News January 24, 2020

2020 PSI Show Report

With an emphasis on embracing sustainability, shunning single-use items and spotlighting creativity in merchandising, Europe’s largest promo show – PSI Dusseldorf – celebrated its 60th anniversary earlier this month.

Although attendance was down from 2019, show organizer Reed Exhibitions registered 16,367 visitors from 81 nations (a decrease from 17,602 last year). These numbers include the PSI show and its sister shows that are held concurrently at the Messe Convention Center: viscom – a show for printers and decorators – and PromoTex Expo, for textile suppliers.

“PSI is the global ‘melting pot’ for a whole industry; it moves people, markets and billion-EUR sales on a global scale. This is what makes it unique worldwide,” said PSI Managing Director Michael Freter, summing up results of the show, at which 720 exhibitors presented current innovations and trends. Freter noted that the fact that PSI’s 60th year didn’t quite hit record numbers is a reaction to the currently worsening market environment in some industries in Europe such as the automotive sector, for instance, which is traditionally a major buyer of promotional products in Germany.

Go Green or Go Home

As a mega trend – or as one exhibitor put it, “the future of the industry” – the sustainability theme is a top initiative in Europe’s promo market. Be it the selection of materials, manufacturing process or the up and recycling of products – this theme has never been more visible than this year. “There’s a significantly greater willingness on the part of advertisers in the industry to dig deeper into their pockets for sustainable promotional products,” said PSI Director Petra Lassahn. Consequently, the “PSI Sustainability Awards” will be presented as part of the PSI Show in 2021.

“Every year certain themes jump out during the PSI show,” said Jo-an Lantz, president & CEO of Counselor Top 40 distributor Geiger (asi/202900), who attends the show annually. “This year product sustainability was the most apparent, with an emphasis on green or recycled products. I suspect in the future this will flow to the supply chain and individual manufacturers’ efforts in reducing their carbon footprint. The other trend was the focus on lifestyle fitness.”

This view is also reflected in the current industry data for the European promo market, traditionally published by the GWW (Confederation of the Promotional Products Industry, the German promo association) in conjunction with the PSI show. According to the survey, sustainability plays a role for two thirds of companies when purchasing promotional products, and companies are prepared to spend up to 10% more on this. “I’m impressed how the promotional products industry has anticipated and driven this development,” said Frank Dangmann, president of the GWW.

For the past fiscal year, the GWW again registered a slight increase in industry sales of EUR 3.65 billion (up from EUR 3.58 billion in 2019). With this result, promotional products underscore their pole position as advertising media with the highest reach, as Dangmann emphasized: “Promotional products reach 89% of the population from age 14 – unlike any other media. This reach puts promotional products undisputedly at the top of the rankings.”

This development is in line with the results from the Europe-wide market analysis. The promo products industry generates annual sales of EUR 14.9 billion in Europe, according to the Techconsult Study ‘Industry Structure Analysis 2017-19,’ produced in cooperation with PSI and supported by 13 partners and associations in total. The study reveals that more than one third of total European promo sales are generated by micro companies employing less than 10 people.

Pros & Cons

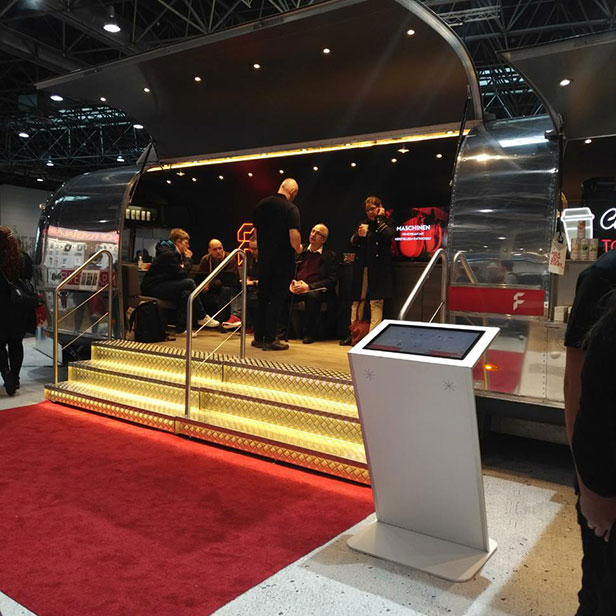

First-time PSI show visitor Howard Cubberly, general manager of industry supplier Goldstar Global – who exhibited at the show – noted the positive energy and optimistic outlook from both suppliers and distributors at the Dusseldorf show. “It was also great to see some large U.S. distributors walking PSI having expanded into the European market either organically or through acquisition,” Cubberly said. “There’s clearly a growing need for international partnerships, supply chain and distribution needs. I was also impressed by the suppliers’ investment in their booths or ‘stands,’ not only in the structure size, but on the product merchandising which had more of a retail feel than typically seen at the U.S. shows. We’ve seen some movement in this direction at the U.S. shows as well, but I don’t think it compares to PSI yet.”

Cubberly further acknowledged the trend toward sustainability and eco-friendly products. “It was far more prevalent at the PSI show for the European market and I think the trend finally has legs globally.”

Additionally, he noticed the juxtaposition in the way business at U.S. shows are conducted, as opposed to those in Europe. “I was impressed by the distributor approach to visiting supplier booths at the PSI show,” Cubberly said. “There was more of an interest to visit, connect and discuss partnership potential at each supplier booth. We had many distributor customers linger for an espresso or draft beer and just chat with their Goldstar sales rep. There was very little ‘Scan me and send a catalog’ visits compared to U.S. shows. It was also common for distributors to stay and socialize with suppliers on the show floor after exhibit hours are over. The U.S. shows are far more active with off-the-floor social events following the show, from award ceremonies to cocktail parties or just customer dinners followed by hanging out in the cocktail lounges – more connections seem to be made after hours at the U.S. shows.”

Cubberly, though, is quick to point out that there are some areas where U.S. trade shows have an advantage, such as social media engagement. “Maybe it’s my connections are more heavily weighted to the U.S., but the creativity within social platforms in the U.S. attracting customers to supplier booths and just sharing friendships, new products, etc. seemed to far exceed what I saw at the PSI show,” he said. “Also, I found it interesting that the booths were far grander at PSI than at U.S. shows, but some of the show’s ‘finishing touches’ were lacking in comparison to the U.S. shows – things like a lack of carpeting in the aisles, no education classes and flimsy paper badges that were hard to read are examples.”

Next year the PSI, PromoTex Expo and viscom shows will be held from January 12-14, 2021 in Düsseldorf. For more information go to www.reedexpo.de.

Photos