News March 18, 2020

Survey Shows COVID-19’s Industry-Wide Impact

The macro data from Counselor’s new study paints a sobering picture of the challenges facing the promotional products industry.

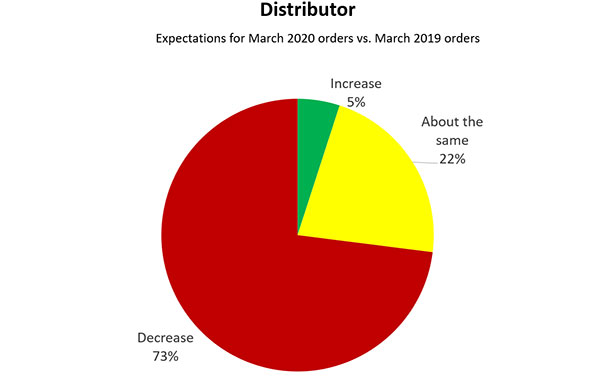

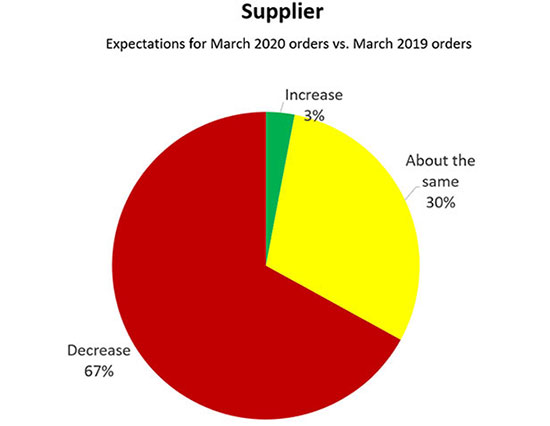

More than two-thirds of promotional products suppliers and about three-in-four distributors expect their March 2020 orders to decrease compared to the same month the prior year.

That’s a key finding in a new industry-wide survey from Counselor that uses hard data to provide a macro-level perspective on how fallout from the novel coronavirus crisis is affecting business in the $25.8 billion ad specialty space.

The data paints a sobering picture of the challenges facing promo during a time of unprecedented disruption, which has included widespread event cancellations that have led to a bevy of branded merch orders being trash-binned. “Ninety percent of my business is shot,” one distributor commented in responding to Counselor’s survey. “Spring trade shows, golf outings, open houses – all are canceled.”

Beyond hurting sales, attempts to check the spread of coronavirus are impacting day-to-day operations. Suppliers and distributors are implementing work-from-home policies for staffers whose positions allow for remote work. They’re also undertaking special cleaning initiatives at facilities/offices, nixing business travel and in-person meetings, and instructing employees to practice social distancing.

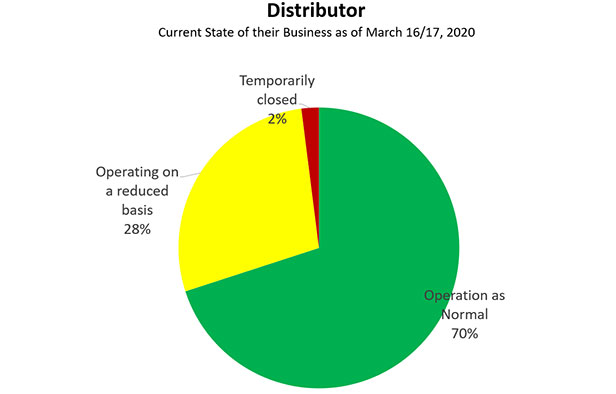

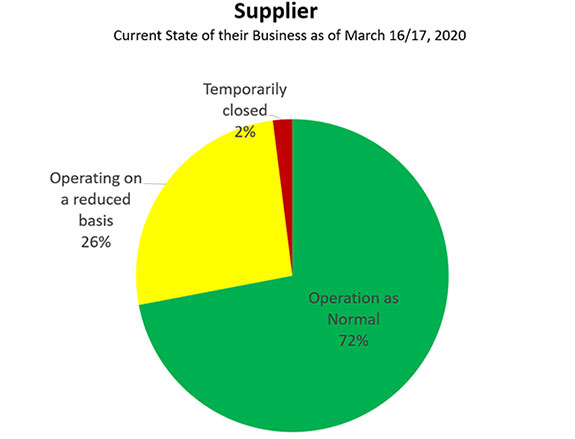

While the majority of industry firms say the upheaval hasn’t stopped them from operating normally, nearly 30% of distributors say they’re operating on a reduced basis, with 2% stating that they’re temporarily closed, according to Counselor’s survey. Similarly, more than a quarter of suppliers are running at less-than-full operational status, with 2% saying they’ve temporarily shut up shop.

