News July 16, 2020

Promo Distributor Sales Drop 44.4% in Q2

Caused by fallout from the coronavirus pandemic, the historic plunge could have been worse had there not been an industry-wide pivot to selling personal protective equipment.

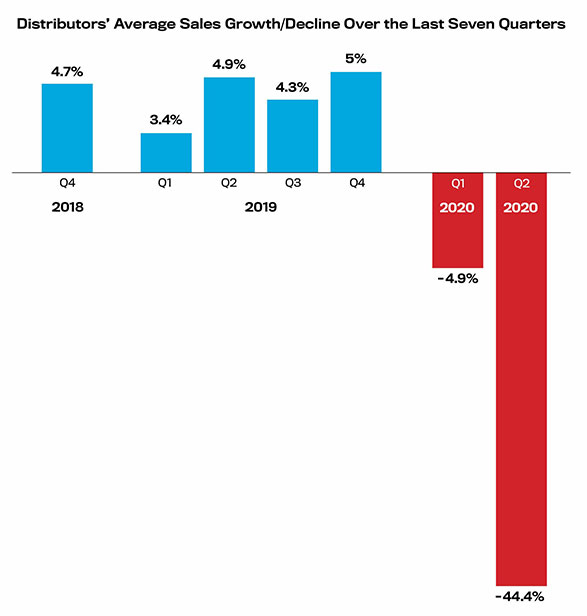

North American promotional products distributors’ sales in the second quarter of 2020 declined 44.4% on average compared to the same period the prior year – a historic plunge in business caused by the coronavirus pandemic and its related societal shutdown measures.

That’s according to ASI’s just-released Distributor Quarterly Sales Survey, which showed that distributors’ sales retreated for a second straight quarter after having posted constant gains for more than a decade.

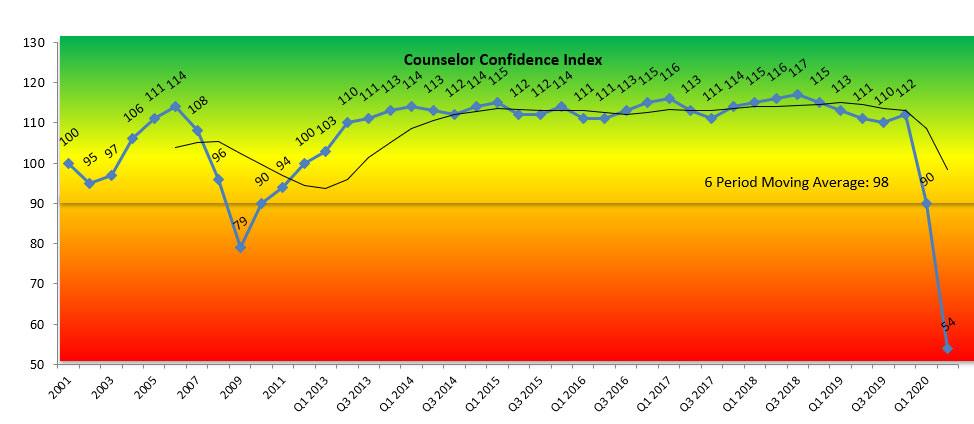

The Counselor Confidence Index, which measures distributors’ financial health and optimism, fell to a record low reading of 54 – far below the baseline of 100 established at the index’s founding 19 years ago. The previous lowest reading, 79, occurred in 2009 during the economic downturn known as the Great Recession.

Counselor Confidence Index: The index is at its lowest point in history.

