The promotional products industry is powered by thousands of distributors – most of them small businesses serving clients in their towns, cities and regions. For companies of every size, understanding the local sales landscape is essential for spotting opportunities and gauging growth potential.

That’s where ASI Media’s exclusive State and Regional Sales Report comes in. Drawing on multiple metrics, ASI Research has calculated promotional products sales by state and Washington, D.C., providing a comprehensive snapshot of the market.

This year’s results reveal a stable national picture: While only three states recorded growth of 5% or more, just six experienced declines in 2024. Most states instead posted slow but steady gains that mirror both the overall North American promo industry and the broader U.S. economy.

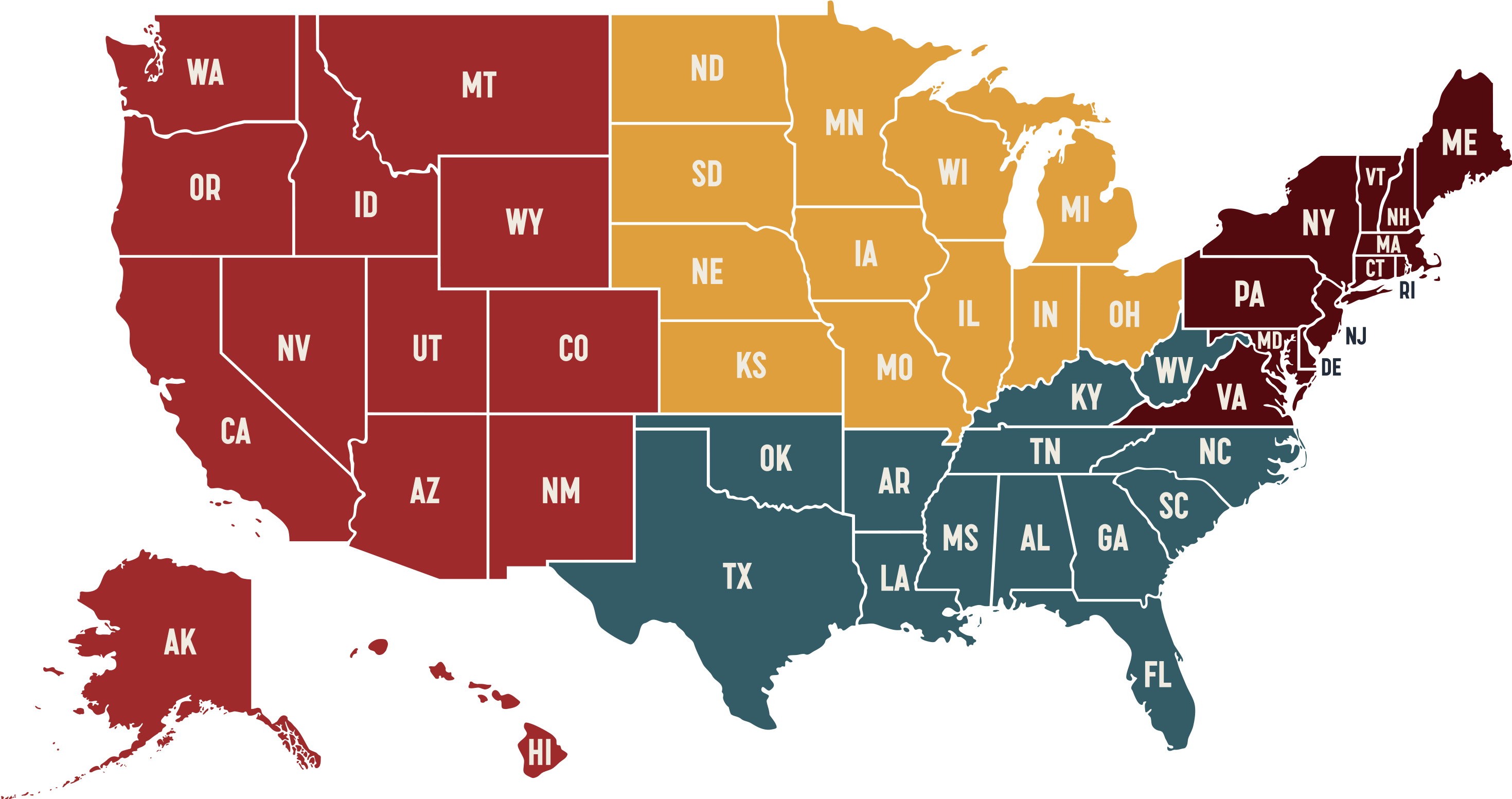

Growth by region was tightly grouped, with the South, West and East separated by only a tenth of a percentage point. All four regions demonstrated consistent performance and point to a wealth of opportunities for distributors to expand their businesses.

