Awards September 04, 2019

Promo Market Watch: Pharmaceutical

It’s been a decade since pharma promo sales were turned upside down, but distributors are still finding success with creative and educational promotions.

Ten years ago, pens, mugs and notepads touting the benefits of Lipitor, Celebrex and other drugs were blacklisted in one fell swoop. The ban on these gifts to healthcare providers sent shockwaves through the promo products industry as suppliers and distributors that were heavily invested in pharma lost millions of dollars in a heartbeat. Some even went belly up.

For many, the story ends there. But not all pharma-related promotional products were banned, and some distributors – through out-of-the-box thinking and, in some cases, a lane shift – were able to weather the storm. Though distributors say the market’s heyday will never return, they also agree that the pharma industry remains viable with the right approach.

“It was obviously a big game changer,” says John Delaney, president and CEO of Genuity Concepts (asi/199861), a distributor based in Greensboro, NC. He’s referring to New Year’s Day 2009, when the Pharmaceutical Research and Manufacturers of America (PhRMA) enforced restrictions prohibiting drug and medical device manufacturers from gifting branded merchandise to doctors unless it was educational in nature and under $100. As late as 2006, according to Counselor State of the Industry data, pharma was the top market for promo products, accounting for more than 10% of overall industry revenue. By the end of 2009, pharma sales plummeted to 1.1%.

Top 40 supplier BIC Graphic (asi/40480) was hit especially hard by PhRMA’s tough new rules. “We lost about $12 million overnight,” recalls CMO Melissa Ralston. “Some of our top distributor customers serviced pharma companies who would place an order for one million pens to launch a new drug. That type of order volume from pharma was never replaced.”

Brand Fuel (asi/145025) felt a similar pinch. “The guidelines wiped out approximately 8% of our business,” according to Co-President Danny Rosin, whose company is based in Morrisville, NC, and Norfolk, VA. “Adding insult to injury, this was on the heels of the economic meltdown.”

After catching its collective breath and not knowing which way to turn for a while, Stran Promotional Solutions (asi/337725), a distributor based in Quincy, MA, started looking for similar alternatives within the pharmaceutical industry, eventually landing a client that sells to veterinarians. “Vets like surprise and delight,” says Howie Turkenkopf, the firm’s director of marketing. “You can send them as many pens as you want.”

For Delaney, whose business at the time was focused almost exclusively on pharma, 2009 was a wakeup call to take stock and plow ahead. “As distributors, our job is to add value. The new codes forced us to transition to a different type of project or sale, essentially,” he says. “We had to move away from pens and mugs in favor of educational items, while still demonstrating a comprehensive understanding of the client, giving us an advantage to move toward where we can add value.”

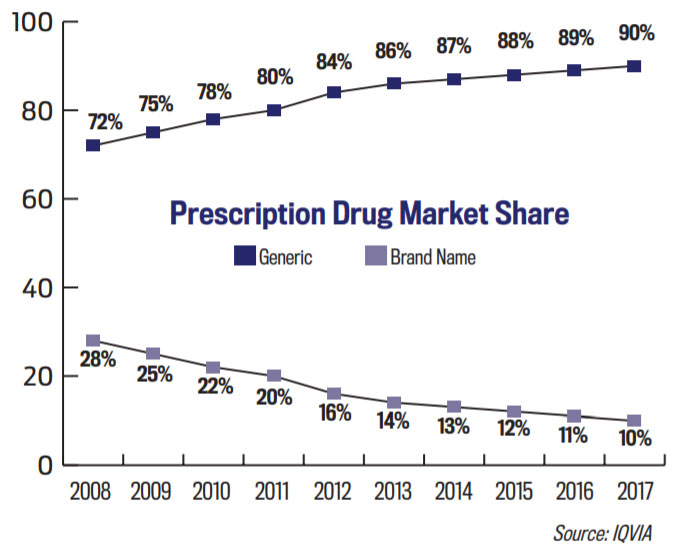

Statistically Speaking: The market share of generic prescription drugs has increased steadily in the past decade, heightening the need for pharmaceutical companies to market their brand-name drugs.

With that mindset, Delaney launched a host of PhRMA-compliant products that are inexpensive and strictly for educational purposes. Among them, anatomical and interactive medical education models, pedometers and fitness bands, locked content memory devices and brochure dispensers. He even figured out a way to continue selling branded pens by cleverly pairing them with patient dosing journals. “The restrictions turned out to be a good thing for us,” says Delaney. “We like to think we took our talents to other places.”

It’s that kind of resiliency that demonstrates the continued viability of the pharma market after many gave up on it a decade ago. Even though it only makes up about 0.6% of industry revenue, that still translates to $148 million in sales – no insignificant sum.

Peter Will, president of UniversalPromo Inc. (asi/92977), a Maple Grove, MN, supplier, maintains the PhRMA move worked in his company’s favor too. “We were already selling products, like pill boxes and dosing spoons, with the end-user in mind as opposed to the doctor,” he says. “We just let it be known that we were PhRMA-code compliant, and distributors that sold pens turned to us for alternatives to keep their existing customers.”

Some popular products just needed subtle tweaks. Stran had a client that manufactured baby formula, so the distributor produced a cooler bag for delivering product samples and informational pieces to new mothers in the hospital. “The bag may have only subtle branding or no logo at all in order to be PhRMA compliant,” says Turkenkopf, “but it’s designed for the end-user and falls within the guidelines due to the materials inside.”

On the flipside, Brand Fuel regained traction by setting its sights solely on “internal branding for our pharma clients where there remains a hearty need for employee engagement and recognition,” explains Rosin. The distributor secures Bluetooth speakers, jackets, polos, T-shirts, lanyards, pens and awards for employee events, like family days, walkathons and recognition ceremonies. Stainless-steel tumblers are popular holiday gifts, and flashlight keytags that double as factory whistles are purchased for safety campaigns.

The Need Remains

Why does promo still have a place in pharma? Because even as the number of prescriptions filled for Americans increased 85% between 1997 and 2016, the vast majority of prescriptions (90%) are for generic drugs, compared to 50% in 2005, according to health research firm IQVIA. High costs of brand-name prescription drugs and the falling costs of generics have the biggest players in the pharma industry fighting tooth and nail for market share.

According to the Journal of the American Medical Association, annual spending on pharmaceutical marketing since 1997 has increased from $18 billion to $30 billion, with about 68% ($20 billion) of that money used to “educate” healthcare providers on the benefits of their products.

In addition, drug makers are becoming more concerned with controlled dosing. “Naturally, they want patients to finish their course of prescribed medications, and a pill organizer is one very visible and tangible way of getting them to do that,” says Will. “We can put the company’s name on the box because it’s under $100 and seen as a medically functional item.”

Despite the difficulties of the past decade, distributors that have had success in this market are still optimistic about the future of promo sales to the pharmaceutical industry. “If you listen to the customer and find out how they want to develop their own individual marketing aids to drive their patient compliance and education component, then there’s still a market for you,” says Delaney.

Turkenkopf agrees: “This is still a very viable vertical, but it takes an understanding of where the limits are, and it takes being creative within the structures everyone has to play by.”

Product Picks

Custom prescription form holder from Genuity Concepts (asi/199861); genuityconcepts.com

Liquid medicine spoon dispenser (1000) from UniversalPromo Inc. (asi/92977); uplineideas.com