News January 23, 2019

Distributor Sales Hit Record $24.7 Billion in 2018

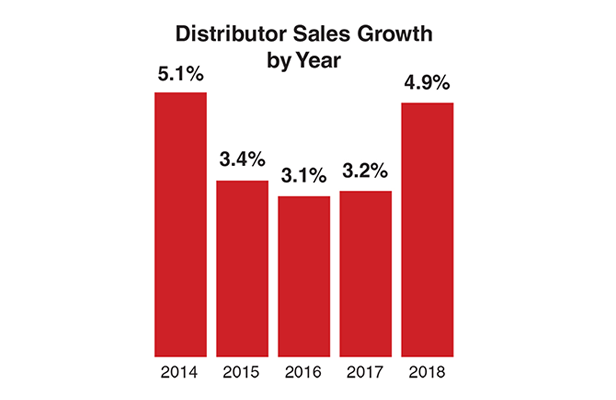

The annual revenue increase was 4.9% last year, considerably higher than in 2017.

North American promotional products distributors increased annual revenue in 2018 to $24.7 billion, a 4.9% rise over the prior year, according to new data from ASI. Marking the ninth consecutive year that a new record was set, 2018’s sales surge outpaced 2017’s growth, which was 3.2%. “There’s no question that 2018 was a very strong year for promo,” said Nathaniel Kucsma, ASI’s executive director of research and corporate marketing.

In all, nearly half of distributors (48%) increased revenue last year, while 30% held steady on sales. The industry’s bigger firms performed best overall: 70% of distributors with revenue of $1 million or more reported a 2018 year-over-year sales rise.

"There’s no question that 2018 was a very strong year for promo." — Nathaniel Kucsma, ASI’s executive director of research and corporate marketing

Consolidation within the promotional products sector has been a trend in recent years, with larger distributors gaining market share through organic growth and acquisition. Indeed, Top 40 firms like AIA Corporation reported an 11% gain (asi/109480) in 2018, while number-one-in-North-American-revenue distributor 4imprint’s (asi/197045) preliminary full-year sales results indicate an 18% rise. Additionally, Top 40 distributor PromoShop (asi/300446) told Counselor that topline revenue was up 14% in 2018, while fellow Top 40 firm Corporate Imaging Concepts (CIC; asi/168962) nearly doubled revenue to $83 million. A quarter of CIC’s gain came through organic growth and 75% through the 2018 acquisition of eCompanyStore, CEO Bob Herzog told Counselor.

“Unless there’s an economic slowdown, we expect the compression to continue,” PromoShop CEO Memo Kahan told Counselor. “Bigger companies will grow and smaller companies will struggle to keep up with client demands.”

Memo Kahan, PromoShop

While that remains to be seen, many smaller distributors held their own in 2018. About 4-in-10 firms with revenue of $250,000 or less recorded an annual increase, while 48% of distributors with sales between $250,001 and $1 million also made gains, ASI data shows. Some 14% of $1 million-plus firms, 27% of mid-sized companies and 22% of the industry’s smallest distributors reported a sales decline for 2018.

In the fourth quarter in particular, nearly 40% of distributors reported a sales increase over the prior year’s Q4. Conversely, about 20% recorded a decline and about 42% said their sales were steady. Approximately 55% of $1 million-plus distributors said quarterly sales were up, compared to 39% of distributors in the $250,001 to $1 million range, and 28% of distributors bringing in $250,000 or below.

Notably in the fourth quarter, however, the Counselor Confidence Index dipped as import tariffs, stock market instability, and growing worry about the domestic and global economies weighed on minds in addition to industry-specific concerns about both web-based and traditional competitors. “There appears to be concern in the market related to the impact that tariffs are going to have in 2019,” said Kucsma. “There’s also an increasing fear that the economy is slowing down and online competition is rising, so I’m definitely looking at 2019 more cautiously.”

Nonetheless, the Index, which gauges distributors’ financial health and optimism, still tallied a strong reading of 115 in the fourth quarter – just two points down from Q3’s 117, which was a record high. The 115 score was also spot-on Counselor’s rolling six-quarter average reading for the Index, while also being above Q4 2017’s reading of 114.

Kathy Finnerty Thomas, Stowebridge Promotion Group

Perhaps it’s not a surprise then to find that, despite concerns over tariffs and other potential economic headwinds, many distributors remain optimistic about their prospects in 2019. Distributors consistently used words like “hopeful,” “optimistic,” “better,” and “growth” to relate a sum-up of their outlook for the year, according to ASI research. “We’re anticipating a bright new year of growth with a cautious eye to changing trade agreements,” Kathy Finnerty Thomas, president of Stowebridge Promotion Group (asi/337500), told Counselor. “We have additional capabilities driven by our customers’ needs that we’re excited about. These will give us more control over our sales and production.”

Others are upbeat, too. AIA, for instance, believes a nearly 8% topline revenue increase to $210 million is within reach. CIC feels that 12% organic growth is in the cards – with potential additional gains coming from a possible acquisition that would put the Illinois-based distributor’s revenue above $100 million, Herzog told Counselor. PromoShop anticipates another annual revenue rise in the neighborhood of 14%. “The only thing that can stop us is a global recession, but we’re looking forward to beating our projections,” Kahan said.

On the whole, Herzog and other executives believe the promo industry is in line for a strong 2019. “The economy is stronger than the news media is reporting,” Herzog said. “Employment is so tight that companies will spend more on swag to keep employees happy. I expect industry-wide distributor sales to increase between 3% and 5% this year.”