News April 15, 2022

Two Years Later: An ESP Retrospective

A data-driven look at the wild last two years of product trends. Plus, the top 10 ESP searches from March.

Traditional promotional product categories once again reigned in the top 10 ESP searches for March 2022, indicating a welcome return to normalcy in end-buyer demand.

Now, two years after COVID upended our industry and society, ASI Media offers this promotional products retrospective that looks back at the roller-coaster ride of the past 24 months, told through ASI’s data and the recollections of the distributors and suppliers who weathered the storm. We also have a look at product trends from March’s ESP data, including a jump in demand for warm-weather favorites and the swift decline in PPE searches.

Highest Highs, Lowest Lows

The promo industry was riding high in early 2020. ASI data backs it up: average daily ESP searches in February 2020 were 5% higher than the previous August (when traffic begins to spike ahead of the busy Q4 selling season).

This video shows trends in the top 10 most-searched terms in ESP from January 2020 through March 2022, including skyrocketing demand for hand sanitizer starting in early March 2020, a portend of the major shift that was to come.

The beginning of 2020 was shaping up to be “excellent” for Top 40 distributor Nadel (asi/279600), based in Los Angeles. “We were on the way to an amazing year,” says President Craig Nadel. “It would have been a record for sure.”

It was full steam ahead at Top 40 supplier SnugZ USA (asi/88060) as well. Chief Revenue Officer Brittany David says 2019 was the West Jordan, UT-based company’s best year on record, and January and February 2020 were the firm’s biggest-ever sales months. “We were planning for growth,” says David. “We were on fire.”

And then COVID changed everything; it was “a punch in the gut,” says David. What started as murmurs overseas in the early part of the year hit the promo industry full-force in mid-March, causing the first quarterly decline in more than 10 years.

28%

The percentage that average daily searches in ESP fell during March 2020.

Average ESP daily searches in March fell by 28%. The following month, they dropped another 23%.

In the promo industry, sales had fallen a historic 44.4% year over year by the end of Q2 2020. That was followed by a 24.8% decrease in Q3. Nadel says company sales were off 50% between mid-March and August of 2020, when things improved slightly. That trend repeated itself a year later, in 2021.

A Mad Scramble

Meanwhile, from early March to early April 2020, “sanitizer” dominated ESP search terms, becoming the single most searched-for item in one month in ESP history. For SnugZ USA, it was a wild ride.

“We lovingly call that period of time ‘sanigate,’” David says. “It was pure insanity. Everyone wanted sanitizer. We make it, and we had it. April 2020 was actually decent for us because of the sanitizer and other PPE.”

762%

Increase in ESP searches for hand sanitizer from February to March 2020.

Traditional promo was on hold for most of the year as everything turned toward sourcing and selling PPE as quickly as possible. “We were one of the first companies to pivot to PPE in March 2020,” says Trevor Gnesin, CEO of Tustin, CA-based Top 40 supplier Logomark (asi/67866). “Because of our quick adaptability to changes, we were fortunate to have a good year in 2020 and we’re proud that we could retain our staff and continue servicing customers.”

In the first few weeks after the initial shock, Top 40 supplier Gemline (asi/56070) turned to its SARS preparedness plan from about 20 years ago. “We dusted it off, and established a Standard of Care advisory panel for the PPE we were sourcing, much of it donated to healthcare facilities,” says CEO Jonathan Isaacson. “March and April were terrible, but May was crazy busy. We added health items like soap and sanitizer to our offerings, we added to the food business, and we offered more drop-ship and fulfillment services. The business exploded, and it wasn’t just PPE. We’ve had record months since May 2020.”

It wouldn’t be until the fall of 2020 that traditional promo made a solid return to the ESP top 10 search term list, which had been dominated for about five months by masks and sanitizer. ESP search frequency continued to gradually increase from its April 2020 low, and has been on a general trend upwards ever since (aside from normal seasonal drops in December). Still, average daily searches in October and November 2020 lagged year over year by roughly 25%-30%.

