Strategy April 24, 2017

Promotional Product Sales Growth: East

Despite sales challenges, the East remains a promo powerhouse.

few years ago, Howard Schwartz moved from Pittsburgh to Phoenix in search of warmer weather and an even warmer business climate. “The Southwest is one of the two strongest areas in the country,” said Schwartz, founder and CEO of HDS Marketing (asi/216807). “One, it’s new business. And the weather’s warmer. People want to be there. The cities are growing.”

few years ago, Howard Schwartz moved from Pittsburgh to Phoenix in search of warmer weather and an even warmer business climate. “The Southwest is one of the two strongest areas in the country,” said Schwartz, founder and CEO of HDS Marketing (asi/216807). “One, it’s new business. And the weather’s warmer. People want to be there. The cities are growing.”

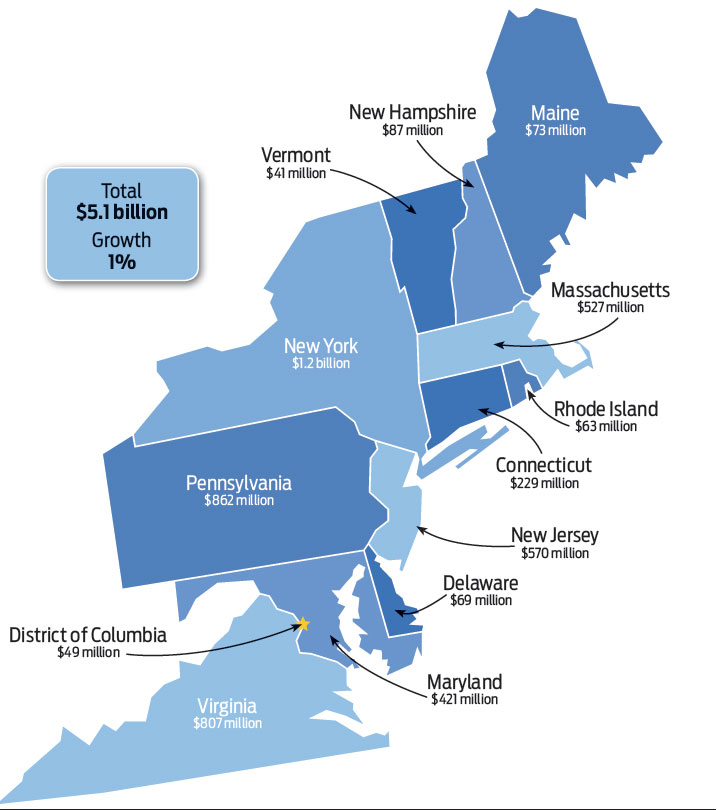

Yet he left HDS firmly entrenched in western Pennsylvania, where it employs 60 people (there’s another 30 in Cleveland and only nine in Phoenix) and continues to see strong business with a variety of clients. For promotional product companies, there is little reason to forsake the East, which remains a promotional powerhouse with over $5 billion in sales thanks to major business centers like New York City, Philadelphia and Boston.

>>State Spotlight: Growth Prospects in Washington, D.C.

What the East lacks currently is robust growth. The region itself saw only a 1% increase in sales last year, after less than 2% growth the year before. New York, Pennsylvania and Vermont posted small declines, while Connecticut, Maine and Rhode Island saw little to no growth at all.

>>Case Study: Brewing a Better Customer

There are, however, some bright spots. New York remains the fourth-largest ad specialty sales market behind Texas, California and Florida (which took over the number-three spot the Empire State held in 2015). Tiny Delaware grew 3.4% to nearly $69 million in annual sales. And the District of Columbia continues to be a booming market for promotional product sales, reporting a nearly 6% increase in 2016.

Slowing population growth is a contributing factor. While there are pockets of innovation – particularly in the District of Columbia – most industries are mature, leaving little room for explosive growth, industry veterans say.

As a result, staying on top requires a lot of hard work. “It’s a challenge,” says Marty Bear, president of Professional Marketing Services Inc. (asi/299860) in Stratford, CT. “It’s the profitability that’s really the issue these days. It’s what you have to give away to have the same the year before. You’re taking small margins in hopes the customers will order something you can make money on.”

The meetings and conferences market, Bear says, continues to be a struggle, as meetings migrate online and fewer products are being distributed. “There’s much less face-to-face opportunity,” he says. “You can do webinars, you can hit the links. They don’t have to see you in person. If they don’t have to see you, you don’t have to give them anything. They’re not going to give out bags.”

