Awards April 01, 2016

How Will Mergers and Acquisitions Impact Small Firms?

In recent months, several of the industry’s largest distributors and suppliers have joined forces, embracing one of business’s oldest mantras: bigger is better.

In recent months, several of the industry’s largest distributors and suppliers have joined forces, embracing one of business’s oldest mantras: bigger is better.

>>Back to the Big Book of Questions

The industry’s largest supplier, alpha- broder (asi/34063), joined with Bodek and Rhodes (asi/40788) to create an apparel organization with over a billion dollars in revenue. (And it was only two years ago that alphabroder acquired Ash City, the ninth largest supplier at the time.) Top 40 supplier Prime Line (asi/79530) acquired Jetline (asi/63344), a move that will bump Prime Line’s revenue over $100 million. Brand Addition, Europe’s largest distributorship, purchased GatewayCDI (asi/202515) in January to make its official entry into the U.S. market.

And beyond this most recent spate of activity, Top 40 distributors such as Taylor Corporation, Staples Promotional Products (asi/120601) and HALO Branded Solutions (asi/356000) have all made major acquisitions in the past year.

The rash of partnerships has become so persistent that the industry’s biggest players can’t help but take notice. In its most recent earnings statement, BIC Group, parent company of Top 40 supplier BIC Graphic (asi/40480), noted “that the consolidation of the industry continued on both sides” and included a statement from the company’s CEO that read: “Considering the recent evolution of the promotional products industry’s environment, the Board has decided to initiate a review of strategic alternatives for BIC Graphic.”

In today’s promotional product arena, it seems joining forces is often more strategic than going it alone. “People can get better and better economies of scale” by consolidating, says

David Blaise, president of Blaise Drake and Company, a business consultancy based in Wyomissing, PA. Combining assets, manpower and customer lists allow companies to get better pricing with vendors, expand their sales territory and otherwise increase their corporate strength in the marketplace.

That concept isn’t new. But the urgency to leverage M&A deals in order to remain competitive is helping to reshape the industry landscape. And it reaches well beyond the scope of promotional products. Last year was deemed the biggest year in M&A activity for businesses nationwide, with The Wall Street Journal reporting $4.7 trillion in mergers in 2015.

So what’s behind it? Any number of reasons can be considered, say experts, including a sizable group of business owners who are baby boomers looking to exit the market, and an ever-expanding service offering among distributors that requires ongoing expansion and growth among the industry’s most ambitious players. “You have a demographic bubble in terms of baby boomers reaching an age when coming up with some kind of resolution with their company becomes more of a driving force,” says Warren Feder, a partner at Carl Marks Advisors, an investment banking firm based in New York.

Also at play are the increasingly complex requirements necessary to succeed today in business. Marc Simon, CEO of HALO Branded Solutions, notes a more stringent regulatory climate that “has become far more demanding of accountability, the environment and safety.” Beyond that, clients are demanding more complex operational, financial and employee management systems that smaller firms can’t afford or develop on their own, says Simon. Meeting all of those requirements demands time, resources and money – something many smaller firms fall short on in at least one, if not all, of those categories.

Of course, brands can employ an army of specialized marketing agencies to satisfy those various requirements. But do they want to? A survey this year commissioned by RSW/US (an outsourced lead generation firm) found that 56% of brands in 2014 and 33% in 2015 consolidated their agencies; another 30% planned to consolidate this year. “Marketers as a whole aren’t as enthusiastic about adding large numbers of agencies to their roster as they have in years past,” the report surmised.

Of course, brands can employ an army of specialized marketing agencies to satisfy those various requirements. But do they want to? A survey this year commissioned by RSW/US (an outsourced lead generation firm) found that 56% of brands in 2014 and 33% in 2015 consolidated their agencies; another 30% planned to consolidate this year. “Marketers as a whole aren’t as enthusiastic about adding large numbers of agencies to their roster as they have in years past,” the report surmised.

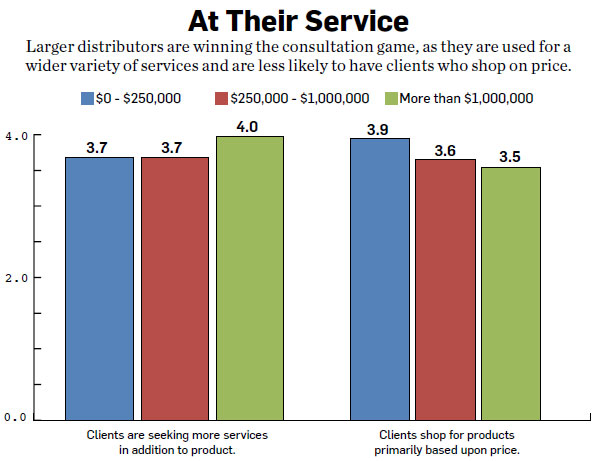

This means clients are looking to marketing agencies, including promotional product distributors, to satisfy a wealth of needs under one roof. Distributors have heard this call over the years and have strived to become indispensable to clients – locking up customer loyalty with an expanded palette of offerings from online stores to digital marketing to creative capabilities. Services once relegated exclusively to advertising firms or marketing departments are now quite frequently the purview of distributors. And oftentimes, only larger companies can deliver a comprehensive suite of services.