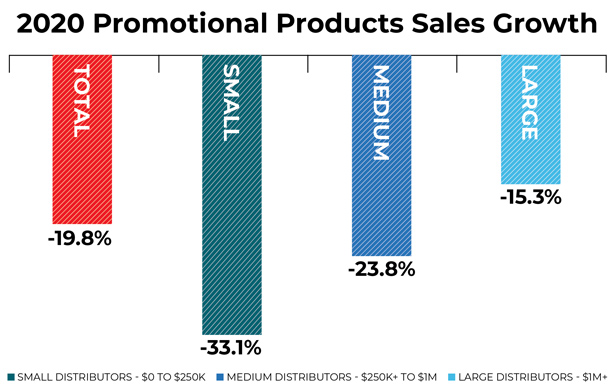

Based on ASI market research data, small distributors (those with up to $250K in annual revenue) fared the worst in 2020.

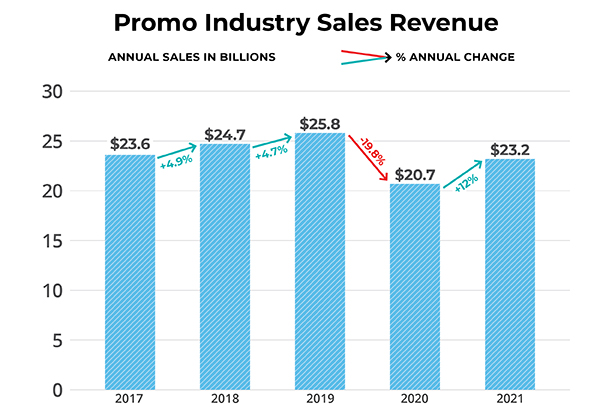

Quite simply, the damage had been done. Industry sales numbers in 2020 fell 20%, a percentage that would have been much larger if not for PPE sales.

A New Problem

With vaccines on the horizon and clients of all types poised to bounce back, there was hope that 2021 would bring a “V-shaped” recovery that would have the industry partying like it was 2019. Alas, the reality was more complicated. COVID variants rose and fell throughout the year, and events came back very slowly. A plethora of residual effects from the pandemic impacted the economy – supply chain delays, staff shortages and rapidly diminishing stock.

Some companies took a proactive approach to avoid the brunt of the sourcing woes. “We took a calculated risk in October 2020 and loaded up on our regular inventory,” says Gnesin. “We doubled our usual spend, so we received inventory before the container prices and delays took effect.” A lot of companies, however, were paying significantly more and waiting much longer for goods – problems that cascaded down to distributors and clients.

Industry sales declined nearly 15% in Q1 of 2021 compared to the same quarter a year before – a concession to the fact that January and February of 2019 were strong sales months before everything crumbled. Lack of events and lingering uncertainty didn’t help.

“The first quarter wasn’t great,” says David. “Events didn’t come booming back, so neither did lanyards and some of our core business.”

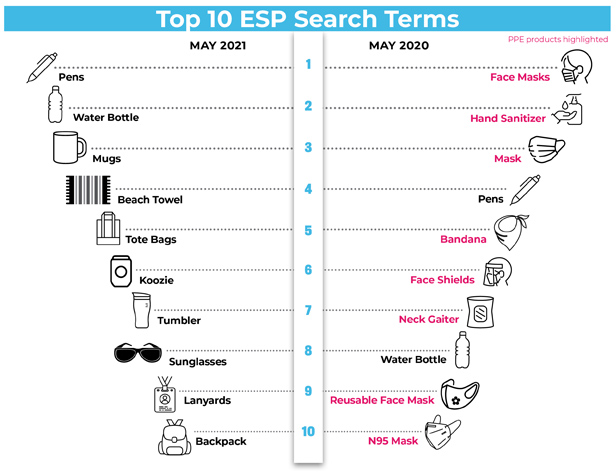

But as the year continued, traditional promo made huge in-roads into the top 10. PPE searches gradually fell away in the spring and by May 2021 had even disappeared out of the top 10.

It took over a full year from the start of the pandemic for PPE to fall out of the top 10 ESP searches.

