Awards September 25, 2017

Advertisers Down on Digital

As large advertisers scale back on online marketing, promo product distributors may find new opportunities to sell.

In one move, Procter & Gamble Co. stunned the ad world.

The personal and household care juggernaut – the world’s largest advertiser – slashed more than $100 million in digital marketing spend in the April–June quarter this year, a decision company officials say had little effect on its business. Despite a slump in consumer spending, P&G’s net sales reached $16.1 billion for the quarter, holding steady from the same time period in 2016. “We didn’t see a reduction in the growth rate,” finance chief Jon Moeller told listeners during the company’s earnings call. “What that tells me is that the spending we cut was largely ineffective.”

The digital spending reduction has been part of P&G’s recent push for operational efficiency, analyzing the success of marketing and manufacturing strategies such as ad campaigns and product development programs to determine where funding should be stopped. In 2016, the company determined that ultra-niche targeting has limited effectiveness, and subsequently eliminated Facebook ads tailored to specific consumers.

Trian Fund Management LP denounced P&G’s decision to reduce digital advertising, claiming it’s “a tactic we believe will damage the value of the company’s brands if continued in the long term,” the firm told The Wall Street Journal.

P&G – whose brands include Bounty, Crest, Tide and Pampers – spent $2.45 billion on U.S. advertising last year, excluding spending on some digital platforms, according to Kantar Media. Needless to say, when P&G acts, other companies pay attention.

Along with P&G, Unilever – the second biggest global advertiser and fellow personal care giant – also cut digital ad spending this year. The company reduced spending by 57% on 155 websites it advertises on year-over-year, and trimmed overall website ads by 11%. “We need to make sure the digital supply chain is less murky,” Unilever CMO Keith Weed told an audience at Cannes Lions, one of advertising’s largest gatherings every June.

Other major players like JPMorgan Chase have reduced their digital ad spending as well. In March, chief marketing officer Kristin Lemkau told The New York Times that the bank had slashed its online ad offerings to just 5,000 pre-approved websites, down from 400,000 websites previously available through automated services.

These sudden and pronounced moves have refueled the debate over whether digital ads are a worthwhile marketing investment. While some marketers argue that targeting the digital space is vital for brand awareness in the 21st century, others have criticized the inherent inability to measure ROI, fearing that their ads never reach their intended audience. Google revealed a few years ago that 56% of internet ads are never seen by human beings; instead, those ads are viewed only by automated bots, which run up advertisers’ tabs without giving them the eyeballs they sought.

If P&G serves as a bellwether for the advertising industry, perhaps other corporations will follow suit by reducing their digital spend. It’s highly unlikely that all marketing budgets would eliminate funds for online ads; rather, it would be just another stage in the evolution of digital advertising – and possibly offer a new opening for promo product sales.

Digital Timeline

In 1994, the first digital ad appeared: HotWired, the former online off-shoot of Wired magazine, posted a banner ad that read: “Have you ever clicked your mouse right here? You will.” HotWired sold space to advertisers, charging an up-front cost to occupy for a set time period. AT&T paid HotWired $30,000 to maintain the space for three months; the ad had a click-through rate of 44% compared to today’s average click-through rate of 0.08%, according to FastCompany.

Many companies began following AT&T’s lead, but they wanted to reach a more relevant audience. WebConnect, an ad agency that specialized in online ads, helped their clients identify which websites their ideal consumers visited so they could post ads on those sites. WebConnect also introduced the CustomView tool, which replaced ads that users had already seen a number of times.

