News August 20, 2021

Apparel Decorators Contend With Ink Shortages and More

There are challenges related to other decorating materials and equipment too – a consequence of the supply chain disruption that’s been plaguing the promo industry.

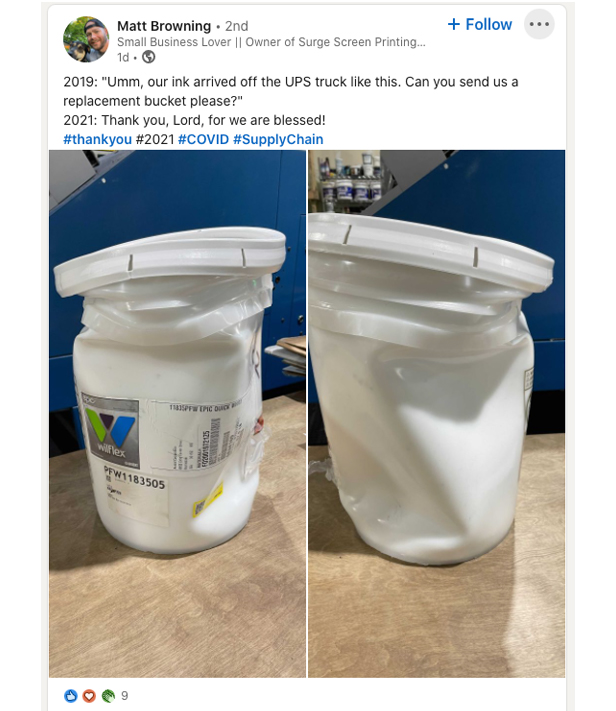

The LinkedIn post spoke a thousand words.

In it, apparel decorating entrepreneur Matt Browning showed pictures of containers of screen-printing ink that had been damaged in delivery.

The caption read: “2019: Umm, our ink arrived off the UPS truck like this. Can you send us a replacement bucket please?” 2021: Thank you, Lord, for we are blessed!”

The change in reaction was down to the owner of Kentucky-based Surge Screen Printing & Embroidery simply being thankful to have received the ink. Why the burst of gratefulness? Because apparel decoration supplies like screen-printing inks and heat-transfer materials are increasingly difficult to obtain and stock to what decorators would consider normal quantities.

“The fundamental problem is there isn’t enough to go around, and when it runs out, you’re looking at longer replenishment times given delays with shipping and delivery,” says Andy Shuman, general manager at Topton, PA-based contract decorator Rockland Embroidery (asi/734150). “When there’s stock, there’s a mad rush for it.”

‘A Precious Commodity’

Unfortunately, the same COVID-caused global supply chain upheaval that has led to inventory shortages, rising prices and longer production/delivery times relative to apparel and hard goods in promo is causing the squeeze on apparel decorating materials. Those materials are essential to the promotional products industry, as they’re used to create the logos, graphics and messaging that adorn blank garments, accessories and other items.

Got 1 minute? Then you can get the basics on what's causing inventory shortfalls & rising prices in the #promoproducts industry with this vid. More depth? Read: https://t.co/rTZceaX0dP @Melissa_ASI @Tim_Andrews_ASI @ASI_MBell @asicentral pic.twitter.com/N7aT0U7TY5

— Chris Ruvo (@ChrisR_ASI) June 8, 2021

“Ink, both traditional screen-printing and digital ink, has become a precious commodity,” says Ryan Moor, a member of Counselor’s Power 50 list of promo’s most influential people and the CEO/founder of Ryonet (asi/528500), a leading provider of screen-printing supplies and equipment.

Moor adds: “Some of the raw materials used in manufacturing both plastisol and water-based inks have been greatly constrained. Additionally, massive shipping delays in ports for raw materials or finished product coming from Europe or Asia has compounded the problem. Even digital ink from a cartridge and raw material perspective has been affected.”

GroupeSTAHL is feeling the pinch, too. The Michigan-headquartered company is a major manufacturer within the heat-printing market. Its Stahls’ (asi/88984), Stahls’ Transfer Express and Stahls’ Hotronix divisions are “experiencing delays, limited supplies and materials rationing,” says CEO Carleen Gray, a member of Counselor’s Power 50. “We thought the issues would level off, but they haven’t yet – they’ve actually accelerated and spread.”

“All vinyl, including apparel vinyl, has been in and out of stock,” notes Howard Potter, CEO of Utica, NY-based apparel decorator A&P Master Images (asi/102019).

Decorators report the issues haven’t been pronounced on embroidery supplies, which include needles, threads, backings and toppings. “Barely any embroidery supplies have been out,” says Potter.

While embroidery products appear to be generally more available, it can take longer to get them than usual – as is the case with inks – given the general delays in transporting goods that’s resulted from lack of sufficient shipping capacity.

“It’s taking a little longer than usual to get everything,” says Ira Neaman, a Power 50 member and president of Top 40 supplier Vantage Apparel (asi/93390), which boasts a massive in-house decorating operation.

Rationing

Further up the supply chain, producers are placing ink/materials vendors on “force majeure” – a legal technicality that allows them to break contract commitments they’d made to provide certain levels of product due to unforeseen circumstances.

Relatedly, ink sellers are, in some cases, only allowing apparel decorating shops to buy a limited amount of ink.