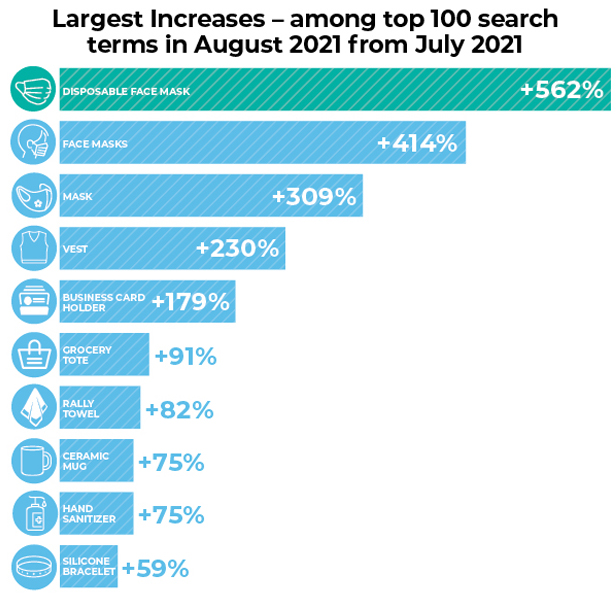

That continued until late summer, when PPE appeared back in the top 10 as the delta variant swept the world. It had been three months without PPE in the top 10. In August 2021, searches for masks of all types jumped anywhere from 300%-500% compared to the previous month.

Once the delta variant hit last summer, mask searches took off again.

Meanwhile, the promo industry did its utmost to continue moving forward. ESP searches reflect increased activity. Average daily searches in April 2021, for example, increased 35% compared to the low point of April 2020. By August and September, average daily searches were only 13% down compared to 2019.

“It was definitely a rebound year,” says Mitch Freed, CEO of Genumark (asi/204588) in Toronto. “Certainly it was nowhere near 2019 figures, but it was well above 2020. Customers were cautiously optimistic, though. Life in Canada didn’t go back to normal. Our salesforce spent a ton of time and energy working with our customers to focus on culture rather than event initiatives, and that worked out really well for us.”

Despite the ongoing uncertainty surrounding variants and a myriad of supply chain issues, distributors increased their sales by 18.4% in Q3 in 2021, compared to the same quarter in 2020. By the end of 2021, sales had increased to $23.2 billion, a 12% year-over-year increase.

Distributor sales in 2021 hit $23.2 billion – an improvement on 2020 and just below the record $25.8 billion achieved in 2019.

“Fall of 2021 was amazing,” notes Nadel. “We just ended our fiscal year about two weeks ago, and we’re ahead of year-end March 2020 by high single digits.” November and December of 2021 were the best in SnugZ USA’s history, says David, who adds the company is on track to beat those numbers in Q4 2022.

The year couldn’t finish without one more complication: the fast-moving omicron variant, which caused ‘KN95’ to move quickly into the top 10 ESP search terms in January; one month later, however, KN95s had dropped from the top 10.

Where Things Stand

Now, at the end of Q1 2022, traditional promo has a stranglehold on the March top 10. Pens lead the ESP searches for the 16th consecutive month. “Water bottle,” “tote bags,” “mugs” and “lanyards” round out the top five.

There’s no PPE in the top 10 of last month’s search results. Compare that to March 2021, where “face masks” and “masks” appeared in the top 10. Meanwhile, March 2020 had three different types of sanitizer searches in the top 10, as well as searches for “N95 mask” and “face mask.”

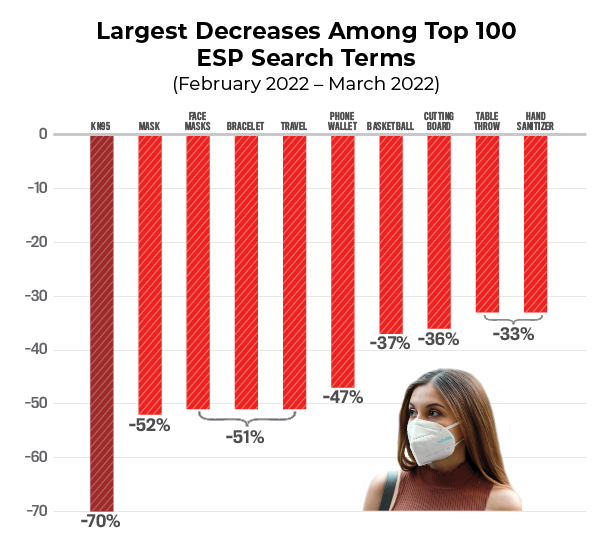

Signaling a large-scale move away from PPE two years after demand skyrocketed, search term frequency for “KN95” fell 70% between February and March, followed by “mask” (52%), and “face masks.” In addition, “travel” declined 51%, perhaps indicating new travel hesitancy following Russia’s invasion of Ukraine in late February, as well as surging airfare prices and the risk of canceled flights.

