Awards January 12, 2018

The Future of Cotton in the Promo Industry

Athleisure blends are on the rise, so what does that mean for the most popular fabric of all?

Go ahead and sing it out loud: “The touch, the feel of cotton, the fabric of our lives.”

We all know the jingle. Except lately, the uber-popular fabric isn’t quite getting the love it used to.

Slowly but steadily, cotton has been replaced by athleisure blends and performance materials. Younger generations want clothing options that effortlessly transition from work to play, all while being comfortable and multipurpose – and that means more polyester and blends. Morgan Stanley expects activewear sales to boom far into the future and reports show synthetic fibers are steadily eating up more of the global apparel market share than natural ones, which are staying stagnant.

Could the 100% cotton T-shirt, the stalwart of fashion that keeps us cool and comfortable and saves us from clingy fabrics that highlight our self-diagnosed unflattering body sections, fall from its throne? And will technology changes render cotton obsolete as smart fabrics start to rule? It depends who you ask.

King Cotton

Rest assured, suppliers across the promo products industry are emphatic that the basic cotton T-shirt will continue to have a strong following in the future. Ringspun cotton in particular is seeing a rise in popularity, according to Billie Staton, owner of Staton Corporate and Casual (asi/89380), with its slightly heavier weight but softer, more durable construction. Plus, she says, you can’t beat the forgiving fit, which makes it a large-quantity order powerhouse.

Jennifer Wilson, vice president of production at Charles River Apparel (asi/44620), agrees, noting that not only is the traditional tee still kicking in the background, but suppliers also “still see the need for cotton basic items like hoodies, pullovers and joggers.”

But the persistence of traditional cotton items comes with a caveat: if those tees aren’t already a cotton blend, they will be soon. Sure, the cotton will still be there in the garment, just less of it.

“Fashion buyers are drawn to tri-blends and athleisure-type materials,” Wilson says. “The interesting thing about this is, although they’re a different material make-up, they feel like cotton. For the fashion consumer, this is what a cotton T-shirt is. I think we’ll continue to see experimentation with cotton blends from all brands.”

PCNA’s Shoo Passey, the firm’s director of global product design and development for apparel, agrees that already the standard piece of cotton clothing has evolved into something that’s a blend and not 100% cotton. Still, she believes that change is almost undetectable to the average consumer.

“Blended yarns tend to lead for T-shirt fabrication, whether it’s CVC, CVS, or tri-blend,” she says. “The look and feel of cotton will continue, but the actual 100% cotton content isn’t the driver. One of the great things about polyester and synthetic blends is the ability to look and feel like cotton but have the technical and functional features we benefit from for durability and comfort.”

Passey also notes that cotton on its own is having a sort of technology renaissance. Advanced treatments to the textile are currently being explored but aren’t cost effective enough to hit mainstream apparel yet.

Andrea Routzahn, the vice president of the sourcing and design groups at alphabroder (asi/34063), sees the same trend of treating cotton in different ways to achieve results similar to the polyesters and blends threading through the market.

“There’s a bit of poly-fatigue occurring in the market, especially at retail, which will trend into our industry in 2018 and beyond,” she says. “Designers and fabric developers are using cotton in new ways, however. Technologies in fabric development are able to impart cotton with the same wicking and other performance functionalities as polyester, without losing the comfort of cotton. The classic T-shirt will never go out of style, but it is and always will be evolving.”

And with all the new cotton options, Routzahn says samples are more important than ever when trying to sell an order of cotton apparel.

“We’re seeing such incredible choice in our industry now,” she says. “T-shirt fabric innovations and designs are exploding. It’s exciting, but it’s also a bit overwhelming. Many of these fabrics need to be touched and felt to really appreciate them.”

Currency of Cotton

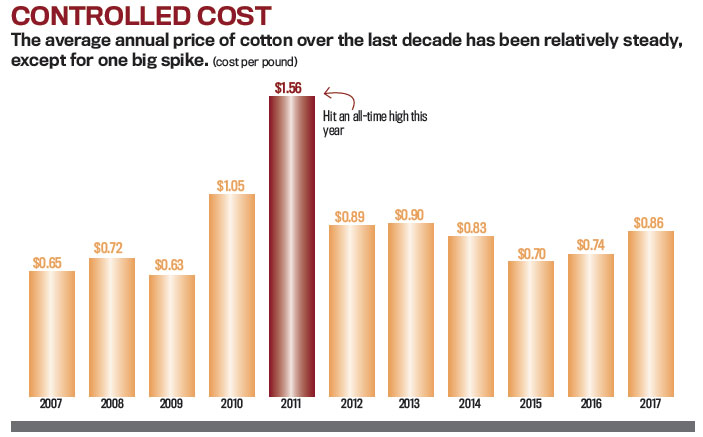

Like pricier ringspun cotton, the more advanced alterations made to plain old cotton mean it’s going to cost more, putting suppliers in a tighter spot margin-wise. And although cotton prices seem to have steadied for the past few years, the International Cotton Advisory Committee believes cotton costs can still be quite volatile.

