News June 23, 2020

Trump: China Trade Deal Still in Place

The clarification comes after a top White House adviser appeared to indicate the deal was over.

President Donald Trump says the Phase One trade deal between the U.S and China that was agreed to in January remains in place – a clarification he felt compelled to make after a top administration official appeared to indicate the deal was dead, thereby rattling stock markets.

The China Trade Deal is fully intact. Hopefully they will continue to live up to the terms of the Agreement!

— Donald J. Trump (@realDonaldTrump) June 23, 2020

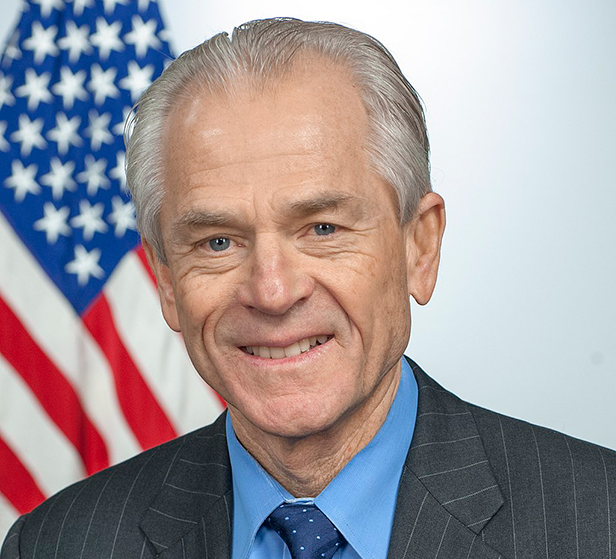

Peter Navarro, a top White House adviser, seemed to declare that the trade deal with China was “over” during an interview on Fox News. Navarro indicated China’s handling of the COVID-19 pandemic was a cause for the breakdown.

However, Navarro later asserted that “my comments have been taken wildly out of context. They had nothing at all to do with the Phase One trade deal, which continues in place. I was simply speaking to the lack of trust we now have of the Chinese Communist Party after they lied about the origins of the China virus and foisted a pandemic upon the world.”

Peter Navarro

Word that the deal remained in place helped settle markets and sent stocks higher, before a reported surge in coronavirus cases in areas of the U.S. sent markets down again.

Under the deal, China has pledged to increase buying of U.S. goods by $200 billion over two years. The coronavirus pandemic has affected that effort though; exports to China fell in the first quarter.

During the trade war with China of the last several years, the Trump administration imposed tariffs on about $370 billion worth of imported Chinese products, which contributed to price increases on some promotional products. The majority of promo products sold in the North American market are produced in China. The tariffs remain in place, but under the Phase One deal the rate of tariffs particular to a certain $120 billion worth of imports were scaled back from 15% to 7.5%.

Some analysts fear that escalating tensions between the U.S. and China, the world’s two largest national economies, could exacerbate global economic hardship already being experienced due to the coronavirus.

“We had expected U.S.-China tensions to escalate in the second half of this year in the run-up to the U.S. elections,” Vasu Menon, senior investment strategist at OCBC Bank Wealth Management in Singapore, told Reuters. “China hawks ... like Navarro could gain the upper hand and egg [Trump] on to take action against China. So expect markets to be very bumpy in the second half of this year because of the double whammy from COVID-19 and U.S.-China tensions.”