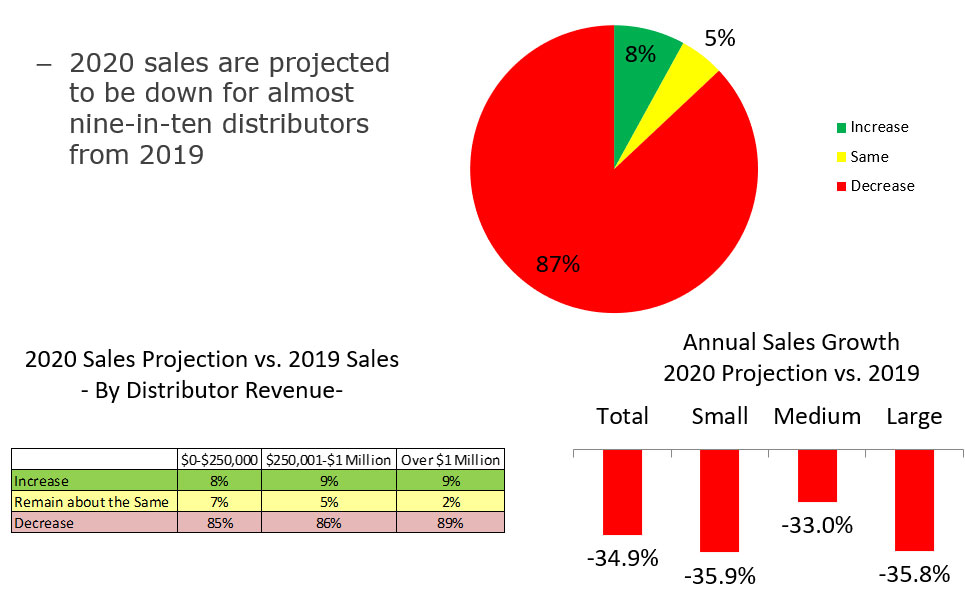

For the rest of 2020, distributors appear to expect a small bounce back from Q2 lows but are still collectively predicting that annual sales will, on average, be down about 35% compared to 2019.

2020 Projected Sales vs. 2019 Sales

“The Q2 numbers are just staggering when you think about where we were just six months ago,” said Nathaniel Kucsma, ASI’s executive director of research and corporate marketing. In 2019, distributors’ collective annual sales reached an all-time record high of $25.8 billion.

“If it weren’t for sales of personal protective equipment (PPE) products, the industry would be in much worse shape,” Kucsma continued. “Fortunately, the pivot that many companies were able to make to selling PPE somewhat mitigated what was a historically down quarter.”

When societal shutdowns began in mid-March, shuttering businesses across sectors and compelling the cancellation of trade shows, concerts, conferences and other live events, sales in the promotional products space ground to a near total halt.

Still, as Kucsma noted, both distributors and suppliers across the industry quickly switched their focus to selling PPE items like face masks, as well as related health-protecting products like hand sanitizer. The nimble pivot to these product categories kept some revenue coming in and enabled promo to help society in its hour of need as the items were in high demand.

Some distributors had so much success with PPE that they bucked the downward trend and increased year-over-year sales in the second quarter of 2020.

“Sales were up over last year due to PPE,” said Matt Gledhill, vice president of sales and marketing at San Antonio, TX-based distributor Walker Advertising (asi/354440). “I was blessed to receive the largest order of my career – one million face masks. Our industry is so incredibly lucky to have PPE options available to help us stay busy and keep the business flowing. I just hope it keeps up. I consider every order a step closer to an end to this time.”