See where your state ranks this year in the ASI Media 2025 State and Regional Sales Report, and how your region is playing a part in growing the promo industry.

South West East Midwest Downloadable Report

2024 U.S. Promotional Products Sales Revenue

$24.6 billion | 1.9%

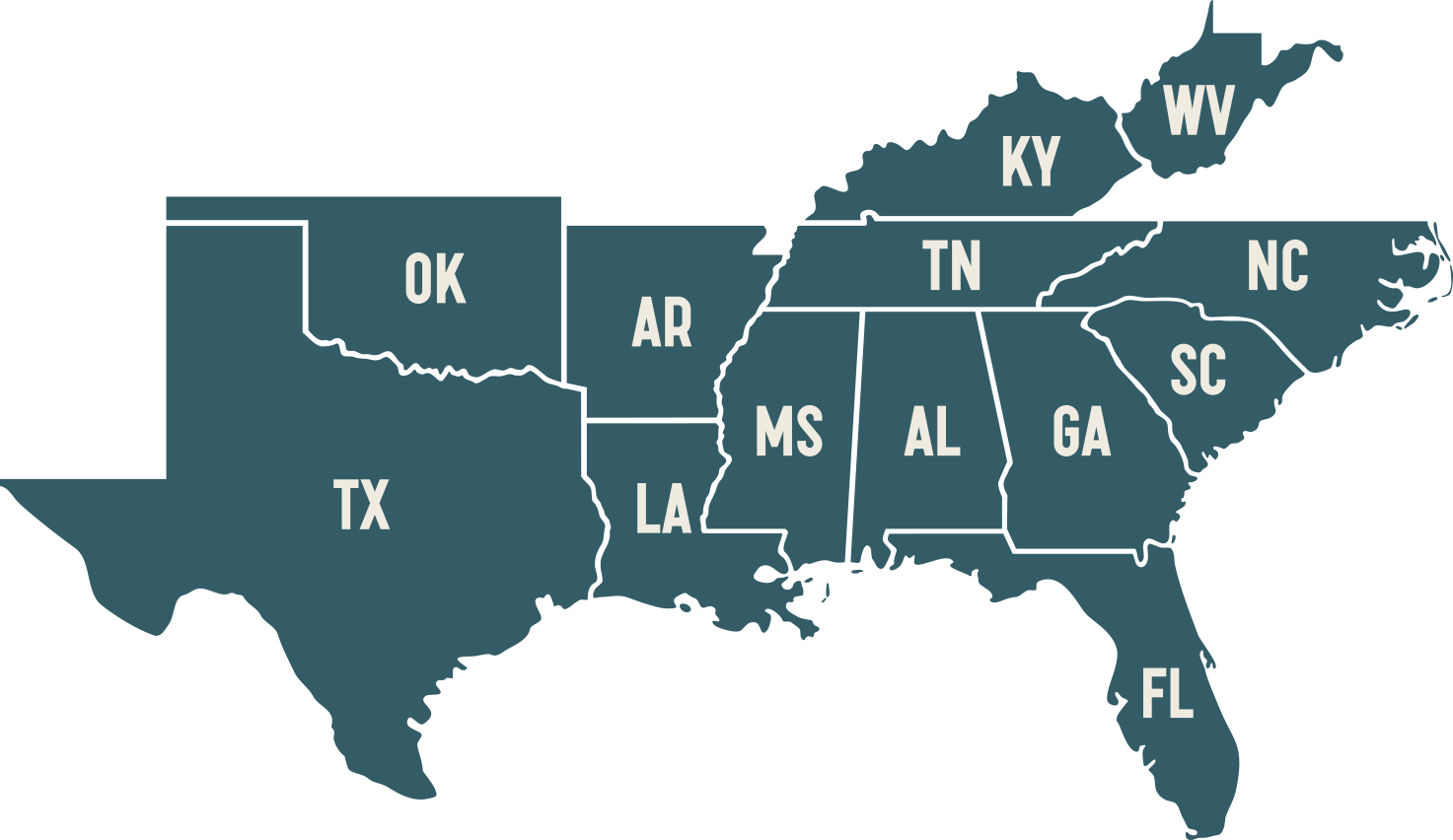

South

$10.1 billion | 2.1%

The South – the largest region in promo sales – delivered the strongest mix of growth in 2024, with several states adding significant revenue. Georgia and North Carolina ranked among the seven fastest-growing states nationwide, each increasing by about $45 million to surpass the $1 billion mark. Florida posted one of the biggest gains, adding more than $50 million in sales. Even Texas, with just a 0.6% uptick, still generated an impressive $24 million increase. Featuring four of the 10 fastest-growing states by population percentage, the South is poised to build on its already impressive gains.