Others say one of the biggest challenges has been the changing relationships with their customers. “I still like the relationship part of our business, but it’s getting a lot harder,” says Randy LeFaivre, president of Washington, D.C.-based MetroLogo (asi/268938). “I could get really philosophical, but the culture has changed. Because of being online, everybody’s been trained, especially millennials. There’s no real value put in the relationship.”

Companies have needed to get creative to preserve strong growth. Sales at A&P Master Images (asi/702505) in Utica, NY, were up 13% last year, topping $1.7 million. “Most of our growth comes from word of mouth and keeping our existing customers happy,” CEO Howard Potter says. “By keeping them happy, you get natural sales increases by word of mouth.” But it’s taking more to keep those customers happy. A&P does everything in-house so it can streamline the process and cut down on turnaround time.

Key Trends

Key Trends

Online Migration

Technology use continues to grow, which means demand for online company stores grows too. “The online game has really gotten strong for us over the past four years,” says A&P Master Images CEO Howard Potter. “What’s great about that is you’re paid ahead of time on those orders because they’re paying online. That’s a huge benefit.”

Online platforms have helped boost MetroLogo’s spirit wear business through the creation of team stores. “People are used to going online and getting everything from Amazon,” says MetroLogo President Randy LeFaivre. “That’s been a challenge, but with the company stores, it’s a way to get over that. We have to offer the stores for free, and we manage them for free or for a small monthly fee.”

Tech Products Rule

Technology isn’t just ruling how people buy – it’s also ruling what they buy. Marty Bear of Professional Marketing Services says he sees a considerable push toward tech-related promotional products in the meetings and conferences business.

“The old days of the big portfolios are gone,” he says. “The programs are on USBs. They don’t need handouts. People don’t want to carry stuff when they’re traveling. Everything is dictated by technology and the phone. The phone is the key.” But given the varying brands and sizes of tablets and phones, it’s harder to find a one-size-fits-all solution.

Anu Kelly says tech products have been a big seller for her firm Alinea Promos, an affiliate of Geiger (asi/202900). “Products that make people’s lives easier have been really big,” she says. “Many people travel for their work, so tech travel gadgets like cord organizers are great.” Combo items such as a water bottle with Bluetooth speaker capabilities are also hot, Kelly adds.

Fashion-Forward Products

Current retail looks in apparel are in demand. “Apparel is getting to be bigger and bigger,” Kelly says. “The promo industry has been able to change boring polos to retail styles.

“Five years ago, it was, ‘We have the basic cotton polo, and we can embroider on the left,’” Kelly adds. “Now, we can offer more because of what suppliers are able to bring to us to keep in competition with what's at retail stores, what you see at Old Navy or these specialized sporting places like Lululemon and Lucy and Patagonia. We’re able to offer that.”

Potter, of New York’s A&P Master Images, says being able to offer styles beyond “cookie cutter” has driven business. “We don’t design for you to look like a business,” he says. “We design for you to look like a clothing line you find at the mall. Better fabrics, better inks, better threads. It’s more a lifestyle, not just a choice. It makes the employee want to wear it when they get outside of work. It’s not like the old-school days where everybody’s work shirt was the one you wore to mow the lawn.”

The retail trend isn’t just applicable to clothing, however. Hot brands like cooler retailer Yeti are more available as promotional products. “Traditionally, our lag time between a retail trend and getting it into our industry is six months to a year,” says Josh Frey, founder of On Sale Promos and the Swag Coach Program (asi/340317). “Now, they’re closing the gap and getting it within a couple months.”

Changes From the New Administration

Promo product industry leaders are uncertain exactly what changes the Trump administration will bring. Some distributors express concerns over the president’s wish for a tax for goods imported from overseas. “If you’re selling on price,” says Frey, “and you have the president who’s looking to put a 20% import tax on products – they’re about to get it stuck to them.” Yet, as a small-business owner, Frey says he’s optimistic about tax breaks and other benefits Trump has promised to help accelerate economic growth.

Spending cuts could threaten companies that do business with the federal government, some say, but others see opportunity in the defense market, healthcare and industries that would benefit from Trump’s policies. “Healthcare,” says HDS’ Howard Schwartz, “is going to get even stronger. If the administration opens the ability to sell insurance across state lines, you’ll see a huge marketing play. The insurance companies are going to be going after everybody. Buying in health insurance is going to skyrocket. The ones that are positioned well with those insurers are going to do really well.”

Crissa Debree is a contributing writer for Advantages.