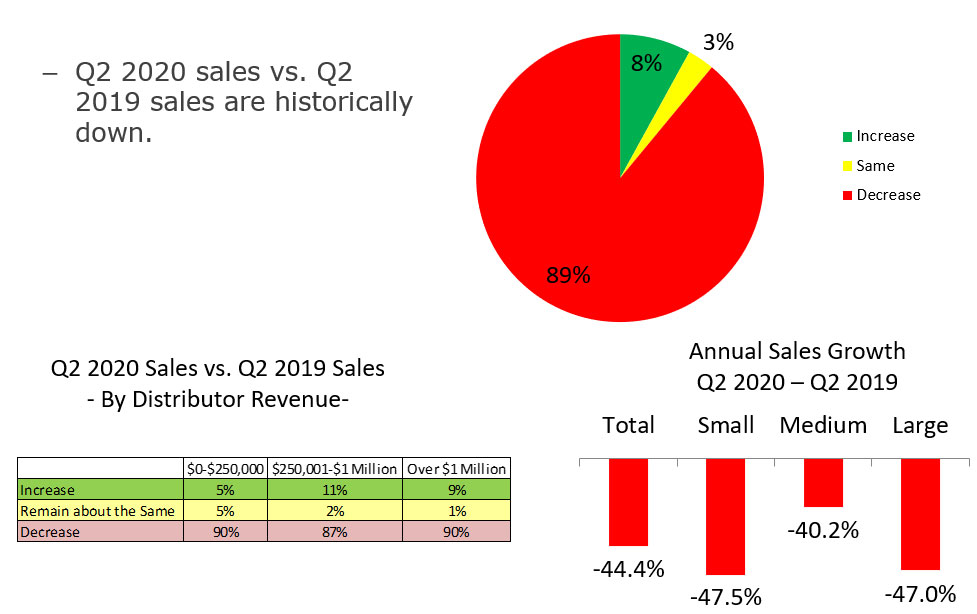

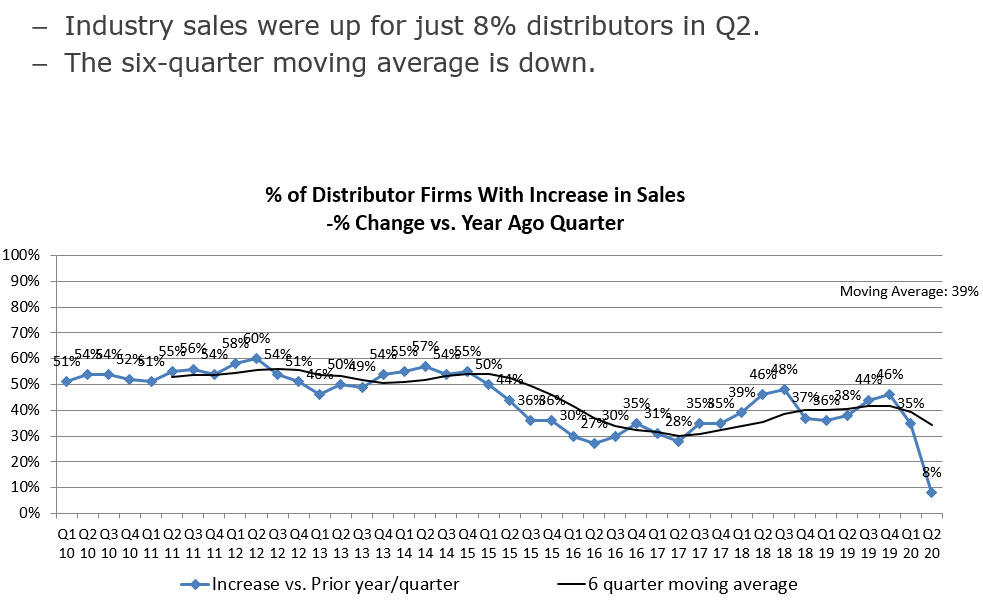

While Gledhill’s story might be encouraging, it’s not representative. Overall, nearly 90% of distributors reported that their sales declined in Q2 2020 compared to Q2 2019. Only 8% reported an increase. As the below chart shows, medium-sized distributors fared the best, with an average 40% decline. The industry’s smallest and largest distributors were both down about 47% on average.

Q2 2020 Sales vs. Q2 2019 Sales

At Warminster, PA-based Heritage Screen Printing (asi/700490), sales eroded about 30% year on year in the second quarter.

“We literally had little or no orders in March and April,” said Owner Steven McKee. “Sales have rebounded slightly since May 1.”

Quarterly Sales – Increase in YoY sales

The uptick at Heritage is thanks, in significant part, to printing cloth face masks. Orders have ranged from 24 pieces to 10,000 pieces. “Another success has been our e-commerce fulfillment program, which has seen a 30% increase in volume during the pandemic as many Americans are home and ordering shirts through the web to be delivered to their homes,” McKee noted.

Elsewhere, Des Moines, IA-based distributor IMPACT Promotional Marketing (asi/230181) is, like many industry companies, “struggling for every scrap of business we can get,” said Owner Mike Rodin. The pivot to PPE helped IMPACT, but that business has slowed in recent weeks as clients now have ample stocks of the products, Rodin said. He noted, as some other industry firms have too, that PPE was a bumpy transition, with everything from unexpected order delays to fast-depleting supplier stocks to requirements to pay upfront making the business a challenge. Traditional sales of promo are occurring, but at a trickle, Rodin said.