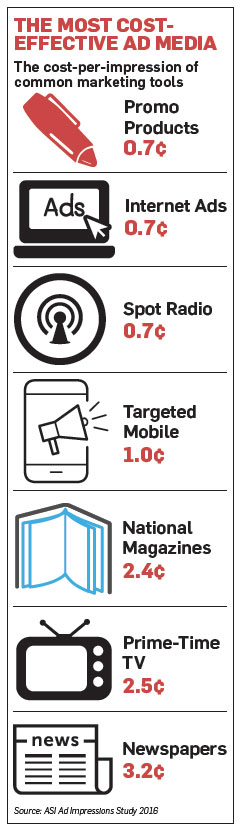

In order to gauge the success of the targeted ads, digital agency DoubleClick developed the Dynamic Advertising Reporting & Targeting service, which let companies track how many times an ad was viewed and clicked across multiple websites. This method spawned a new pricing model for digital ads: cost-per-impression (CPM), in which the advertiser pays a fee for every 1,000 views of the web page the ad is on.

In 1999, GoTo.com launched the first pay-for-placement search engine service, offering advertisers the chance to bid for top search engine results on particular keywords. The service wasn’t considered user-friendly, as search results showed the highest bids first rather than the most relevant content. Google stepped up to provide an alternative – AdWords – which took into account an ad’s click-through rate when determining its placement on the search results page.

Then social media entered the fray and changed everything. During the 2000s, Facebook, Twitter and other social networking platforms emerged on the scene, luring users away from other websites. Marketers needed to get in front of their potential customers again, so they refined their ads to be more personal and less intrusive. Initially resisting ads on its site, Facebook conceded for the benefit of increased profitability, offering small display ads and sponsored links before shifting to ads targeted to users’ demographics and interests.

As new media companies like BuzzFeed arrived at the dawn of this decade, marketers discovered another way to engage audiences: sponsored content. Advertisers pay websites to produce promotional content that resembles other content on the site, essentially blending in with the website’s style and supplementing the user experience.

Cybersecurity Risks

In addition to efficiency concerns, digital advertising faces privacy and safety issues. Online advertising fraud costs advertisers $8.2 billion per year, IAB reported. Basically, for every $3 spent, $1 goes toward ad fraud.

Last December, Russian hackers allegedly committed the biggest digital advertising fraud ever, receiving $5 million per day in stolen revenue, according to Forbes. The hackers created thousands of web domains to impersonate high-traffic sites, attracting advertising placements that were determined by online auctions. Then the hackers had bots “view” video advertising on the sites to inflate the length of time potential customers were exposed to the ads.

Businesses have accounted for 55% of data breaches this year, according to the Identity Theft Resource Center. One of those victims was Abby Clark, owner of Illinois-based Absolutely Creative Promotions (asi/102549). Her email and Square account – a mobile app for credit card transactions – was hacked during the summer. Clients that typically replied within an hour weren’t getting back to her for days. She called them and realized her emails weren’t being received, forcing her to take photos of proofs and then text them to clients.

“It didn’t make me look professional – it made me look vulnerable,” Clark says.

Cybersecurity fears have compelled politicians to speak up. In July 2016, U.S. senators Mark Warner and Chuck Schumer sent a letter to the Federal Trade Commission (FTC), urging an examination of fraudulent ads in online advertising. While the FTC focuses on protecting consumers, and ad fraud obviously impacts marketers, the Democratic senators argue that consumers will ultimately have to pay more for goods and services if the scamming isn’t stopped or reduced.

“Ad fraud is a major industry-wide problem,” says Jay Friedman, COO of Goodway Group, a managed-services programmatic partner to local, regional and Fortune 500 brand agencies. “It has evolved from single browsers bombarding bad websites with thousands of impressions from a data center to looking more like human traffic.”

Goodway Group has launched an anti-fraud initiative after reviewing its own invalid traffic and user anomalies. The company lowered its fraud level to less than 1% after eliminating exchanges with sketchy supply sources. “It’s messy and needs to be done to be effective,” Friedman says. “My advice is to be an expert at analyzing your raw data or work with a digital media partner who is.”

Advertisers are looking to alternative measures such as “walled gardens” like Facebook or media sites with paywalls, in which there is a direct relationship between the buyer and the seller. About 37% of advertisers say they are willing to pay a premium of 11% or more for certified human traffic, IAB reported.

Online advertising agencies understand they’ll be a victim to fraud and accept it as part of the process, says Monica Eaton-Cardone, co-founder of business management solutions firm Chargebacks911.