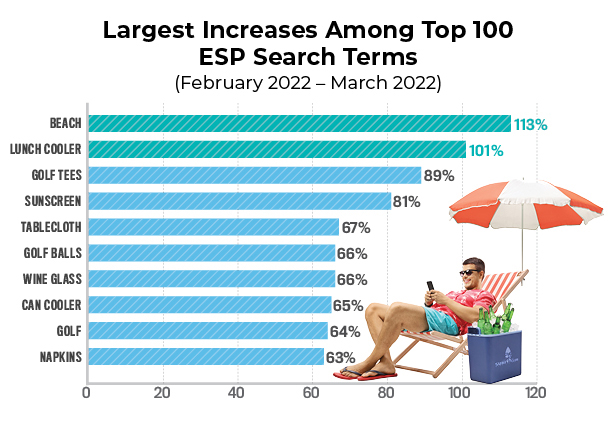

Seasonal changes influenced the greatest month-to-month shift from February to March 2022. Among the largest increases were “beach” (113%); “lunch cooler” (101%) as people return to communal offices; “golf tees” (89%) ahead of spring/summer tournaments and outings; and “sunscreen” (81%).

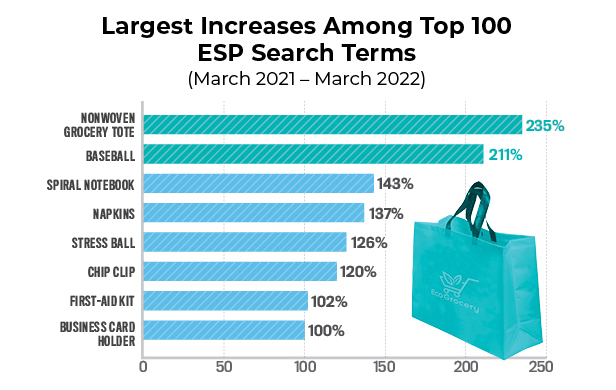

Compared to a year ago, the ESP search terms with the highest increase in frequency include “nonwoven grocery tote” at 235% and “baseball” at 211% – reflecting, a year later, a bigger push for in-person shopping as well as the return of baseball leagues with fans in the stands.

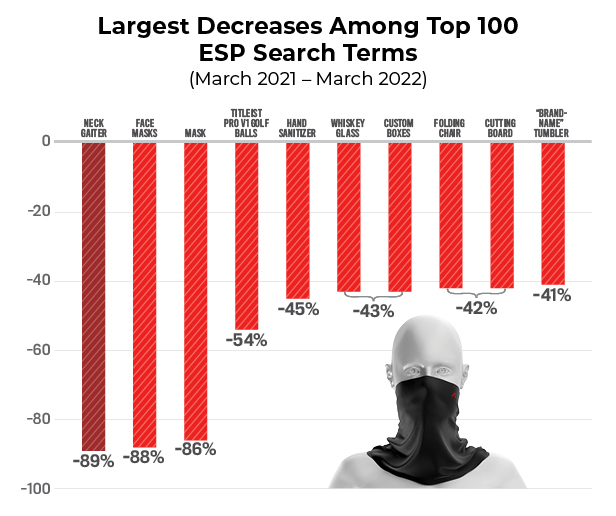

The largest decreases between March 2021 and March 2022 are mostly PPE: year-to-year demand for “neck gaiter” fell 89%, while “face masks” fell 88%, “mask” 86% and “hand sanitizer” 45%.

The industry appears to be recovering well after the pandemic. Average daily ESP searches in March were up nearly 25% compared to January. The March searches were the highest total since February of 2020.

Still, other economic pressures – particularly inflation – have companies worried about timing for a full recovery.

“We had a strong first quarter due to spillover from Q4 2021 when companies weren’t able to get merchandise and deliveries,” says Gnesin. “The war in Ukraine and the recent COVID outbreak in China will have a negative effect on the supply chain, but inflation is a bigger long-term concern that will affect consumer spending.”

On April 12, the U.S. Labor Department reported that inflation in March surged 8.5% compared to a year prior; that’s the highest it’s been since 1981, and, when critical goods like food, energy and shelter all cost more, it affects end-buyers’ ability to purchase promo.

So far, SnugZ USA is having a healthy year, though David says she’s wary of the impact that rising costs across the board will have on the industry in the coming months.

“January and February still weren’t quite as strong as 2019, but March was incredible and April is shaping up to be great as well,” she says. “I’m cautiously optimistic that we’re starting to gain some real momentum instead of just riding highs and lows.”