Prices occasionally take manufacturers and suppliers by surprise. The cotton production industry has fallen victim to everything from sudden increases in demand to floods ruining crops. In the 2010-2011 crop season, for example, costs of cotton per pound skyrocketed without warning due to floods in Pakistan, unexpected government intervention in cotton production and a collapse in mill use. The effect of that trickled down into the promotional products industry, highlighting just how much influence crop prices can have on profits.

“The effects of cotton prices are greater for the mills than they are for the distributor,” Staton says. “If the mills increase their prices, then my competitors and I have to increase our prices. I can hold pricing for my customers as long as I have inventory at a lower cost. The size of the distributor or supplier is reflected in their inventory, and they have more control in the market pricing. This may or may not work in the customer’s favor.”

Wilson agrees, saying it’s important to build in some pricing room just in case there’s a major unexpected fluctuation in cotton costs. Luckily, though, because the crop is so volatile, its cost is monitored closely and discussed often – allowing suppliers and distributors to prepare in advance (most times, at least) for a big long term change in price. Routzahn says that allows suppliers to hedge their bets and make strategic purchases, which could mean buying cotton in bulk earlier so it minimizes the risk in case of a short-term unexpected price change.

The crop’s volatility, though, is yet another reason why 100% cotton clothing is shrinking in market share. Passey notes that a consistent quality product for full-fledged cotton can also be hard to come by – and using blended yarns or a combination with other textile types makes that worry about price fluctuation all but disappear. If you aren’t relying solely on one product, the cost change becomes much less of an issue.

Lauren Cocco, head of merchandising at Vantage Apparel (asi/93390), agrees with Passey. She says that if pricing for cotton jumps markedly higher, “everyone in textiles would have the same consequences. But it may make other product categories more viable” – like textile blends and athleisure, for instance.

Cotton & Technology

Cotton’s innate abilities in the aspects of imprinting and integration technology may also be part of the fabric’s slide in the future. Sure, it’s good for ink imprints (Staton says cotton products have the best absorption rate and sticking power for ink, and Routzahn says it’s one of the best for direct-to-garment printing) and embroidery, but both Passey and Wilson see the benefit of blended fibers and polys for more complicated decoration techniques. Heat seal, for example, doesn’t always work well on plain cotton.

“Blended fibers tend to be the best performers, not only for decorating but for performance and comfort,” Passey says.

Not only that, cotton just won’t work for most clothing with integrated technology. We’ve already got tech-enhanced clothes that contain smart fibers, allowing the fabric to do fascinating things like light up or react to noise, as well as support our health by tracking our vitals, pulse and fitness goals. Consumers can even buy matching shirts that look brighter the closer the wearers are to one another. There’s only one catch, and that’s the lack of cotton involved.

“Cotton cannot be used for advanced technology at this point,” Cocco says. “It would require a conductive material, and cotton doesn’t conduct electricity.”

Wilson agrees that cotton is lacking in this capacity. “Usually tech integration comes from the active market, which doesn’t use a lot of cotton-based fabrics due to poor performance,” she says.

Whether cotton will ever be able to be used for this application is up in the air, Cocco notes. “It’s still to be determined,” she says. “Medical claims like effectively tracking heart rate are still risky. The question is also which government regulatory body will control it, the CPSC, FDA or FCC.”

Overall though, no matter what the future of cotton may hold, the best plan moving forward is to judge what fabrics and construction to use based on function rather than form.

“We don’t tend to focus on fabric content as our primary driver for development,” Passey says. “We identify a market need and the attributes determine what appropriate fibers, blends, or treatments would produce the ‘perfect’ garment. We have a responsibility to ensure the fabric we choose functions seamlessly on each level.”

Cotton Content

We asked two experts: How much cotton is really used in promotional branded clothing?

Billie Staton, Staton Corporate and Casual

“I’d say a little less than 50%. For every 100% cotton item, there’s one that has no cotton. In promotional products, I think you need to look to the large mills: Gildan, Next Level, Bella+Canvas, Hanes – they’re using a lot of cotton.”

Lauren Cocco, Vantage Apparel

“If you’re speaking in terms of the whole category, I would say two thirds of content is cotton. Otherwise, garments have all combinations of cotton and polyester, the full spectrum.”