“We could get rid of all fraud if we had total transparency,” Eaton-Cardone says. “It’s that balance between how much privacy do we want and how much fraud are we willing to accept for that privacy.”

Ripe for the Picking

U.S. advertisers invested $17.6 billion in digital ads in the third quarter of 2016, a 20% increase over the same time period in 2015, IAB reported. Mobile ads comprised 47% of all digital advertising in the first half of 2016, compared to just 30% in the first half of 2015.

Although marketers are increasing their online investment, many are unsure whether it’s strengthening their bottom line. A recent study by IBM and the CMO Council found that 38% of marketers feel digital strategies have mixed results, with only 7% saying digital strategies exceeded their expectations.

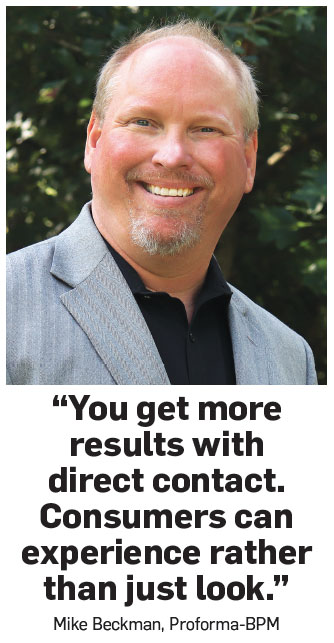

“People are overstimulated,” says Mike Beckman, head of Proforma-BPM (asi/300094) in Atlanta. “Everybody is always on their phone or online, and they’re being bombarded with information.”

With screens constantly glowing in consumers’ faces, it has become increasingly difficult for digital ads to stand out. That’s where promotional products step in, offering a tangible alternative to the smorgasbord of online text, audio and visuals.

In the past few months, Beckman has invested in direct-mail campaigns, sending flat products that fit in envelopes, like fidget spinners and eclipse glasses, to established clients and potential customers. Beckman says he’s gained thousands of new orders in the process. “You get more results with direct contact. Consumers can experience rather than just look,” Beckman says.

Social media marketing peaked in 2016, with 92% of retailers surveyed having invested in the strategy, according to a study by Shop.org and Forrester Research. Facebook is the most popular platform, with two-thirds of marketers investing in ads on the site. Other preferred platforms include YouTube (34%), Twitter (33%), LinkedIn (30%), Instagram (24%) and Google+ (22%).

Despite the record-high investment, many advertisers aren’t feeling any more confident in their spending. A recent study by the CMO Council found that 44% of marketing executives felt social media’s impact on sales was nonexistent or minimal. Only 10% felt social media contributed highly to the company’s bottom line.

“Although it’s good for spreading awareness, getting a like doesn’t usually translate into a sale,” says Steven Schneidman, owner of Canadian distributor Solutions Ink (asi/329824). People are sucked into the rabbit hole of social media, he says, and get distracted by endless posts, numbing their minds to the information in front of them. “It’s not even 15 minutes of fame anymore. Content is immediately forgotten,” Schneidman says.

Promotional products have the benefit of a lengthy shelf-life, especially if they’re useful. While customers may not be in the market for a service today, they’ll be reminded when the time comes because of a T-shirt or mug’s ever-present visibility. In the breakneck pace of the digital age, some advertisers still don’t have the patience for promotional products, preferring strategies that offer instant attention and engagement even if the numbers aren’t in their favor.

“But if they want to develop relationships with customers rather than settling for one-time sales, promo items are a worthwhile long-term investment,” Schneidman says.

By the Numbers

- Despite big brands investing elsewhere, U.S. digital advertising spending is still predicted to grow 15.9% in 2017 – the equivalent of $83 billion in revenue. (eMarketer)

- 92% of retailers invested in social media marketing in 2016. (Shop.org and Forrester Research)

- Online advertising fraud costs advertisers $8.2 billion per year. (IAB)

Email: jcorrigan@asicentral.com