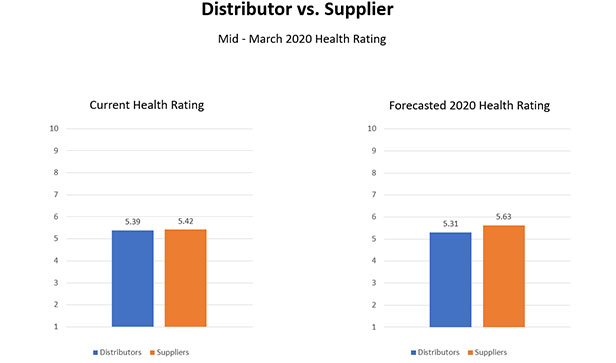

Such findings indicate why distributors and suppliers rating of their businesses’ health has plummeted – and rapidly. In mid January 2020, the mean rating on business health from distributors stood at 7.27 on a scale in which 10 is “robust” and one is “ailing.” Fast forward to mid-March, and the mean health rating has fallen to 5.39. For the whole of 2020, distributors are now forecasting that their health will be 5.31. Suppliers put the tally at a similarly paltry 5.63.

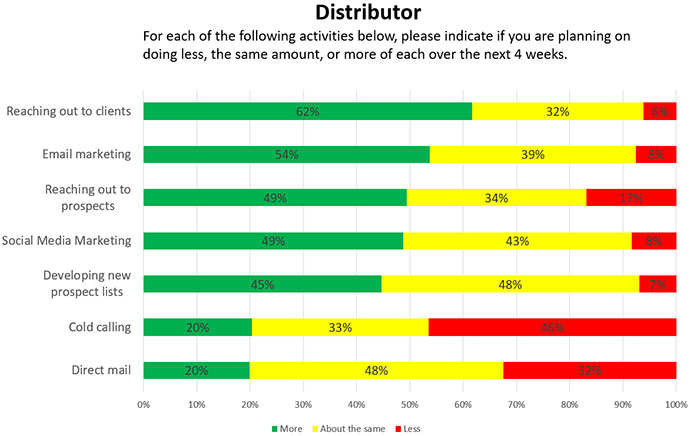

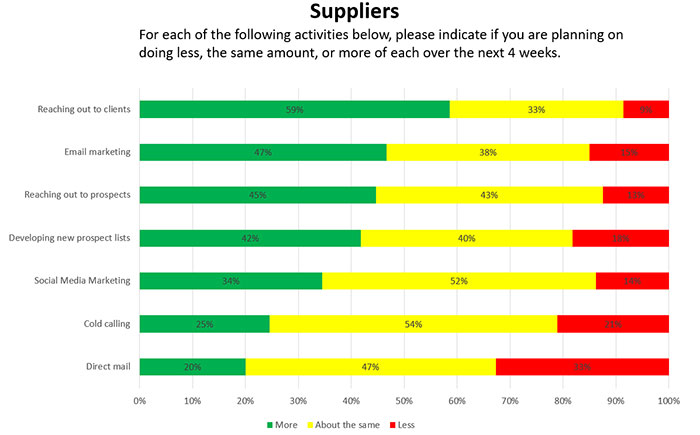

Despite the dour mood, distributors and suppliers aren’t simply sitting on their hands and bemoaning their fate. They’re planning to engage in proactive activities aimed at generating as many sales as possible. For industry firms, actions will include reaching out to clients, email marketing, contacting prospects, social media marketing and creating new prospect lists.