To remain competitive, savvy industry players and ambitious companies find themselves in a position of needing to offer those services and more. Increasing customer demands for Web stores and other online functionality, along with more sophisticated product management, means launching new strategy and deployment techniques on the back end.

Suddenly a demand for “everything from multi-level password protection and purchase approvals to PCI compliance and efficient global delivery,” says Simon (whose company purchased former Top 40 distributor Newton Manufacturing Company last year), translates into a new level of operational sophistication. And that means a spike in business expenses. To keep up, “these costs need to be spread over a larger revenue base,” he adds. Smaller firms simply “cannot meet these needs and remain viable.”

Additionally, some companies simply haven’t achieved expected sales and growth goals in a more competitive marketplace. For those companies, consolidation is often a faster way to reach their goals.

Last year, when a bid to boost revenue through an additional sales member didn’t meet management’s goals, Winger Marketing (a Chicago-based marketing, advertising and public relations firm that also assists with promotional products), decided acquiring a competitor might be a better option. “We had tried to grow organically by adding a salesperson to the team, but after nine months, the situation ended without any results,” says President Karolyn Raphael. Finding the right company to purchase took time – more than a year, in fact. “Honestly, it was a lot like dating,” Raphael says, “but with a chaperon of an accountant or an attorney.” Once she was able to identify the right company to buy, however, Raphael says the entire sales process took less than three months to complete – certainly far shorter than the nine months she invested in an additional salesperson who didn’t pan out. The revenue increase was instant, she adds.

Small Cog in a Large Machine

All of this may leave smaller firms wondering where their role will be in an increasingly consolidated field of competitors. Certainly, some worry that the industry is headed away from its staple mom-and-pop business model toward a landscape of conglomerates. To keep up, many have joined the trend and sought partners to become stronger in the marketplace.

So where does that leave the budding entrepreneur who just wants to sell T-shirts as a one-man sales force? The idea of the home office entrepreneur (who launches a website and is diligent on order completion) is seen by many larger distributors as a dying proposition. “The costs to compete in this industry continuously increase,” says Gregg Emmer, vice president and chief marketing officer of Top 40 distributor Kaeser & Blair (asi/238600). “It’s no longer as easy as putting up a website and waiting for orders to roll in.”

Like so many others both large and small, K&B has grown through acquisitions; Emmer points out that for distributors, mergers often masquerade as acquisitions because it allows the buying company to pick up additional customer lists and grow in a relatively short period of time.

In fact, acquisitions have become so commonplace and desirable that at least one Top 40 distributor decided to establish a division within its company to assist distributors nationwide in future M&As. Last November, after two years of considering the idea, Wayland, MA-based iPROMOTEu (asi/232119) launched The Distributor Exchange as a way to help connect various distributors within the industry who are interested in buying or selling their company. What started as a way to help iPROMOTEu affiliates tap into the many firms available to them has expanded to a national program that helps connect distributors with any affiliation. More to the point, the program is targeted toward smaller firms that might otherwise be put out of business by larger distributor partnerships. Firms with annual sales of $100,000 to $1 million can utilize the service, and tap into low-cost financial, legal and business strategy expertise via The Distributor Exchange.

The goal of the service is to identify and sell or buy a distributorship in as little as 90 days, says Bob Schwei, the company’s managing director. “For every interested seller that contacts us, we have one to two people that want to buy,” Schwei says. But, like the site’s demonstration video states, for many sellers, knowing how to evaluate their business (let alone determine the best buyer for it) can be daunting, if not impossible. The fact that Schwei and his team have brokered several deals already with several more in the works (Schwei declined to give the exact number of deals closed) is a sign that more and more firms are looking to boost revenue through acquisitions as much as they are through organic growth.

Not that doing so isn’t fraught with takeover challenges. Once a company is acquired, there’s no guarantee that its independent sales reps won’t fly the coop for greener pastures or a different distributor, taking their clients with them. Because they’re independent, technically the buyer is often hard pressed to do more than incentivize them to stay. “In the real world, the relationship is between them and the customer,” Emmer says. Plenty of times companies lose sellers who “may have been thinking about going out on their own, and a change of ownership gave them the excuse to say, ‘now is the time,’” Emmer says. That’s a gamble for buyers, but one that can pay off if they successfully court the sellers and customer lists acquired in the transaction. How? Adding bonuses and profit sharing for a set number of years following the sale is one way to sweeten the deal for some sellers, Emmer says. This is particularly effective with companies that are struggling to find a buyer.

It’s very possible that increasing sophistication is changing the fundamental nature of the industry. Blaise points to Canada as an example of what the U.S. promotional product marketplace may look like in years to come. Canadian firms, Blaise says, are more likely to be sizable brick-and-mortar companies with an office, dedicated staff and extensive human resource, product development and sales and marketing training program, as opposed to “a person or two just trying to do everything,” as is commonly seen in the U.S.

To that end, the ideal merger or acquisition is perhaps a more sophisticated company taking over for a smaller, more grassroots one. For a smaller firm, “if they’re affiliating with a company whose focus is on professionalism and getting their people trained on how to sell more efficiently and effectively, or how to target the best quality clients, then it’s hopeful,” Blaise says. But, “if one distributor doesn’t know what he’s doing and buys out another that doesn’t know what he’s doing, there’s not a whole lot of advantage there.”