News May 13, 2022

Distributors Increase Sales 5.4% in Q1 2022

While industry top-line sales increased, a variety of challenges and economic headwinds complicated the quarter.

Complicated, with both positives and negatives.

That sums up the collective sales performance of North American promotional products distributors in the first quarter of 2022.

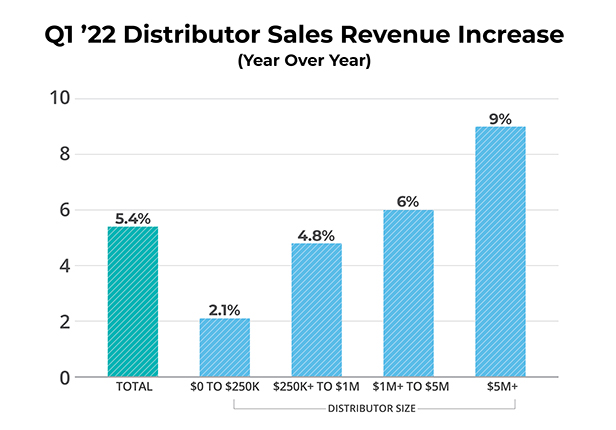

On the one hand, distributors’ overall sales increased, on average, by 5.4%, according to the just-released ASI Distributor Quarterly Sales Survey.

The gain marked the fourth straight quarter in which industry revenue rose when measured against the comparable three-month period the year prior, thereby continuing promo’s reemergence from the darkest days of the COVID-19 pandemic when sales declined annually for five consecutive quarters.

On the other hand, the success wasn’t evenly distributed, with the industry’s largest distributors experiencing a stronger quarter than smaller firms.

Consider: Nearly 80% of distributors that generate $5 million-plus in revenue increased sales year over year in Q1, with nearly 7-in-10 distributors in the $1 million to $5 million annual revenue category doing the same.

Meanwhile, 38% of distributors that tally $250,000 or less in yearly sales reported a Q1 revenue rise, with some 35% saying that sales decreased. For distributors in the $250,000-plus to $1 million range, nearly half (48%) reported that sales accelerated, but 28% said revenue dropped.

One reason for the disparity in the Q1 promotional products industry sales could be that smaller distributorships tend to work with smaller clients. Such end-customers can be more susceptible to economic headwinds, says Nate Kucsma, ASI’s senior executive director of research and corporate marketing. It seemed to be the case in the first quarter as the U.S. gross domestic product declined 1.4%.

“Larger clients have more free cash flow to spend,” says Kucsma, who spearheads the quarterly sales survey.

“Issues,” he continues, “such as soaring energy costs and 40-year-high inflation in the U.S. economy would have a much quicker, more noticeable impact on smaller clients, which can impact their spend on promo.”

Overall, 47% of distributors increased sales in Q1. That was the lowest percentage since the industry returned to growth in the second quarter of 2021, with more than 60% of distributorships reporting quarterly revenue increases in the immediately preceding three quarters.

Still, the 47% of firms reporting growth would have been the third highest quarterly figure from 2015 to 2020. In other words, more distributorships than what was the norm in even pre-pandemic good years increased revenue in Q1.

There’s a similar narrative in play when it comes to the Q1 sales growth of 5.4%.

The rate was a deceleration from the previous three quarters, but those quarters were in comparison to 2020 when pandemic effects on the promo business were at their worst, so there was always going to be less of a mountain to climb to post larger annual gains relative to them. In addition, a 5.4% acceleration is among the top seven best collective quarterly growth rates for promo of the last decade, if you exclude the anomalous most recently preceding three pandemic bounce-back quarters. Indeed, it’s one percentage point off the best pre-pandemic quarterly increase for that period – 6.4%, seen in the first quarter of 2014.

Finding Success Amid Challenges

While there are some positives from a historical perspective, it would be naïve to think that challenges like inflation, supply chain disruption and general economic volatility didn’t restrain growth somewhat in the quarter. “The industry is facing a lot of headwinds right now, as is the general economy,” says Kucsma.

Still, more than 4-in-10 firms (42%) said that first quarter revenue exceeded expectations, with another 28% indicating sales were about what they’d forecasted.

