News July 11, 2024

Interest Rate Cut Likelihood Grows; Don’t Expect Retreat to Low Levels

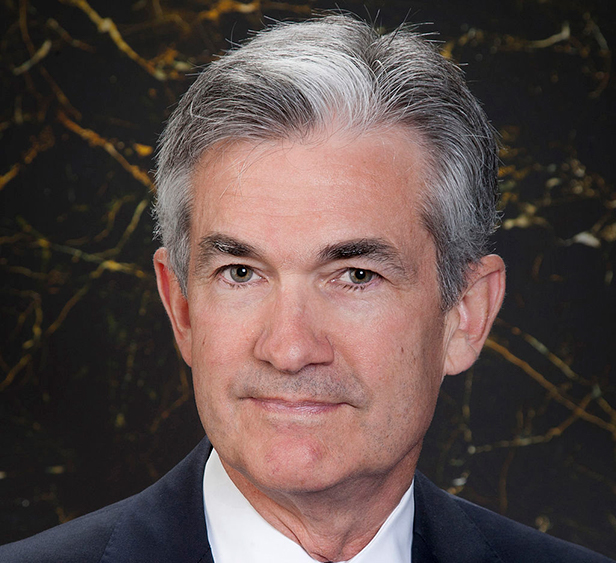

Inflation data and insight this week from Jerome Powell have some experts saying the Federal Reserve may soon reduce interest rates from their current 23-year high.

New encouraging data on inflation and comments from Federal Reserve Chairman Jerome Powell suggest the nation’s central bank could be moving toward lowering benchmark interest rates, but don’t expect the rates to return to the super-low levels experienced from the Great Recession of 2008 into the COVID-19 pandemic.

Those are some key takeaways from Powell’s two-day testimony before the Senate Banking Committee this week and the latest figures from the Consumer Price Index (CPI), which the U.S. Bureau of Labor Statistics released Thursday, July 11.

Jerome Powell, Federal Reserve

What happens with federal interest rates matters to the promotional products industry, as they can impact everything from end-client willingness to buy merch and a promo company’s capacity to invest in its business, to merger and acquisition activity in the market, executives have told ASI Media.

On Thursday, the CPI, a broad measure of inflation that tracks what Americans pay for goods and services, declined 0.1% in June compared to May – the first time a month-over-month decrease was recorded in about four years.

Meanwhile, the CPI was up 3% from a year ago – the lowest annual increase since June 2023, according to reports. Core CPI, which excludes volatile food and energy prices, was up 3.3% annually in June 2024 – the smallest 12-month increase since April 2021, according to the Bureau of Labor Statistics.

“The latest inflation numbers put us firmly on the path for a September Fed rate cut,” said Seema Shah, chief global strategist at Principal Asset Management. “The smallest gain in core CPI since 2021 surely gives the Fed confidence that Q1’s hot CPI readings were a bump in the road and builds momentum for multiple rate cuts this year.”

Labor Market Developments Bolster Case for Rate Reduction

The Fed’s current benchmark short-term borrowing rate of 5.25% to 5.5% is at a 23-year high. The rate establishes what banks charge each other for overnight lending and affects borrowing/interest rates throughout the economy.

The higher interest rate policy is intended, in large part, to slow the runaway inflation that started during the pandemic, bringing it back to a target of 2% annual acceleration. Beyond evaluating inflation numbers themselves, the Federal Reserve has studied monthly employment data in the U.S. to determine when might be appropriate to lower rates.

What Powell has described as an “overheated” labor market over the last couple of years has contributed to inflation. But on Tuesday, Powell testified before the Senate Banking Committee that the U.S. job market is approximate now to what it was before COVID – “strong, but not overheated.” That characterization marks a “subtle but important shift that moved the central bank closer to lowering interest rates,” The Wall Street Journal reported.

“Elevated inflation is not the only risk we face,” Powell said. “We’ve seen that the labor market has cooled really significantly across so many measures. … It’s not a source of broad inflationary pressures for the economy now.”

The Fed last week indicated that it’s eyeing only one interest rate cut this year, down from three. What does that mean for the #promoproducts industry? Some industry leaders weigh in.https://t.co/LRK6SeArCJ

— Chris Ruvo (@ChrisR_ASI) June 19, 2024

While the U.S. has continued to add more than 200,000 jobs on average per month this year, the unemployment rate rose to 4.1% in June – tied for the highest level since October 2021. And, the number of jobs added last month was down about 12,000 positions from May to 206,000.

The positive CPI inflation numbers and the moderating labor market situation, combined with the fact that another Fed-preferred gauge of inflation rose at an annual rate of 2.6% in May, near the target range of 2% and the most recent month for which a number was available on that gauge as of this writing, all suggest an interest rate cut may soon be in the cards.

Analysts said that, as of today, it’s unlikely that rate will come at the Fed’s next meeting at the end of July. The Fed doesn’t meet in August, but a rate cut could be in the cards for September, as Shah and others indicated. While there’s uncertainty on timing, what does appear clear is that rates are unlikely to retreat to the near-zero levels seen between 2008 and 2017 anytime soon, according to Powell and some economists.

An initial rate cut would likely be a quarter percentage point, and even if the Fed continues with cuts as anticipated in 2025, interest rates would likely not ultimately recede to levels seen in pre-pandemic times, Powell said.

“We probably won’t go back to that era between the global financial crisis and the pandemic where rates were very, very low and inflation was very low,” Powell said, as reported by The Hill. “I don’t think we’re going back to rates that are that low.”

Factors like pandemic-era inflation and then price renormalization mean that the baseline interest rate for striking a balance between low unemployment and price stability has increased.

“We have our policy rate over 5% now, and it feels like policy is restrictive but not intensely restrictive,” Powell said. “That suggests that the neutral rate of interest, at least as of now, will have risen somewhat, which means rates will get a little higher.”