Texas $3.9 billion | 0.6%

Florida $1.8 billion | 2.9%

North Carolina $1.1 billion | 4.4%

Georgia $1.0 billion | 4.6%

Tennessee $529 million | 0.2%

South Carolina $491 million | 3.7%

Oklahoma $275 million | -0.1%

Kentucky $241 million | 0.8%

Louisiana $235 million | 1.2%

Arkansas $199 million | 2.5%

Alabama $196 million | 2.5%

Mississippi $122 million | 3.3%

West Virginia $69.5 million | 4.6%

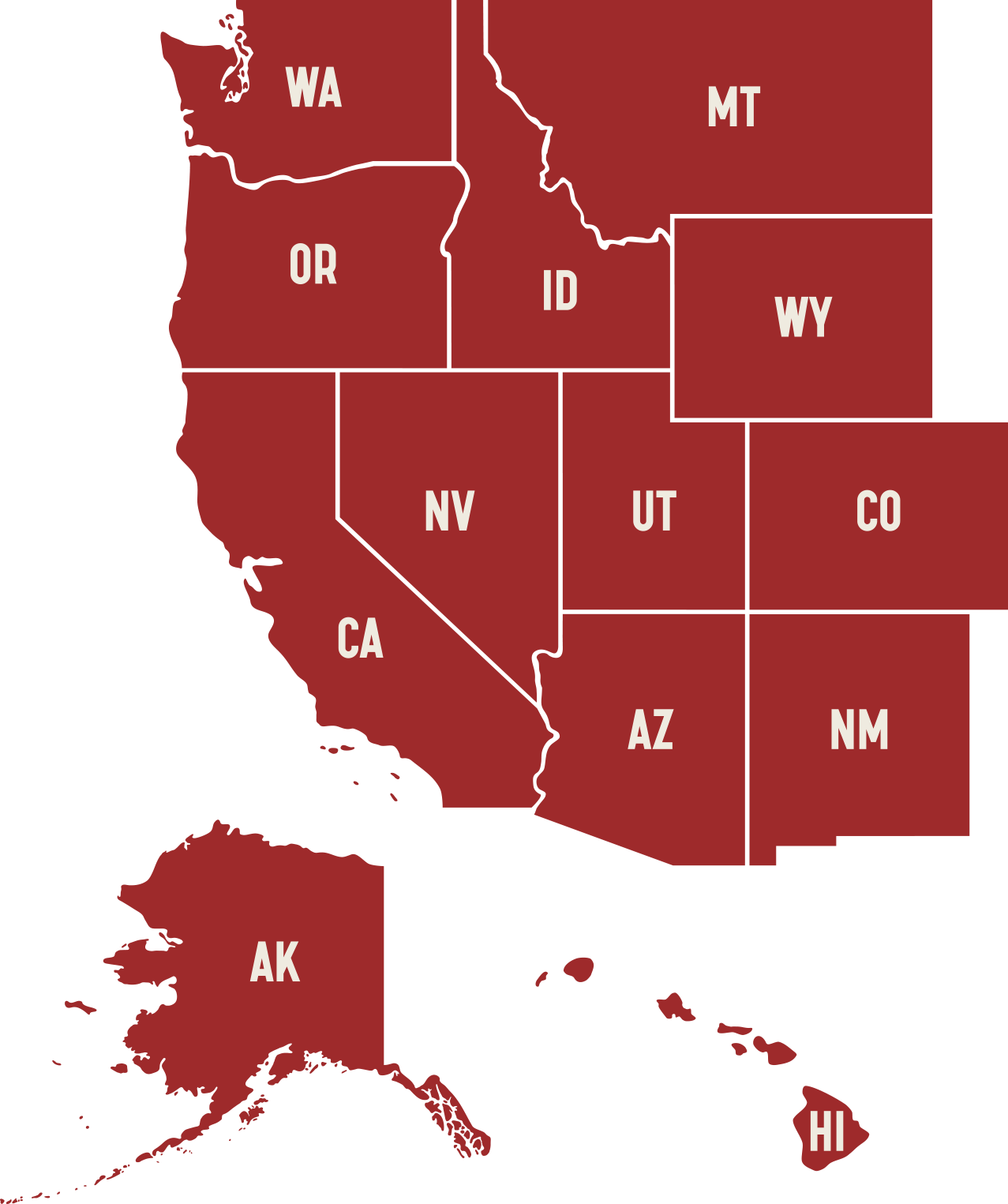

West

$5.5 billion | 2.1%

The West continued to demonstrate solid momentum, led by Utah, which benefited from Salt Lake City’s thriving “Silicon Slopes” tech ecosystem to become the nation’s second-fastest growing state for promo sales. Several other states – including Nevada, Idaho and New Mexico – outpaced the national growth rate, while Arizona added more than $20 million in new sales. California, the country’s largest promo market, grew more modestly at 1.2%, yet still contributed an additional $20 million to the region’s total. With several of the fastest-growing states by population in the U.S., the West continues to be a hotbed of opportunity.

California $1.7 billion | 1.2%

