcoin have begun to revolutionize the payments sector by eliminating the need for centralized financial institutions. This technology can be applied to the global trade regime, reducing costs and potentially adding more than $1 trillion to trade flows.

Overview of Blockchain Tech

Blockchain technology offers users a unique structure. The major disrupting factor of blockchain is that it acts as a decentralized distributed ledger operating on a cloud-based platform. This means there’s no central company or platform that controls how the information is collected or stored. Rather, the ledger is controlled by the members. These peer-to-peer network members are ultimately in control of the management of their respective blockchain ledger.

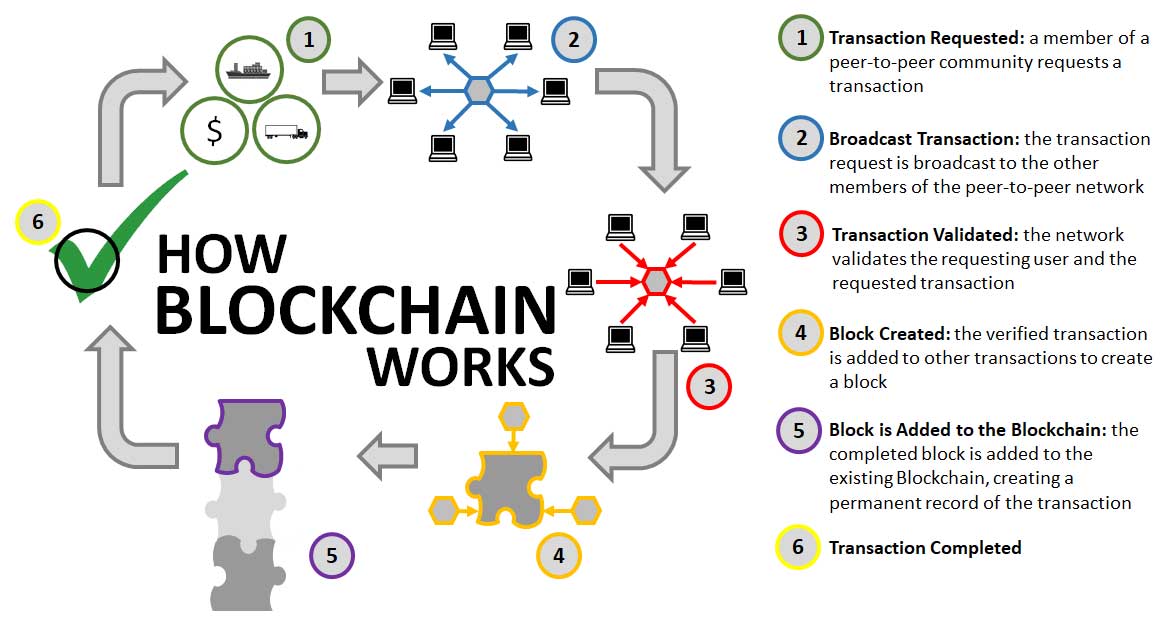

Blockchain transactions have a standard process for how they’re recorded and completed. There are six primary steps involved. First, a member of a peer-to-peer blockchain community submits a request to record and complete a transaction. This transaction is submitted through the blockchain community, whether it’s a private, closed blockchain or a public network. Second, the transaction request is broadcast to the other members of the blockchain network. Third, more than 50% of the network must verify both the identity of the requesting member and the requested transaction. Fourth, the transaction is added to other verified transactions to form a block. Fifth, the block is added to the existing blockchain, and that transaction is permanently included in the ledger. And finally, once the record is part of the blockchain, the transaction is complete.

Click here for a larger PDF on how blockchain works. Source: PWC

These ledgers operate in both public and private spheres, a choice that offers users the opportunity to customize their networks. Bitcoin is a public blockchain ledger, which means anyone can participate. Users have unique identities when buying and selling these cryptocurrencies. By participating in the verification process, users are compensated for their time and computing power with additional bitcoin, which is known as “bitcoin mining.” Private blockchain networks are limited to invited participants. These types of networks offer increased protection and discretion, and instead of monetary compensation for verification, participation in the network itself and benefiting from the convenience of the platform is the reward.

Blockchain offers benefits for both commercial and individual users. The cryptographic keys used during the encryption process are sophisticated and have been tested by almost 10 years of bitcoin transactions. There’s considerable transparency throughout the lifecycle of a blockchain transaction. Since each transaction is recorded on the ledger and is immutable, blockchain has a complete audit history of transactions. And because of its distributed, disintermediary nature, there’s no single point of failure.

Unlike centralized databases, it’s significantly more challenging to compromise more than 50% of the members of the network, which would be required in order to make unauthorized transactions or changes to the ledger. Ultimately, blockchain offers its users a high degree of transparency throughout the transaction lifecycle, a secure system with a sophisticated cryptographic key and network integrity strengthened by no single point of failure.