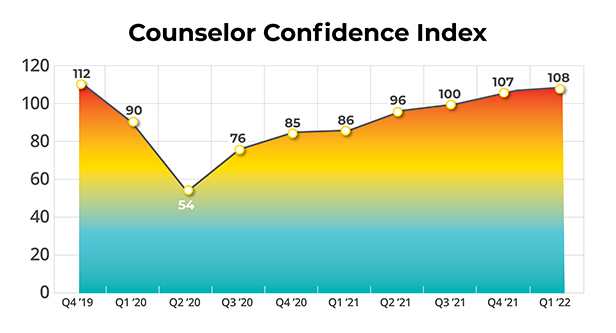

Furthermore, the Counselor Confidence Index reached 108, a tick up from 107 in the fourth quarter of 2021. While that remains below pre-pandemic levels, it’s the highest reading of the COVID-19 era and both comfortably above the baseline reading of 100 and lightyears better than the lowest-ever score of 54, which was experienced during the coronavirus-ravaged second quarter of 2020. The index, which measures distributor health and optimism, dates back more than 20 years.

“It was a fantastic first quarter,” says Craig Nadel, a member of Counselor’s Power 50 list of promo’s most influential people and the president of Los Angeles-based Top 40 distributor Nadel (asi/279600), which posts annual revenue well north of $100 million. “Our sales were up 93%. It would be wonderful if all quarters were like that,”

Distributors that engineered sales increases in Q1 tell ASI Media that a variety of factors played into the topline success. The increasing return of events, conventions and travel helped propel end-client spend related to such things. Hospitality continued its comeback. Firms across verticals also kept investing in promo to assist with hiring and retention/appreciation initiatives given the ongoing labor shortage and so-called “Great Resignation.” Perhaps most broadly and significantly, many clients in industries that have typically been avid promo users seemed ready to ramp up investment in merch, distributors say.

“In general, companies feel safer spending money now that COVID seems to be behind us,” says Kelly Moore, the solo-operating owner of independent St. Petersburg, FL-based distributorship Moore Promotions (asi/601617), whose first quarter sales leapt about 35% year over year.

Of course, some distributors say, it must be acknowledged that inflation/rising prices on promo products also helped fuel topline revenue gains at their firms, as end-buyers continued to invest despite the heavier costs of products.

“It’s not as hard to increase sales when the average customer price for your most popular products has increased 22% on average compared to 2019 due to price increases on the supply side,” says Bret Bonnet, president and co-founder of Aurora, IL-based Quality Logo Products (asi/302967).

“For us at least,” he continues, “the amount of pushback over price increases, especially for program business, has been almost non-existent. I don't know where the customers are getting the money, but the fact that the stress ball they purchased for 68 cents back in 2019 is now $1.99 in 2022 really hasn't resulted in reduced quantities or order frequency.”

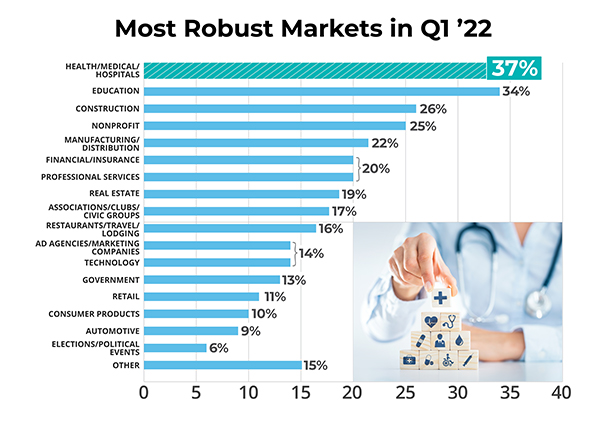

Clients most keen to spend on promo came in markets that have often provided fertile ground for sales. The top four markets for distributor business in Q1 were healthcare, education, construction, and nonprofits. Manufacturing rounded out the top five.

“Manufacturing seems to be the area that we have seen the largest growth,” shares Ann Vidro, co-owner/CFO of Grand Rapids, MI-based Creative Studio Promotions (asi/170976) and, along with co-owner Menda Wright, Counselor’s Distributor Entrepreneurs of the Year in 2021. Her company increased sales 49% in Q1. “It seems,” Vidro continues about manufacturers, “that they are striving hard to attract and retain employees.”