“Ink, both traditional screen-printing and digital ink, has become a precious commodity.” Ryan Moor, Ryonet

For instance, a major ink manufacturer/provider recently told screen-printer customers that, going forward, they can each month only buy up to 75% of what their business’ average monthly spend was between January and July of 2021 on certain popular inks.

Printers who hadn’t purchased the inks in question in 2021 wouldn’t be allowed to do so until further notice, according to the terms of the allotment. The manufacturer relayed that the rationing is necessary as its source has limited how much of the inks it can deliver due to supply chain constraints.

“Basically, raw materials suppliers have been impeded from meeting obligations, creating a ripple effect down the line to us and unfortunately, at times, to our customers,” says Gray.

Coping & Planning

Clearly, a doomsday scenario for apparel decorators would be running dry on ink or other essential materials amid a rise in demand and dearth of supply. Decorators ASI Media spoke with don’t think it will get that bad, but some like Shuman believe there could be times when certain inks won’t be available and that end-buyers could have to consider compromising on colors desired for graphics.

“We’re well-stocked and I don’t foresee us running out of ink, but will we or our competitors always have the precise right ink when it’s needed for the foreseeable future? That’s a question,” Shuman says.

“It’s just another broken link in the supply chain.” Andy Shuman, Rockland Embroidery

Even so, proactive decorators are trying to get out in front of such roadblocks. One tactic has been expanding the network of vendors from which they source, though admittedly that comes with additional challenges like ensuring ink quality from a new source is up to snuff.

“We’re relentlessly looking for solutions to meet the needs of our customers,” says Gray. “This includes constant contact with vendors, long-term forecasts, blanket ordering and looking for multiple vendors, though all vendors are experiencing issues.”

Some, like Potter, have been stocking up on materials further in advance. “We’ve been doubling up buying our supplies to have extra stock ahead of time,” says Potter. “We knew about certain supplies running low before others so we could get a jump on ordering.”

Another practical strategy is meticulous conservation of ink.

“No drop goes unused,” says Shuman. “We’re recycling ink even more stringently than we already were. Every little bit helps.”

Decorators are also trying to make customers aware of the materials shortages, whether those customers are end-buyers or promo distributors.

“Right now, we’re explaining that just like the supply chain disruption has caused problems with inventory, it’s also causing problems with inks and we’re doing our best to navigate that,” says Shuman. “It’s just another broken link in the supply chain.”

Equipment & Product Challenges

Sadly, the pain isn’t just being felt on decorating materials. Influenced by labor shortages and other reasons, apparel decorating equipment is taking longer to produce, and becoming more expensive to make given increasing raw material costs.

“Equipment manufacturers’ lead times have multiplied by three to six times, with some over six months out,” says Moor. “This makes it hard to expand for an (apparel decorating) business that is growing.”

And indeed, many in the apparel decorating game are growing amid an economic rebound in the U.S. that helped propel promotional products distributors to average 27.3% year-over-year growth in the second quarter of 2021.

Going up! #Promproducts distributors' quarterly sales increased year over year for the 1st time since 2019 in Q2. Distributors are the most confident they've been since before #pandemic. https://t.co/JN1mZ5T9CS @Tim_Andrews_ASI @ASI_MBell @asicentral @Melissa_ASI

— Chris Ruvo (@ChrisR_ASI) August 9, 2021

Shuman reports that demand at Rockland has been off the charts, fueled by the reopening of society, return of events and other factors that have boomed business for promo distributors, sending them flocking to the contract decorator. Similarly, GroupeSTAHL has seen demand for customization products and services accelerate 30% and more above previous levels.

While the business is welcomed, the rampant need for materials and equipment to fulfill customer requests places further stress on the supply chain, stretching resources and contributing to inadequate levels.

As decorators deal with such challenges on materials and equipment, they’re also shouldering the business-hampering burdens that come with industry-wide stock shortages on apparel.

“It’s been difficult to get certain items, and when stock runs out in a specific size or color, you can’t really find out when it will be available,” says Tim Guza, founder of Los Angeles-based screen printer Sunday Print Company.

Guza continues: “There was a week where there were no black XL T-shirts available, by any brand, through any vendor. Also, if a client hits you with a last-minute request, you can’t really guarantee that you’ll be able to get their shirts in stock in time to print them.”

A Quick Return to Normal? Not Likely

While decorators are coping, they’re keen for a return to normalization that allows for supply to meet demand in an efficient fashion. Unfortunately, most don’t see that happening in the short term.

“Due to shipping issues and the inevitable hoarding that accompanies shortages, the problems will get worse on the whole before they get better,” says Rick Roth, president and founder of Rhode Island-based apparel decorator Mirror Image.

Like Roth, others are concerned that decorators could potentially exacerbate the supply-and-demand problems by overcompensating on stocking up. “There’s a natural fear of running out so people are overbuying based on that fear, which in itself creates shortages,” Neaman says.

Meanwhile, Gray believes the issues will continue into 2022 and could deteriorate further before improvement begins. “The delta variant, possible shutdowns abroad, rising demand for our products, depleted inventory levels throughout the industry and continued stress on the supply chain are ongoing problems,” the GroupeSTAHL CEO says. “We are thankful for the understanding and patience of many in the industry.”