Commercial Application

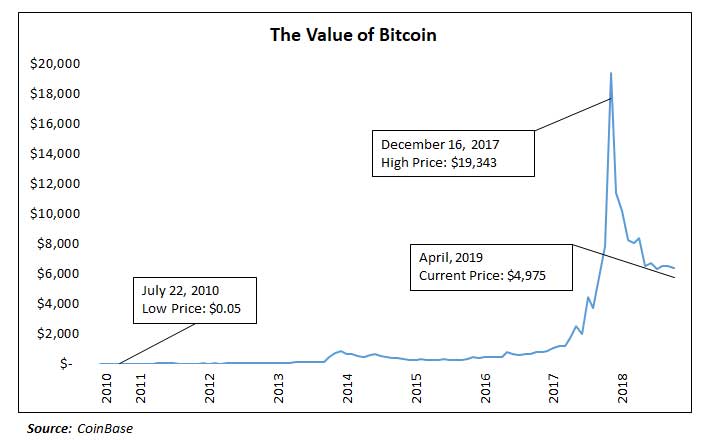

Blockchain has been tied to bitcoin and the other cryptocurrencies. Bitcoin has been one of the best performing assets in history, as its value rose from $0.05 in July 2010 to almost $20,000 in December 2017 – an incredible 40,000,000% increase in price over seven years. More recently, though, bitcoin’s value has dipped – one bitcoin is currently worth about $5,000.

Still, bitcoin’s overall meteoric rise has often been compared to other manias like the Dutch tulip market in the 1700s, when tulip bulb prices rose to more than six times the average annual household salary. And while blockchain is much more than bitcoin, the bitcoin mania brought blockchain technology into mainstream awareness.

There are several other commercial applications for blockchain technology that’ll eventually overshadow cryptocurrency. Benefits like information security, transparency, network integrity and the ability to audit make this technology attractive for other industries and functions. One of blockchain’s most apparent uses is as a registry for supply chain transactions. The blockchain associated with a physical or group of assets can be updated as they traverse the global supply chain. They can be updated at different intervals each time those assets move from one party to another. In addition, blockchain will be useful as a registry for assets that are exchanged less frequently. This means assets like property and patents can also be recorded in a more static ledger. In fact, the first home sale recorded on a blockchain ledger occurred on February 2018 after the city of South Burlington, VT, implemented a blockchain network to record property transactions.

“Ultimately, blockchain offers its users a high degree of transparency throughout the transaction lifecycle.” — Patrick Gleeson

This record of ownership has additional applications as well. For example, assets can be “tokenized” and subdivided among a group of investors. In New York City, one condo development tracks ownership by using an Ethereum-based ledger. This means investors in the development record their ownership on a ledger, can transfer ownership when buying or selling stakes in the development, and have all the benefits and security of blockchain.

In addition, blockchain can be used in an instrument known as a smart contract. A smart contract is built within a blockchain with a set of preconditions that can be coded into the network. When these preconditions are satisfied based on the language in the smart contract, it automatically triggers another set of actions. These self-executing documents are functional legal agreements that can carry the force of law and can’t be changed without the consent of all parties. For example, in a landlord tenant agreement, a smart contract could be designed to allow for the release of rent funds once entry to the unit has been obtained. It’s an automatic transfer that protects the landlord from nonpayment.

Blockchain can also be used as an infrastructure for payments and other financial transactions. While cryptocurrencies are the most common form of blockchain payments, it can also be used to track more traditional currencies, payments for products and services and other types of transactions. Because blockchain can operate outside institutional intermediaries and within a peer-to-peer network, these transactions can be faster and less expensive. And while blockchain transactions can benefit any payment platform, payments within a blockchain network can be especially beneficial where time, cost and trust are an issue, like in trade finance and cross-border transactions.

And finally, blockchain will be beneficial in tracking information attached to identity. A person’s information could be stored on a blockchain ledger and access to that information can be granted using biometrics. Everything from medical information, voting, government records and registration could be stored on a cloud-based platform. Several companies are working to bring these innovations to market. Walmart recently won a patent to store medical information on blockchain ledgers, which would allow for a patient’s record to be accessible when the patient is incapacitated. In West Virginia, overseas members of the armed forces were able to submit their absentee ballots using a mobile application called Voatz, which uses blockchain technology to guarantee the integrity of the voting process.

Impact on Trade

The commercial applications of blockchain are extensive and versatile, and many of these applications can be incorporated into international commerce. Multinational enterprises will be able to leverage blockchain applications to reduce costs, improve transparency and enhance security along their supply chains. These applications are moving beyond the theoretical phase, and several firms have brought commercially viable solutions to the market.

Several of the logistical and financial problems that affect trade could have blockchain-based solutions. While adoption of these solutions will not be instantaneous, and it could take years for the benefits to accrue to the investments made, these upgrades will have a positive net impact on trade by reducing costs, improving speed and strengthening security.

These applications can be used throughout the global trade lifecycle. The first step will be to create a new blockchain ledger entry for the goods being exchanged. In creating these ledgers, the buyer, seller and any third party can make updates on the status of the goods.

Transparency and visibility will be increased throughout the supply chain. The ledger will include key information about who has custody of the goods and where they’re located. This level of transparency is especially important for goods like food products, pharmaceuticals, electronics and, increasingly, promo products, where authenticity and transparency within the supply chain are necessary. These networks will most likely be private and limited to invited participants like the buyer, seller and the shipper, thus ensuring the confidentiality of the transaction.

