News July 22, 2020

How Long Will Promo’s PPE Run Last?

Some say that PPE business is slowing and becoming more competitive, but most still believe the category will remain a fixture in promo into next year at least.

Sales of personal protective equipment (PPE) have been vital to sustaining promo companies as revenue from traditional promotional products has plummeted during the COVID-19 pandemic, but some distributors now say that PPE is either slowing or poised to slow, and is becoming more competitive.

Nonetheless, PPE remains the top-selling category for many ad specialty firms and is likely to remain a fixture in promo companies’ sales even after the sales spike of recent months subsides once the coronavirus is under control, industry executives said.

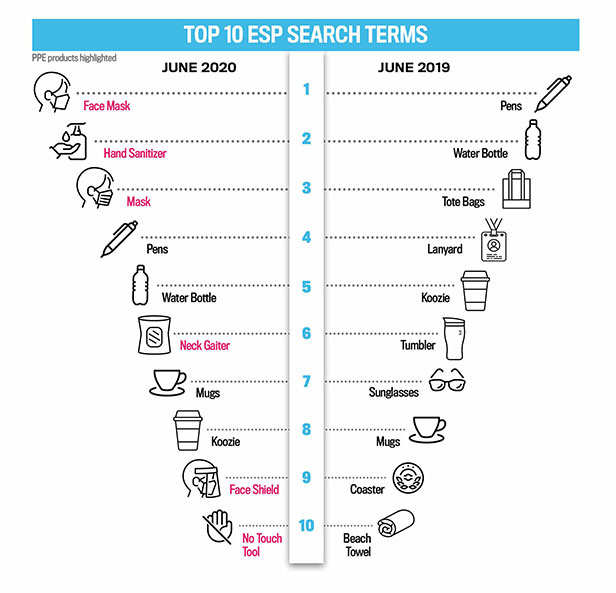

The promotional products industry’s pivot to selling personal protective equipment (PPE) during the coronavirus pandemic continued in June. However, there was also reviving interest in traditional promo items like pens, mugs and can coolers (“Koozies”).

Des Moines, IA-based IMPACT Promotional Marketing (asi/230181) has experienced one of the more severe drop-offs in PPE. Owner Mike Rodin said PPE sales had been strong at his firm until about a month ago. “Three or four weeks back, they dropped off pretty dramatically,” Rodin reported. “Our clients stocked up. They have their supplies – at least for the time being. The market became saturated.”

Meanwhile, Jordy Gamson, president of Atlanta, GA-based distributor The Icebox (asi/229395), said sales of face masks have remained consistent. Demand for thermometers and hand sanitizer has waned somewhat, he said.

“With more promo companies, as well as companies from other industries getting into the PPE game, our PPE sales could slow in the months ahead because there are more vendors for end-buyers to purchase from,” said Gamson.

In the second quarter of 2020, PPE sales accounted for more than 50% of New York City-based distributor Harper+Scott’s (asi/220052) business. Company President Jon Alagem said the distributor’s PPE business hasn’t so much slowed as it has changed.

“In the beginning, our phone lines did not stop, and companies were just firing orders left and right,” Alagem said. “Now what we’re seeing is companies taking a step back and planning their futures. We’re helping them put together larger initiatives and programs at mass scale to protect their employees for the many years to come.”

Going forward, Alagem and others expect that soaring COVID-19 caseloads in areas of the United States and wider-spread adoption of face mask-wearing could stimulate a renewed surge in promo’s PPE sales. Walmart and other retailers recently mandated the wearing of masks in stores, while more political leaders, including President Donald Trump, have been encouraging or mandating people to wear masks in public.

“We believe that until there’s a widely distributed vaccine, which we anticipate being in about 14 months, PPE sales will continue to dominate the promo world,” Alagem said, though he does feel the category will account for less of a percentage of industry sales in the second half of 2020 as more traditional promo business returns. He said: “I predict PPE sales will account for at least 90% of all promo industry sales for H1 and slightly lower for 2020 as a whole. I’m including things like signage that will be used for COVID purposes also in that estimate.”

Similar to Harper+Scott, about 50% to 60% of Top 40 distributor Proforma’s (asi/300094) second-quarter sales came from PPE. Kimberly Fulford, product and PPE manager for the Ohio-headquartered firm, said Proforma has experienced “some slowdown in the large medical opportunities with PPE. However, PPE has remained strong as an overall category and nearly all items in the category remain in high demand for medical and nonmedical applications.”

Fulford believes sales of PPE will remain robust during the third quarter amid back-to-school season, back-to-the-office initiatives and, sadly, the sharp rise in COVID-19 cases in parts of the country. Proforma currently anticipates that the demand will slow in the fourth quarter, but that by then there could be increased interest in traditional branded merchandise items to offset the potential PPE decline.

“Proforma has been fortunate to pivot quickly into the PPE category and it has allowed our network to maintain overall year-over-year growth,” Fulford explained. “While we believe that PPE sales will decline over the balance of 2020, we also anticipate that PPE will be an important category in 2021 and will present opportunity for branded and unbranded sales in the promotional products industry.”

She noted that Proforma owner-affiliates have been handling more orders for branded PPE. “Even with a decline in PPE, there’ll still be opportunity in the category,” Fulford said. “Stay on top of it by focusing on new opportunities and the new PPE-related products that are coming out. Look to provide branded PPE solutions.”

Regardless of how PPE sales are going at the moment, promo pros should also be diversifying their product and service offerings and working hard to lay the groundwork for traditional promo sales, some executives said.

“PPE has been propping up (promo) businesses, but that will stop in the late summer,” said Michael Emoff, chief vision officer at Dayton, OH-based distributor Shumsky (asi/326300). “Distributors have been able to sell PPE because larger pharma suppliers wouldn’t sell relatively small quantities, but those orders will go back to the big companies eventually. Start getting orders now in regular promo so you’re ready.”

Chicago-based promo distributor Edventure Promotions (asi/186055) is hard at work on just that. In Q2, a full 100% of Edventure’s sales were PPE. Several weeks ago, however, Edventure began executing orders that involved non-PPE items, though there were often still certain PPE-related products, such as masks and hand sanitizer, in the mix of those orders too, said company President Ed Levy.

To generate non-PPE sales too, distributors need to get back to the basics, Levy maintained.

“Stay top of mind with clients by bringing value and communicating,” said Levy. “Call them and write them letters. If you see an article pertinent to their business, send it along with a note. There is nothing magical about our business. We have a lot of products that people simply continue to enjoy. That is what makes this such a great industry. The demand is built-in.”