Washington $773 million | 1.7%

Colorado $693 million | 1.4%

Arizona $611 million | 3.7%

Utah $423 million | 5.5%

Oregon $397 million | -0.2%

Nevada $259 million | 4.2%

Idaho $219 million | 3.2%

New Mexico $119 million | 3.7%

Montana $99 million | 3.7%

Hawaii $69 million | 3.4%

Alaska $53 million | 0.7%

Wyoming $48 million | 2.6%

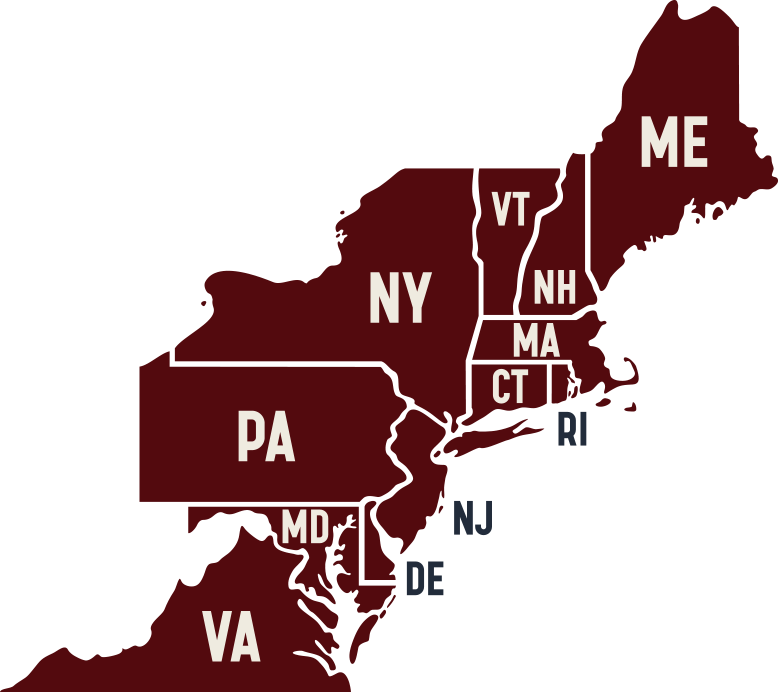

East

$4.6 billion | 2.0%

Congratulations to Delaware – a favorite of corporations for its corporate tax loopholes, and also the fastest-growing state for promo sales (6.6%) in 2024. Meanwhile, larger states such as New York, Pennsylvania, Massachusetts and New Jersey registered more modest gains, helping the East achieve overall growth of 2% – just ahead of the North American promo industry’s 1.9% pace. Encouragingly, the region’s smallest markets, each under $105 million in sales, delivered some of the strongest growth in an otherwise challenging year. In keeping pace with historically faster-growing regions in the South and West, the East presents lucrative possibilities combined with a tradition-rich business climate.