These applications can also be used to properly identify the product, ensuring a high degree of authentication and verification. This is especially important for cross-border trading where the buyer and seller will need to verify the contents of shipments for purposes of customs and tariffs. It will ensure documentation cannot be duplicated, altered or falsified. These types of applications will be important for products like pharmaceuticals and medical devices, where FDA regulations require increased scrutiny over the transparency and safety of these products.

While bitcoin’s meteoric rise has ended, the asset has still increased considerably in value since it was created.

Blockchain technology could be applied to trade finance as well. According to the Asian Development Bank, there was a gap in trade finance that exceeded $1.6 trillion, which means some trade deals will never be financed. This gap disproportionately affects small businesses – 57% of trade finance loans to small and medium-sized enterprises were rejected. And while this affects SMEs more than large enterprises, 10% of multinational companies also struggled to finance trade. These transactions can also be completed much faster. Barclays conducted the first ever blockchain transaction for trade finance between a dairy producer in Ireland and a firm in the Seychelles. While traditional financing would take 7-10 days to complete, this transaction reportedly took less than 24 hours.

Smart contracts are one way to strengthen the integrity of trade finance. The example highlighted previously in a landlord-tenant relationship could also be applied to relationships in global trade. These self-executing legal instruments could potentially eliminate some of the counterparty risk of nonpayment and nonperformance by guaranteeing payment when the goods are delivered.

The Players

These blockchain solutions are already coming to market. There are several major players that could have a powerful impact on global trade. In January 2018, European shipping giant Maersk and U.S. technology firm IBM formed a partnership called TradeLens, a blockchain shipping solution. There are about 100 partner organizations, including ports, other shipping companies and customs authorities. According to its website, the blockchain platform is “a new form of command and consent that can be introduced into the flow of information, empowering multiple trading partners to collaborate and establishing a single shared view of a transaction without compromising details, privacy or confidentiality.” TradeLens will allow trade partners to view transactions and shipments without jeopardizing confidentiality and privacy.

Skuchain is another firm seeking to leverage the power of blockchain to benefit supply chains and logistics. Launched in 2014, Skuchain is eliminating manual processes, minimizing the amount of paperwork involved in the global supply chain, and improving visibility and transparency. In 2018, Skuchain partnered with Japanese information systems firm NTT Data Corporation to leverage the power of blockchain with the information gathering potential of IoT (the internet of things). The partnership will also utilize smart contracts to limit counterparty risk.

In addition to Barclays’ pilot program, nine European banks have launched a blockchain-based trade finance platform called we.trade across 11 European countries. The founders of we.trade include financial giants Deutsche Bank, Santandar, Societe Generale, and HSBC. The platform has already completed several transactions, demonstrating that the initiative is commercially viable.

What’s Next

The World Economic Forum estimates that integrating blockchain applications into the global supply chain could potentially increase international trade by more than $1 trillion by reducing barriers to trade and improving transparency. Although these improvements will take time to implement, there are already several major players in the market introducing new products and services.

Blockchain applications are going to do more than just reduce costs and improve transparency, however. These innovations are going to make it easier for SMEs to participate in the global trade regime. According to the WTO, SMEs account for 90% of the firms in the world, 50% of the value add, and 60% of total employment. However, the WTO also reports that SMEs derive 7.6% of their volume from global trade, while large enterprises derive 14.1%. And in the United States, only 10% of SMEs participate in global trade.

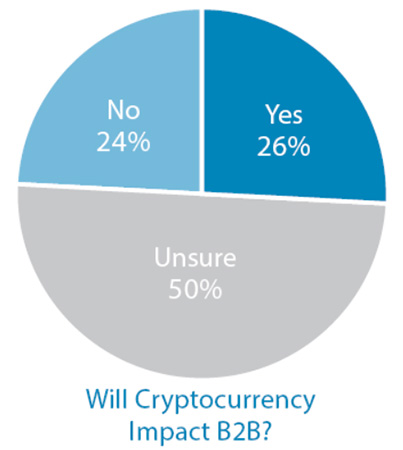

Lack of Consensus: In 2018, Counselor asked ASI Power Summit attendees if they thought cryptocurrency was going to have a major effect on B2B markets, including the promo products industry, over the next decade. These poll results show leaders are uncertain about the topic.

Blockchain isn’t going to be the savior of international commerce, though. There are nationalistic trends in some of the world’s largest economies, including the U.S., Brazil and the European Union. Brexit, the United States’ withdrawal from TPP, the trade war with China, and ongoing challenges within the European Union all threaten to adversely impact global trade. Blockchain has the potential to improve access to the global marketplace, reduce costs and increase transparency, but without a global policy push to protect trade, the impact of any technological improvements will be minimized.

Patrick Gleeson is a consultant based in Chicago. He previously worked for a Washington D.C., firm where he focused on free trade agreements and their impact on manufacturing, emerging markets and foreign policy. He earned his J.D. from Loyola University Chicago and his MBA from Georgetown University.