“We go in every day and try, but it’s the most challenging I’ve ever seen it in 26 years in business,” said Rodin. “We typically do a lot of event-related business, and that market just doesn’t exist right now because there are no events. Other clients are reluctant to spend. With promo, it can be that we’re the first budget item to get cut and the last to get reinstated.”

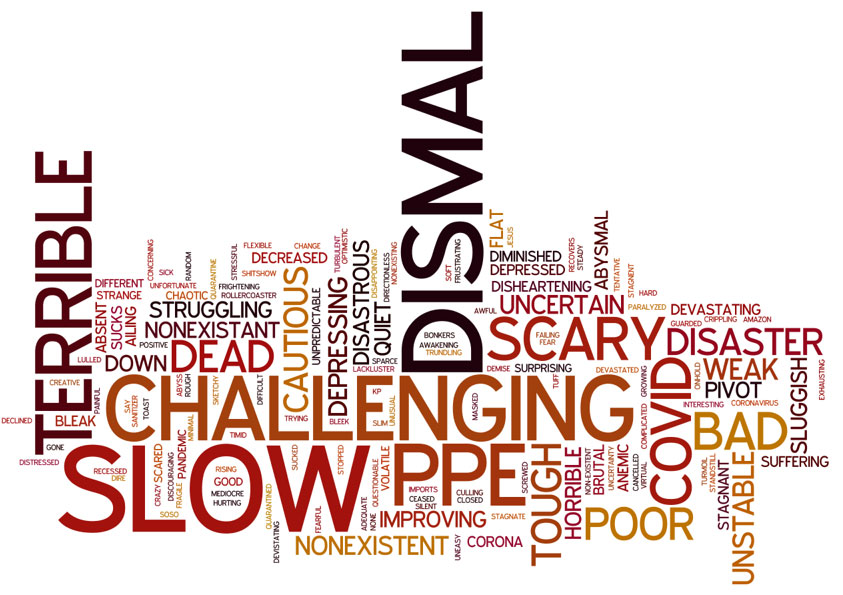

One Word to Describe Q2 2020 Sales Environment

Nonetheless, Rodin does see better days ahead.

“I think we’ll see improvement in the fourth quarter,” he said. “Employers will want to thank employees for hanging in there during this crisis. That’s a significant opportunity to provide branded products and gifts.”

Brandon Kennedy is also optimistic. His California-based Proforma Progressive Marketing (asi/300094) was among the exceptional 8% of distributors that increased sales in Q2. He and his team pulled off the feat through everything from selling PPE to existing clients, to gaining new clients initially through PPE sales and then also providing them with traditional promo items.

“The second half of the year has nothing but opportunities ahead for us all,” Kennedy said. “We’re hearing marketing budgets for retention are increasing since live events have been canceled, and we’re seeing a rise in uniforms as people are getting out again and hiring staff back. Printing and mailing has been quoted much more in the past few weeks. Overall, I think we’re positioned to be helpful in getting our clients and communities back to work.”

Even so, promo and the American economy haven’t yet sailed out of the storm of COVID-19. With new confirmed cases of the virus surging in parts of the country, societal reopening initiatives have been rolled back in areas, including Kennedy’s own California. That has the potential to negatively affect promo, especially if restrictions on business and social activity become more widespread and re-intensify to levels seen in March and April.

California's rollback on reopening is poised to impact the #promoproducts industry https://t.co/SHE3ZEjdv4

— Chris Ruvo (@ChrisR_ASI) July 15, 2020

“We are seeing some light at the end of the tunnel, but we expect the rest of this year to be challenging,” said Mark Lenox, vice president of brand and creative at Illinois-headquartered Top 40 distributor IMS (asi/215310). “We expect continued focus on PPE products, both for our clients and for their customers. Many client events are slow to restart and not expected to return back to normal until 2021 or even later. This will impact demand for promotional items.”