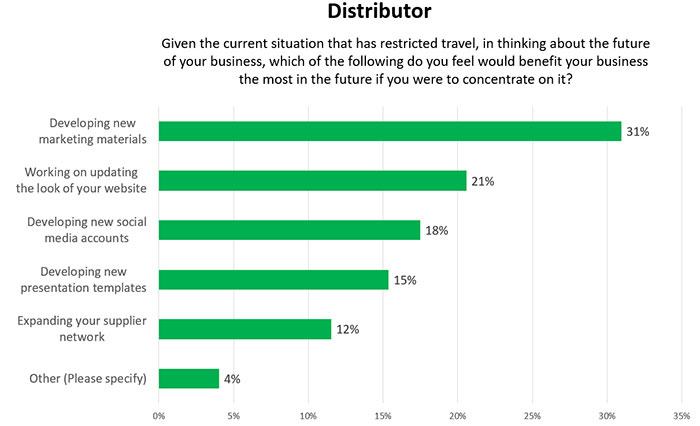

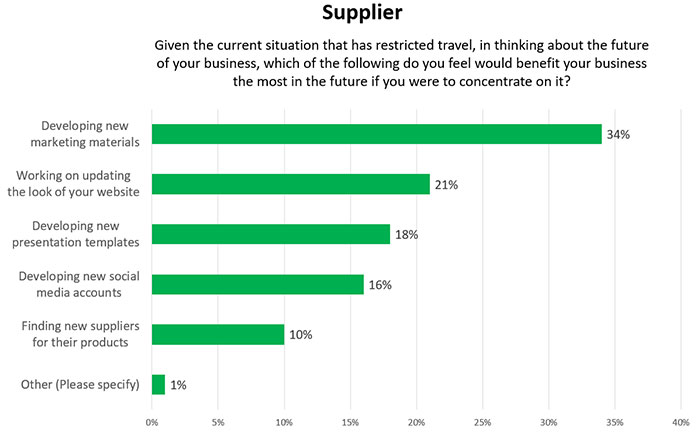

Meanwhile, distributors and suppliers also agree that developing new marketing materials and updating the look of their websites are two of the most important things they can do to benefit their businesses in the wake of travel restrictions that have put many face-to-face meetings on hiatus.

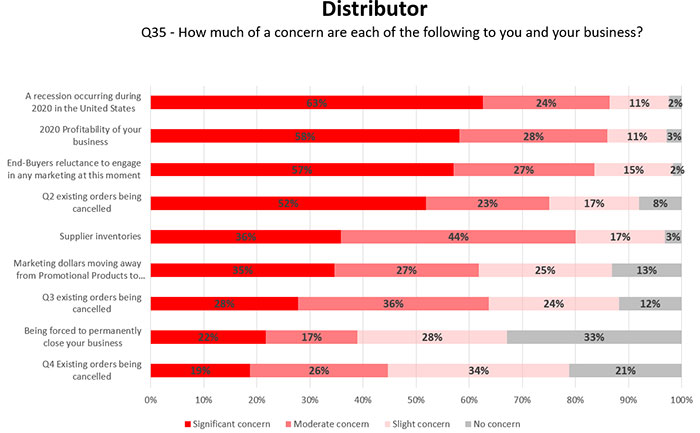

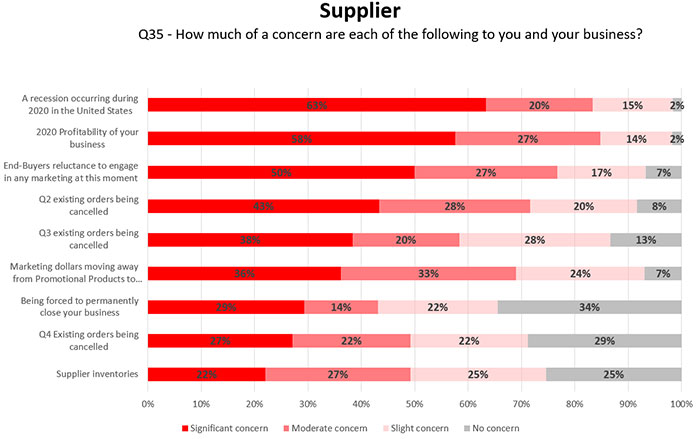

Given the tumultuous economic climate that’s emerged amid the COVID-19 pandemic, it’s perhaps not surprising that 83% of suppliers and 87% of distributors say they’re either significantly concerned or moderately concerned that the U.S. will experience a recession in 2020. Relatedly, 86% of distributors and 87% of suppliers have significant or moderate concerns about the profitability of their businesses in 2020. Other worries include the prospect of more canceled orders and reluctance on the part of end-buyers to invest in marketing.

Given the tumultuous economic climate that’s emerged amid the COVID-19 pandemic, it’s perhaps not surprising that 83% of suppliers and 87% of distributors say they’re either significantly concerned or moderately concerned that the U.S. will experience a recession in 2020. Relatedly, 86% of distributors and 87% of suppliers have significant or moderate concerns about the profitability of their businesses in 2020. Other worries include the prospect of more canceled orders and reluctance on the part of end-buyers to invest in marketing.

The novel coronavirus outbreak began in Wuhan, a city of 11 million people in China. The disease has since spread around the world, disrupting daily life and economies. While conditions in China have improved, confirmed cases of COVID-19 are proliferating in the U.S. At least 120 people in the U.S. have died since the disease was first identified stateside in January.

The novel coronavirus outbreak began in Wuhan, a city of 11 million people in China. The disease has since spread around the world, disrupting daily life and economies. While conditions in China have improved, confirmed cases of COVID-19 are proliferating in the U.S. At least 120 people in the U.S. have died since the disease was first identified stateside in January.