Elsewhere, healthcare was huge for folks like Moore. “I did projects for Hospital Week, Nurses Week and Doctors Week, so I was busy,” she shares. “Nurses Week was especially phenomenal. I had two brand new hospitals jump on board and spending was at a higher price point.”

Distributors consistently listed supply chain challenges among the biggest roadblocks they faced in the first quarter. Those challenges, which have intensified during the early second quarter due in significant part to societal shutdowns in China, have contributed to inventory shortages and delays in production and order delivery in promo – imbroglios that have, in cases, led to distributors losing orders. Says Vidro: “It has been difficult to manage client expectations at times in regards to backorders, expected dates of restocking, etc. due to the unreliability of this type of data.”

Intensifying COVID lockdowns in China are causing supply chain imbroglios for North American #promotionalproducts suppliers & are poised to delay replenishment of inventory levels at the domestic industry firms. https://t.co/bOL3KwrXTO @asicentral @ASI_MBell

— Chris Ruvo (@ChrisR_ASI) April 25, 2022

The Image Group (asi/230069), a Top 40 distributor, tells ASI Media that supply chain access and production capacity were the biggest issues coming out of the holiday season into Q1. Nonetheless, the firm managed to adapt – a nimbleness that helped drive a more than 30% quarterly sales increase for the company.

“We had to get creative, and several team members went above and beyond to help us work through bottlenecks with our suppliers and our internal decoration business,” says Zack Ottenstein, president of The Image Group. “As a result, we were able to convert a lot of large orders and deliver. Resolving challenges led to great opportunities.”

Close partnering with preferred suppliers also enabled Top 40 distributor AIA Corporation (asi/109480) to navigate supply chain-related issues – a tactic that proved critical to fueling a more than 40% year-over-year quarterly sales gain, says CEO Nancy Schmidt, a member of Counselor’s Power 50 list.

“With demand continuing to increase in the first quarter, our supplier partners did a wonderful job of anticipating, educating, strategizing and delivering amidst complex supply chain dynamics,” says Schmidt. “Their support and partnership enabled AIA’s owner community to design solutions and meet our commitments.”

Labor issues, which include shortages, soaring costs and difficulty hiring/retaining, were impediments for promo distributors and suppliers in Q1 too, as they were for industries throughout the United States. “It’s difficult to find employees,” notes Nadel.

Both distributors and suppliers have shouldered increased labor costs as they vie to attract and keep talent. They’ve also dealt with staffing shortfalls that impact customer service and production/fulfillment. (A surge of COVID infections at the beginning of the year also compounded staffing issues.) Even so, none of it was enough to derail industry growth. Some distributors even hustled to develop advantages from the labor stress.

“While the labor market is competitive, we have worked to capitalize on the high-quality talent in our industry and bring them to AIA as an opportunity to drive innovation,” says Schmidt.

Labor woes: Wage increases & difficulties in finding workers are driving price increases & creating operational challenges for distributors & suppliers in the #promoproducts industry https://t.co/i4DX9U1vHn @ASI_MBell @asicentral

— Chris Ruvo (@ChrisR_ASI) May 9, 2022

Also during the first quarter: Russia’s invasion of Ukraine created a humanitarian disaster to which many promo companies and organizations, including ASI, responded to with fundraising efforts aimed at aiding the Ukrainian people. From a purely business perspective, however, promo distributors on the whole said that the war has had little sustained effect on sales to date, though some distributors reported limited impacts. “We’ve seen,” says Ottenstein, “a reduction in volume from several clients with European operations that have been impacted by the war.”

As 2022 proceeds, distributors are looking ahead with measured optimism and the sense that they’ll have to keep adapting to considerable challenges, from supply chain and inventory issues to the vicissitudes of the broader economy.

Bonnet, for instance, believes inventory will become scarcer as the year goes on, with more product price increases and product shortages. Still, he says, there remains ample opportunity to build business.

“Our customers who weathered the COVID storm are more aggressive in their marketing efforts than ever,” Bonnet shares. “With the trust we built in the hardest of times, it’s no surprise why they’re still here today putting their marketing dollars in our hands to get the job done.”

Stay Ahead of the Curve

Subscribe to ASI's industry-leading newsletters.

All the award-winning content from ASICentral and Print & Promo Marketing, delivered right to your inbox.