New York $934 million | 1.7%

Virginia $807 million | 3.1%

Pennsylvania $786 million | 1.2%

Massachusetts $525 million | 1.5%

New Jersey $510 million | 1.0%

Maryland $367 million | 1.1%

Connecticut $203 million | 2.9%

New Hampshire $105 million | 5.0%

Maine $85 million | 4.4%

Delaware $77 million | 6.6%

Rhode Island $60 million | 3.3%

Vermont $44 million | 3.2%

District of Columbia $43 million | 3.8%

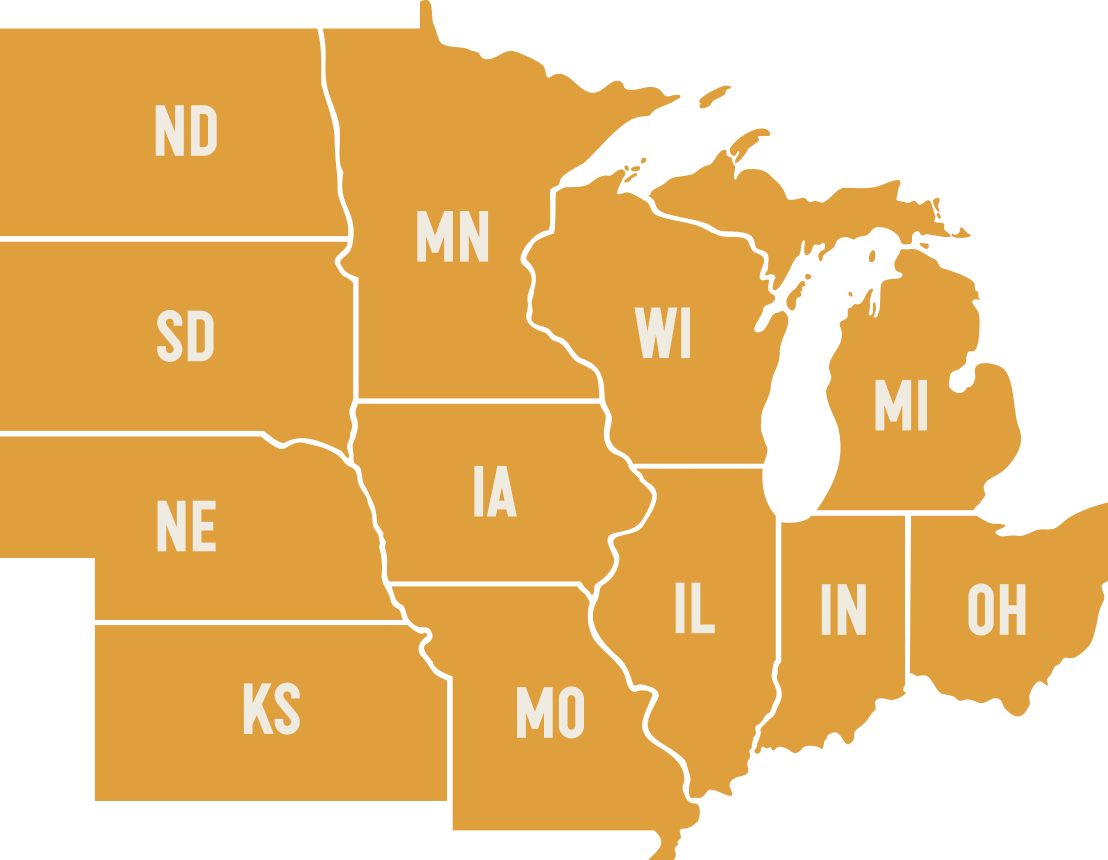

Midwest

$4.4 billion | 1.1%

The slowest growing of all four regions, the Midwest still displayed steady performance, with the largest state (Ohio) producing a 1.4% gain. Michigan, Missouri and Wisconsin posted the strongest growth rates, highlighting regional resilience during what was a challenging year in the promo industry. Overall, the Midwest region reflects a mixed picture, with solid growth in larger states balancing modest downturns in smaller markets. Even with slight increases, the Midwest offers a stable foundation and steady opportunities for distributors who can navigate its mix of mature and emerging markets.

Ohio $691 million | 1.4%

Illinois $583 million | 0.1%

Michigan $513 million | 2.3%

Indiana $505 million | 1.2%

Minnesota $460 million | 1.3%

Missouri $390 million | 2.0%

Wisconsin $370 million | 4.2%

Iowa $260 million | -1.4%

Kansas $205 million | -0.7%

Nebraska $188 million | -0.6%

North Dakota $89 million | -2.2%

South Dakota $83 million | 0.0%